American Companies Are Offshoring High-Paying, Remote-Friendly Jobs

The race to save costs is pushing skilled jobs abroad

US-based employers expanded employment abroad faster than domestically for the past 7 years. This is particularly pronounced among Tech and Consulting firms.

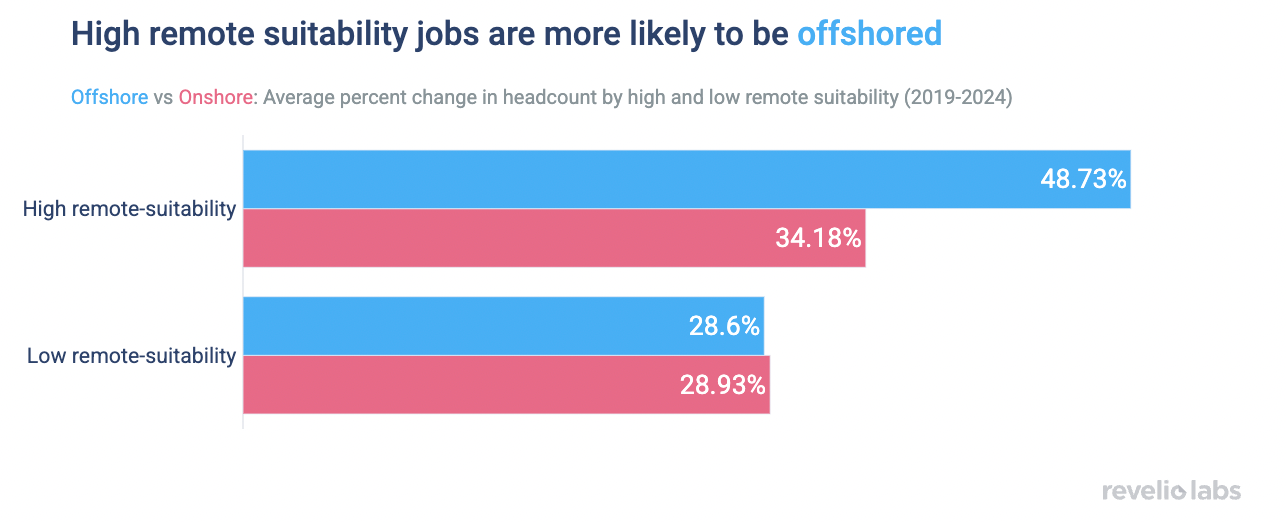

Highly remote-suitable roles have grown 42% faster outside the US than within the US since 2019, while there is no difference in growth rates for roles that are not remote-suitable.

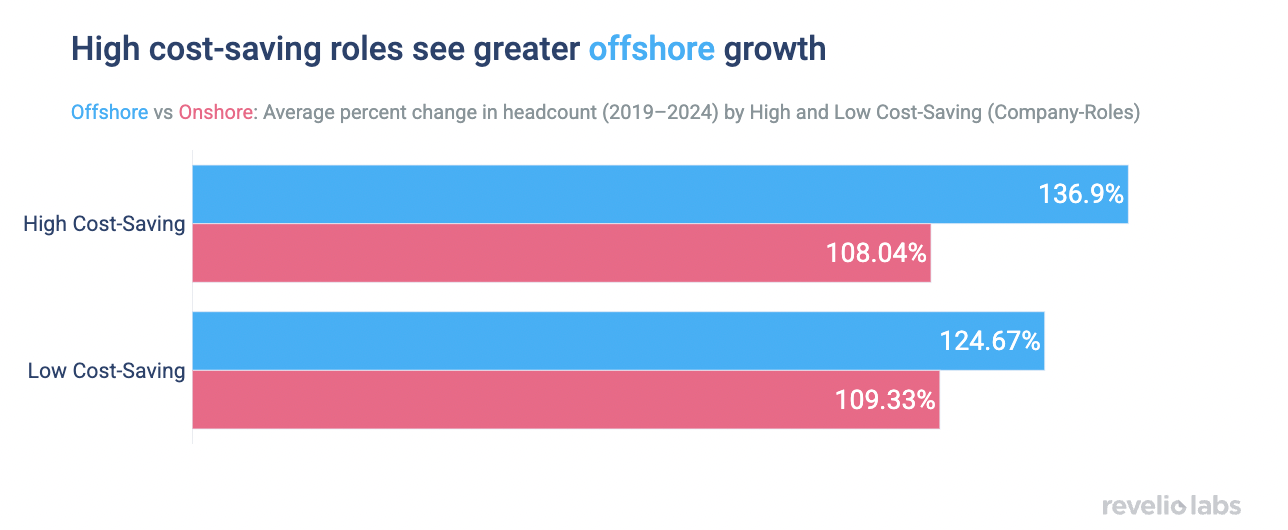

Cost saving considerations play another large role for offshoring. For every 10% reduction in foreign worker salaries compared to average US salaries for the same role, employment outside the US grew 13.1 percentage points faster than within the US.

Salesforce just announced a major layoff to its Bay Area workforce. At the same time, the company has shifted its employee base increasingly to international talent over the past 5 years. Salesforce is not alone: US-headquartered multinational enterprises that employ workers both abroad (offshore) and domestically (onshore) workers have grown their offshore workforce faster in recent years than their onshore workforce. Among these companies, the number of offshore workers grew by 32% since 2019 while those onshore grew by 16.7%, producing a rise in the share offshore overall.

The growth of US companies’ employment offshore relative to onshore relates to three key factors: company growth, the nature of the role (whether it is remote-suitable), and offshore versus onshore pay differentials. First, employment growth abroad is correlated with overall company growth, in tandem with domestic expansion, meaning that companies that grow abroad are also growing domestically. On average, however, company growth abroad has outpaced domestic employment growth. Second, the pandemic forced many employers to reorganize themselves for maximal remote work and demonstrated, in many new cases, that distributed teams can be highly productive. Third, US wages are higher than in many other countries, and rigid immigration laws limit the supply of new talent moving to the US This creates incentives for companies to seek specialized talent and labor cost savings by expanding employment in lower-wage counties if production technology can support it. The realization that companies no longer need to hire consultants or software engineers in the most expensive location has made offshoring an attractive, cost-saving option in workforce planning.

This week, in partnership with Aaron Sojourner (W.E. Upjohn Institute for Employment Research and Elton Mykerezi (University of Minnesota), we explore what kinds of jobs experienced the highest rates of offshore hiring by US-headquartered multinational enterprises since the pandemic. We consider all companies with headquarters in the US and their affiliates and focus on employment growth rates from 2019 forward.

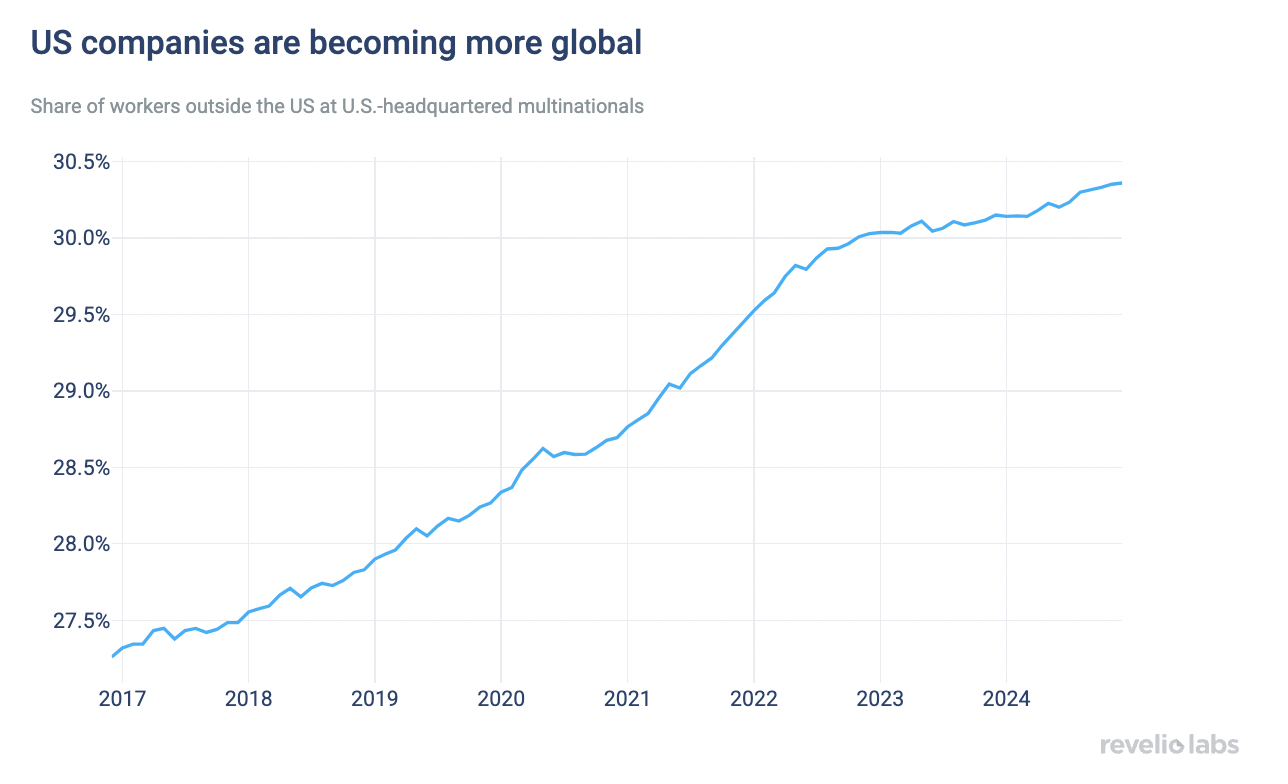

The share of US-based companies’ workforce abroad grew steadily from 2017 through early 2022 but has slowed since mid-2022. Currently, the share of employees working abroad for US-based conglomerates is just over 30%, which is 3 percentage points higher than seven years ago, or a 10% increase.

We leverage Revelio Labs' global workforce dataset, which details employment and pay by employer, role, and location over time, compiled from professional online profiles across a broad sample of firms worldwide. The analytic sample includes all companies headquartered in the US with more than 50 employees. The data spans all industries and geographies. Revelio Labs' corrects for sampling bias to ensure the representativeness of the data across different roles and local labor markets. We also aggregate companies up to their final parent entity to capture complete organizational structures and use employees' position locations to clearly distinguish between onshore and offshore workforces.

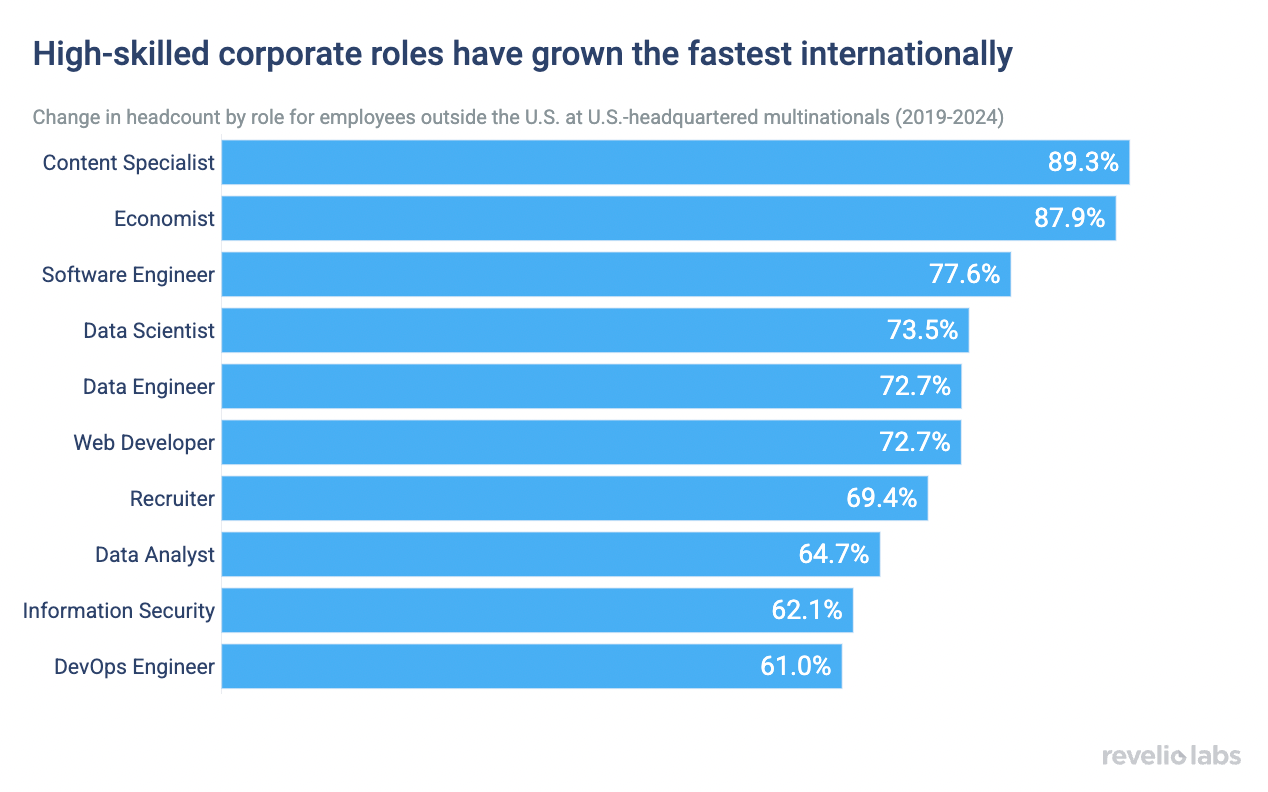

While offshoring has long been part of corporate talent management strategies, the types of companies using offshoring and the roles being offshored has changed. Historically, offshoring was concentrated in manufacturing or basic customer services, such as call centers. However, the fastest-growing offshored roles recently include high-skill positions such as economists and analysts, software development, human resource roles, and consulting. Notably, these positions tend to be high paying, reflecting their specialized expertise and significant strategic impact.

Thanks to advances in remote work technology and evolving workplace practices, roles in which location is flexible are becoming increasingly viable for global talent sourcing or offshoring. We measure roles’ remote suitability based on the share of recent open global job postings that offer remote work arrangements and classify roles in high and low suitability using the median share as a dividing point. Growth for highly remote-suitable roles is much faster for offshore than onshore, with a gap of 15 percentage points in the workforce’s growth rate. In contrast, for roles with low remote suitability, the companies have grown their offshore and onshore workforces at equal rates. This suggests that companies are leveraging remote work to tap into global talent pools, particularly for roles that align well with distributed team models.

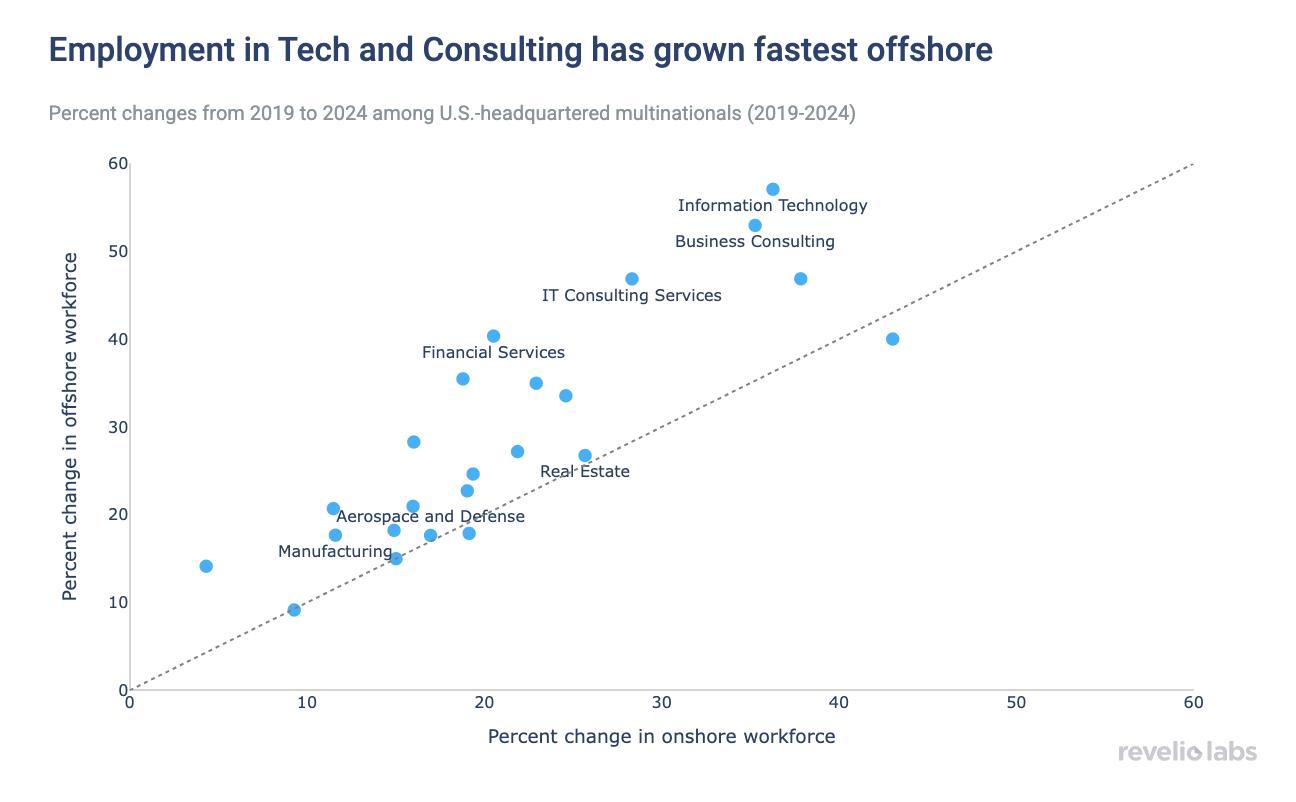

While these differences in hiring patterns are not limited to a particular industry, the largest skews in favor of offshore are in Tech, IT Consulting and Business Consulting. The figure below shows the onshore workforce growth rate for each industry on the horizontal axis and its offshore growth rate on the vertical. Those appearing above the 45-degree line have faster offshore than onshore growth and the vertical distance to the line measures the difference in growth rates. While onshore employment in Tech, IT consulting and Business consulting has grown substantially over the past 5 years – by as much as 30 to 40% – offshore growth has surpassed domestic growth by about 20 percentage points, laying well above the 45-degree line. On the other hand, for other industries, such as Real Estate onshore and offshore workforces grew at equal rates. Only a few industries, including Aerospace and Defense, grew faster onshore than offshore, placing them below the line.

The faster offshore expansion of US multinational companies in these industries reflects a mixture of two motivations: first, replacing onshore jobs with offshore jobs, and second, expanding offshore production to serve offshore customers in ways that could not be done as well onshore. In terms of job displacement from onshore to offshore, remote work and digital co-working tools have decreased coordination costs of running distributed teams. This means that companies can hire cost-effective, productive talent wherever it is available globally. In this case, US workers are competing with international hires.

On the other hand, there has been a rising demand to solve local problems with local expert knowledge and solutions, particularly in the consulting industry. Clients across the world may prefer to deal with consultants who know local languages and customs, while still relying on the global expert network and corporate solutions of a US multinational. In these cases, the ability of US companies to compete for customers and expand offshore could be expanding demand for onshore workers within the company performing complementary roles. In either case, workers globally are seeing unprecedented opportunities to work for US companies, often in desirable roles.

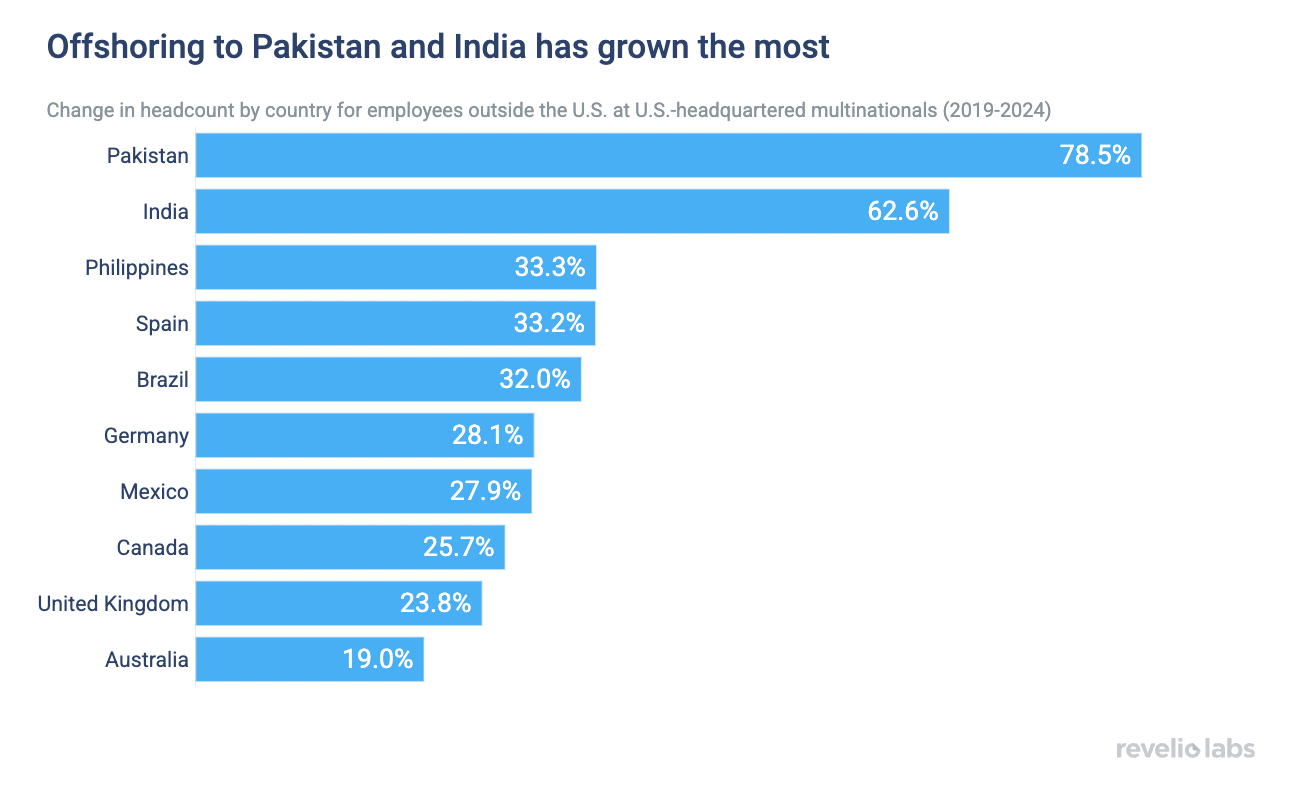

The countries with the fastest increases in workforce among US-headquartered multinationals are Pakistan, India, the Philippines, and Spain. The first three are characterized by the availability of highly-skilled talent with English-language proficiency, especially in the Engineering and Tech space, and with labor costs a fraction of those in the US. We have previously written about the remote talent specialties of each country and associated cost savings compared to the US as a way to solve talent shortages.

Cost savings can also motivate offshore hiring. By outsourcing roles to lower-cost regions, companies manage their budgets while still accessing high-quality talent. This financial incentive can be particularly impactful in industries facing tight margins or heightened competition. In fact, when offshore wages are around 10% lower than their US counterparts, offshore employment tends to grow roughly 13.1 percentage points faster than onshore employment. The plot below shows how offshore cost savings in 2019 relate to employment growth onshore and offshore from 2019 to 2024. Offshore cost savings are larger if the average offshore wage is a smaller share of the average onshore wage. Company-role pairs with high (above median) offshore cost savings have seen substantially faster offshore hiring relative to onshore hiring. For company-role pairs with lower (below median) offshore cost savings, the difference between onshore and offshore employment growth rates is smaller.

As global production and hiring continues to evolve, the labor market is set to be reshaped in profound ways. For companies, workers, and policymakers alike, shaping and adapting to the new possibilities is critical. New communications and coordination technologies boost the productivity of distributed production and remote service provision. Businesses must refine their approaches to workforce planning and talent retention. If potential cost savings exceed the harm of productivity loss, employers have incentives to offshore more.

In the context of policies facilitating international flows of capital and products and technologies lowering the costs of distributed production, policies that clamp down on international labor flows create competitive pressure to move production from countries with higher labor standards towards countries with lower standards. However, it’s also true that lowering the cost of performing some tasks can raise the productivity of others doing inter-related tasks, increasing their job opportunities and compensation. The globalization of labor markets presents both opportunities and challenges, redefining what it means to build a successful workforce in the 21st century.