As Earth Warms, Wall Street Cools on ESG

People are dropping ESG from their titles

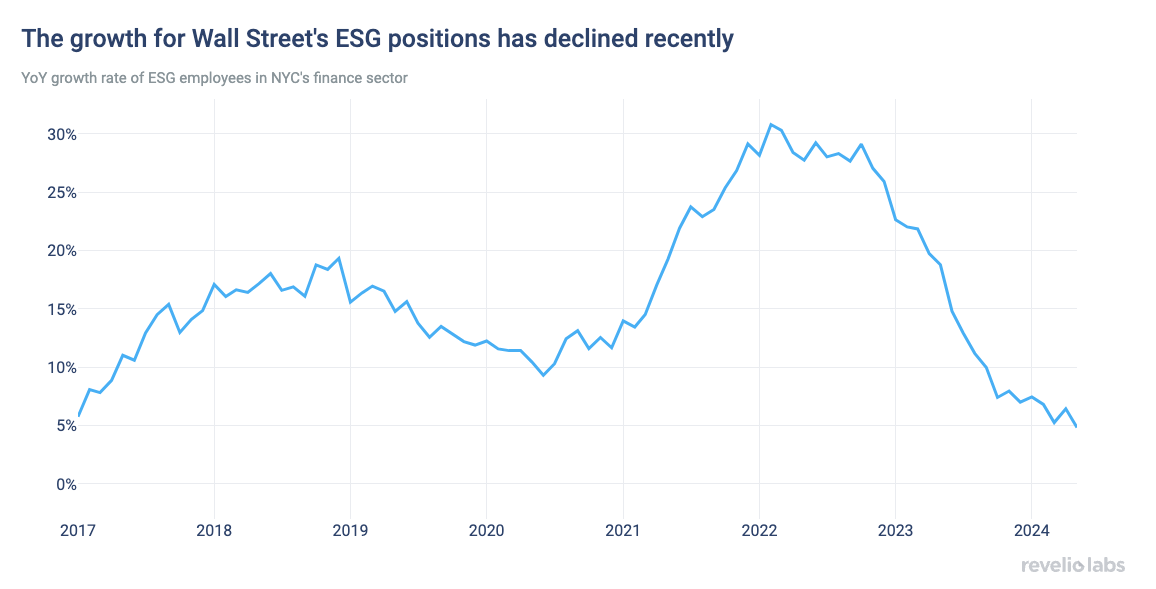

The number of ESG positions on Wall Street has increased in recent years, but the pace of growth has dropped off considerably since its 2022 peak.

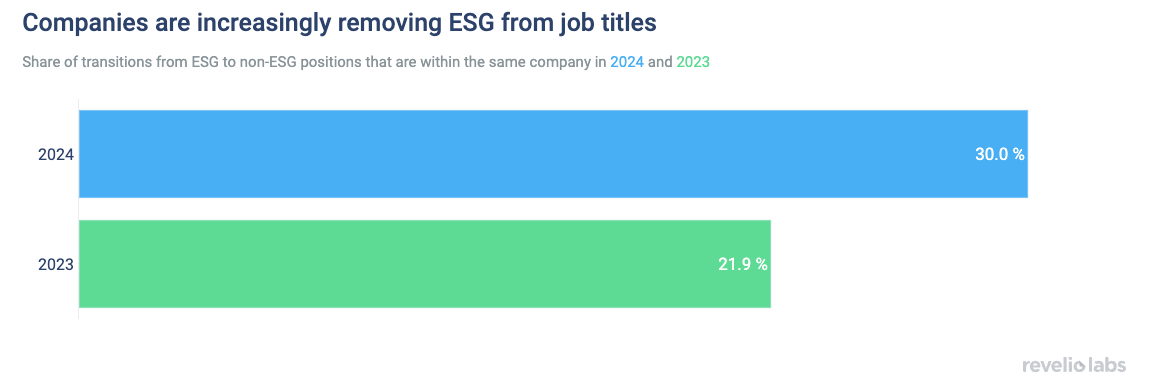

Part of the decline in growth may be due to companies removing ESG from job titles in response to political backlash and relative underperformance of ESG funds.

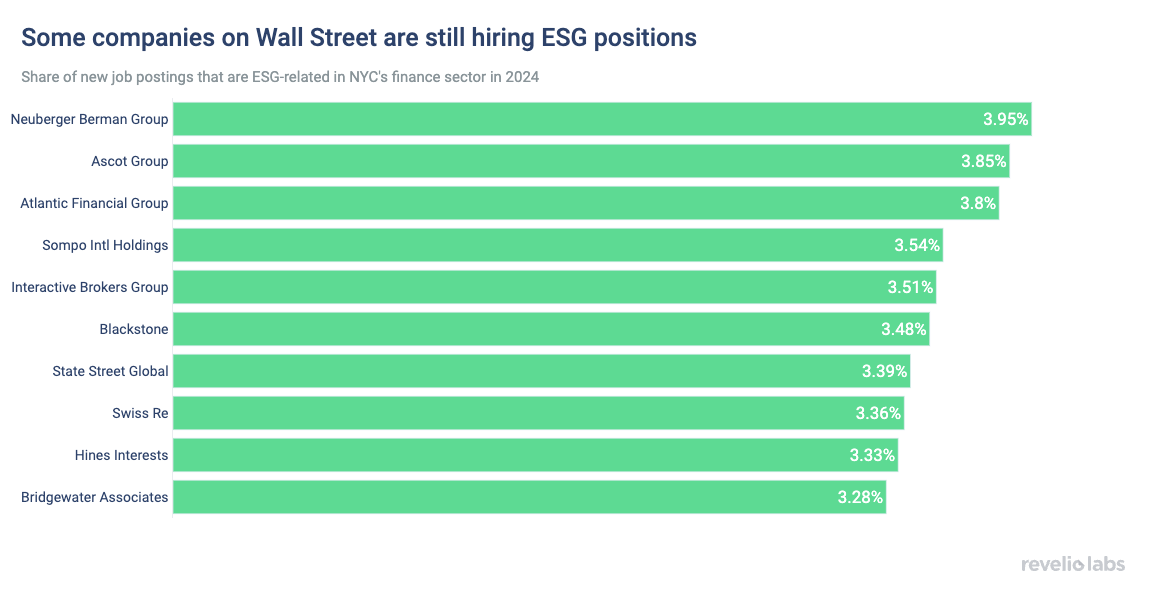

However, Wall Street is not giving up on ESG. Some firms remain steadfast in their commitment to ESG investing, including one of the ESG loyalists, Neuberger Berman Group.

In recent years, environmental, social, and governance (ESG) criteria have become a significant focus on Wall Street, reflecting a growing awareness of sustainable and ethical business practices. Major investment firms and corporations have integrated ESG principles into their investment strategies as well as their workforce, offering up a wide range of new funds and products to socially conscious investors and stakeholders. However, this trend has been losing steam recently amid political backlash and relative underperformance of ESG funds. This week, in collaboration with Bloomberg, we look into the recent deceleration in the growth of ESG positions on Wall Street and at how companies have responded to the controversy by stripping ESG from job titles and rebranding their sustainability efforts.

Using Revelio Labs’ HR data, we find that the number of ESG-related positions in New York City’s finance sector has increased since 2020. This surge reflects a broader trend of incorporating sustainable and ethical considerations into business practices. However, due to the recent political backlash and possibly poor financial returns on environmentally conscious investments, the growth of ESG positions on Wall Street has faltered. Companies are becoming more cautious in their approach to ESG, wary of the potential reputational and financial risks associated with the political controversy. Additionally, firms have reported that certain ESG investments, including wind and solar energy, have not yielded the expected financial returns, leading to a reevaluation of their strategies.

Consequently, the year-over-year growth rate of Wall Street’s ESG positions has dropped from around 30% in late 2022 to only 5% as of May. This decelerated focus on sustainability is occurring at the same time as rising temperatures break one record after another and the world is experiencing ever graver weather events–not exactly a great time to stop caring about the environment and green assets.

Part of this decline in growth is due to companies removing ESG from job titles and moving employees internally to teams not focused on ESG. When we examine the transitions of ESG practitioners to non-ESG related positions, we find that although the majority of transitions result from employees leaving the company altogether, a significant portion occurs within the company itself. The share of these internal transitions increased from 22% in 2023 to 30% in 2024. When we look into the title changes associated with these internal transitions, we find that most of ESG practitioners remained as investment specialists, just without ESG listed in the title. This suggests that, in some cases, companies are quietly scrubbing ESG from job titles in response to the political backlash.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

However, Wall Street is not giving up on ESG altogether. Some firms remain steadfast in their commitment to ESG initiatives, including Neuberger Berman Group, a long-time advocate. Since 2024, nearly 4% of all new job postings from Neuberger Berman Group have been related to ESG.

Given recent extreme weather events and the ongoing climate crisis, we can expect that ESG will continue to play a critical role in shaping the strategies of a wide range of investors. With so much money still slated for climate-focused investment, there remain significant financial incentives for those firms offering ESG-focused services. Companies will likely continue to add ESG-related jobs as they increasingly recognize the long-term benefits of sustainability and ethical practices, not only for the environment but also for their financial performance.