Cloudy Forecast for AWS

Companies are seeking Azure skills at the expense of AWS

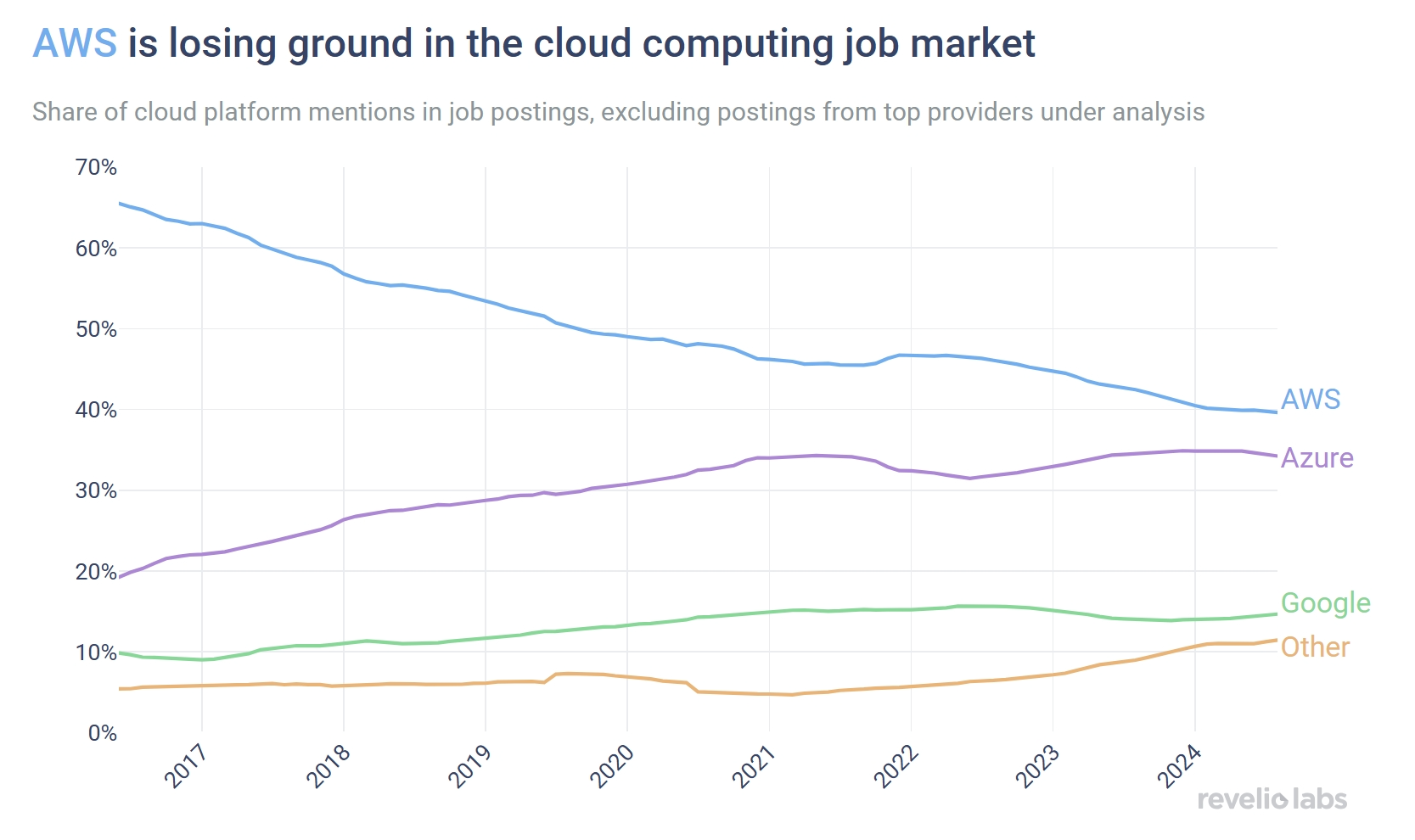

In the race for market share in the $800+ Billion cloud computing market, usage of Azure is catching up to AWS: While in 2017 AWS accounted for more than 60% of mentions of top cloud services skills in job postings, this number is down to 40% in July 2024. Meanwhile, Azure’s share has risen from 21% to 34%.

Mentions of the technologies suggest that this trend is mostly linked to employers moving away from AWS in favor of Azure, as well as to an increased interest in candidates with general cloud computing skills, instead of AWS skills specifically.

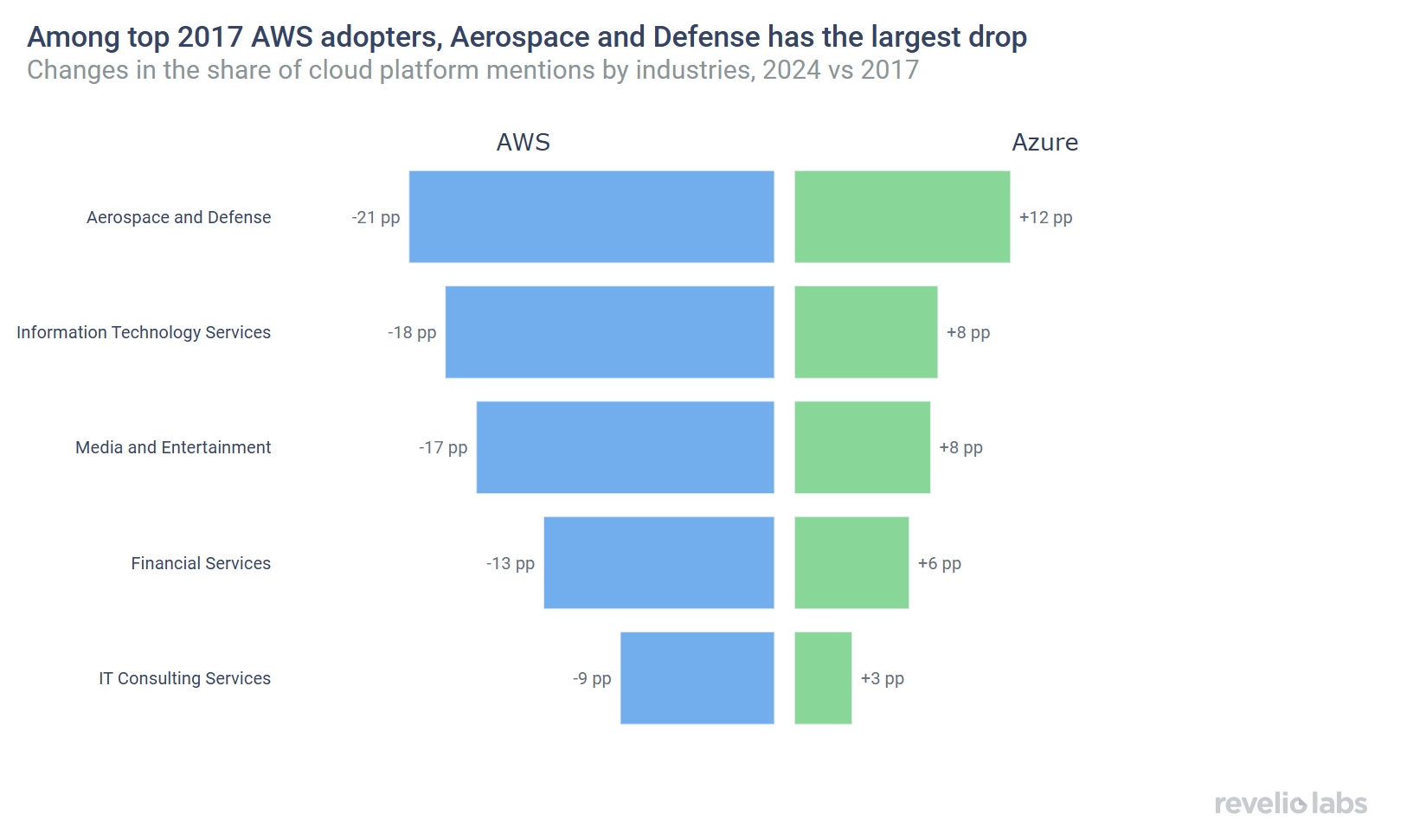

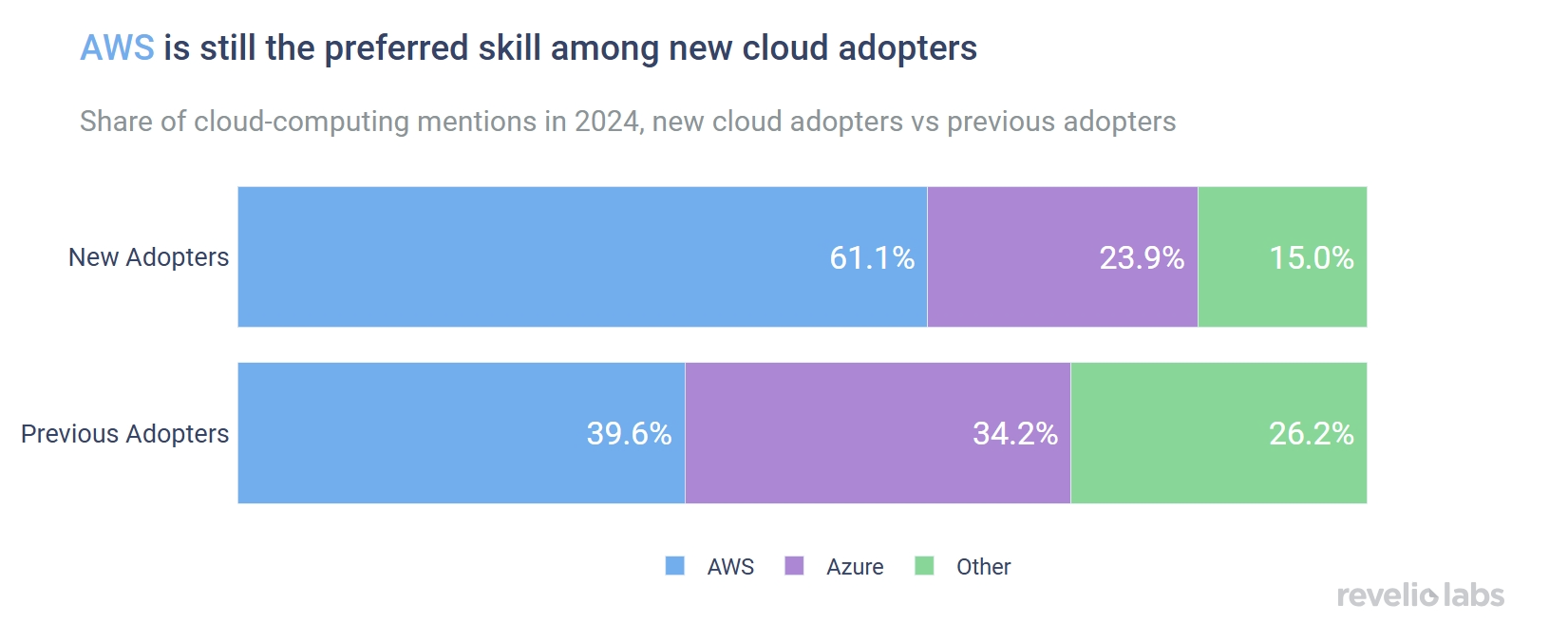

The major industries where Azure is catching up to AWS are Aerospace & Defense and Information Technology Services. Meanwhile, AWS remains the preferred cloud technology among new cloud adopters.

As companies continue their digital transformation, cloud solutions are steadily on the rise, driven by a surge in demand for AI-ready infrastructure. Major cloud providers, such as Amazon Web Services, Microsoft Azure and Google Cloud are competing fiercely to expand their share in this dynamic and growing market, which is projected to surpass $800 billion in 2024. AWS has historically dominated the market, but recently it seems to have started to lose ground to Azure. This week, we use our workforce insights data to shed light on the evolving competitive dynamics in cloud computing, examining which companies are solidifying their leadership and which are gearing up to make significant strides.

Our analysis focuses on six major cloud providers—AWS, Azure, Google Cloud, Alibaba Cloud, IBM Cloud, and Oracle Cloud—all of which offer primary cloud services. We begin by examining how the demand for these services has shifted over the past 7 years by looking at skill requirements in job postings. In 2017, AWS accounted for more than 60% of all mentions of major cloud services in job postings. However, by July 2024, this figure had declined to just 40%. Meanwhile, Microsoft Azure has steadily gained ground, increasing its share from 21% in 2017 to 34% in July 2024, narrowing the gap with AWS to just 6 percentage points.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

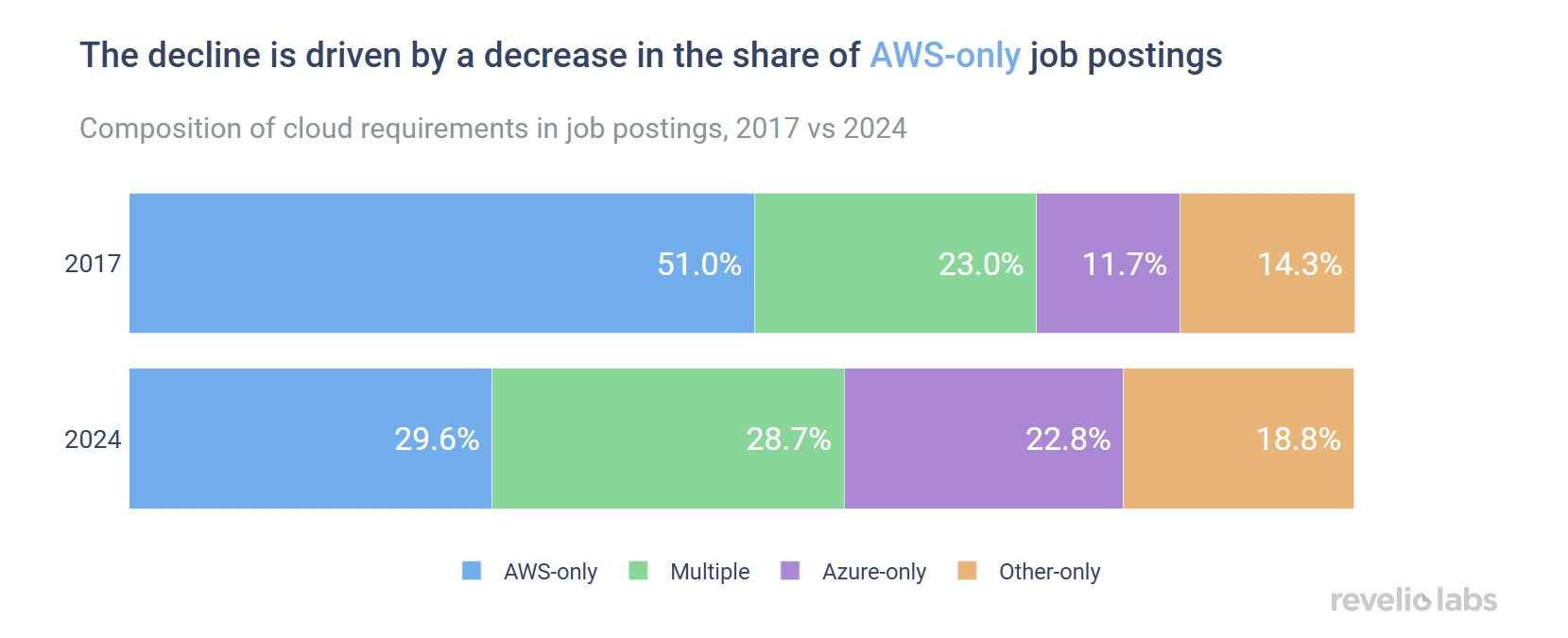

Further analysis of the data reveals two significant trends that are linked to AWS’s decline. First, the share of job postings that exclusively mention AWS has dropped from 51% in 2017 to just 29% in 2024, while postings mentioning only Azure have doubled, reaching 22% in 2024. This shift suggests that some employers might be transitioning to Azure, possibly at AWS’s expense. Secondly, the share of postings that require cloud skills from multiple providers has risen by 6 percentage points, now accounting for nearly 29% of job postings in 2024. This indicates a growing demand for candidates with broad cloud expertise, rather than a focus on any single technology.

Next, we analyze which industries have seen the biggest competitive change over the last 7 years. Among the top 5 adopters of AWS in 2017, Aerospace & Defense and Information Technology Services are the two industries with the greatest drop in demand share for AWS. The share of cloud mentions in Aerospace & Defense cloud job postings has dropped from almost 73% in 2017 to 52% in 2024, a 21 percentage-point decrease. On the other hand, Azure’s share has increased by 13 percentage points, reaching close to 36% in 2024. Similarly, the share of AWS cloud mentions has decreased by 18 percentage points in Information Technology Services and stands at 45% in 2024, whereas the Azure share has increased by 8 percentage points, reaching 34%.

Despite this overall trend, AWS still maintains an advantage over other cloud providers when it comes to firms who are just starting out to build their cloud infrastructure. Among firms who have their first postings with cloud skills in 2024, AWS’s share is 61%, 2.5 times as much as Azure’s. On the other hand, for previous adopters AWS and Azure’s shares are much closer to each other.

In conclusion, while AWS remains a dominant force in the cloud computing market, particularly among new adopters, our analysis of demand data shows that the competitive landscape is clearly shifting. Azure’s steady growth in the past 8 years highlights its growing appeal as a strong AWS alternative. Additionally, employers are increasingly open to general cloud skills. As this dynamic market continues to evolve, the battle for cloud is far from over.