Employee Turnover And Firm Performance

What's the right amount of turnover for future performance?

A recent paper by Ben Lourie, a Professor at the University of California, Irvine used Revelio Labs HR data to explore the relationship between employee turnover and financial returns. He and his coauthors find a positive correlation between high turnover rates and poor future financial performance, and even seeing a strong association to lower stock returns.

The finding has many implications for how financial performance can be understood through workforce data.

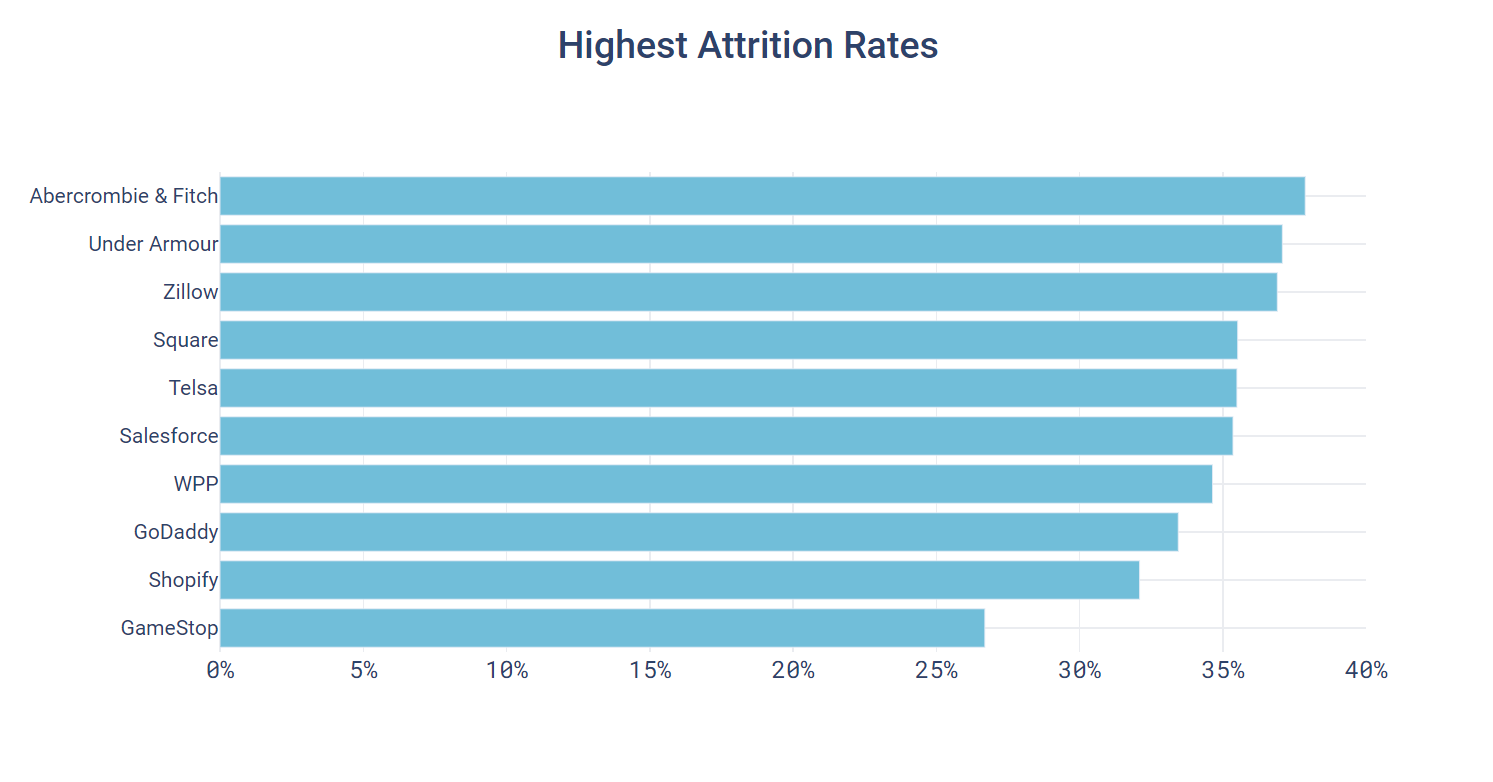

Below are the companies with the highest annual turnover:

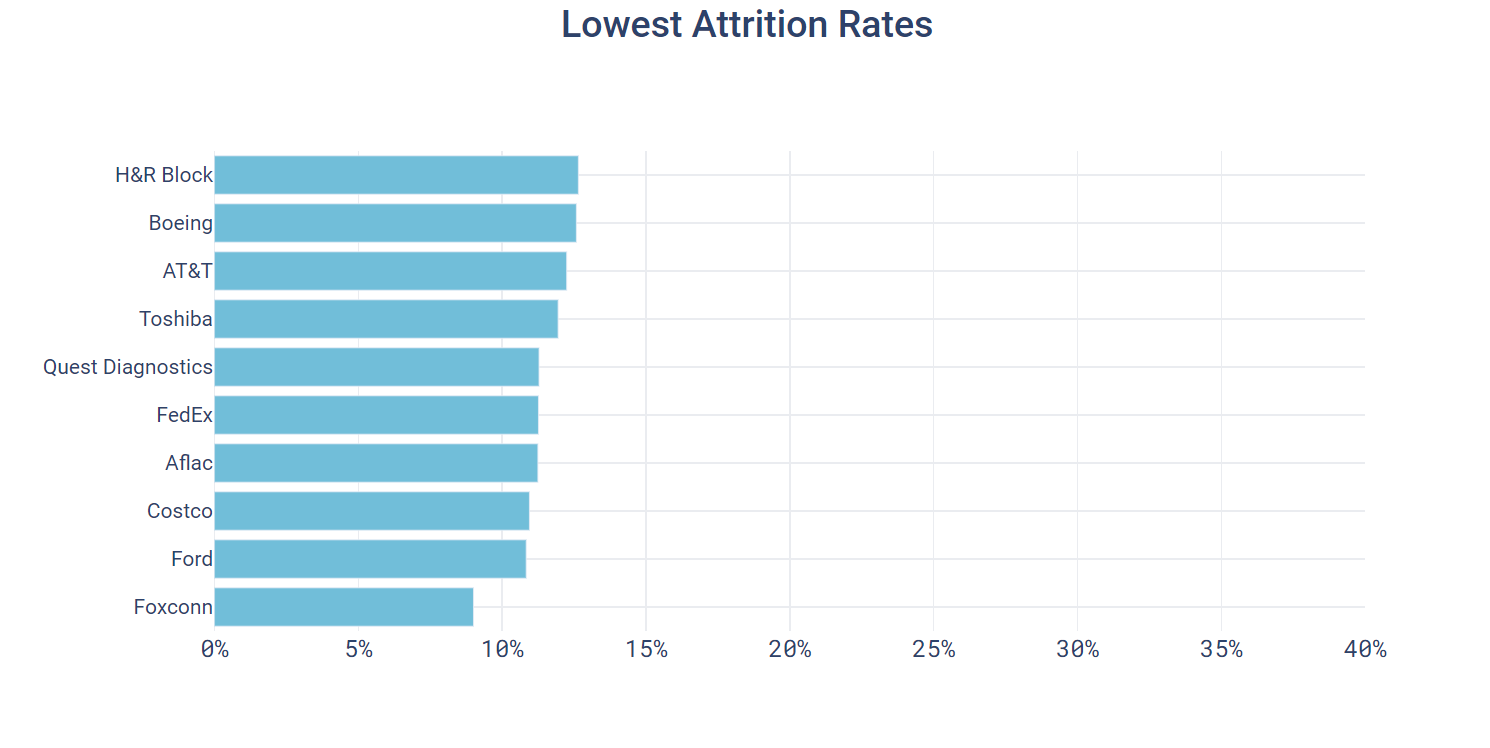

Another fascinating pattern identified in the paper is that extremely low turnover can also be a negative sign of future performance. There are a couple of potential reasons for this: (i) companies with low attrition may have a harder time rebalancing their workforce; and (ii) as the adage goes “science progresses one funeral at a time” -- perhaps entrenched ideas maintain the status quo when employees stay too long.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

Below are the companies with the lowest annual turnover:

Takeaways:

- High turnover (or attrition) can be a powerful sign of low performance (one-quarter ahead ROA and sales growth). Conversely, extremely low turnover can be a sign of a suboptimal workforce.

- Even fast growing companies, such as start-ups, can have attrition problems and require aggressive hiring to compensate.

- Companies with especially low turnover rates tend to be older, more traditional companies.

If you have any ideas of other metrics to track or would like to hear more about Revelio Labs and our HR data, please feel free to reach out. You can also check out some of our earlier newsletters on turnover and the use of labor market data to indicate future financial performance.