Is Recruiter Recruitment an Oracle for the Future?

Revelio Labs x Appcast: Recruiters are fighting for new jobs, but some industries are hiring again

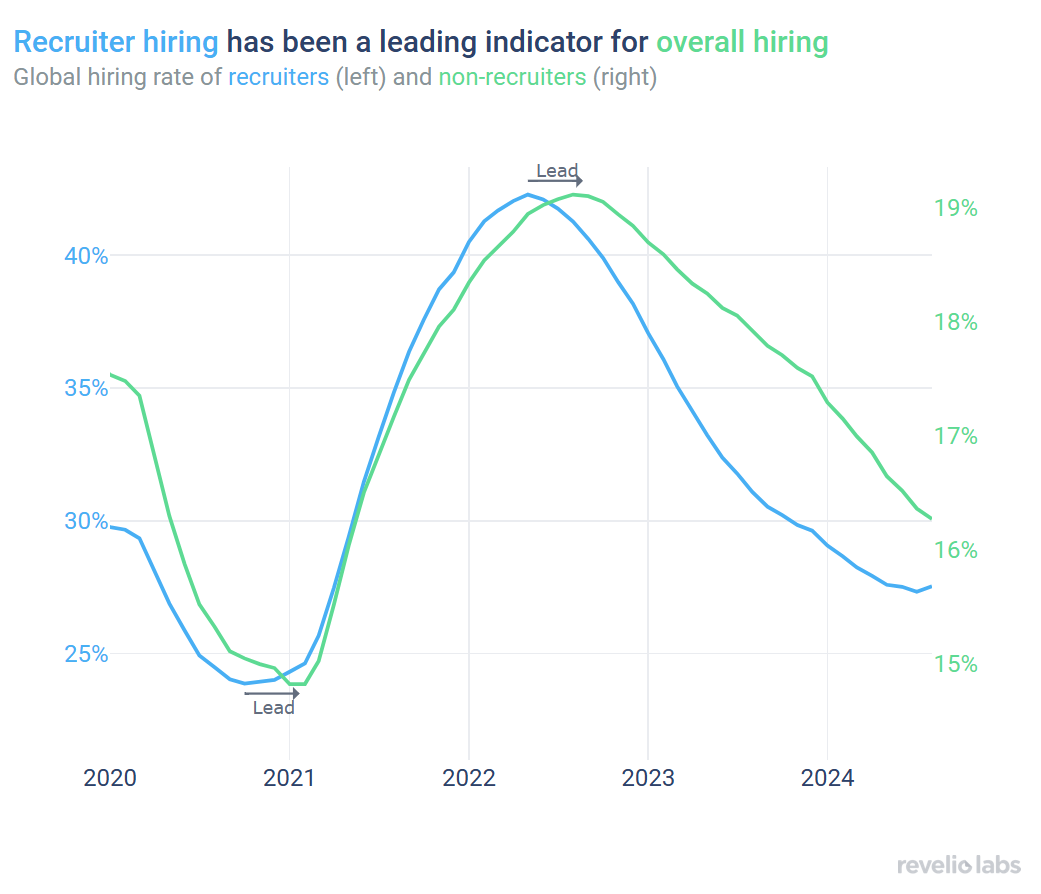

Since the pandemic, the hiring rate of recruiters has been a leading indicator of hiring in the broader economy, anticipating trends by about three months.

While demand for recruiters has partially recovered after the slump in 2023, recruiters still face a tough market, with increasingly competitive application processes for new jobs.

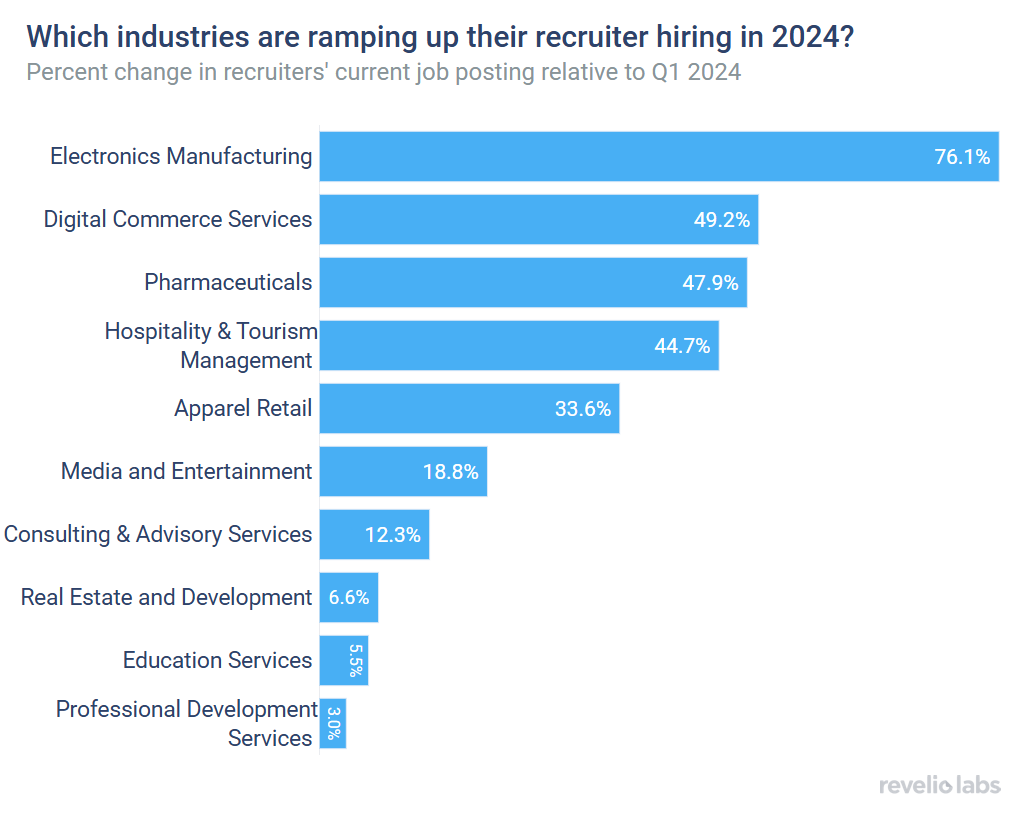

Some industries are ramping up their recruitment of recruiters. Such industries include Electronics Manufacturing, which has seen a 75% increase in Q3 recruiter hiring relative to Q1 2024.

Recruiters play a pivotal role in connecting talent with opportunities, ensuring an efficient hiring process and productive experiences for both candidates and companies. They often go above and beyond to facilitate successful hires, matching the right people with the right positions. In fact, recruiters' own job prospects tell an important story about the economy as a whole. In today’s newsletter, in collaboration with Appcast, we explore how trends in the recruiting job market reflect broader economic conditions and analyze the current state of the recruiting profession.

Recruiting is a highly cyclical profession, booming when companies expand and shrinking even more sharply during downturns. As we have previously shown, 2021 was the year to recruit recruiters, with this trend continuing to reach its peak by mid 2022. Currently, recruiters are facing a challenging job market: As Revelio Labs’ workforce data shows, their hiring rate has dropped over 10 percentage points since its peak in July 2022, which coincided with the post-pandemic hiring surge. This cyclical nature also makes recruiting an indicator for the broader economy. Trends in recruiter hiring often precede shifts in the wider labor market, with peaks and troughs typically leading to similar patterns in other sectors by about three months.

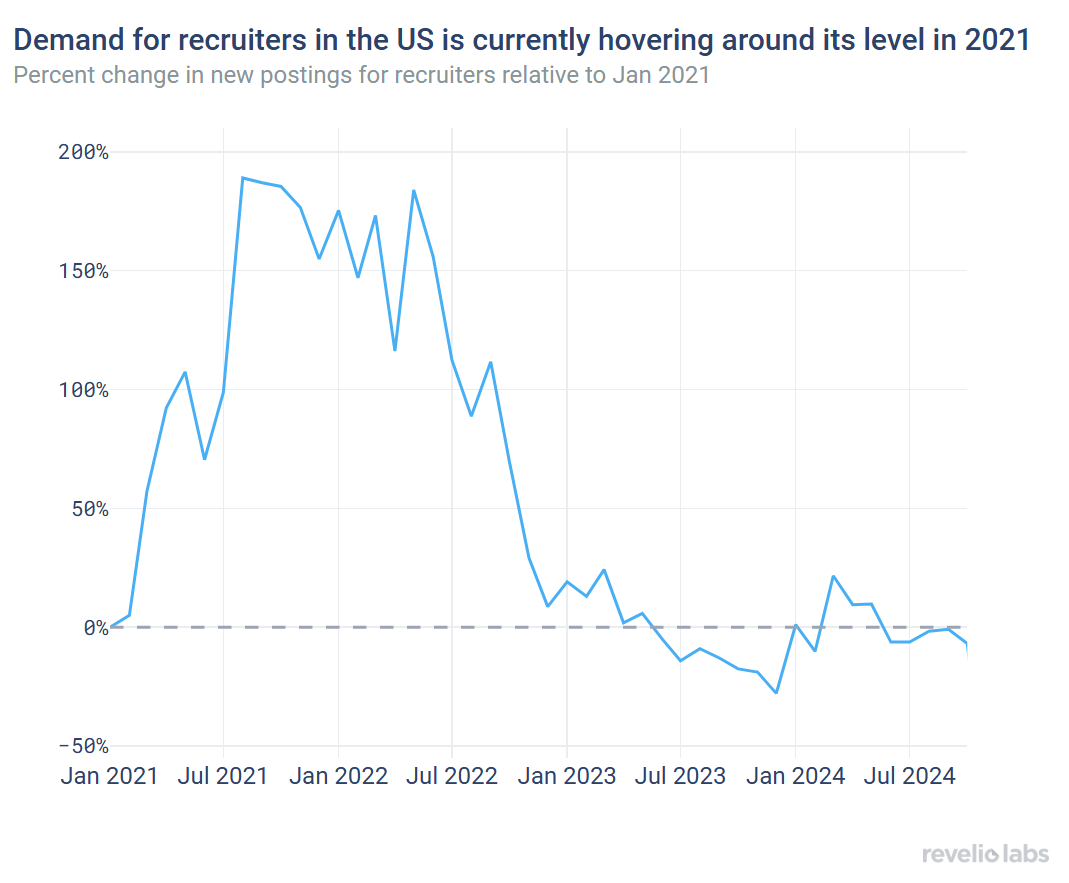

We find similar signs of cyclicality when analyzing recruiter job posting trends. After skyrocketing during the post-pandemic hiring surge, new job openings for recruiters plummeted during the summer of 2022, reaching their lowest levels in 2023. The past year showed signs of a timid improvement, as demand has stabilized at the same level as early 2021, signaling a return of the market to its “normal” level.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

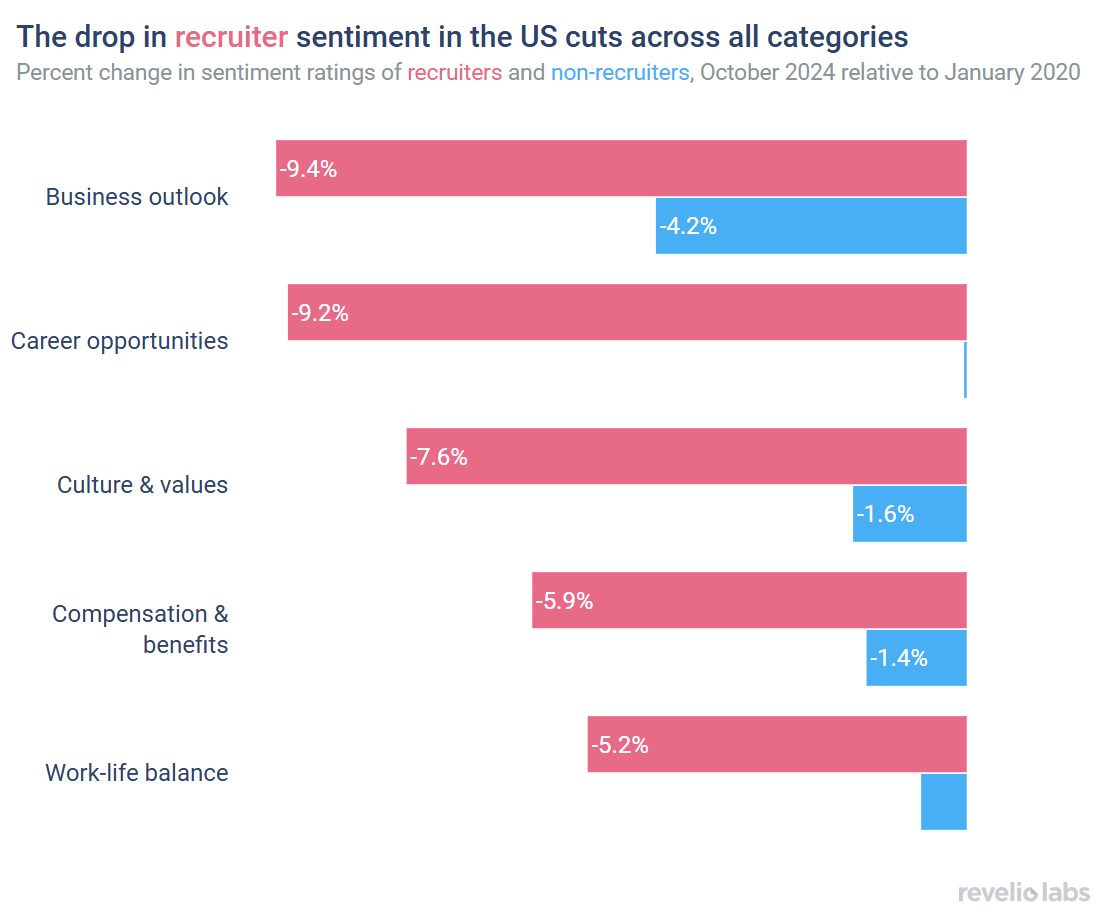

Not surprisingly, the tough labor market translates into lower morale across the profession. An analysis of recruiter sentiment data supports this trend: Compared to pre-pandemic levels, US recruiters have seen a marked decline in sentiment across all categories, ranging from a 5.2% decrease in work-life balance ratings to an almost 10% decrease in business outlook ratings. This drop is also far steeper than changes observed in other occupations, underscoring the particularly challenging environment recruiters operate in.

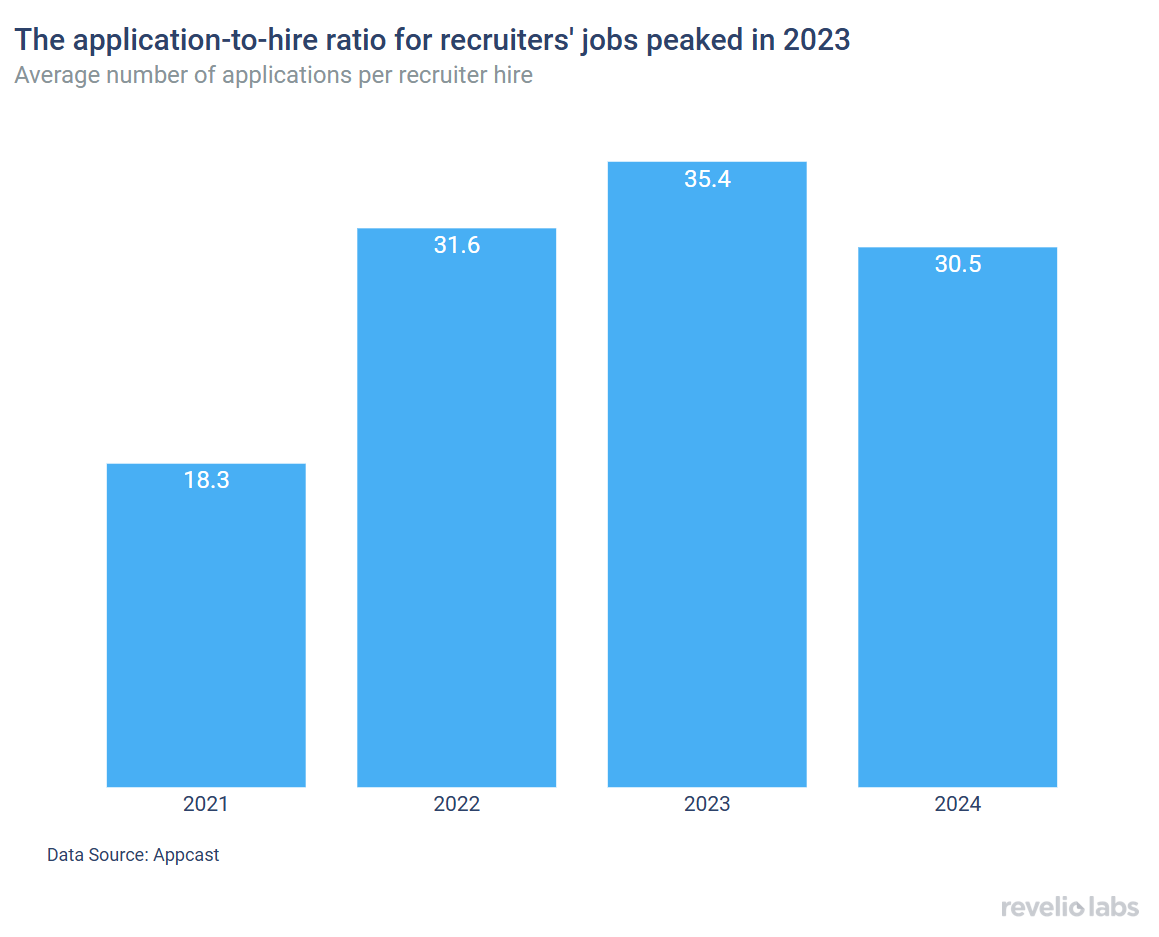

This challenging hiring environment is shaping the job search experience of recruiters seeking new opportunities. An analysis of Appcast job applications data reveals that the average application-to-hire ratio for HR roles in the US surged during the hiring slowdown of 2023, remaining almost twice as high compared to 2021: While in 2021 it took on average 18 applications to hire a successful candidate in human resources, the number has now increased to almost 31 applications. This uptick underscores the competitive landscape recruiters now face as they navigate their own job market amid reduced demand.

Despite the challenges in the recruiting job market, certain industries show a solid demand for recruiters. For instance, in 2024, companies in Electronics Manufacturing have significantly increased their job postings targeting recruiters, indicating that it is an industry that may be gearing up for substantial growth. As shown in Appcast research, recruiters in the Manufacturing sector, particularly in electronics and transportation, are poised for a period of significant growth. Federal initiatives, paired with private sector collaboration, have sparked a boom in US chip manufacturing. Private fixed investment has surged to $150 billion—more than double pre-pandemic levels—fueling demand for skilled talent.

The recruiting job market can serve as a valuable indicator of broader economic conditions, offering early signals of shifts that may ripple across other sectors. While recruiters are navigating a challenging landscape with reduced demand and high application volumes, signs of a potential turnaround are emerging in certain industries.