PE Investments Bring Talent Divestment

How PE deals fuel attrition, lower wages, and erode employee morale

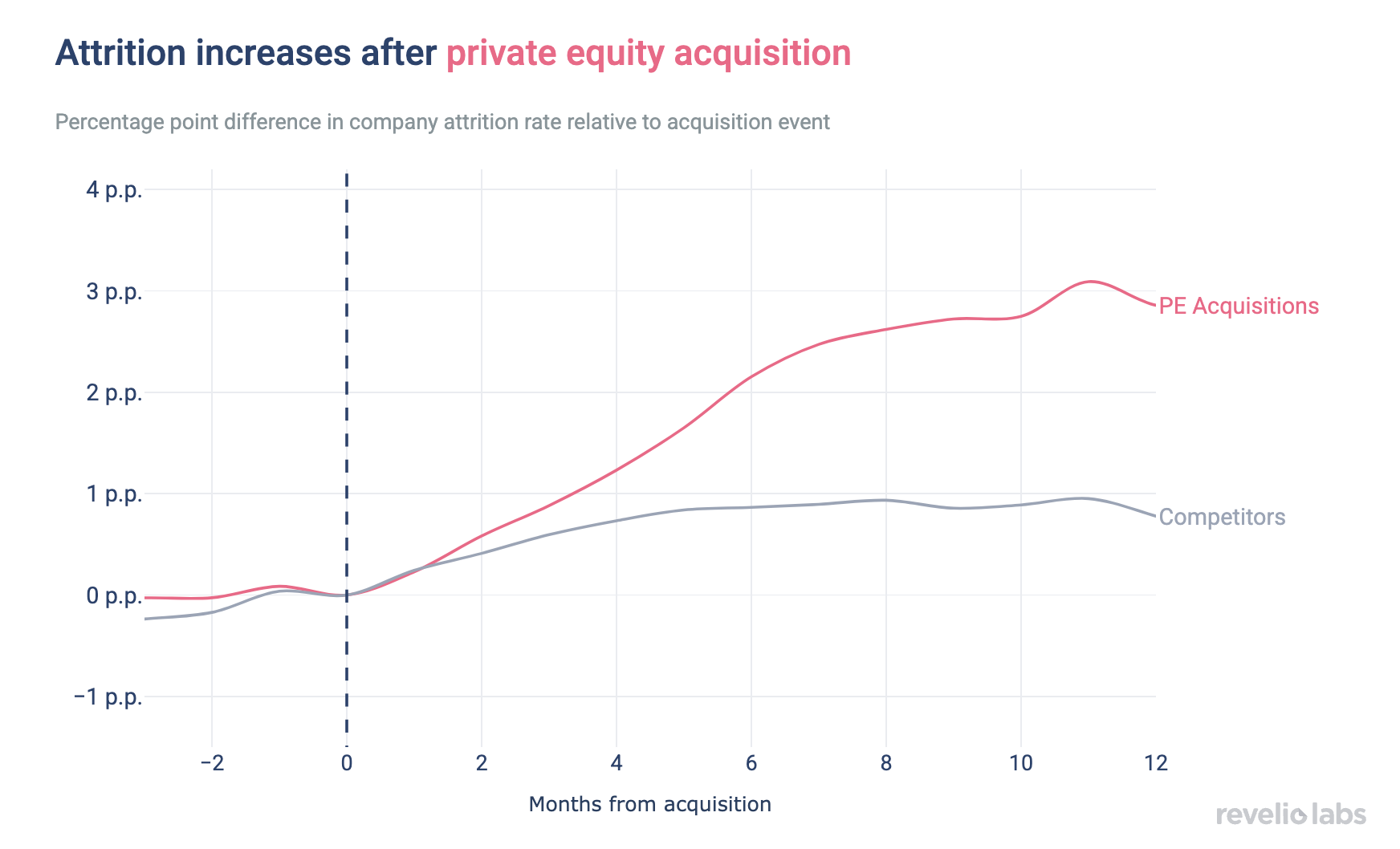

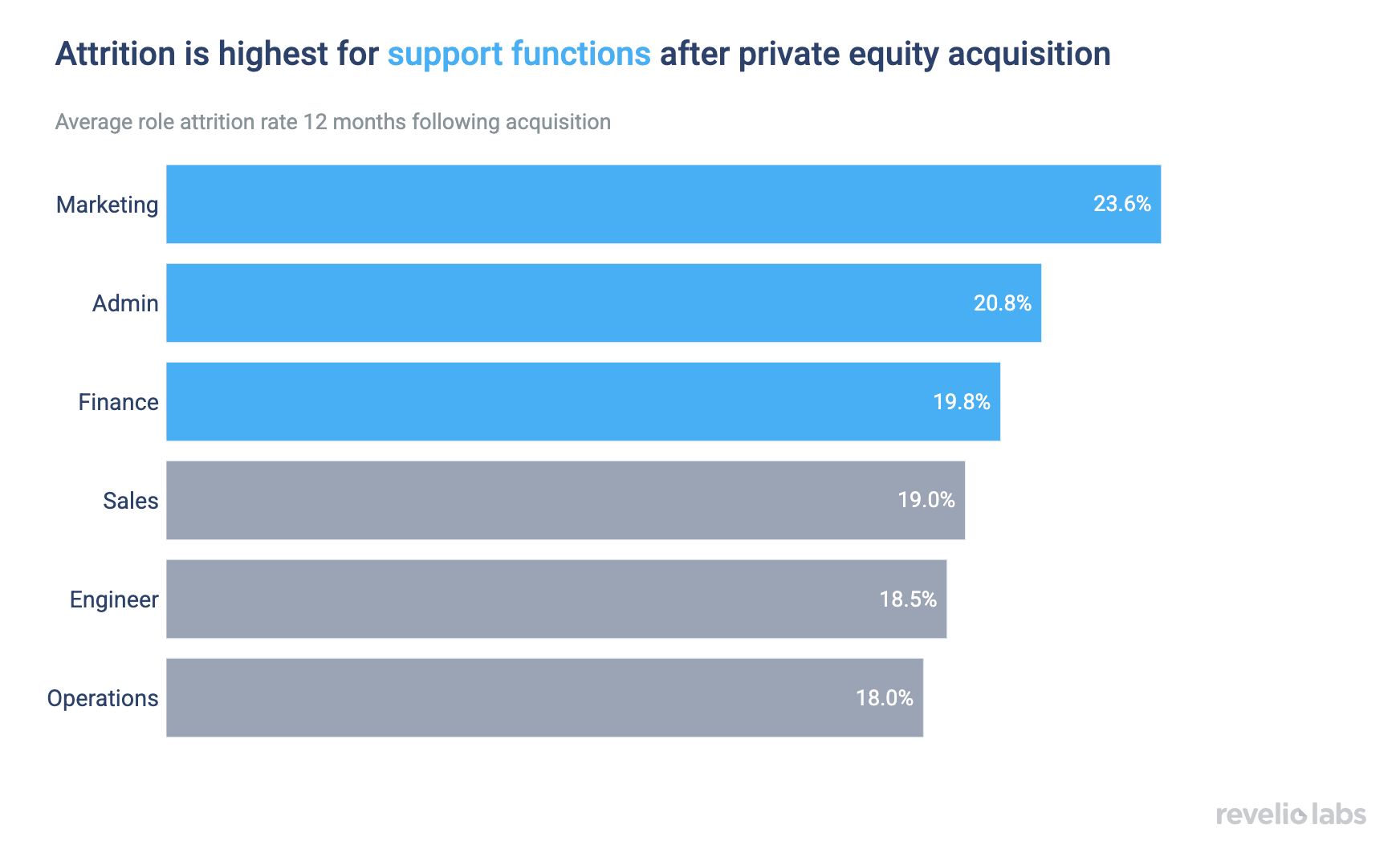

Companies acquired by private equity firms typically experience a sharp increase in attrition after the acquisition, particularly among high-paying roles and support functions. This trend reflects common cost-cutting strategies, such as mass layoffs and restructuring.

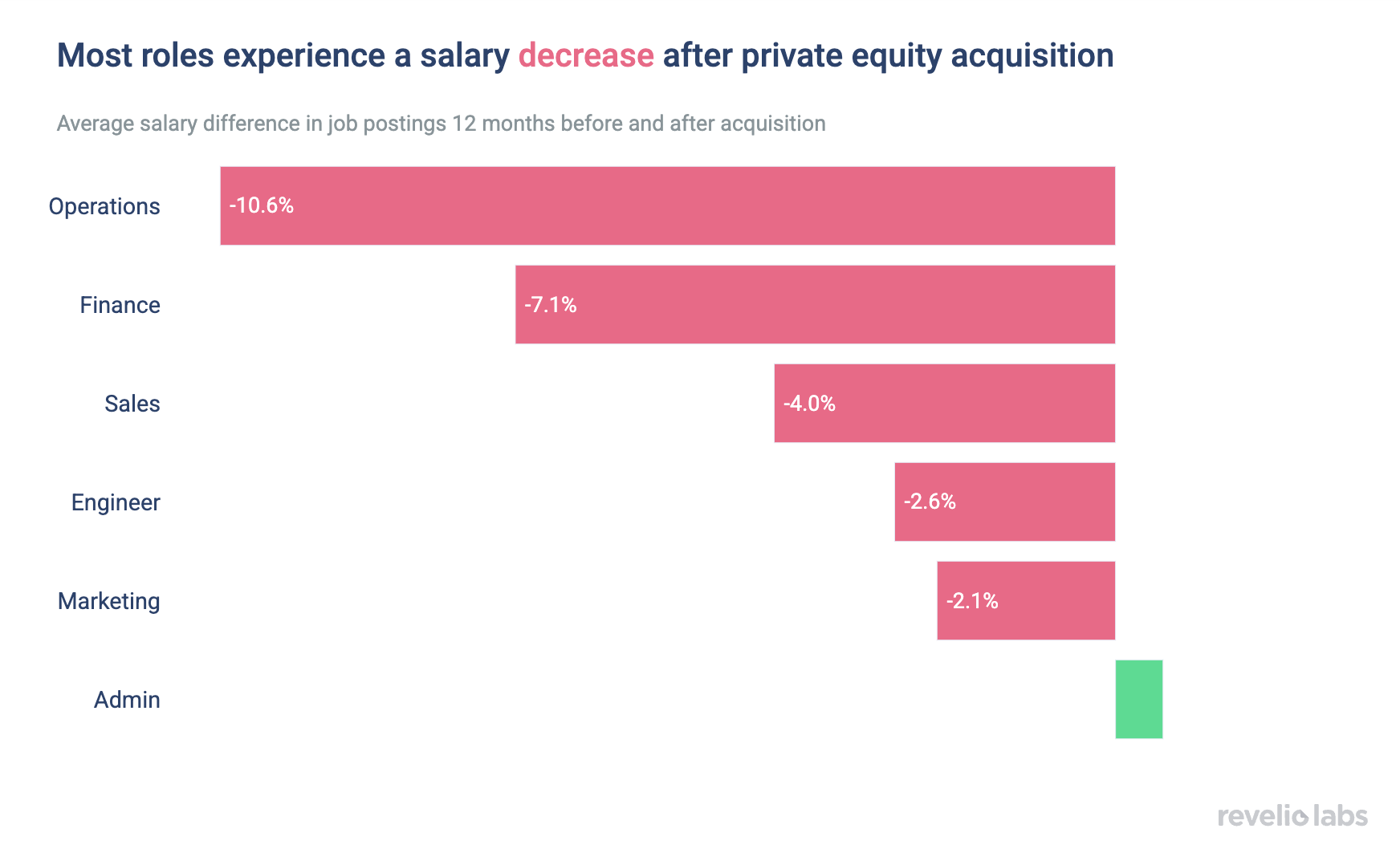

Further cost-cutting strategies are evident in job postings, which show lower salaries after the acquisition across most roles—except for administrative positions. This suggests a targeted approach to attract new leadership with higher compensation, while trimming costs in other business functions.

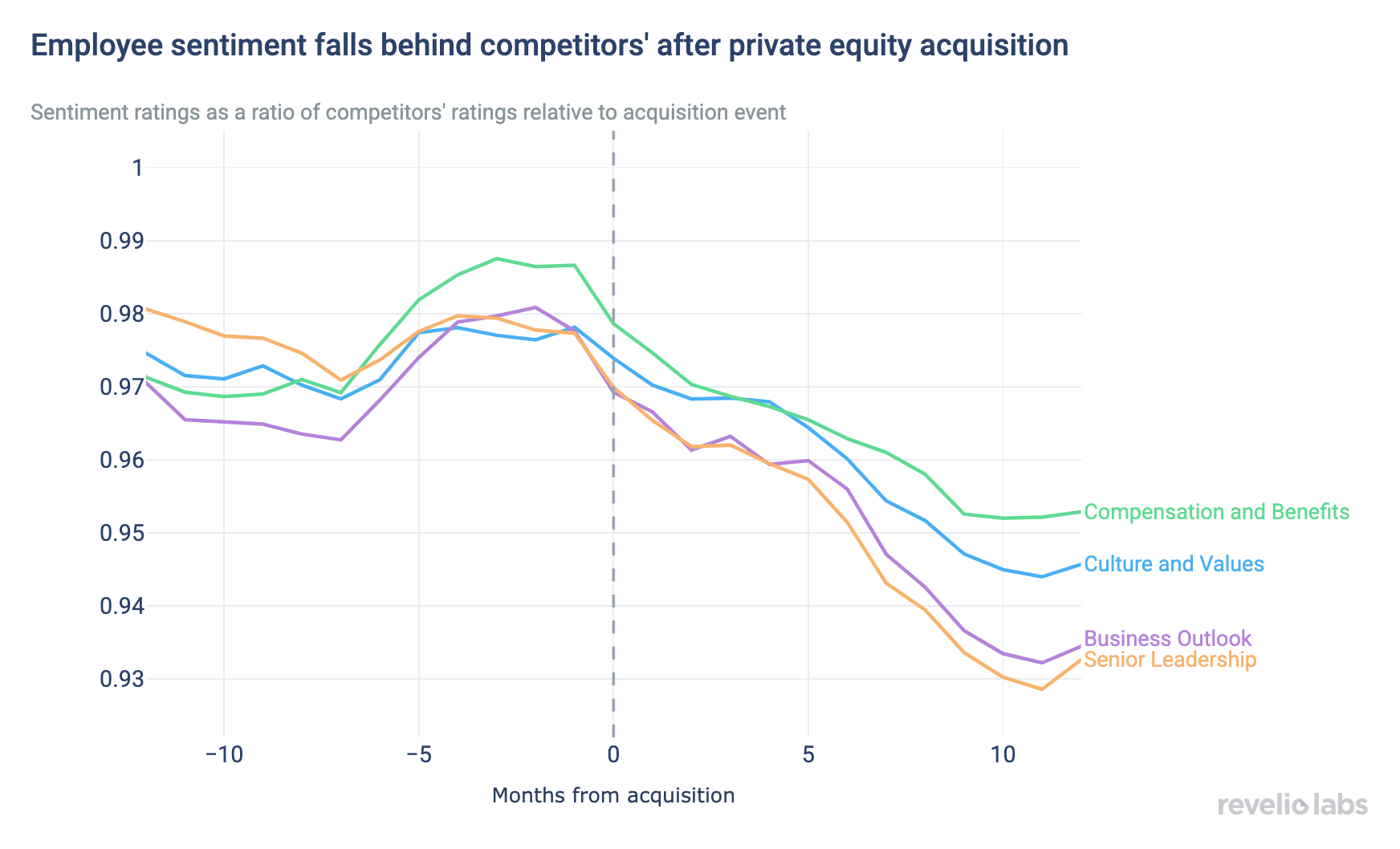

These cost-saving tactics come at the expense of current employees. Employee sentiment regarding senior leadership, business outlook, and company culture dips after the acquisition. The decline in employee sentiment is persistent, extending beyond the typical recovery period associated with other mass layoffs.

Private equity (PE) acquisitions introduce uncertainty regarding a company’s future direction, leadership, and operational strategy. To maximize profitability, private equity firms frequently implement large-scale cost-cutting measures, such as mass layoffs and workforce restructuring. Our previous research has shown that these aggressive tactics in mergers and acquisitions (M&As) can lead to declines in employee sentiment toward company culture and values, as workers perceive M&As negatively. This week, we focus on private equity acquisitions. Using Revelio Labs’ workforce data, we analyze a series of acquisitions to quantify private equity’s impact on workforce composition, assess the effectiveness of these strategies in reducing costs, and examine the toll it takes on employee sentiment.

As anticipated, companies acquired by private equity firms experience a significant increase in attrition during the year following the acquisition. The increase in turnover is especially notable when compared to competitors, who maintain relatively stable turnover rates during the same period, despite having similar rates prior to the acquisition. The heightened turnover at private equity-acquired companies is likely driven by a combination of mass layoffs and voluntary attrition from disgruntled employees.

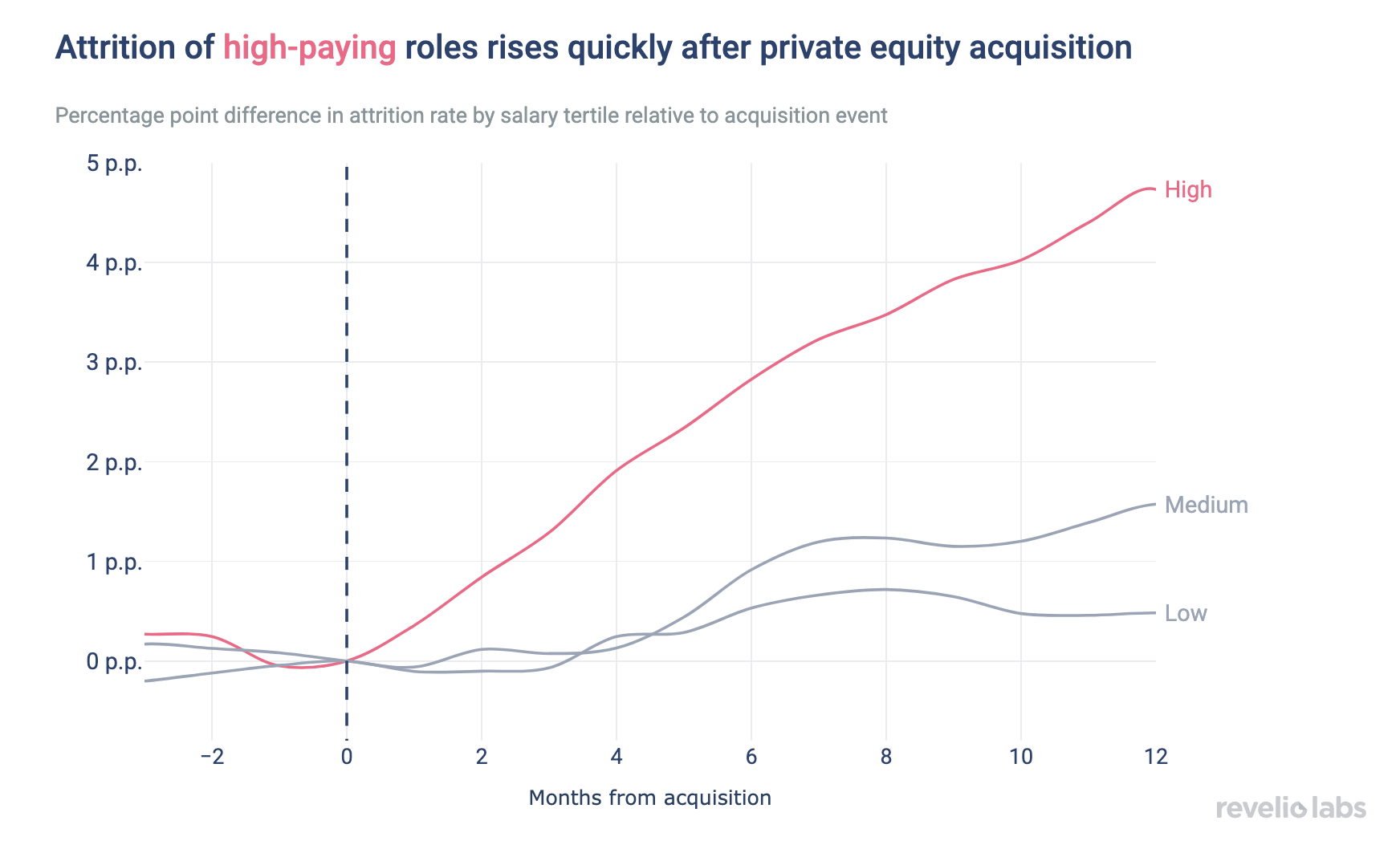

Attrition at companies acquired by private equity firms varies by salary level. When examining different salary tiers, the highest-paying roles experience the largest increase in attrition rates during the year following the acquisition, while medium and low-paying roles show similar, lower rates of attrition. The increase in attrition highlights the use of layoffs as a cost-cutting strategy and suggests potential restructuring of high-paying leadership positions.

Cost-cutting measures are also evident when examining attrition across different functions. While attrition is elevated in all roles, it is notably higher in support functions such as marketing, administration, and finance. Revenue-generating and product-related functions experience lower levels of attrition. As private equity firms focus on increasing profit margins, they resort to cutting non-essential roles.

While attrition of high-paid roles and support functions rises following a private equity acquisition, job postings in the year after also reflect cost-cutting measures. Most replacement roles are posted with lower salaries compared to pre-acquisition levels, indicating that employees are being replaced at lower compensation. An exception to this trend is seen in job postings for administrative roles, which experience a slight salary increase. This is likely due to the restructuring of leadership positions, where higher salaries are used to attract more qualified talent.

However, these cost-saving tactics come at the expense of employee satisfaction. Prior to the acquisition, companies acquired by private equity are already rated more poorly by their employees on average, which may offer insights into why they were targeted for acquisition. After the acquisition, this sentiment gap widens, with further declines in areas such as senior leadership and CEO performance, culture and values, business outlook, and compensation and benefits. The existing sentiment deficit grows in the year following the acquisition, extending beyond the typical recovery period after mass layoff events noted in an earlier newsletter.

While private equity firms are undeniably effective in their cost-cutting efforts, the workforce often pays a heavy price. Private equity acquisitions typically lead to higher attrition, lower pay, and declining employee sentiment. It is in the best interest of private equity firms to consider the long-term consequences of aggressive cost-cutting measures as the exodus of key employees and low morale can impact company growth. On the other hand, employees of companies acquired by private equity should be mindful of these historical trends as they weigh their futures under new ownership.