SPAC Special: Which Startup Will Be Acquired Next?

Workforce intelligence tools can hint at who is readying for a SPAC merger

The term SPAC (or Special Purpose Acquisition Company) has made a splash in headlines over the past year. Considered by some to be a "blank check", the unique instrument is essentially a shell corporation designed to quickly take private companies public.

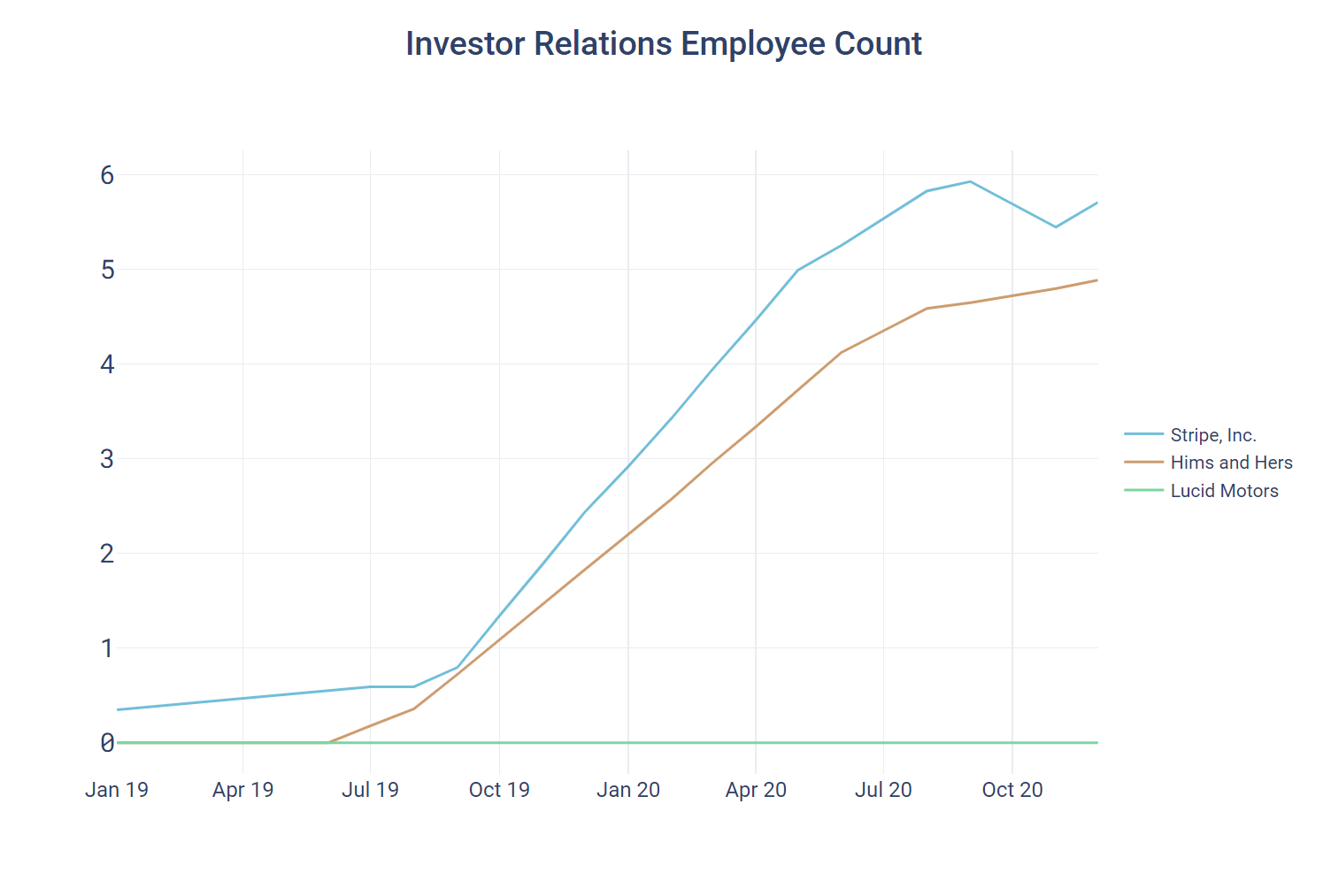

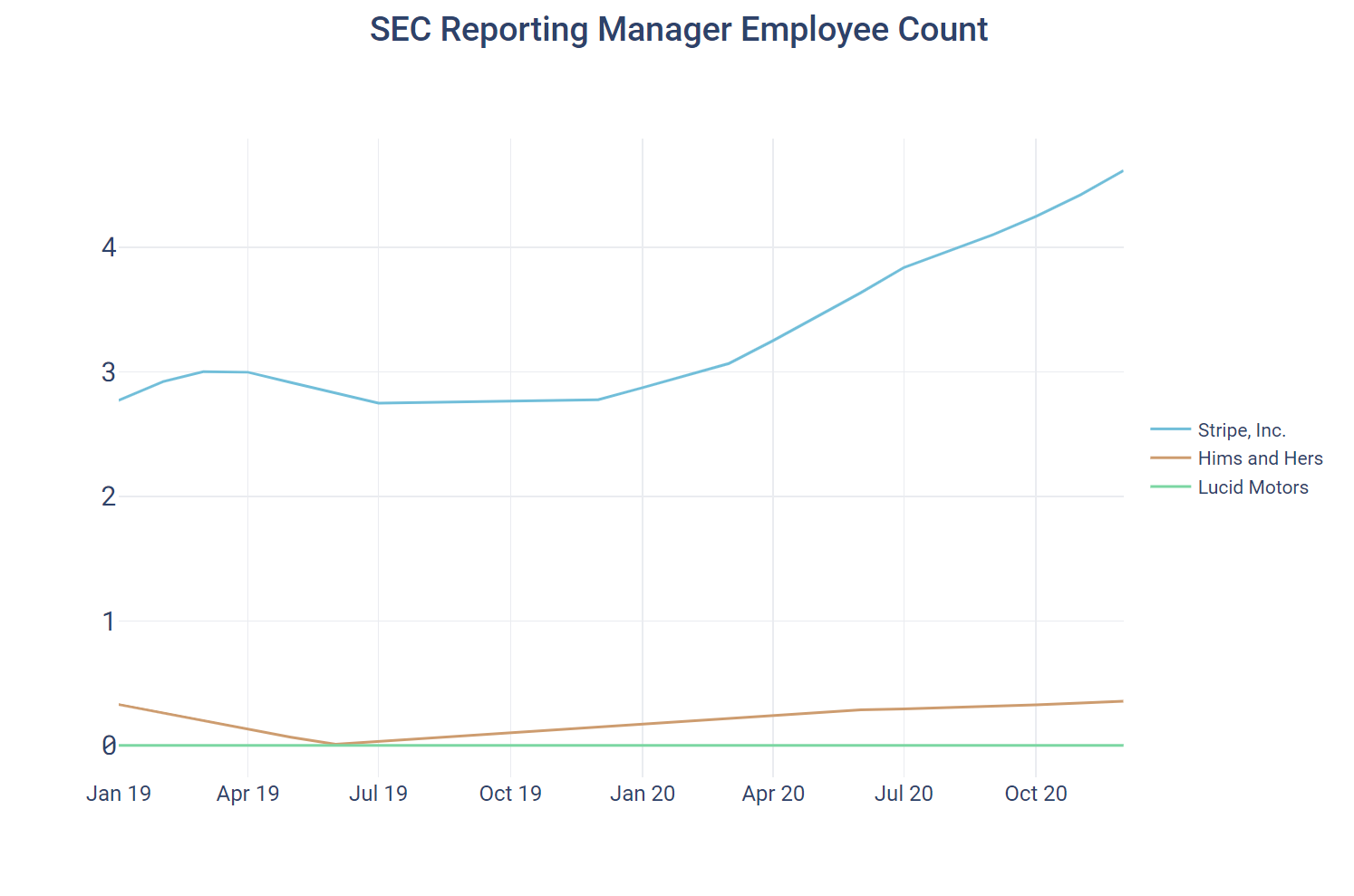

Before a SPAC merger, private companies have been known to build out a small but critical ‘Investor Relations’ team. These employees play an interesting role: part finance, part publicist -- Investor Relations help companies prepare for a sale. Additionally, SEC Reporting Managers are critical for preparing legally required financial reports and SEC filings in preparation for a merger. These employees can also act to support the Investor Relations team by providing financial documents to be distributed among SPAC investors.

Working with Amass Insights and using Revelio Labs' HR database systems, we’ve begun to track these positions (along with several others) among popular tech startups to better predict SPAC acquisitions by observing changes in workforce planning.

We recently analyzed three companies upon which intense speculation has been focused over the past several months: Hims & Hers, Lucid Motors, and Stripe. Of the three, Hims & Hers remains the only company to have completed a merger - with Oaktree Acquisition Corp in January. Stripe reportedly has been in limited talks with Pershing Square Tontine since last autumn, while more recently Lucid Motors is rumored to be in talks with Oaktree Acquisition Corp.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

Here, we show the counts for Investor Relations and SEC Reporting at the three companies:

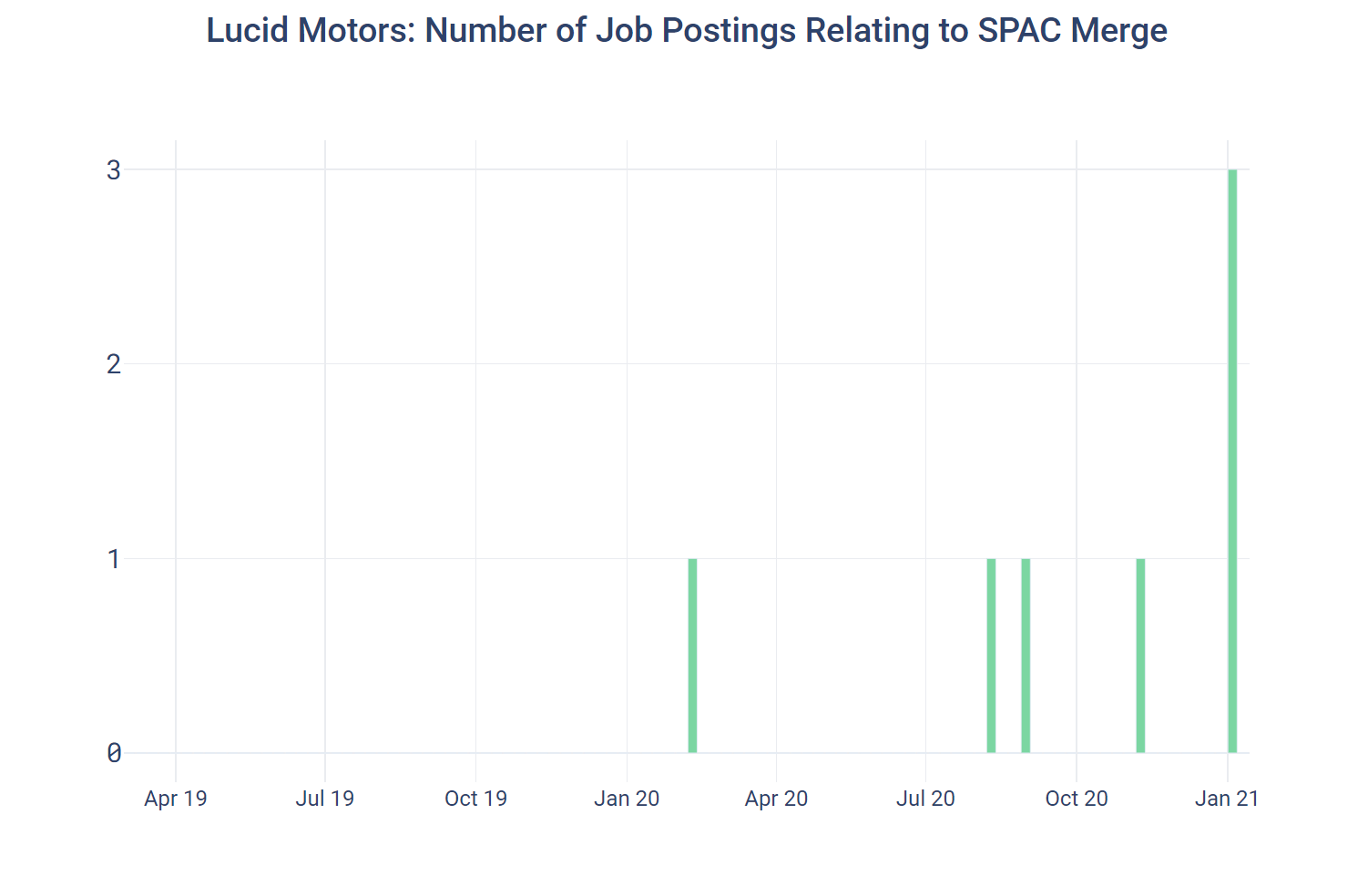

Even though Lucid Motors has not hired any new employees related to the SPAC merger, we see (using another Revelio Labs data analytics tool) that there are postings for relevant jobs in recent weeks:

Takeaways:

- Of the 3 companies, Stripe has been most predictably preparing for a SPAC merger or IPO by increasing the size of their Investor Relations and SEC Reporting teams.

- Lucid Motors has only just begun making key hires to ready themselves for an acquisition, Revelio Labs' job postings data analytics tool shows.

- As SPACs become a popular option for smaller companies to go public, the ability to predict new SPAC acquisitions with changes in workforce planning can provide investment opportunities, help gain insight into a company’s health, and map out its long term trajectory as a part of a larger holding company.

If you have any ideas of other metrics to track or would like to hear more about Revelio Labs' HR database systems, please feel free to reach out.