The Hedge Fund Comeback

You can't keep a good hedge fund down

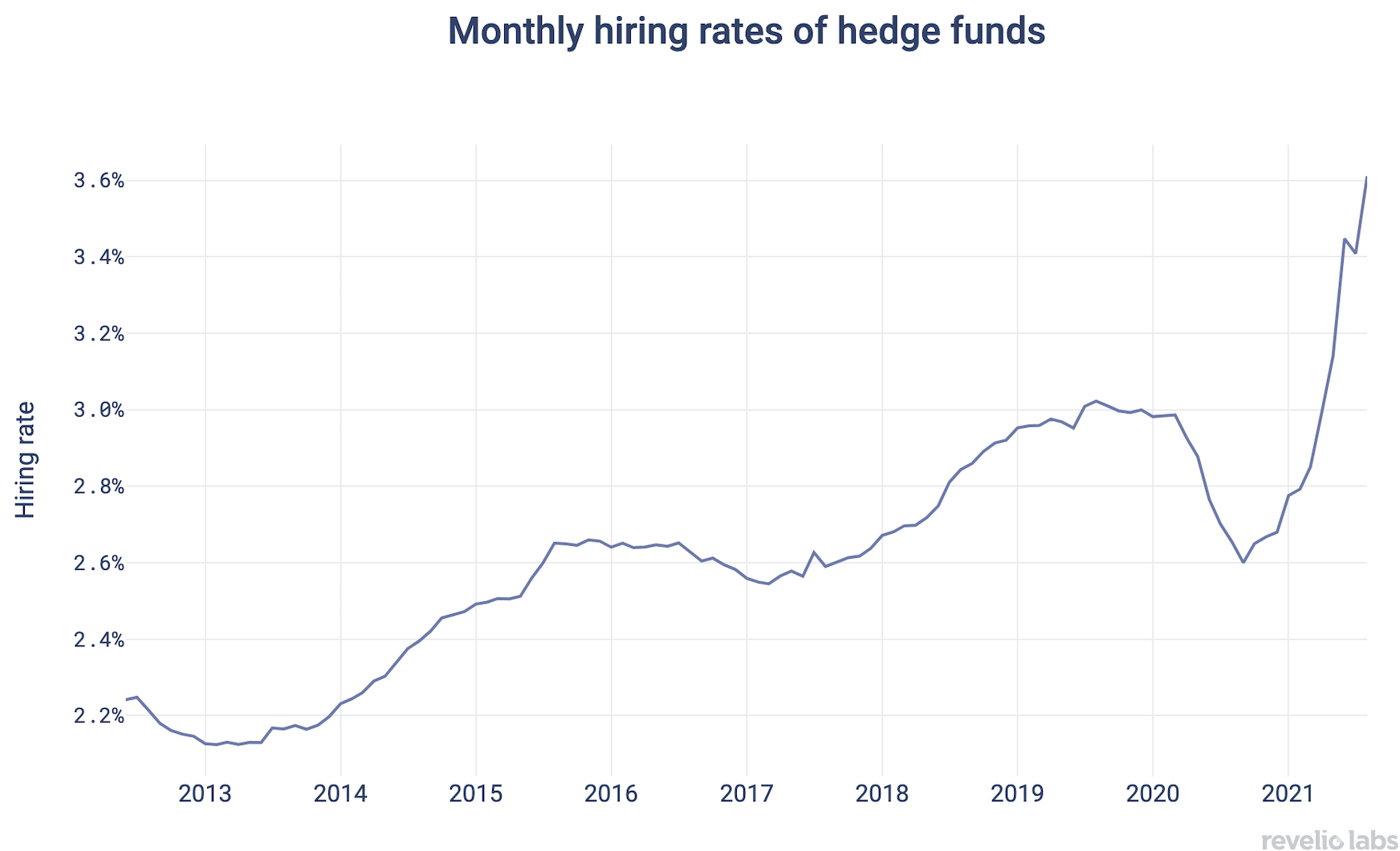

This week, we collaborated with Hedge Fund Alert to track hedge fund hiring trends as people return to offices. Our labor market analysis shows that after a dip following the pandemic, hedge fund hiring rates in 2021 are greater than they have been in 8 years and are continuing to rise sharply.

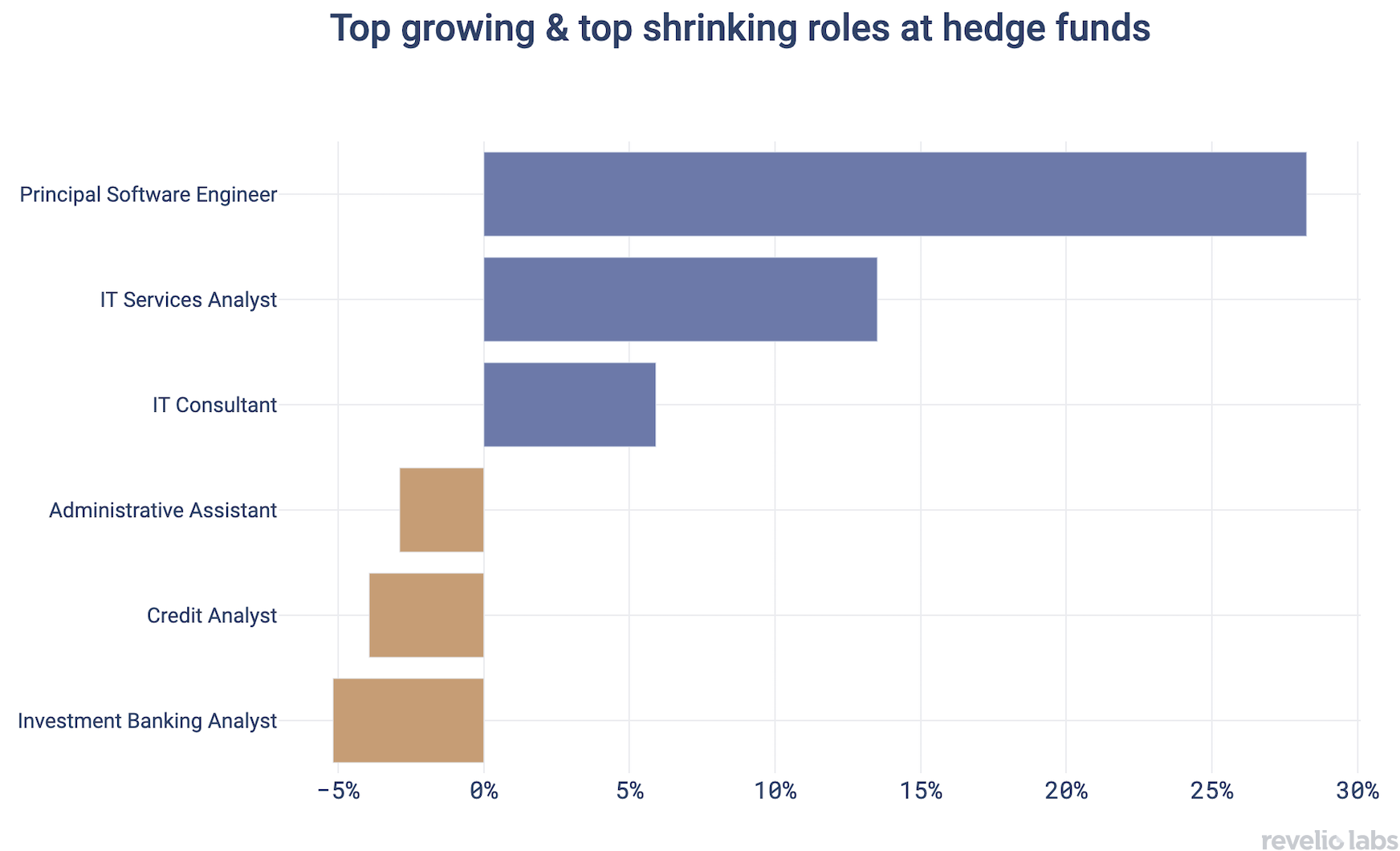

Looking at the headcount growth of certain roles in 2021 versus 2020 using the Revelio Labs job taxonomy, we see that there is a strong growth of senior roles with engineering and technical focus. Traditional banking roles, which are still strong in absolute numbers, are seeing a relative decline. This may be due to the industry’s growing focus on algorithmic trading.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

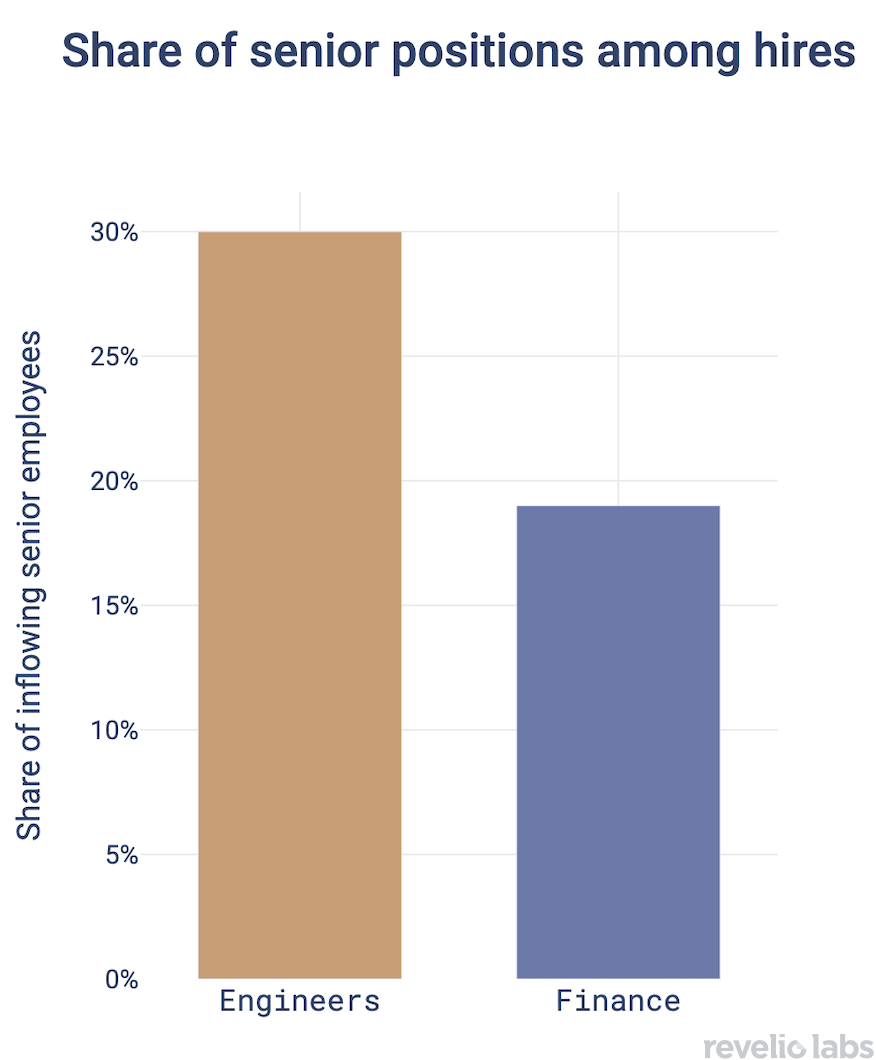

When inspecting the share of incoming employees hired for senior level positions, we see that hedge funds are hiring a more experienced engineering workforce in comparison to their finance workforce. Like we saw a few months ago in The War for Talent: Hedge Funds vs Big Tech, we continue to see that hedge funds are poaching these senior engineers from big tech.

Key Takeaways:

- Hedge fund hiring rates are at an all time high, with a monthly hiring rate of 3.6 percent, our labor market analysis shows.

- Utilizing the Revelio Labs job taxonomy, we find that the fastest growing roles are senior software engineers and other tech-focused roles, consistent with our earlier newsletter.

- The incoming engineers tend to be more senior than finance focused roles.