These Employees Should Brush Off Their Resumes After an Acquisition

New company in, old employees out

Acquisitions result in increased employee attrition at the acquired company 18 months after the event.

Recruiting and marketing roles, as well as entry-level and executive-level roles at the acquired company, are hit hardest after acquisitions.

Companies acquired by other companies in different industries seem to be the most successful. Five years after acquisition, employee counts following these acquisitions grow at three times the rate of those following acquisitions within the same industry.

Acquisitions are significant events for companies, often leading to shifts in growth and expansion. However, they may also bring about feelings of uncertainty for employees. While some employees may see opportunities for synergies or collaboration, others could face challenges such as redundancy, shifts in responsibilities, or cultural misalignment. We have previously written about the effects of M&A on employee sentiment and stock performance. This week, we use Revelio Labs’ workforce data to focus on the labor market outcomes of employees.

We analyze acquisition events from the past ten years, excluding acquisitions by holding companies and limiting the sample to events where both the acquired and acquiring companies had at least two thousand employees at the time of the event.

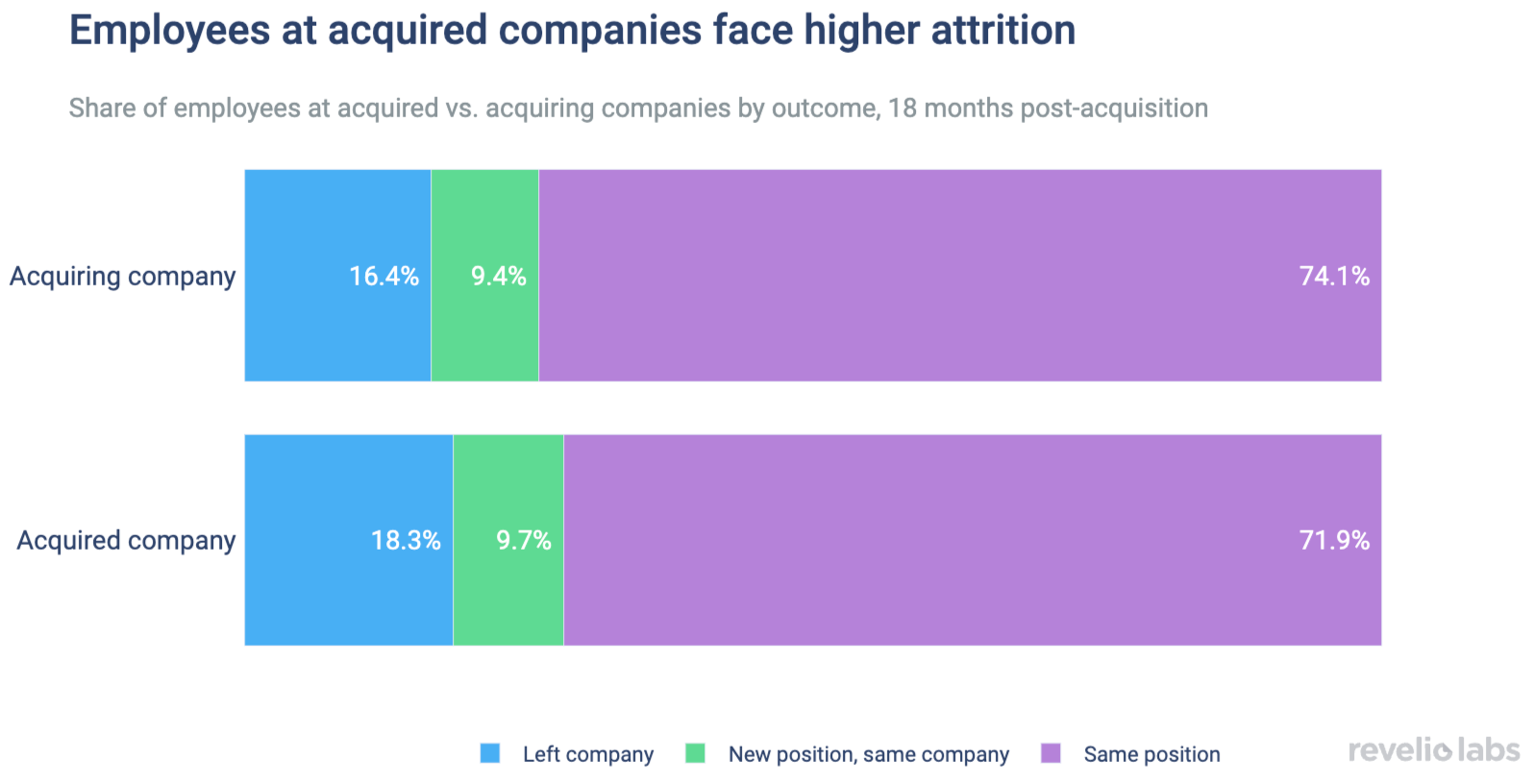

Employee attrition, both voluntary and involuntary, is typically top of mind regarding acquisitions. Employees at both the acquired and acquiring companies may face layoffs and corporate restructuring. We find that employees at acquired companies are slightly more likely to experience employment changes after the event, with about 18% no longer working at the parent company 18 months following an acquisition and almost 10% starting new positions.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

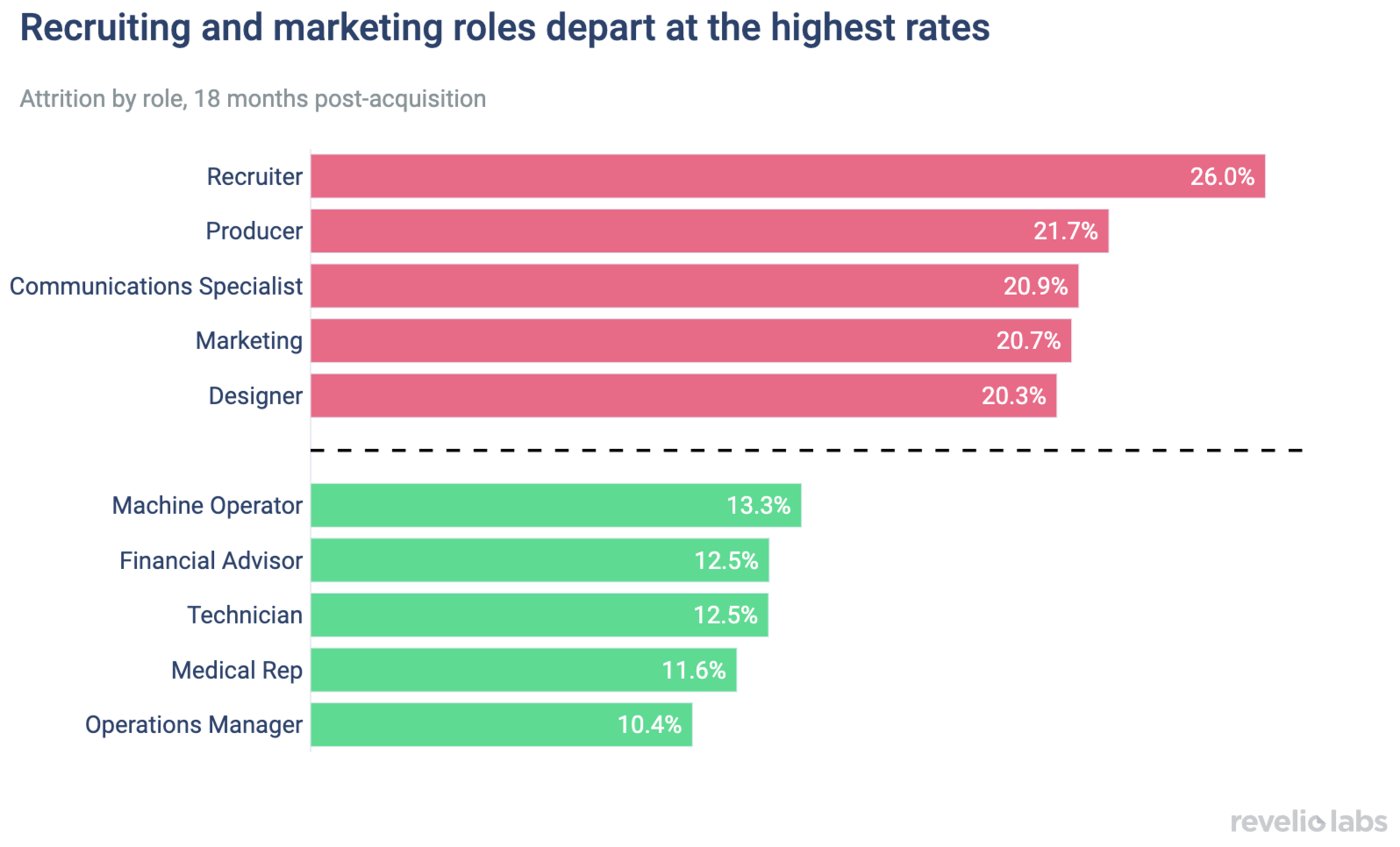

Which roles are more likely to face attrition in the event of an acquisition? We find that marketing, sales, and admin roles have the highest departure rates. Recruiters in particular are most likely to leave after an acquisition, having an attrition rate of 26%. Employees in marketing roles also have a relatively high likelihood of leaving. Acquisitions often involve consolidating branding and messaging under the parent company, so there might not be a need for multiple marketing teams, especially if audiences overlap.

On the other hand, more technical or operations-focused roles, including machine operators, technicians, and medical reps, are at lower risk of attrition. Acquisitions may be less likely to reduce on-the-ground operations, resulting in fewer departures for employees in these positions.

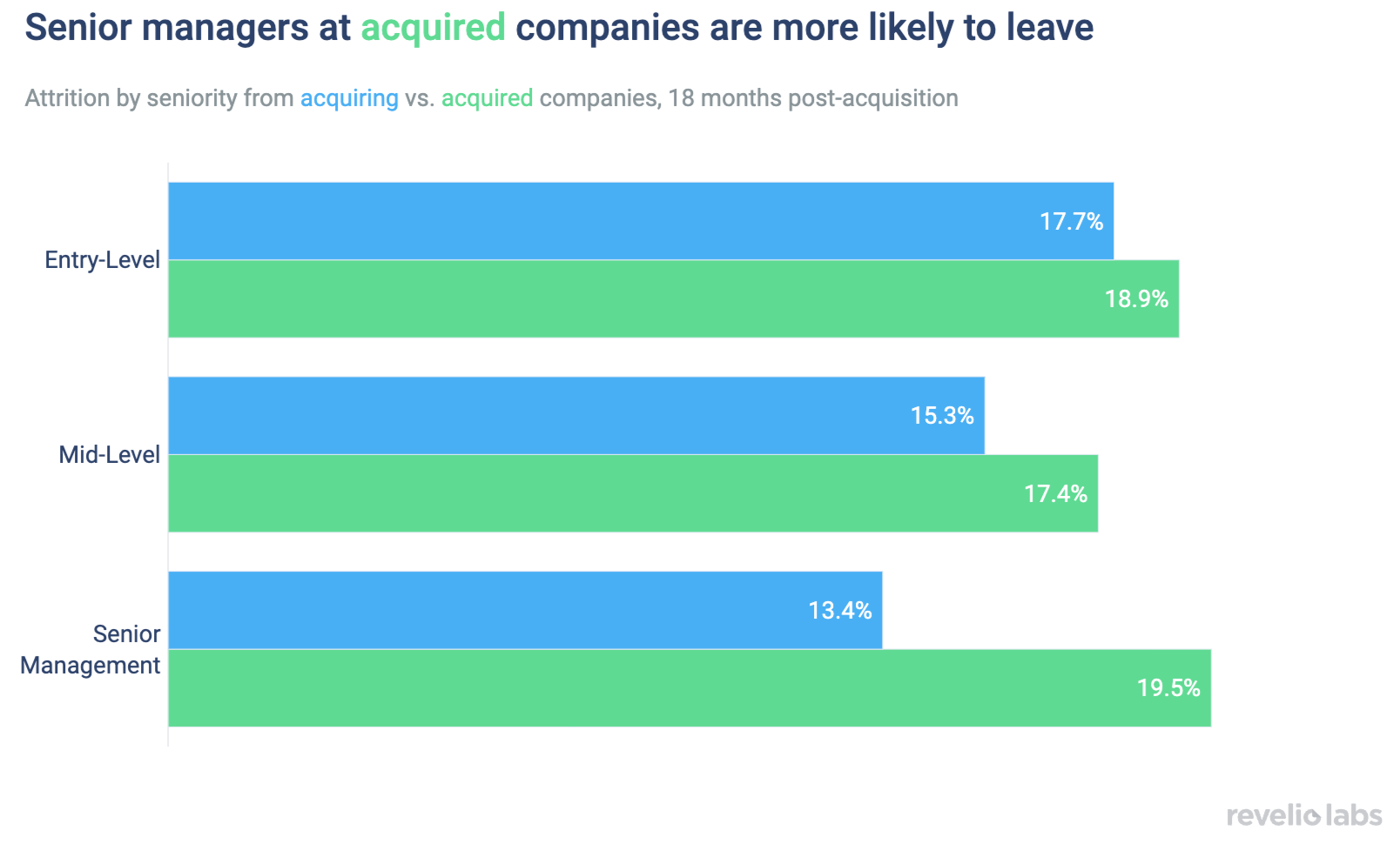

We also examine differences in attrition by seniority level. On average, entry-level employees experience the most upheaval, with around 18% no longer working at the company 18 months after an acquisition. This may be expected: Entry-level roles often involve performing tasks that require less specific knowledge and can be considered redundant across companies. If both companies have similar entry-level positions, they would be more likely to consolidate their workforces in these roles. Additionally, training entry-level employees at both the acquiring and acquired companies would also require time and resources. The acquiring company might prefer to retain more experienced employees from their own organization as well as the acquired firm, reducing the need for additional investments into onboarding and training.

However, not all experienced staff may be treated equally in the event of an acquisition. For acquired companies in particular, we observe a U-shaped association between seniority and attrition. Middle managers at acquired companies fare relatively well, perhaps in an effort to retain the institutional knowledge they hold. However, senior management at the acquired firm has the highest attrition rate across all groups, with nearly 20% no longer employed at the parent company after 18 months. This can be due to several factors: Parent companies may prefer to install their own executives to ensure employee loyalty, for example, resulting in the displacement of senior leaders from the acquired company. Furthermore, some of this attrition could be voluntary: Senior leaders from the newly acquired company often face reduced decision-making power or authority, or they may clash with existing leadership at the parent company, leading to overall dissatisfaction and a higher likelihood of departure. Finally, some senior executives at the acquired firm may have so-called “golden parachutes” as a condition of the acquisition, receiving generous severance packages or other benefits as an incentive to leave.

While acquisitions may lead to some short-term restructuring, their ultimate goal is long-term success. One metric of success that we are able to observe in our data is headcount growth. Which acquisitions, then, lead to higher employee growth?

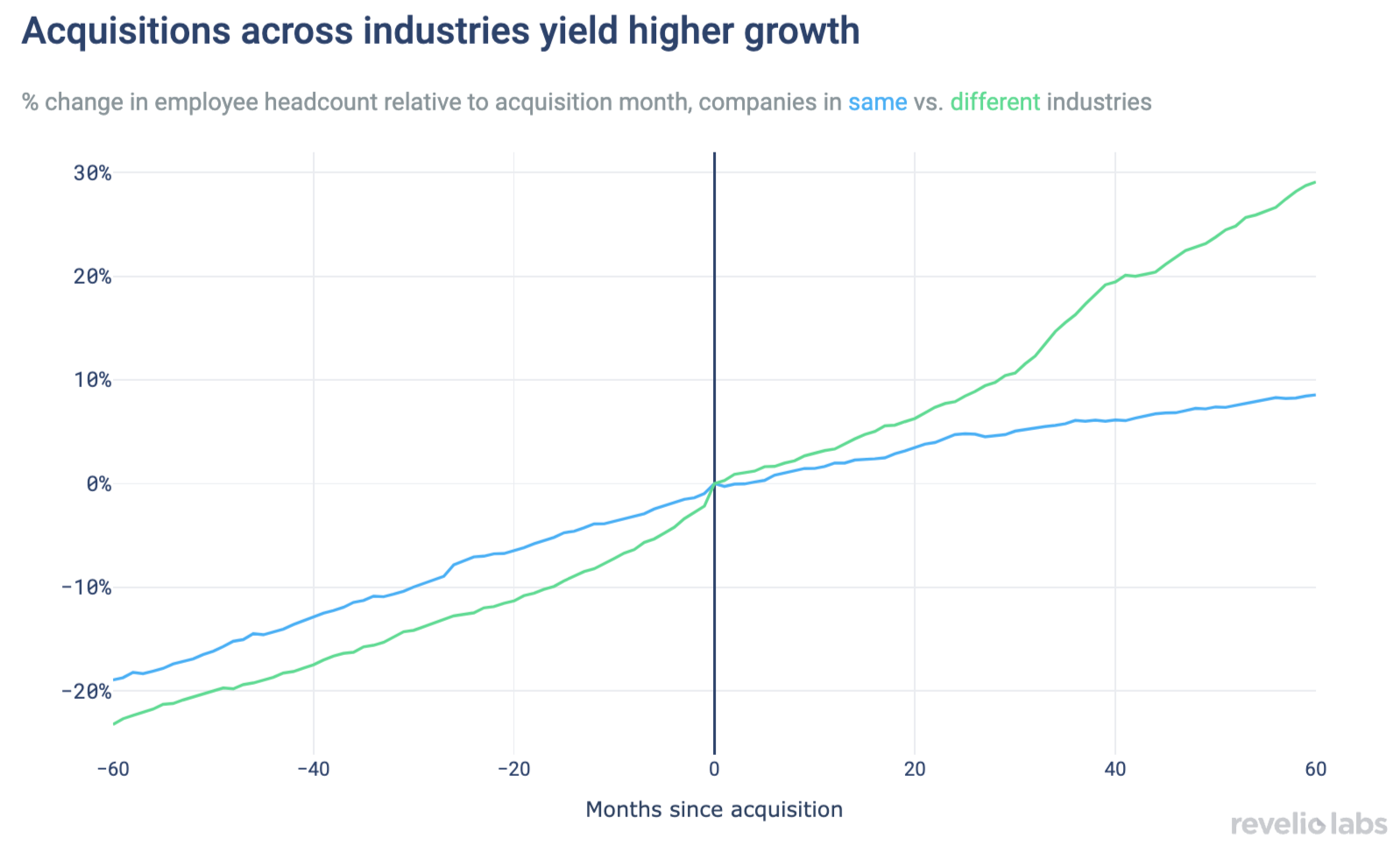

The industries of the companies in question may be a contributing factor. The acquisition of a company in the same industry, for example, can be advantageous for acquiring companies by growing their market share, increasing operational efficiency, and familiarity with industry-specific knowledge. For example, same-industry acquisitions may lead to cost savings in certain areas, such as combining facilities or supply chains, or reducing overhead. In doing so, they may have more room to allocate resources for expansion and growth. On the other hand, cross-industry acquisitions could foster higher growth by accessing new markets, sparking innovation, and creating synergies that may not be possible in within-industry mergers. These benefits can give the acquiring company a competitive advantage, leading to long-term success.

Looking at acquisitions for which we can observe at least five years of headcount data around the event, we find that those involving companies in different industries do in fact yield higher employee growth: Five years after the acquisition, these companies’ headcounts have grown at three times the rate of companies with acquisitions in the same industry.

Acquisitions can bring challenges for employees, including difficulties in integration, attrition risks, and culture clashes, with effects varying by role and seniority level. However, acquisitions can also be transformative events for companies, offering opportunities for growth, diversification, and expansion. Ultimately, successful acquisitions should balance short-term difficulties with longer-term success, while employees should strategically consider their options during the period of transition.