Fewer Elves Are Stocking the Shelves

Retail hiring cools off this year

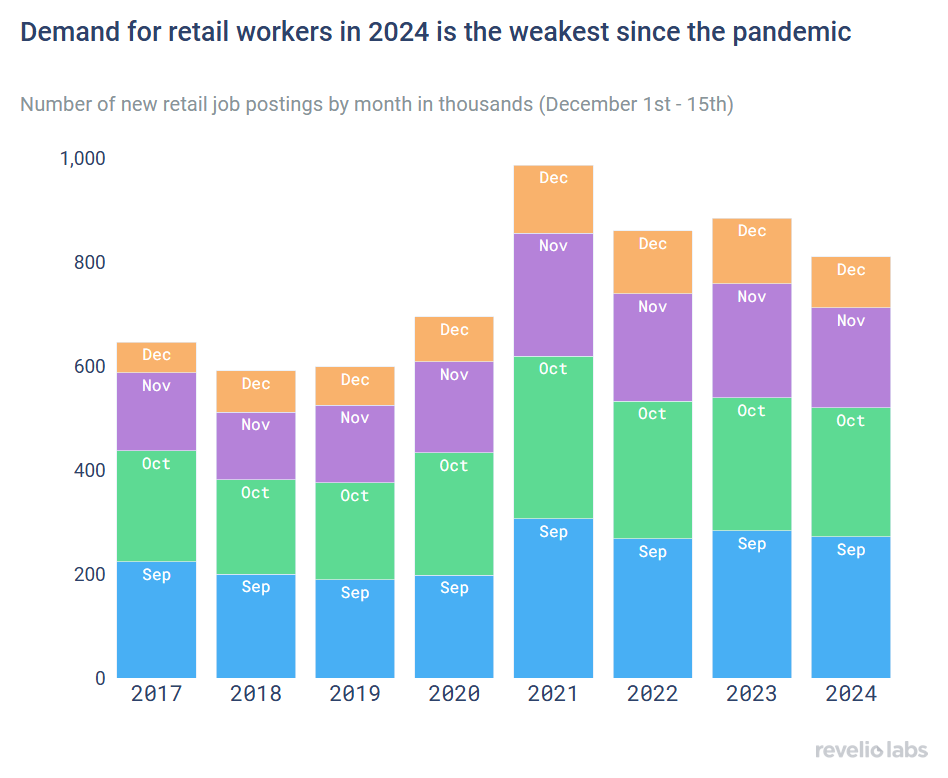

Demand for retail workers during the 2024 holiday season remains above pre-pandemic levels but has declined compared to recent years, reflecting a shift back to more subdued demand following the post-pandemic hiring surge.

Inflation continues to shape consumer behavior and labor demand. With limited real growth in holiday spending, retailers are scaling back their labor needs for the winter holiday season.

Amid economic uncertainty, retail labor demand suggests a shift in consumer spending priorities rather than any increase in overall spending. Grocery stores are leading the hiring surge, driven by inflation-induced demand for essentials and value-focused purchases.

The holiday season is here, and retailers have been preparing for their busiest time of the year. The holiday period not only drives a significant portion of annual revenue, but also serves as a barometer for the broader economic climate, offering insights into consumer confidence, inflation, and labor market dynamics. This year, amid elevated economic uncertainty, understanding retail hiring trends is crucial to forecasting both short-term business strategies and long-term market stability. In this newsletter, we dive into Revelio Labs’ workforce data to explore how holiday retail hiring trends reflect both the resilience of the sector and the broader economic environment. In other words, Revelio Labs’ workforce data will help predict how heavy Santa's sleigh will be this year.

Data on new job postings in the retail sector for September, October, and November reveal a weaker demand for workers leading up to the 2024 holiday season compared to prior years. While retail job postings remain higher than pre-pandemic levels, they have declined each month relative to the same months in recent years. This moderation in hiring signals a shift toward more subdued labor demand, following the post-pandemic hiring surge that defined the past few years.

Historically, growth in demand for retail workers has closely mirrored growth in retail spending, especially during the holiday season. While consumer sentiment has improved since 2022, the Conference Board’s Holiday Spending Survey reveals that the average U.S. consumer plans to spend $1,063 on holiday-related purchases in 2024, up from $985 in 2023. However, this increase is largely driven by inflation. In real terms, planned spending is only 5.3% higher than in 2023 and remains below 2022 and 2021 levels. As inflation continues to squeeze purchasing power, consumers are prioritizing essentials and value-driven purchases. This shift in spending behavior has led retailers to temper their labor demand for the holiday season.

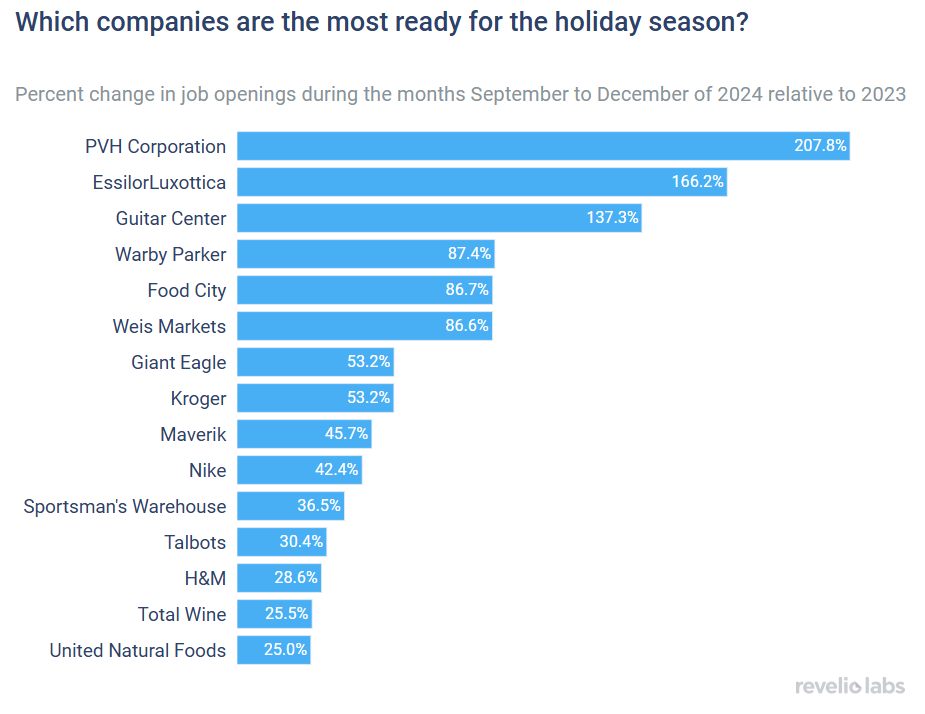

As companies prepare for the holiday season, some retailers have ramped up their hiring plans in 2024. Among the leaders in this trend are many grocery store chains, including Food City, Weis Markets, and Kroger. The surge in job postings by food retailers reflects a broader trend of growing demand for food retail, driven by shifting consumer behaviors. As inflation pressures households to prioritize essentials, grocery stores have been capturing a larger share of consumer spending year over year. Moreover, the increasing popularity of online grocery shopping and meal delivery services has created additional labor needs, from in-store order fulfillment to last-mile delivery. In addition, eyewear companies like Warby Parker and EssilorLuxottica are also on the list, capitalizing on the seasonal demand for gifts and prescription glasses, as consumers rush to spend what's left in their flexible spending accounts before the end of the year. Other notable companies preparing for the holidays include H&M, Nordstrom, Talbots, and Nike, all of which are likely expecting busy sales periods and higher demand for both fast fashion and upscale apparel.

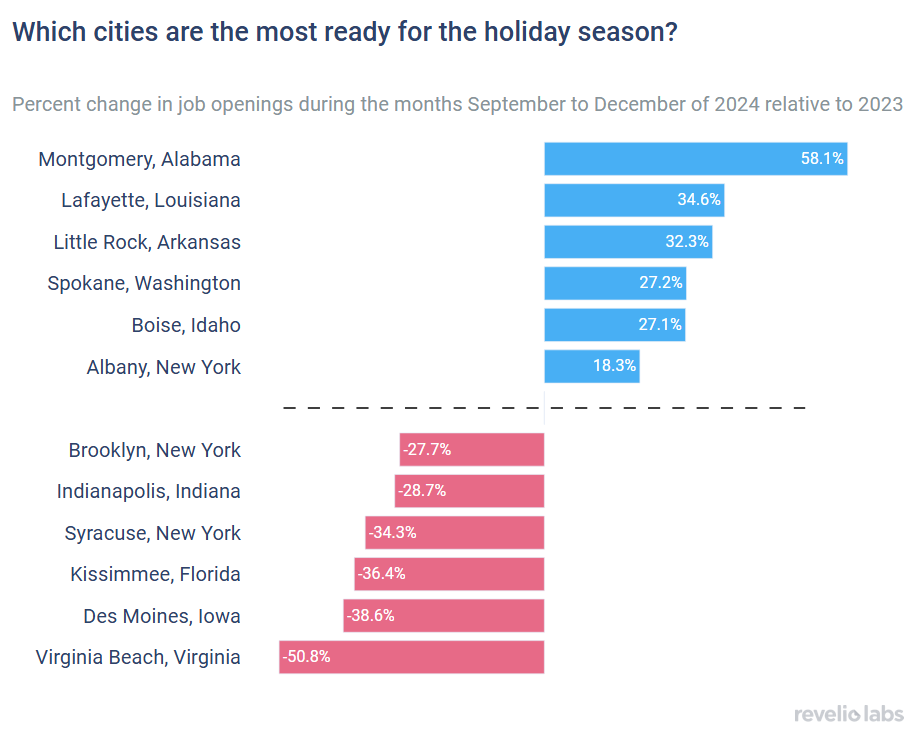

Cities such as Montgomery, AL; Little Rock, AK; and Boise, ID are experiencing a noticeable increase in demand for retail workers relative to 2023. On the other hand, cities like Virginia Beach, VA and Des Moines, IA are seeing a notable decline in demand for retail workers, potentially due to factors including shifts in consumer preferences and local economic conditions. This regional variation in demand provides valuable insights into where consumers are expected to spend their holiday budgets, aligning with broader economic trends that may influence retail performance across the US.

The retail labor market dynamics ahead of the 2024 holiday season highlight both heightened uncertainty and economic shifts in the retail sector. While hiring trends align with traditional seasonal patterns, changes in labor demand reflect broader economic shifts. Retailers are adapting to inflationary pressures and evolving consumer behaviors, focusing on essentials and value-driven spending. As we move through the holiday period, these trends will not only shape the success of the season but also offer critical insights into the resilience and adaptability of the retail sector in the current economic climate.