Jobs Outlook

The labor market is stronger than one bad data point, with postings data suggesting continued job gains ahead

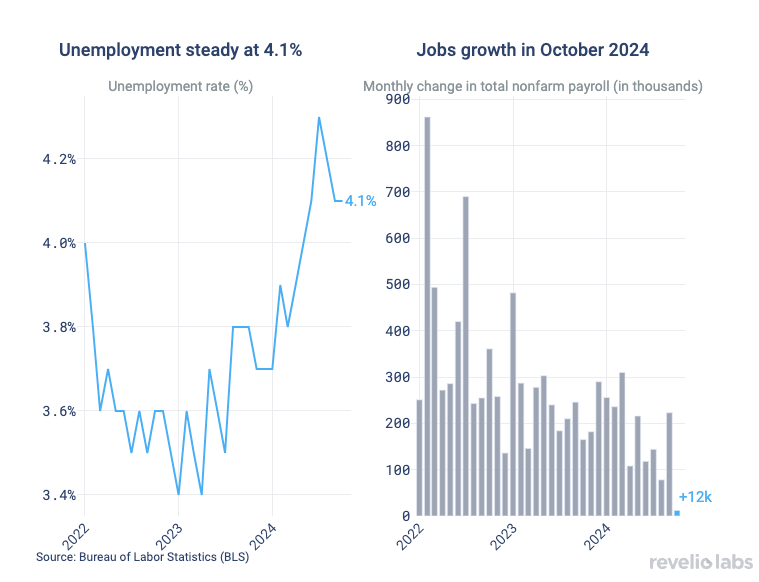

In October the US economy added the fewest jobs in nearly 4 years. However, things are not as bad as they seem: the BLS numbers come with some major caveats, unemployment remains in check, and Revelio Labs’ COSMOS job postings data points to solid labor market demand.

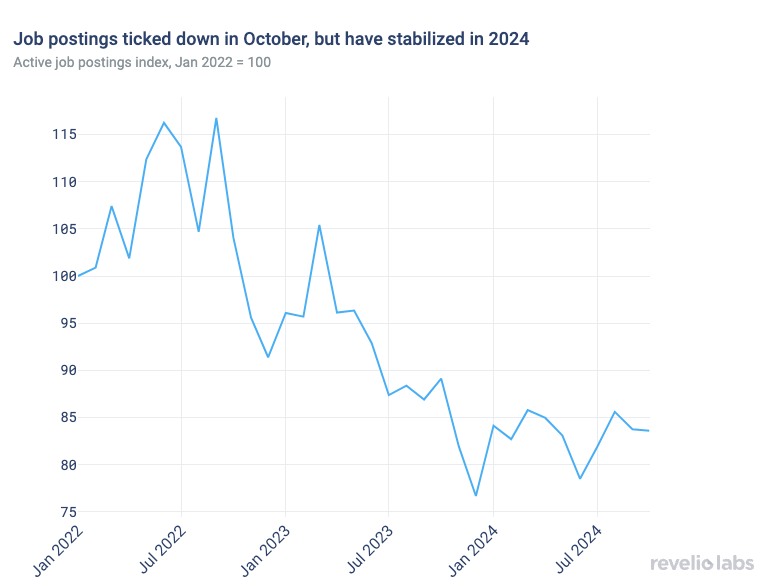

Looking ahead, job postings data suggest sustained, but slower job growth ahead. Overall, active job postings ticked downward in October, but have stabilized in recent months at a level reflecting fairly robust labor market demand.

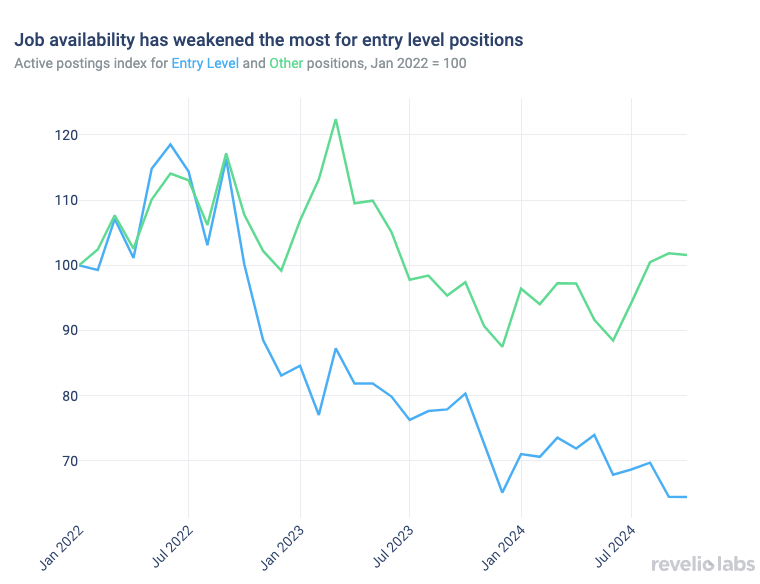

While the labor market remains robust, the steady cooling in labor demand over the last two years is impacting those in the lowest tier of the workforce the hardest, with the availability of entry-level jobs falling the furthest from their 2022 peaks.

The BLS reported the lowest level of monthly job growth in almost four years today, but things are not as bad as they seem.

In October, the US economy only added 12,000 jobs, but the BLS data comes with two big caveats. First, Hurricanes Helene and Milton would have both had an impact on this month’s jobs tally, potentially deflating the reported numbers substantially. Second, manufacturing employment was negatively impacted by strike activity, with the industry as a whole shedding 46,000 jobs.

With this in mind, the jobs report does not look so bad. Unemployment remained steady, at a low 4.1%. Even with this month’s very low jobs gain, the economy continues to add jobs at a steady clip. Nonfarm payrolls have seen average gains of 104k and 194k over the past 3 and 12 months, respectively, buoyed by gains in government and healthcare.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

Given the uncertainty of this month’s BLS report and likely revisions, outside data sources like Revelio Labs will be more important than ever to help gauge the current health of the labor market. Looking at labor market demand via Revelio Labs’ COSMOS job postings dataset, active job postings data suggest continuing, albeit relatively slower, job growth ahead.

Active job postings ticked marginally downwards in October, and are currently 16% lower than they were at the beginning of 2022. However, the overall level of active postings has largely stabilized since January 2024. Although job availability has fallen from its post-pandemic peak, the data still indicate relatively strong labor demand, likely supporting steady job growth in the months ahead.

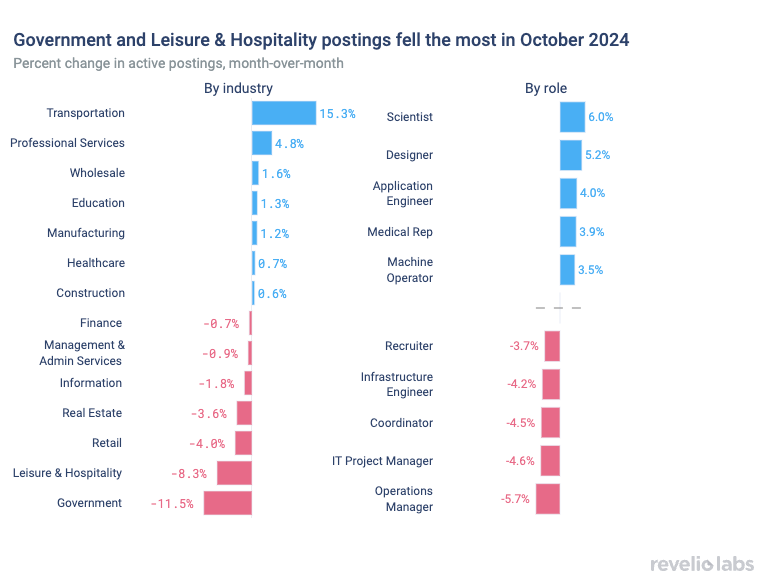

While the overall tally was relatively flat, there were some big winners and losers across industries. The transportation sector saw the biggest gains in job postings last month, followed by professional services, and wholesale, while government, leisure & hospitality, and retail saw the biggest declines in postings in October.

The direction of public sector hiring will be critical. Government jobs, which are generally non- or counter-cyclical, have helped sustain the persistent job creation we have seen in 2024. However, with job postings indicating weakening demand ahead, a slowdown in public-sector inflows could mean even slower headline job growth ahead.

While the overall labor market remains strong, the cooling over the last couple of years has not impacted the workforce evenly. Demand for entry-level positions has dropped off considerably, while upper-tier positions have held up better in the face of higher interest rates.

Most companies are holding steady on headcount, neither cutting jobs nor actively hiring. The pace of hiring has certainly dropped off from the levels we saw a couple of years ago, and while it remains a good time to be a worker in the US with unemployment near historical lows, it is not a good time to be looking for a job. Entry-level positions and those requiring limited experience are especially hard to come by, making things even more difficult for those just starting their careers or trying to break into a new industry.

Despite this month’s weaker print, recent strong economic and labor reports have caused longer-term benchmark interest rates to actually rise since the Fed started its cutting cycle in September as expectations shift for less monetary easing ahead. As the Fed gauges how far and how fast to cut interest rates, the impact of labor market cooling on those at the fringes of the labor market should be something for policymakers to keep in mind as they delicately balance their dual mandate in the coming quarters.