Jobs Outlook February 2025

Job growth is slowing moving into 2025

Job growth is cooling headed into 2025, but low unemployment and solid wage gains reflect a labor market that remains strong.

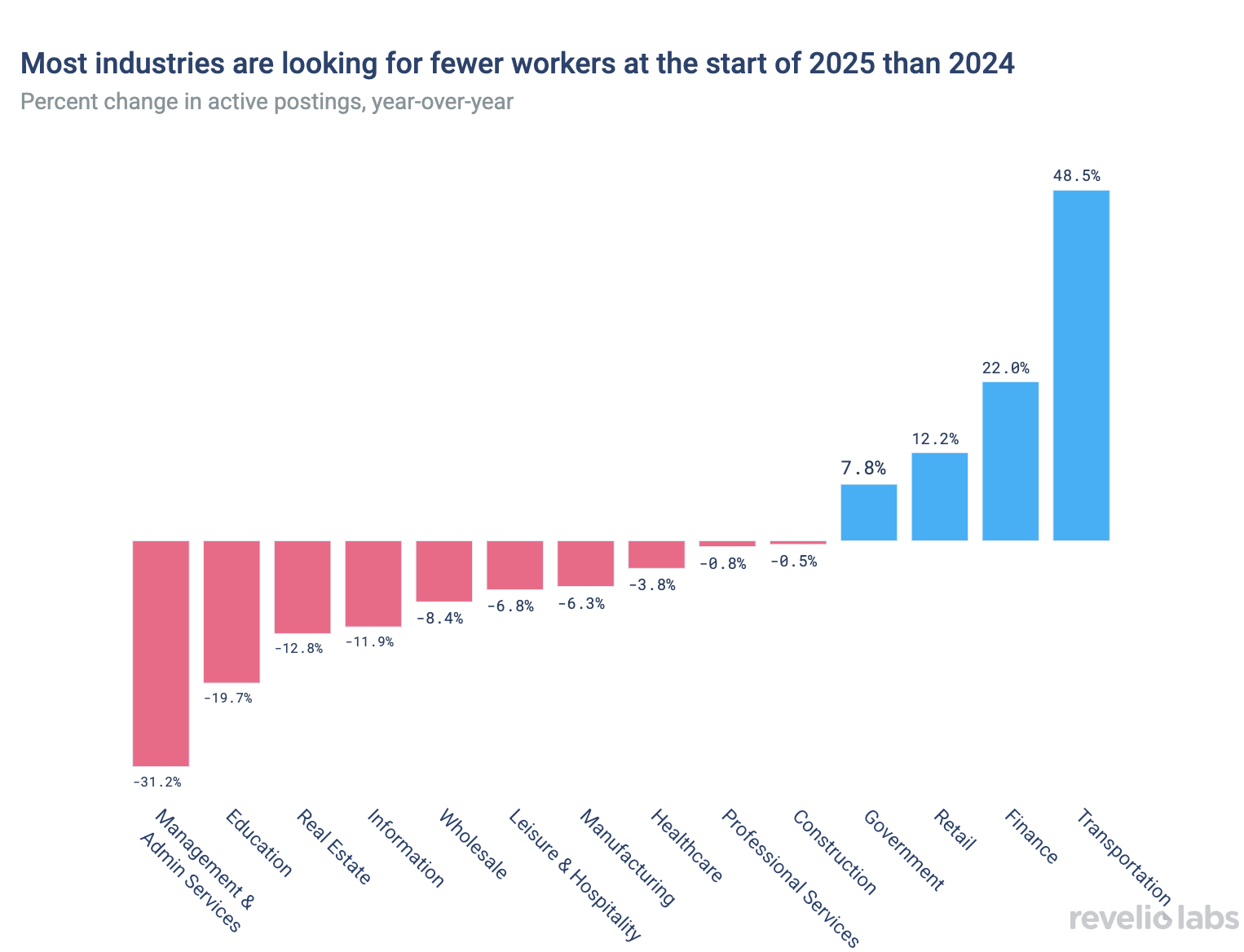

Revelio Labs’ job postings data indicates that many industries are seeking fewer workers at the start of 2025 compared to 2024, with fewer postings likely to weigh on hiring in the months ahead.

While job creation is likely to slow, stronger economic data and inflation prints have led the Federal Reserve to pause its cutting cycle as we await further clarification on the direction of the economy and policy formation under the Trump administration.

Job growth is cooling moving into 2025, and Revelio Labs' job postings data are indicating that most industries are pulling back on hiring plans amid heightened economic uncertainty and elevated borrowing costs.

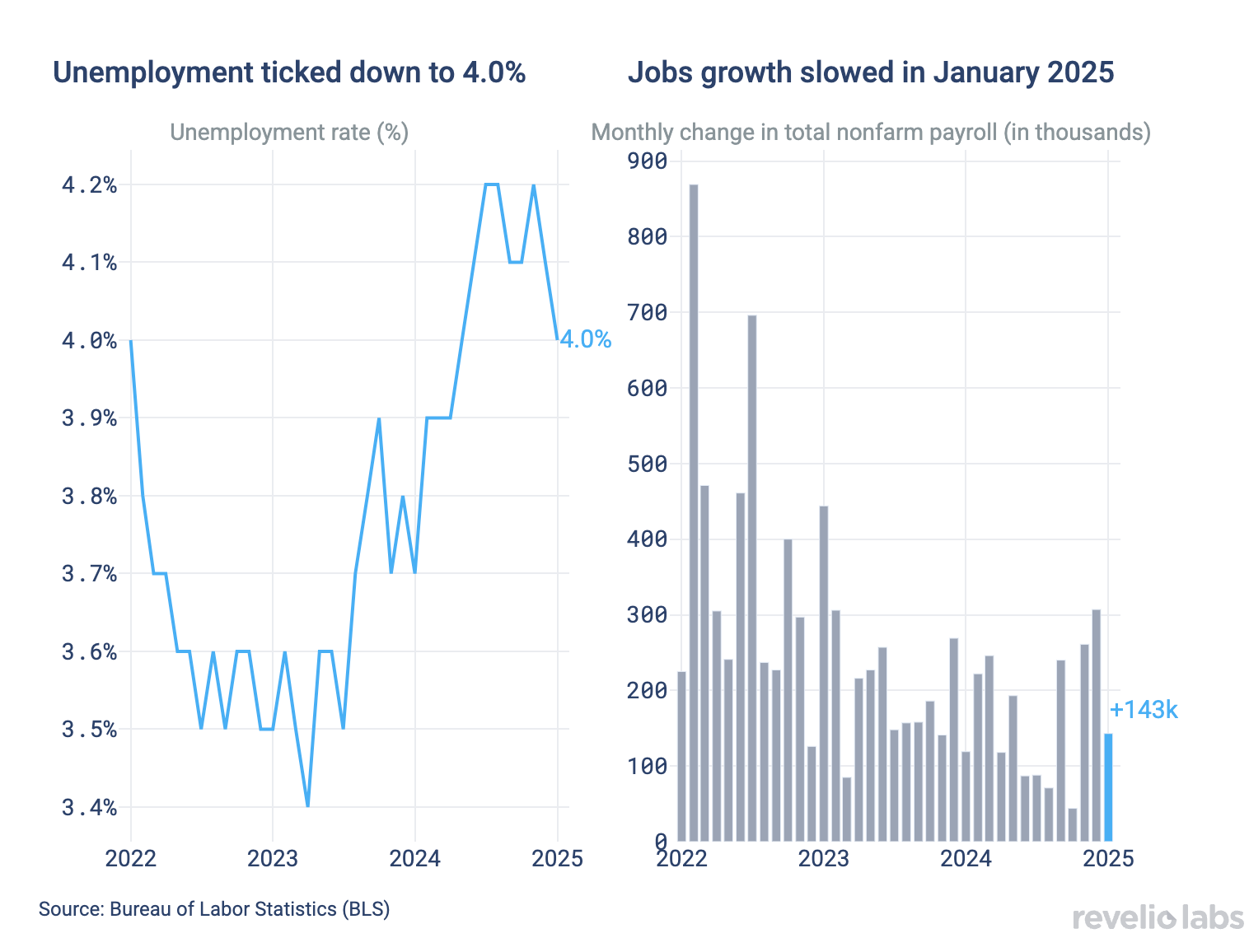

However, the economy remains on stable footing for now. The pace of job creation is slowing but still solid, with the economy adding 143,000 jobs in January. Unemployment ticked even lower in January following BLS annual adjustments to population controls, reflecting a US economy that continues to expand at a steady clip.

Wage growth also ticked higher, with hourly earnings rising 0.5%, for an annual gain of 4.1%. Strong wage gains will be somewhat of a concern for policymakers at the Fed worried about a rate of inflation that remains stubbornly above target, but solid productivity gains will help limit the inflationary impact of rising nominal wages.

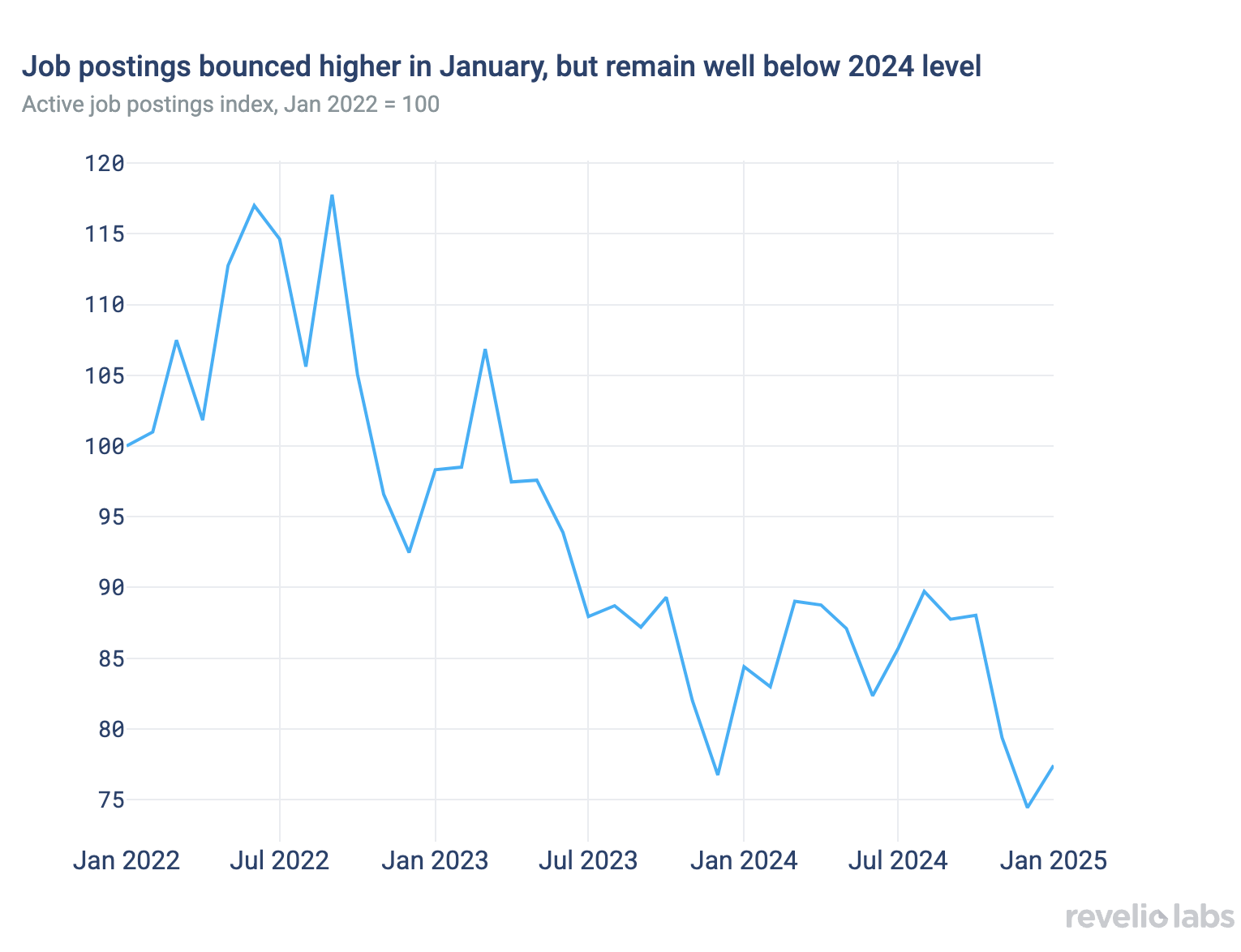

Looking ahead, Revelio Labs’ job postings data indicates that further cooling in hiring is likely. While the level of active postings ticked higher in January—driven by seasonal hiring patterns—it remains well below the level seen at the start of 2024.

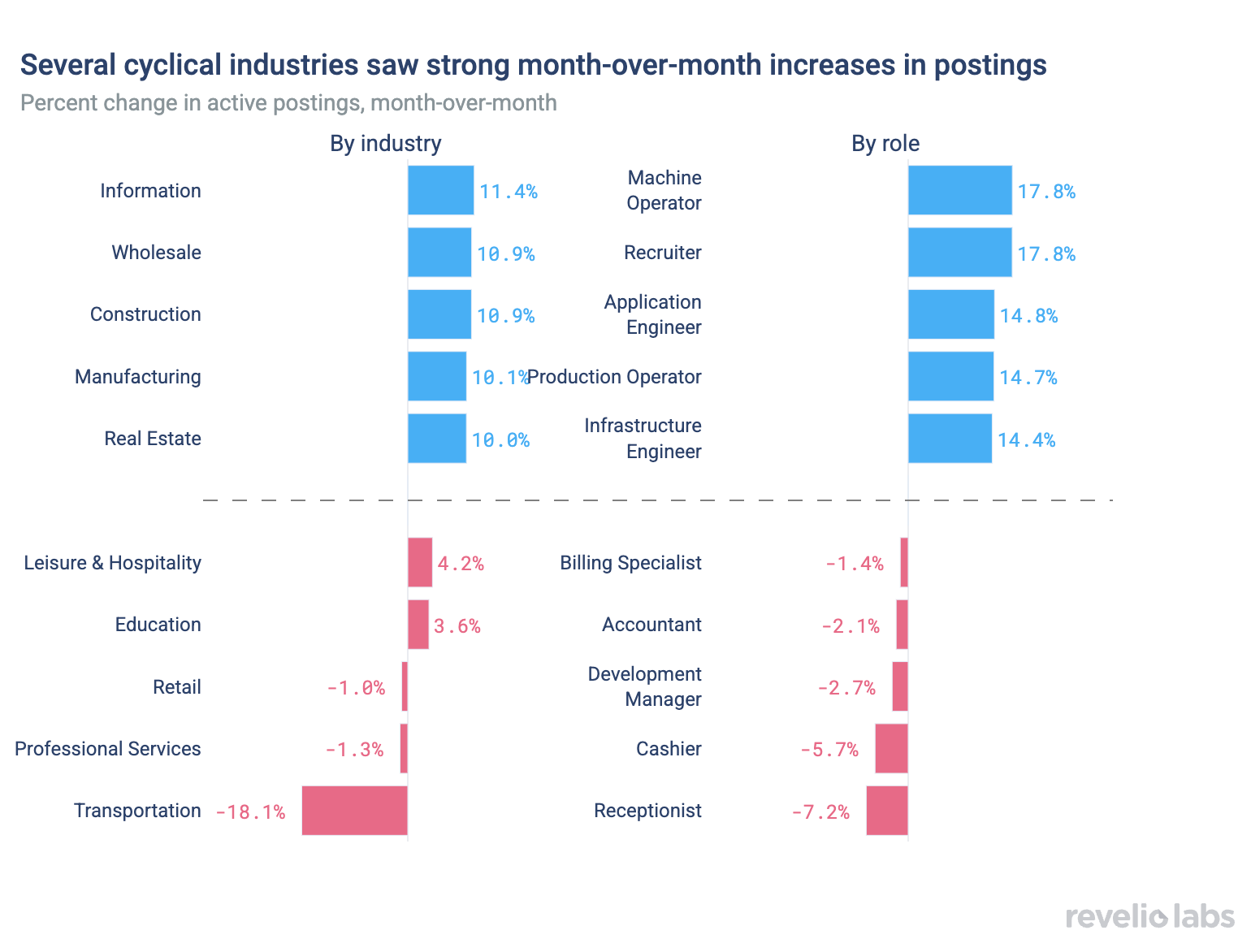

The month-over-month uptick in active job postings was driven by a number of different industries, with cyclical industries like construction, manufacturing, and real estate all seeing double-digit increases in postings. Additionally, active postings for recruiters, which we have previously identified in our research as a potential harbinger of additional hiring, have also increased.

However, much of the monthly gains were likely a reflection of a seasonal increase in hiring activity from January to December.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

Looking at the change in job postings compared to one year prior, our data shows a marked decline, with most industries looking to hire fewer workers compared to last year. Fewer jobs postings will likely mean continued cooling in hiring over the coming months.

While concerns over the health of the labor market have subsided since the second half of last year, when the Federal Reserve began to cut interest rates, looming shifts in trade, fiscal, and immigration policy—all of which would have significant impact on the labor market and prices—mean the economic outlook is decidedly uncertain. With the economy on solid ground for now, the Federal Reserve has paused its cutting cycle to await additional data and clarity on policy, and without significant deterioration in labor market conditions, we should expect to remain on pause for much of 2025.