How Is the Labor Market Swinging in Battleground States?

Worker sentiment and hiring are down in key swing states

Kamala Harris and the Democrats are running on the Biden administration’s jobs record, but sentiment among workers remains weak, especially in key swing states, as the labor market cools ahead of the election.

Revelio Labs’ state-level data shows that while the labor market remains strong overall, key indicators are noticeably weaker in swing states compared to where they were during the midterm elections in 2022.

While we still have not seen a spike in layoffs or attrition rates, momentum and sentiment matter, and the decline in labor metrics may undermine what might have been Democrats’ strongest economic achievement—the robust US labor market.

With only 6 weeks to go until the election, Trump and Harris are still running neck and neck in key swing states. This will be a close one, and just like all US elections, it will largely be decided on the state of the economy. The Biden administration has managed to maintain a robust labor market throughout the past four years despite headwinds from higher interest rates, yet economic sentiment is poor. The bout of high inflation will account for much of the weak sentiment, but just as inflation has come down, the labor market is showing signs of weakening—poor timing for an incumbent running on their jobs record.

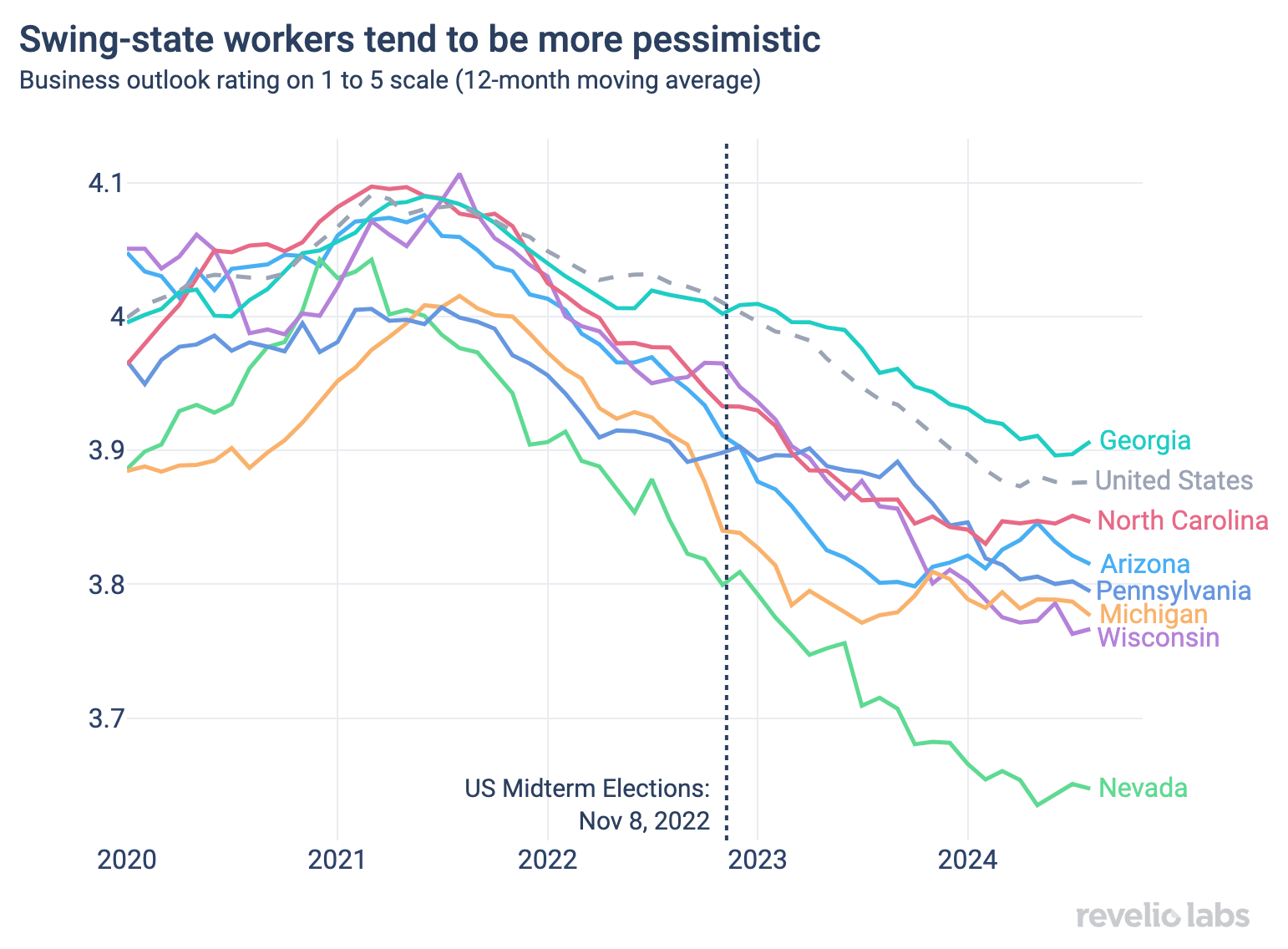

Much has been said about the so-called “vibe-cession” in the US. In addition to the low consumer sentiment, workers’ sentiment captured in employer reviews has been falling steadily in recent years. Looking specifically at employees’ feelings about their company’s business outlook, we see that worker sentiment has dropped since mid-2021— especially in swing states likely to determine the outcome of the election.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

Among the seven most important swing states in the upcoming election, only workers in Georgia are feeling more optimistic about their companies’ business prospects when compared to the national average. In some critical states—especially Nevada—sentiment is considerably weaker, which may be reflected on voters’ ballots in November .

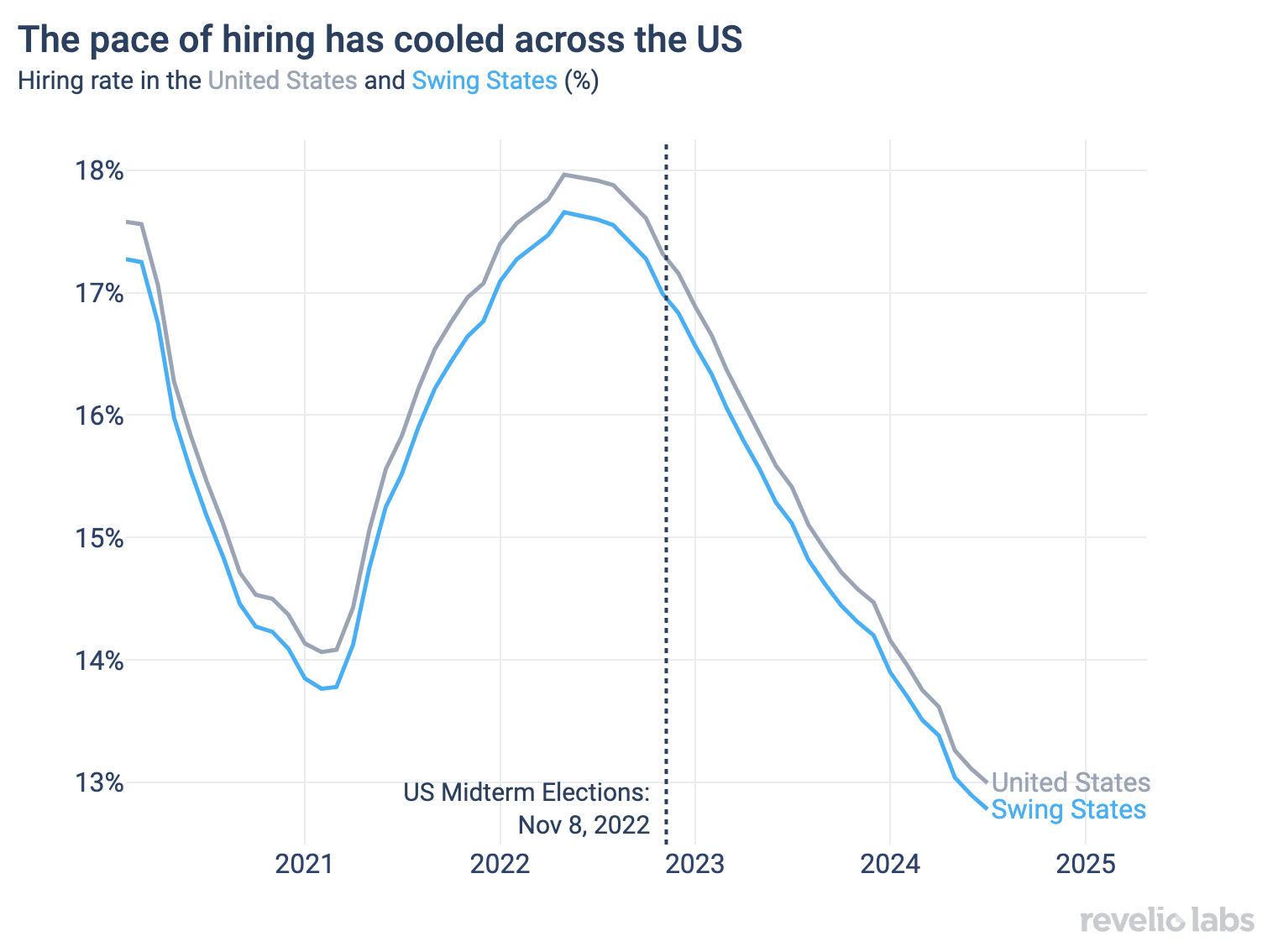

The steep downward trend in worker sentiment corresponds with and is likely driven by a slowdown in hiring. While attrition rates have also fallen, and the US economy continues to add jobs at a decent pace, companies are simply not hiring like they were two years ago, as many businesses tighten the purse strings amid higher interest rates and economic uncertainty. More uncertainty also contributes to the lower attrition rate as people are hesitant to change jobs.

Even though most metrics show a labor market that remains above pre-pandemic levels, workers—especially those in key battleground states—are likely to compare their current prospects with the boom years of 2021 and 2022 and may feel that they are left wanting. The abundance of available jobs and the pay bumps that came with them are now few and far between, and this is weighing on the mood of US workers, many of whom now feel stuck as the labor market cools.

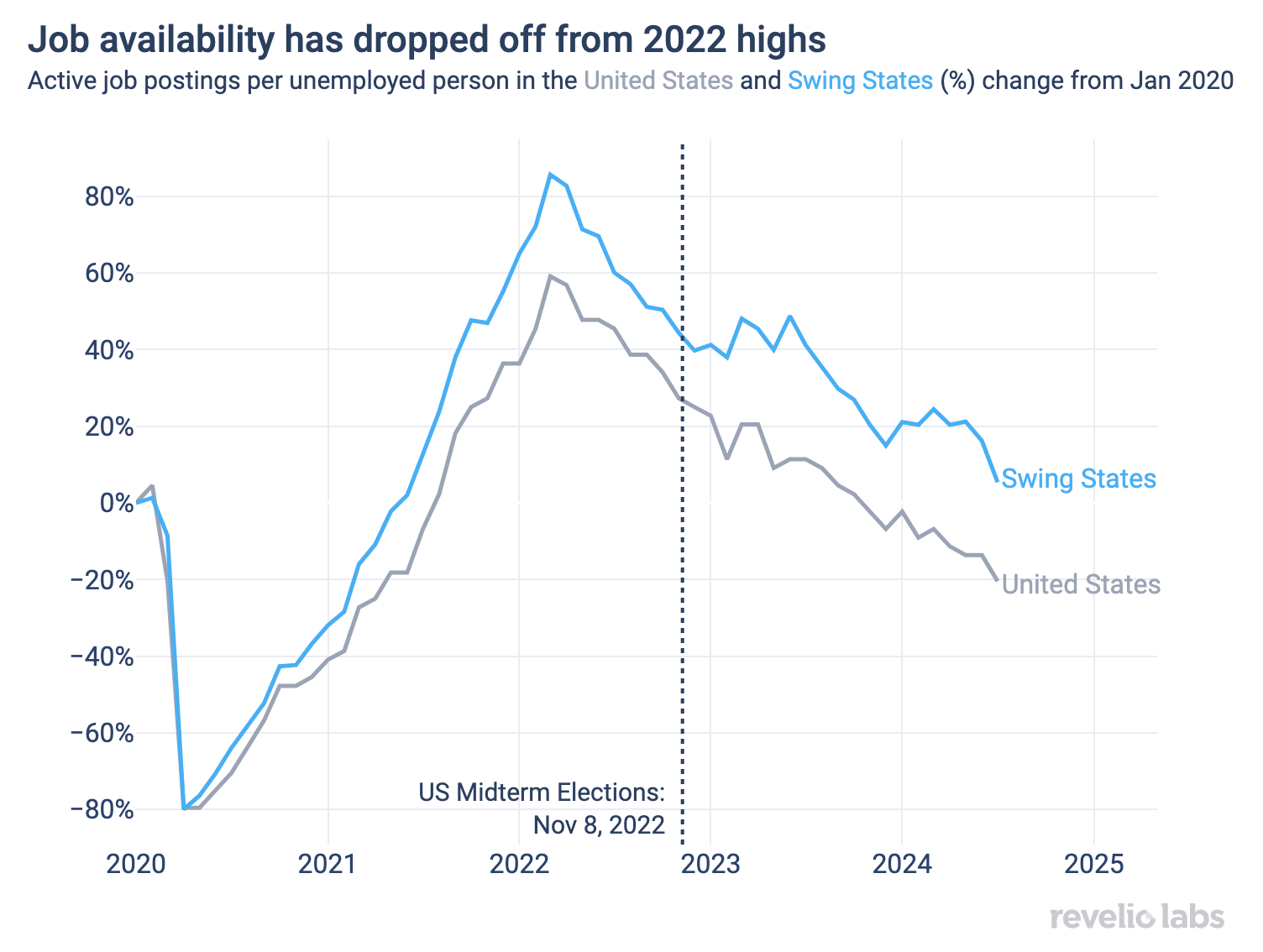

Looking ahead, job postings data—which tend to lead hiring by several months—suggest that hiring rates in swing states are likely to continue to slow as the labor market cools further leading up to November’s vote. The number of jobs available to job seekers in the economy has been trending downwards and is now well below the level it was during the last national election when Democrats performed well above expectations in the November 2022 midterm elections.

That said, job availability is still trending above pre-pandemic levels in swing states, with many key battlegrounds like Arizona, Pennsylvania and Georgia currently having a significantly higher number of active job postings relative to their unemployed population than the US as a whole.

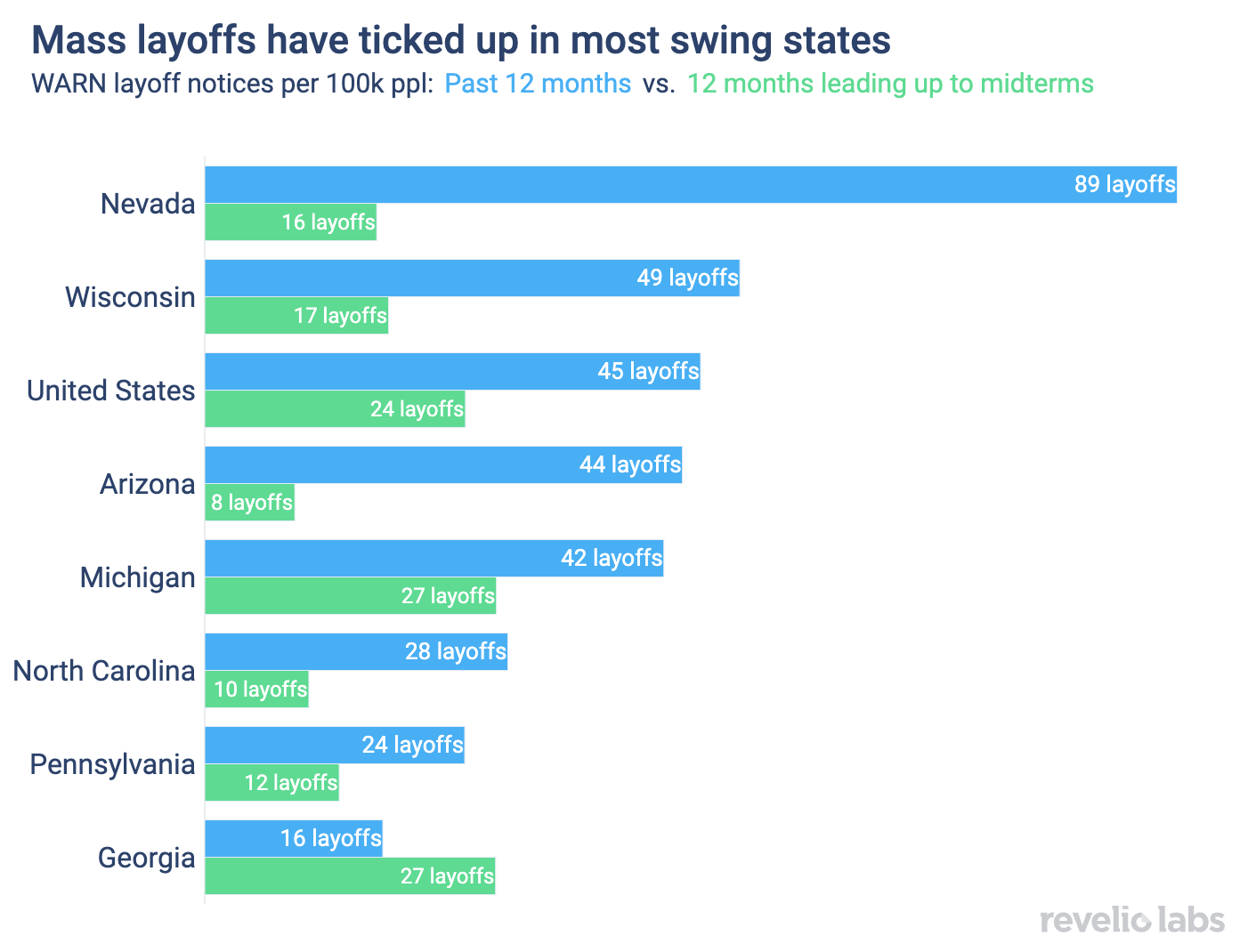

The cooling in the labor market has come largely in the form of slower hiring and job postings, but we are not seeing the levels of involuntary separations that accompany an economic downturn. However, while still low, the number of employees severed during mass layoffs has increased from the lows seen during the period of extreme labor market tightness that corresponded around the 2022 midterms. Layoffs tend to be a little lower in swing states, with the notable exception being Nevada, where sentiment and hiring rates are also lower.

Overall, the labor market is still strong, but momentum and sentiment in the local labor markets of key swing states matter a lot more than US-wide aggregations when it comes to elections. Back during the 2022 midterm elections, the labor market was extremely tight, giving workers unprecedented bargaining power that underpinned high levels of job switching and nominal wage gains. While workers are largely retaining their jobs, much of that leverage is gone and is weighing on the mood of the US workers, who are also the bulk of US voters.

The US economy has performed better than any other major economy in the world coming out of the pandemic, but taking a victory lap on job creation may be premature given the current direction of the labor market. Given this reality, a campaign focused on improving employment opportunities going forward would likely resonate better with workers (aka voters).