WARNing: Layoffs Ahead

Amidst layoff season, a look at the WARN Act effectiveness

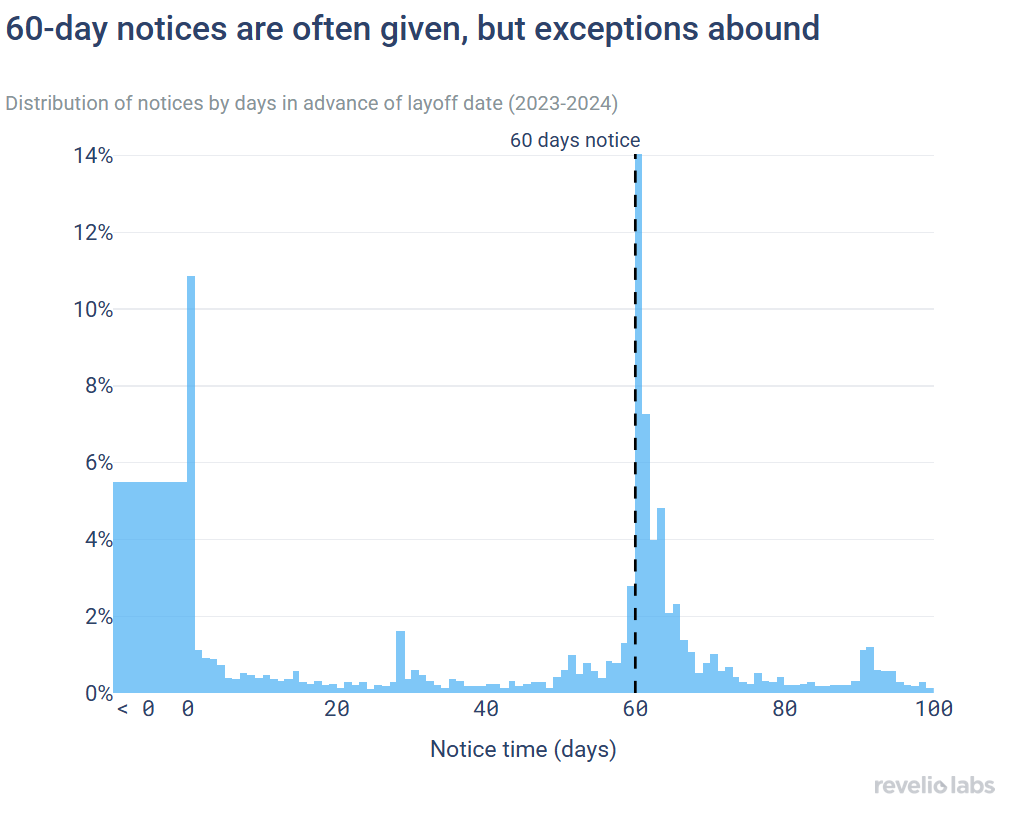

Companies experiencing mass layoffs and plant closures are required to report them 60 days in advance, in accordance with the WARN act. A large share of companies file layoff notices at least 60 days before the layoff date. However, many companies also file notices on the day of the layoffs, capitalizing on WARN’s built-in flexibility due to unforeseen business circumstances.

Although WARN notices do not capture all layoffs in the US, they are a leading indicator of labor market disruptions. WARN notices can act as an early warning system, offering insights into layoff trends up to five months ahead of labor market reports.

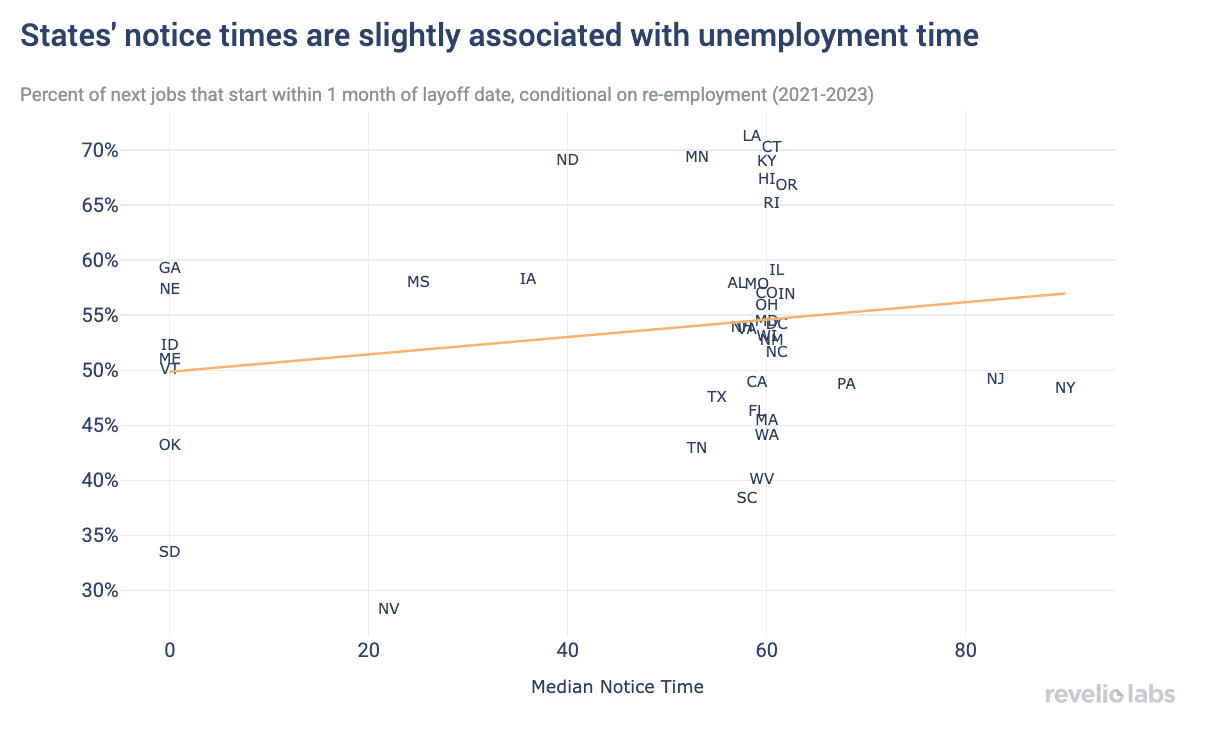

Advance layoff notices are helpful for affected employees in giving them enough time to secure alternative employment opportunities. We find a positive correlation between the median layoff notice period recorded in WARN notices and the share of outflows who secured new jobs within one month.

January often marks a season of workforce restructuring. As companies reassess their priorities and budgets at the start of a new year, layoff announcements frequently dominate headlines. As we start off 2025, several prominent companies across various industries have announced significant layoffs, including Meta, which plans to reduce its workforce by 5%, BlackRock, which is set to cut 1% of its workforce, and Microsoft. This annual trend adds to the importance of policies like the Worker Adjustment and Retraining Notification (WARN) Act, designed to protect employees and communities from the abrupt impact of mass layoffs by mandating that eligible employers provide written notices ahead of mass layoffs or plant closures. In this newsletter, we explore how effective the WARN Act has been in providing workers as well as job centers with the critical time needed to prepare for employment transitions.

Under the federal WARN Act, which was enacted in 1988, businesses with 100 or more full-time workers must issue advance layoff notices if they plan to lay off at least 50 employees within a 30-day period. These advance notices allow affected employees time to explore alternative employment or learn about unemployment insurance and also give local job centers the opportunity to prepare supporting displaced workers.

Revelio Labs collects, standardizes, and enhances data on layoff notices filed under the WARN Act. We use data on WARN notices filed since 2019 to assess whether employers abide by the WARN Act. Given a host of possible exceptions to the WARN act that we discuss below, non-compliance may not represent a violation of the policy. Nevertheless, it is useful to measure to what extent employers adhere to WARN rules in general. That is, we can only measure adherence to the requirements of the WARN Act by assessing differences in notice time given that a notice was filed.

Is WARN Strictly Enforced?

Analyzing compliance with the WARN Act is rather complex, as the policy has plenty of exceptions and the rules also lack strict enforceability. The act requires employers to provide written notices to the state Department of Labor and to employees 60 days in advance of a mass layoff event, with three exceptions: (i) unforeseeable business circumstances, (ii) layoffs resulting from a natural disaster, and (iii) situations where giving advance layoff notices would impede the company’s ability to secure new capital. Violating the WARN Act makes an employer liable for back pay to affected employees for the violation period. Enforcement of the WARN Act relies on private legal action in the US District Court in affected districts.

First, we examine the distribution of the length of notice periods for layoffs in 2023 and 2024. Notice period is measured as the difference in days between notice and layoff dates in years 2023 and 2024. We observe two prominent spikes: one at zero days (indicating that notice and layoff dates coincide) and another at 60 days. The zero-day spike primarily reflects exceptions to the WARN Act, such as unforeseen business circumstances, which require employers to provide as much notice as feasible under the circumstances. This pattern underscores the flexibility built into the WARN Act to accommodate sudden economic shocks or operational crises.

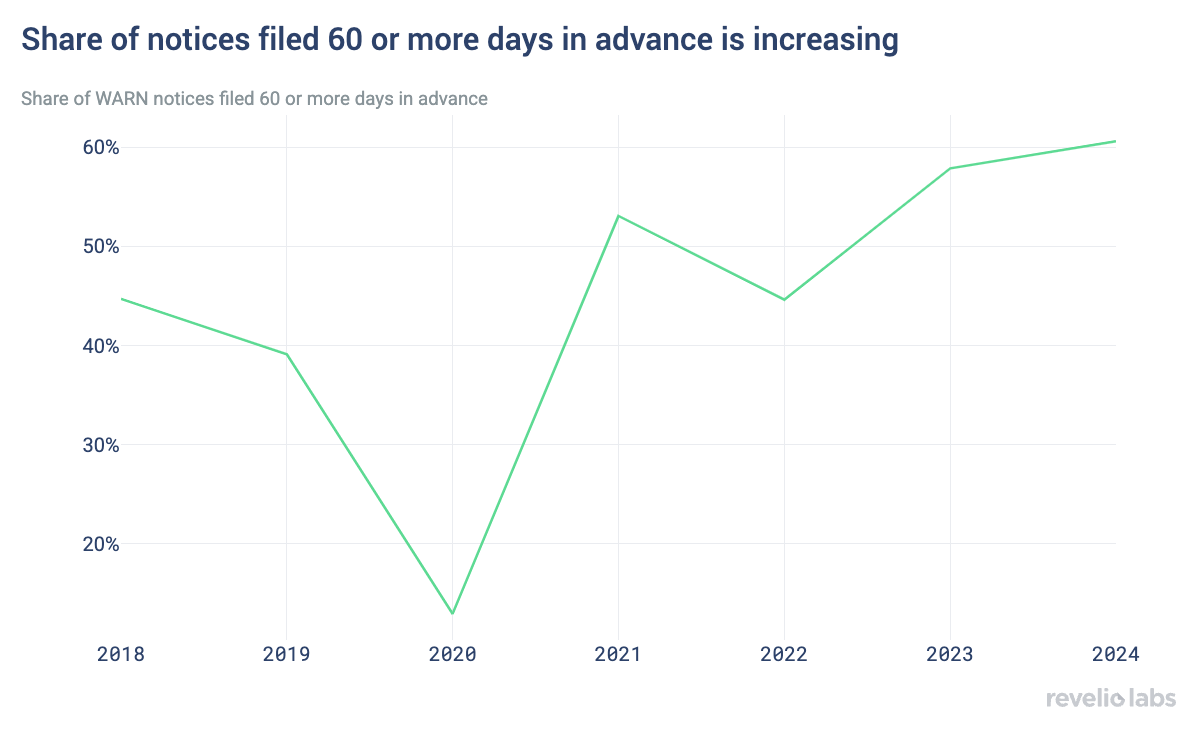

From 2018 to 2024, an increasing share of WARN notices were filed 60 or more days in advance, reaching over 60% last year. The year 2020 marked a stark deviation that can be attributed to the unpredictability and immediacy of pandemic lockdowns, which left many businesses unable to comply with the standard notice requirements. Only 13% of WARN notices in 2020 were filed 60 or more days in advance.

WARN captures mass layoff events with a two-month lead

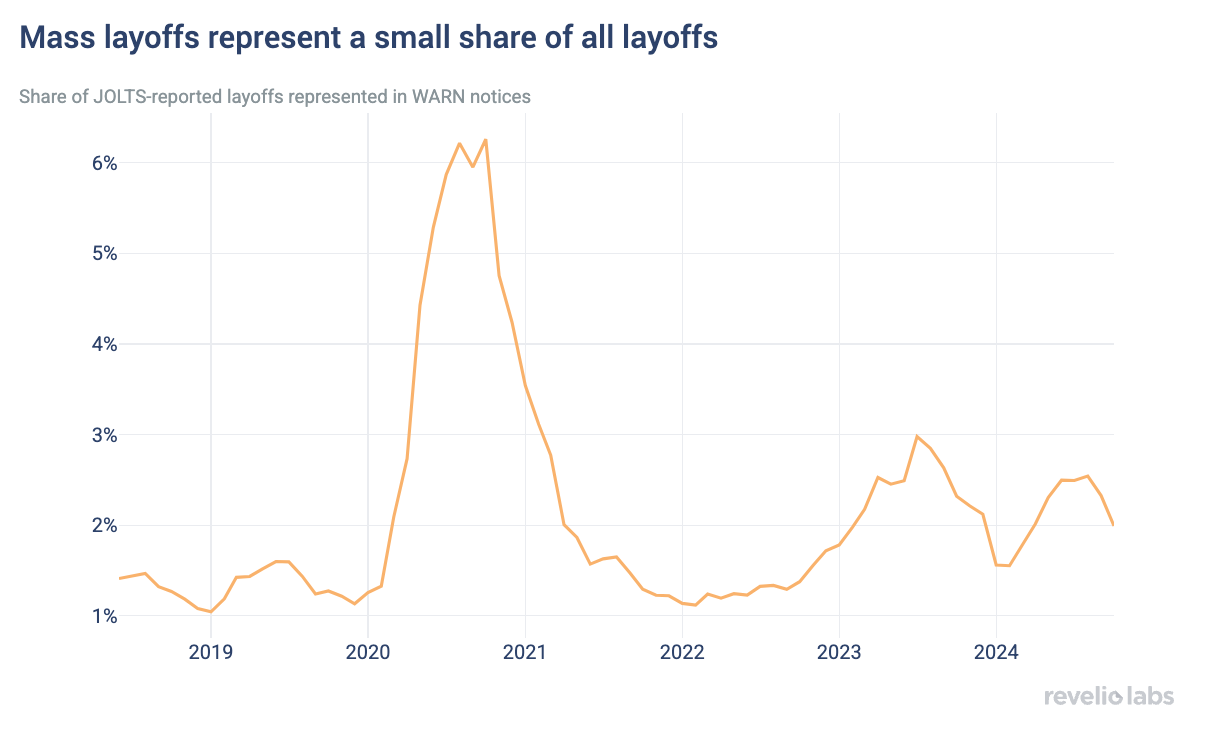

By design, WARN layoff notices capture only a fraction of total layoffs in the economy – namely, mass layoffs at larger establishments. As previously mentioned, the federal WARN Act mandates eligible employers to provide written notices ahead of mass layoffs or plant closures for businesses with 100 or more full-time workers, with at least 50 employees affected. This means that workers in small businesses, part-time workers, and layoff events that affect less than 50 workers do not require employers to file a WARN notice for them (at least under the federal WARN Act).

When we compare the employee count in WARN notices to aggregate layoff data reported by the Job Openings and Labor Turnover Survey (JOLTS), we observe that mass layoffs in WARN notices constitute between 1 and 6% of total layoffs. Despite this being a seemingly small percentage, mass layoffs serve as an important predictor of total layoffs. The share of layoffs from JOLTS that were reported in WARN notices peaked during the pandemic year. In addition, we observe a notable uptick in the share of layoffs reported in 2023, coinciding with the uncertain labor market conditions during the Fed’s interest rate hikes.

What is the advantage of tracking WARN notices if they only represent a fraction of total layoffs? WARN notices provide a unique advantage as a leading indicator of labor market disruptions. Unlike the JOLTS data, which are released with significant delays—e.g., January 2025 data will not be available until March 2025—WARN notices are typically filed 60 days before a mass layoff event. This lead time allows WARN notices to act as an early warning system, offering insights into layoff trends up to five months ahead of labor market reports.

Where are notice times the longest?

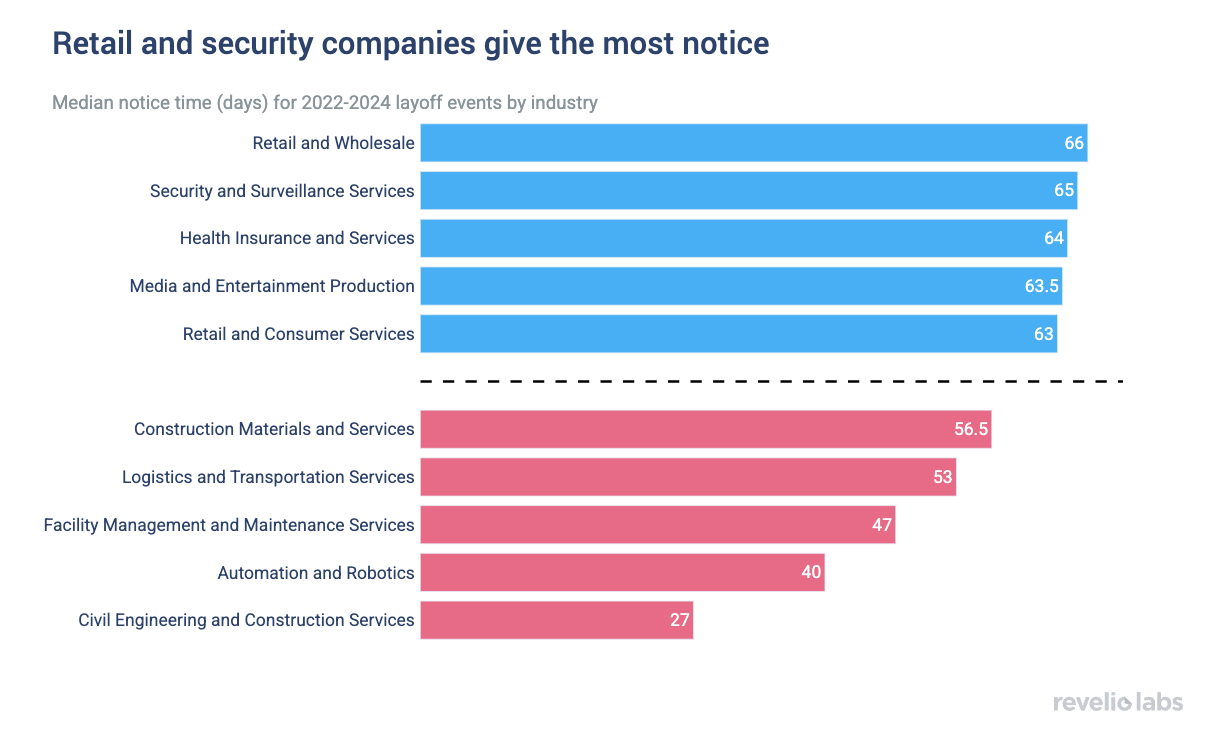

We first examine differences in notice time by industry. Employers in the Retail and Wholesale, Security and Surveillance Services, and Health Insurance and Services industries appear to be among the most compliant with the WARN Act, consistently providing a median notice period exceeding 60 days. These industries typically operate with longer planning horizons and more predictable demand patterns, allowing them to anticipate workforce changes well in advance. In contrast, employers in industries like Construction, Facility Management, and Logistics and Transportation exhibit lower compliance, with median notice periods ranging from 27 to 56 days. These sectors often face volatile demand, project-based work structures, and tight margins, which can make it challenging for companies to provide extended notice periods without risking operational disruptions. Companies such as JELD-WEN and Aramark Facilities Management laid off many employees in 2024 with notice periods of 30 days or fewer.

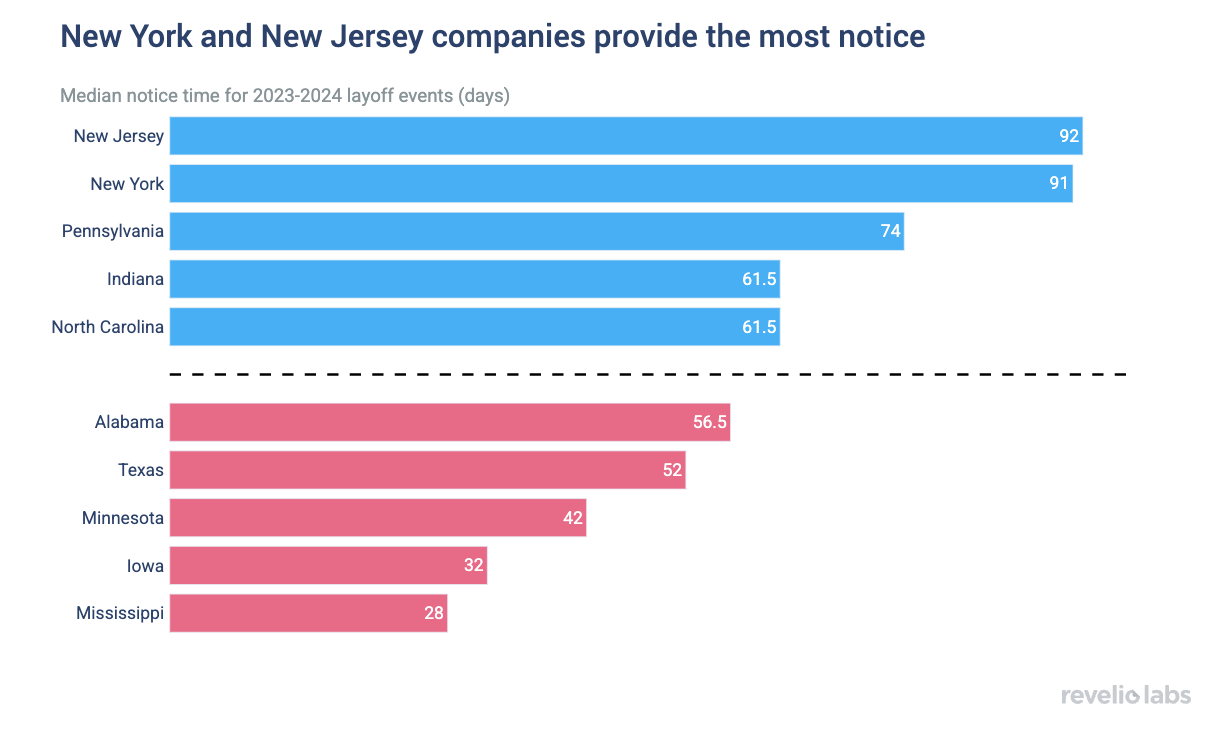

In addition to variation by industry, we also observe significant variation in notice times across states, with the median notice period ranging from 28 days in Mississippi to 92 days in New Jersey. This variation reflects differences in state-level economic structures and labor market dynamics. For example, states with a larger share of small businesses, lower union density, or industries prone to demand fluctuations might be less covered by the federal WARN Act's requirements.

Most importantly, however, variations in WARN compliance across states could be driven by different policy environments. For example, states like New York and New Jersey have enacted their own, more stringent WARN laws that impose stricter requirements, such as longer notice periods or broader coverage of layoff events. Conversely, states with shorter median notice periods, such as Mississippi, may have less robust labor protections or industries characterized by higher volatility and shorter planning cycles.

State WARN Acts

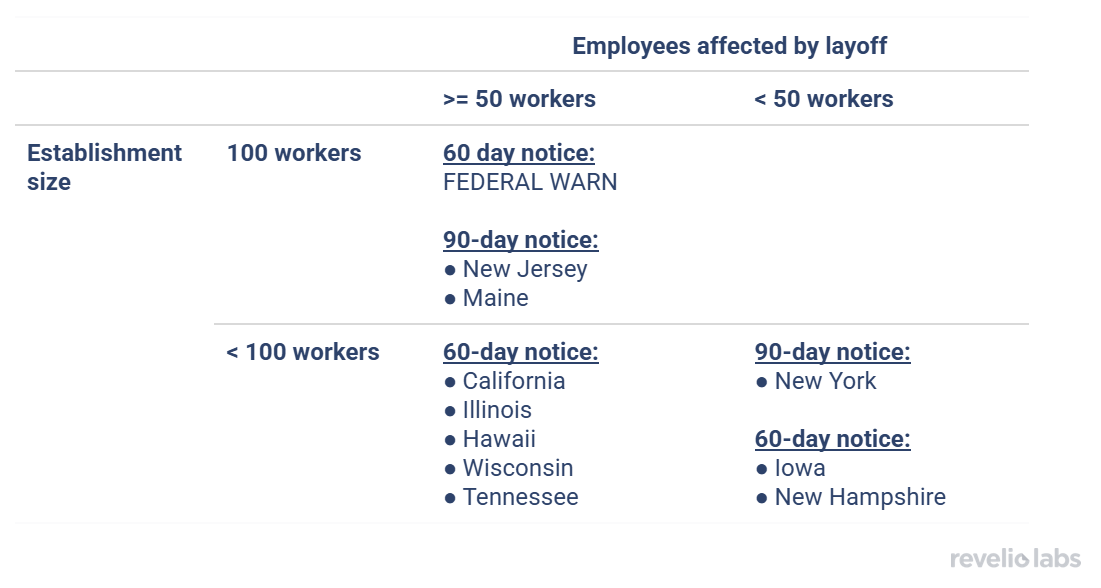

We further examine differences in state-level WARN legislation. While the federal WARN Act mandates establishments with 100 or more full-time workers to issue advance layoff notices if at least 50 employees are affected, many states have enacted their own WARN laws with stricter provisions. Thirteen states have implemented their own versions of the WARN Act, ten of whom have set more demanding requirements around mass layoffs. These ten states, which are listed in the table below, provide greater employment protection by calling for longer notice periods (e.g., New York, New Jersey, and Maine), covering employees at smaller establishments (e.g., Illinois and Tennessee), including part-time workers (e.g., California), or requiring a combination of these measures. The table below illustrates the varying degrees of protection in state WARN Acts compared to the federal standard.

The divergence in state-level WARN laws reflects broader economic and political priorities. States with more strict requirements often have higher costs of living and stronger labor advocacy, where sudden layoffs can create ripple effects in local economies. For instance, requiring longer notice periods in high-cost states like New York and New Jersey helps workers transition more smoothly and reduces the economic shock to communities. Conversely, states with less strict protections may prioritize business flexibility, particularly in industries with higher volatility or lower margins, where strict layoff rules could discourage investment or job creation.

How effective are state WARNs in protecting affected employees? While our data does not allow us to identify the individuals who receive advance layoff notices directly, we can still observe worker outflows from establishments at a metro area level. We match WARN notices issued by companies in a given metro area to workers’ outflows from those companies in the metro areas where layoffs were announced, and assess the share of these employees who started a new job within one month of the layoff notice date.

We find a positive correlation between the median layoff notice period recorded in WARN notices and the share of outflows who secured new jobs within one month. On average, a one-day increase in the median notice period is associated with a 0.08-percentage points increase in the share of outflows reporting new employment within one month. While this relationship is relatively weak, it suggests that longer notice periods may provide workers with slightly more time to secure alternative employment opportunities. The modest relationship highlights that while advance layoff notices are helpful, they are not a remedy for the uncertainty problem following layoffs, especially in the sluggish US labor market, where hiring and attrition are at their lowest points in decades. The effectiveness of WARN notices may depend on additional factors, such as the state of the local labor market, industry-specific dynamics, and the availability of job-matching services or retraining programs. WARN protections should be coupled with broader workforce development initiatives to improve outcomes for laid off workers.

The WARN Act, both at the federal and state levels, offers a framework to mitigate the shock of mass layoffs, yet its effectiveness is limited by its design. While our analysis shows that longer notice periods correlate with a quicker probability of re-employment for affected workers, the relationship is relatively modest. This suggests that while advance notice may play a role in helping affected workers adjust after layoffs, it is not a complete remedy for the challenges posed by layoffs in the current sluggish labor market.

From an economic perspective, the WARN Act serves as a signal of broader labor market trends. While mass layoffs represent a relatively small fraction of total layoffs, they often coincide with macroeconomic shifts. The timeliness of WARN notices make them not only a tool for worker protection but also a valuable leading indicator for economists and policymakers monitoring labor market health. The predictive nature of WARN notices can complement other datasets, providing an important piece of the puzzle in understanding labor market dynamics.

Should policies like the WARN Act evolve to better address the realities of today’s workforce? This may include, for example, expanding coverage to include smaller businesses or part-time workers, or integrating more robust enforcement mechanisms. At the same time, the rise of remote work and gig employment raises new challenges for defining and addressing layoffs. In uncertain economic environments, the implications of adjusting policies such as the WARN Act remain important to evaluate.