Can Wall Street Attract AI Talent Away From Silicon Valley?

Financial expertise might be the bottleneck for banks’ AI endeavors

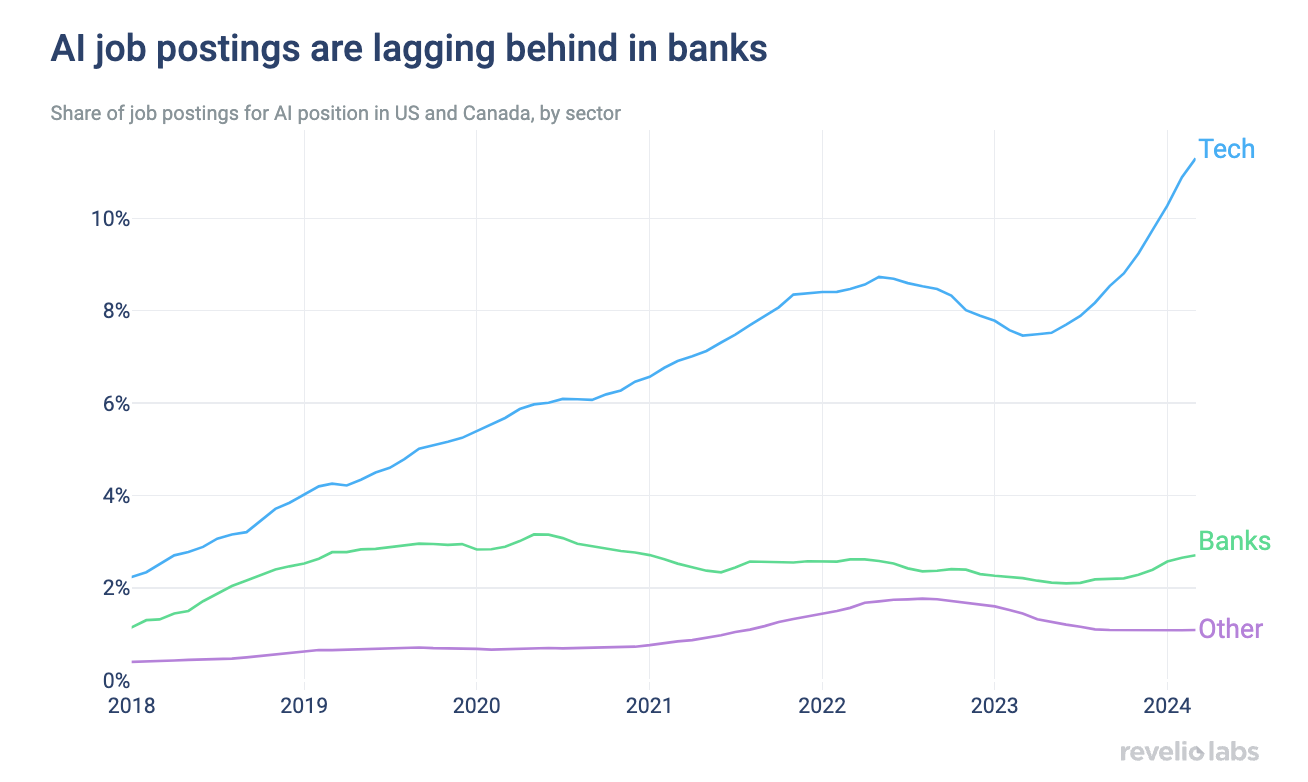

While banks are recruiting for AI positions more than firms in other industries, they are still lagging behind tech.

AI work in financial institutions requires a unique combination of finance domain knowledge and AI technical skills, which may be hard to find in the market.

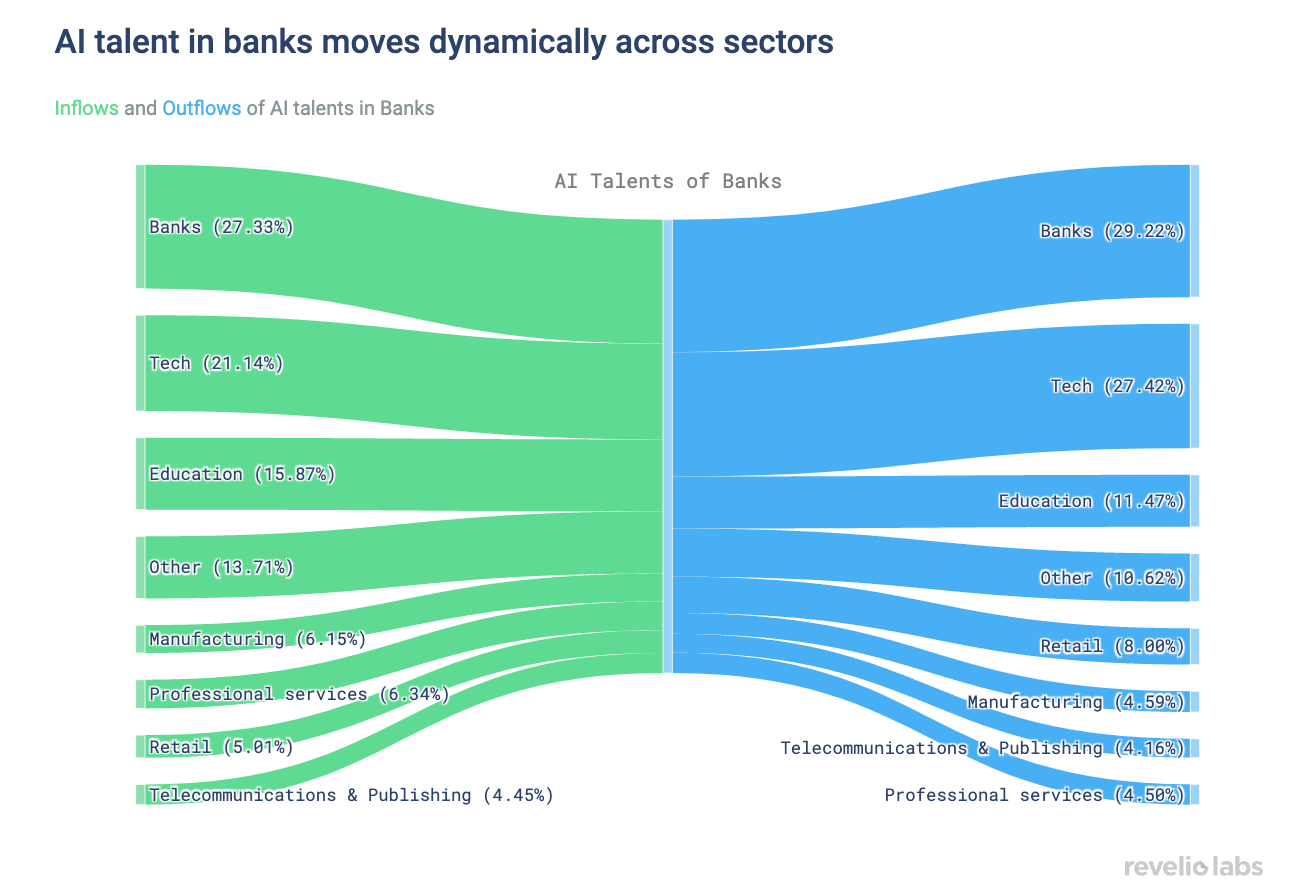

Mobility of AI professionals between industries intensifies the competition for AI talent in Finance. Tech receives the largest share of AI talent leaving Finance.

AI is set to have an outsized impact on the financial industry, enhancing customer service, strengthening security and boosting operational efficiency. To get these benefits, banks have to hire and retain top AI talent, competing not only with each other, but also with other sectors such as tech. In today’s newsletter, we look into these hiring efforts, and analyze the state of AI talent in financial institutions.

About 2% of job postings at banks in the US and Canada require AI skills, twice as much as in other industries. Relative to the tech industry, however, banks are still lagging behind. While the share of jobs requiring AI skills has continued to rise among tech companies, the demand for AI skills in the financial sector has flattened out after 2020. Additionally, while AI professionals make up almost 2% of the tech workforce, the share of AI professionals in banks is only around 0.5%.

These differences could stem from several factors. First, banks traditionally have an army of quantitative analysts tackling similar tasks, potentially enabling them to redeploy existing staff rather than seeking external hires with expertise in AI. Secondly, AI work in banks may require unique combinations of tech and finance skills and detailed domain knowledge, which may be hard to come by. Finally, the intense competition for AI talent may make it hard for financial institutions to attract employees in the space.

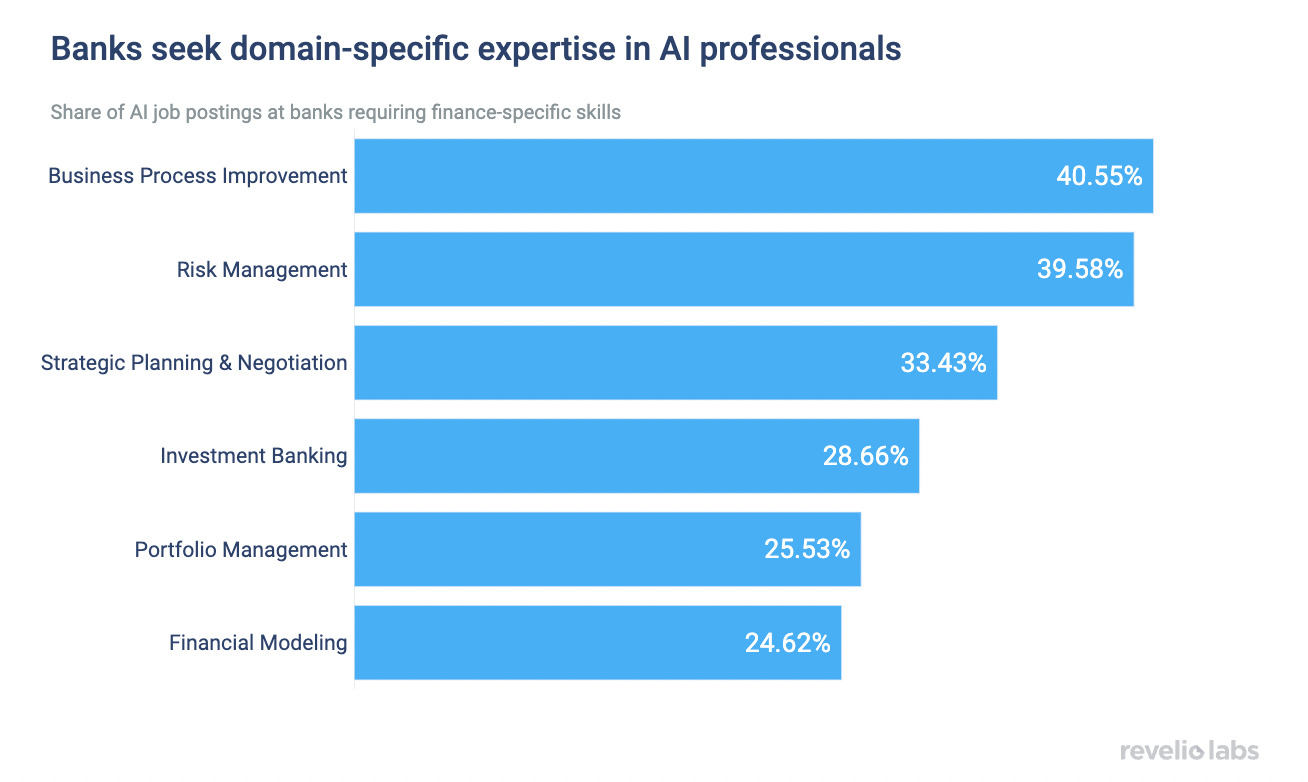

Examining the job descriptions of AI professionals employed in tech companies and financial institutions sheds more light on these mechanisms. Relative to AI tech employees, those in finance are much more likely to mention traditional finance applications, such as risk management, credit cards, and anti-fraud models.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

An analysis of the skills required in the postings for finance AI professionals shows that domain-specific skills are in high demand in the financial space. 40.5% of AI job postings in finance require business analysis skills and 39.5% require risk management and banking skills. Conversely, only around 7% of AI tech job postings require these skills. This confirms the unique mix of technical and domain-specific expertise that banks look for in AI professionals.

Despite this focus on traditional finance applications, the background of the current AI workforce in banks is varied. While the majority of AI inflows (27%) come from other financial institutions, banks hire many professionals from other sectors such as tech and education. Similarly, AI professionals in banks are able to transfer their skills to other industries. More than 70% of outflows from AI positions in banks go to another sector, the largest outflows being toward tech (27%). This dynamic job market, with lots of inter-sector mobility, suggests that competition for AI talent may be even more fierce.

While the financial sector acknowledges the transformative potential of AI, it continues to lag behind the tech industry in the competition for AI talent. The specialized knowledge required for AI applications in finance may narrow the pool of suitable candidates. Moreover, the substantial dynamism of AI professionals across different sectors underscores the urgent need for banks to revamp their hiring strategies and workplace environments to stay competitive in this evolving landscape.