Should Salesforce Really Buy Slack?

The two companies have remarkably similar workforce compositions

Back in October, Revelio Labs published a piece on predicting successful mergers based on occupational and geographic similarities, titled “How Can You Know If A Merger Is A Good Idea?” By studying these types of data analytics, we saw a strong correlation between the diversity of the companies’ workforce and post-merger performance.

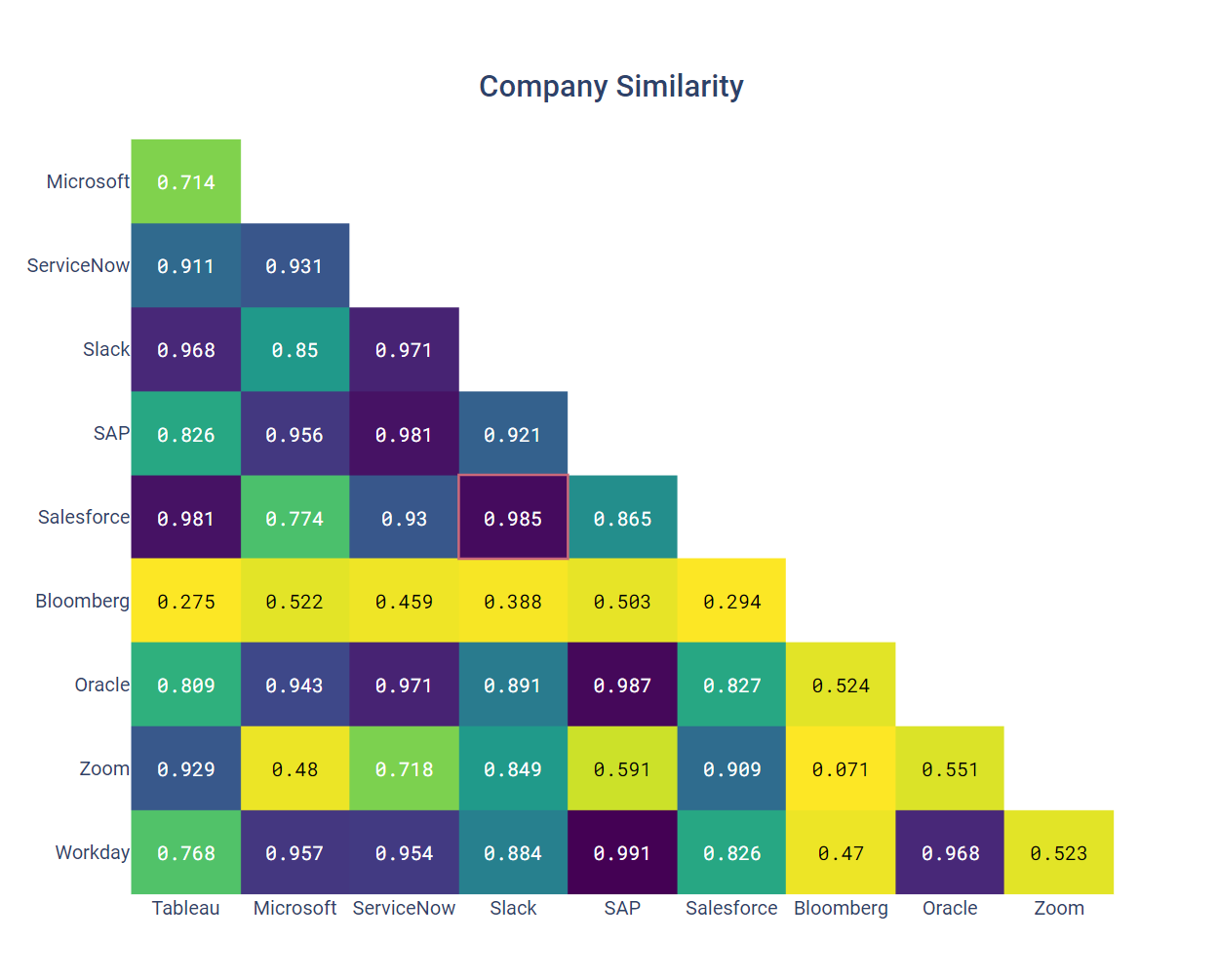

Interestingly, among the set of SaaS productivity companies, Salesforce and Slack have an extraordinarily similar workforce to each other, raising significant questions about whether the acquisition will be beneficial for Salesforce in the long term. Below, we see the similarity scores of all companies in the market:

Among all pairwise similarities, the only pairs that are comparable are between SAP & Oracle, SAP & Workday, SAP & ServiceNow, and between Salesforce & Tableau. Given that Salesforce has acquired the two most similar companies to itself, we suspect that these acquisitions have less to do with exploiting complementarities to maximize value, and more to do with building its empire to gain market share.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

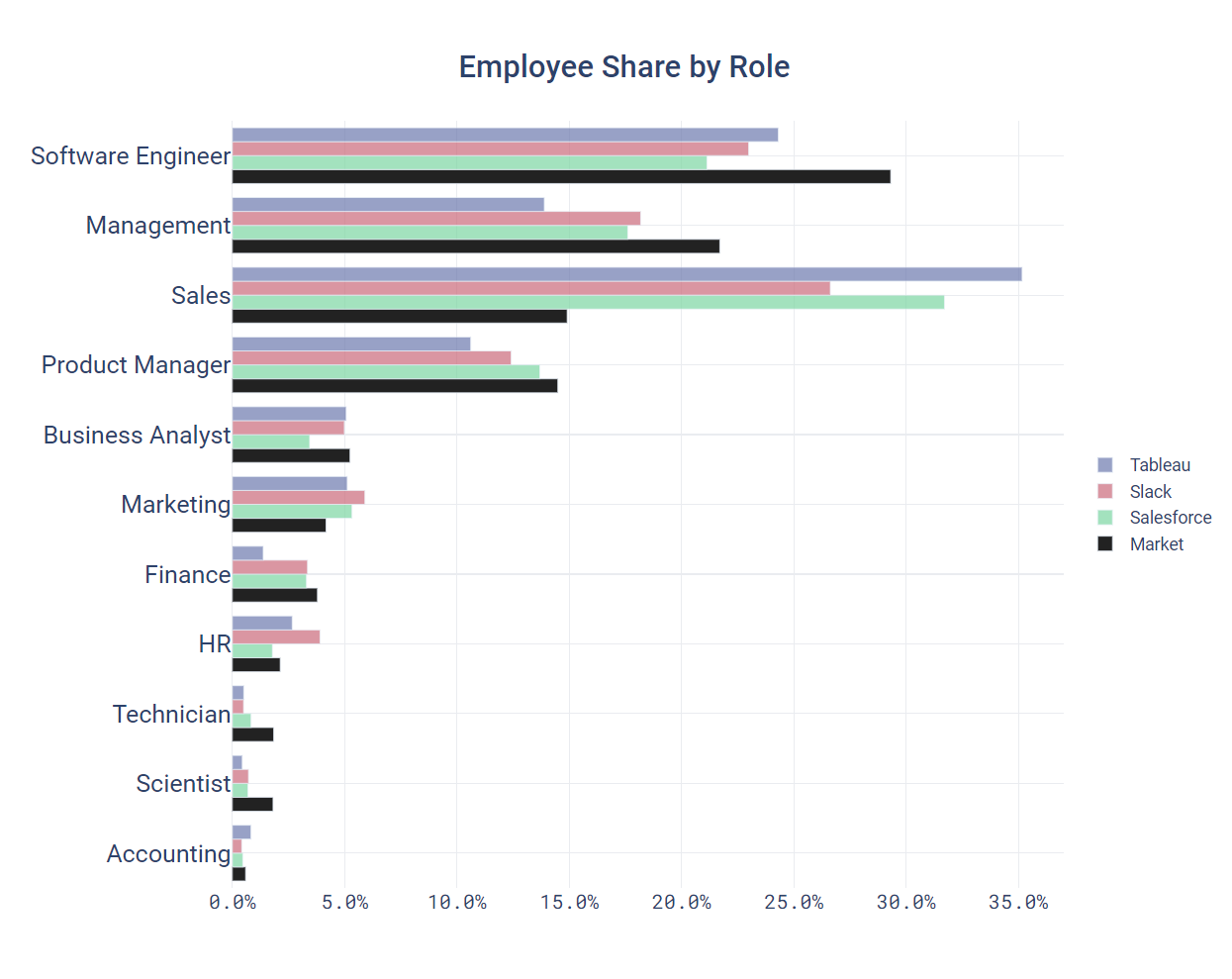

Below, we can see that the distribution of roles in Salesforce, Slack, and Tableau is very different from the broader market:

The Salesforce empire now has many more account managers than its primary competitors.

Takeaways:

- Of all large SaaS productivity companies, Salesforce and Slack are strikingly similar in terms of workforce composition, putting the long term benefits of the acquisition into question.

- Account Management, Sales, and Customer Success are the most concentrated roles, and where Salesforce is continuing to stand out.

- Salesforce has far fewer engineers and product managers than competitors, and that gap is increasing, suggesting that the product-led strategy of Salesforce’s past is long gone.

If you have any ideas of other types of data analytics or would like to hear more about Revelio Labs workforce composition data, please feel free to reach out. You can also check out our previous newsletter, which is on the nurse shortage, here.