Did July’s Jobs Report Really Warrant Market Turmoil?

A deeper dive into the workforce

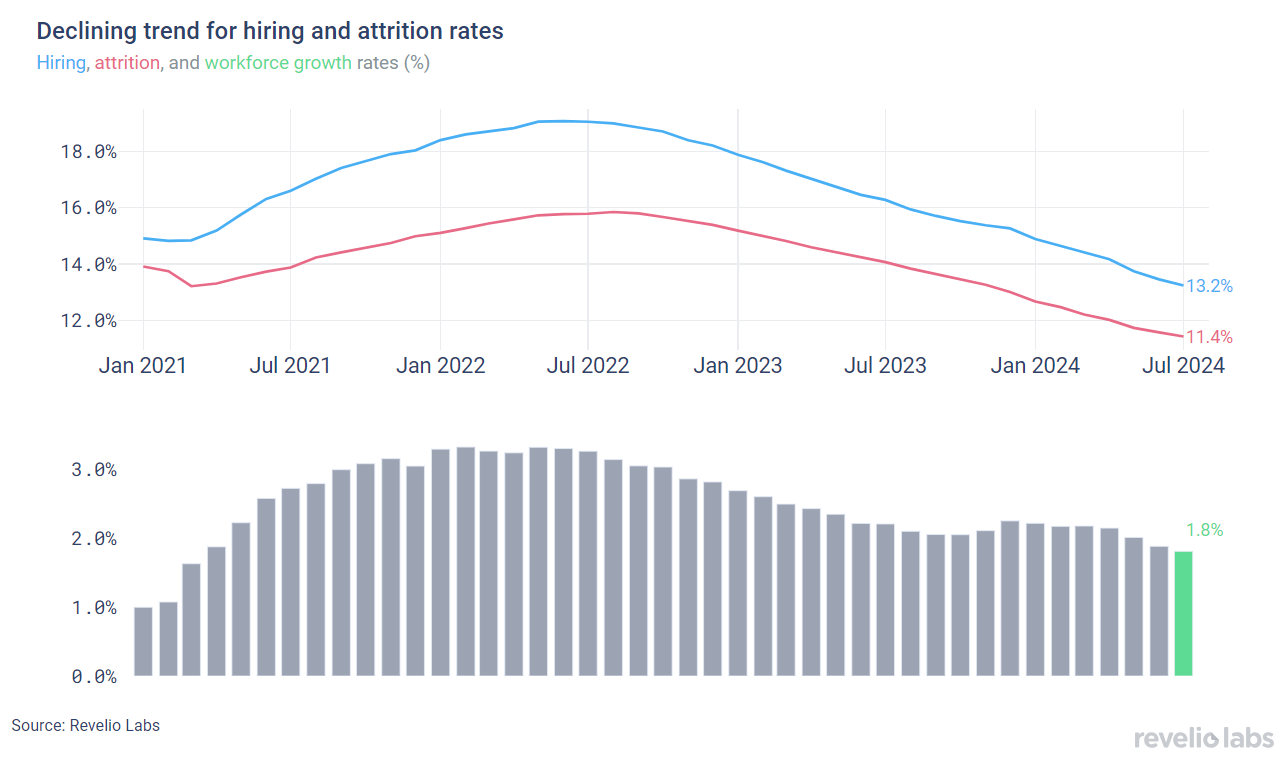

⬇️ 1.8% workforce growth rate in July 2024; lower than the growth rate observed in June. The positive workforce growth rate comes amid the declining hiring.

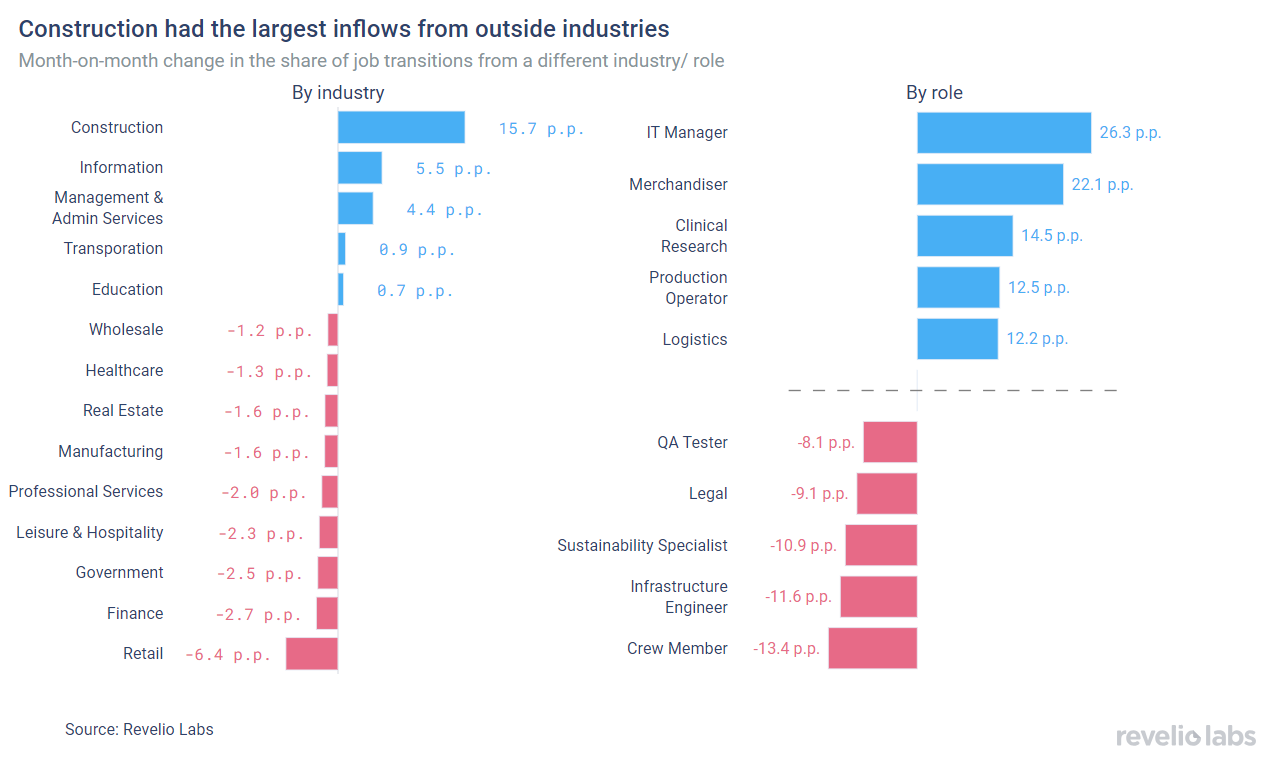

⬇️ 40.4% of workers who started a new job in July transitioned to a new role and 67.8% transitioned to a new industry. Construction had the largest increase in the share of workers coming from other industries.

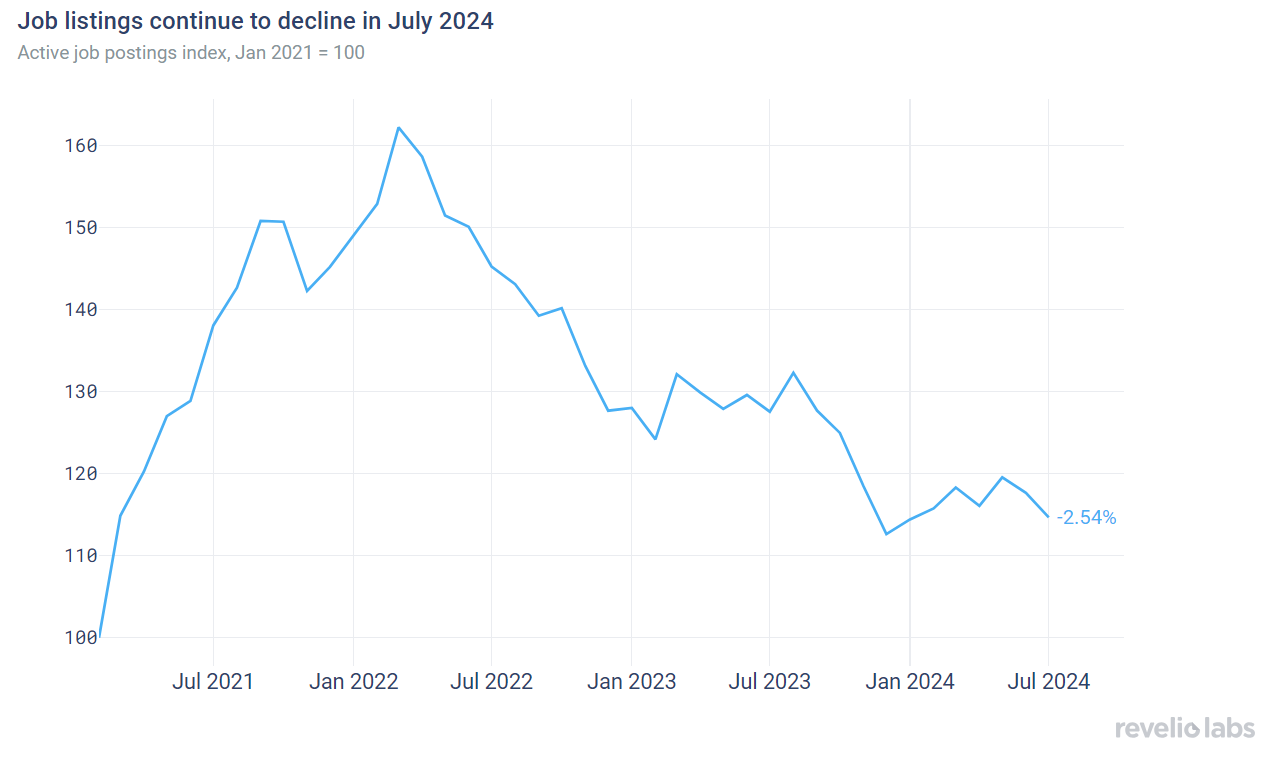

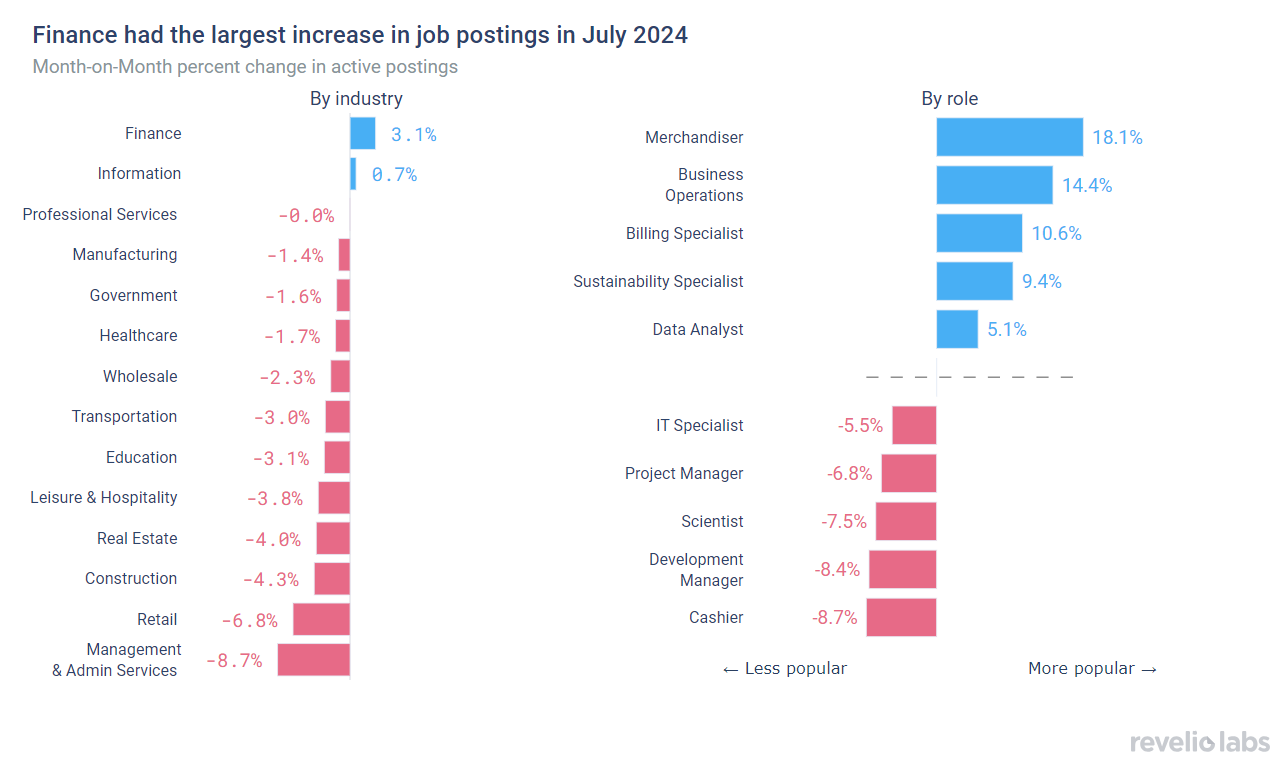

⬇️ 2.5% decrease in active job listings in July from June, with the decline being widespread across most industries. The Management and Administrative Services sector had the largest decline in the demand for workers (-8.7% decline in active listings in July), while Finance had the largest increase in active job postings (+3% increase in July).

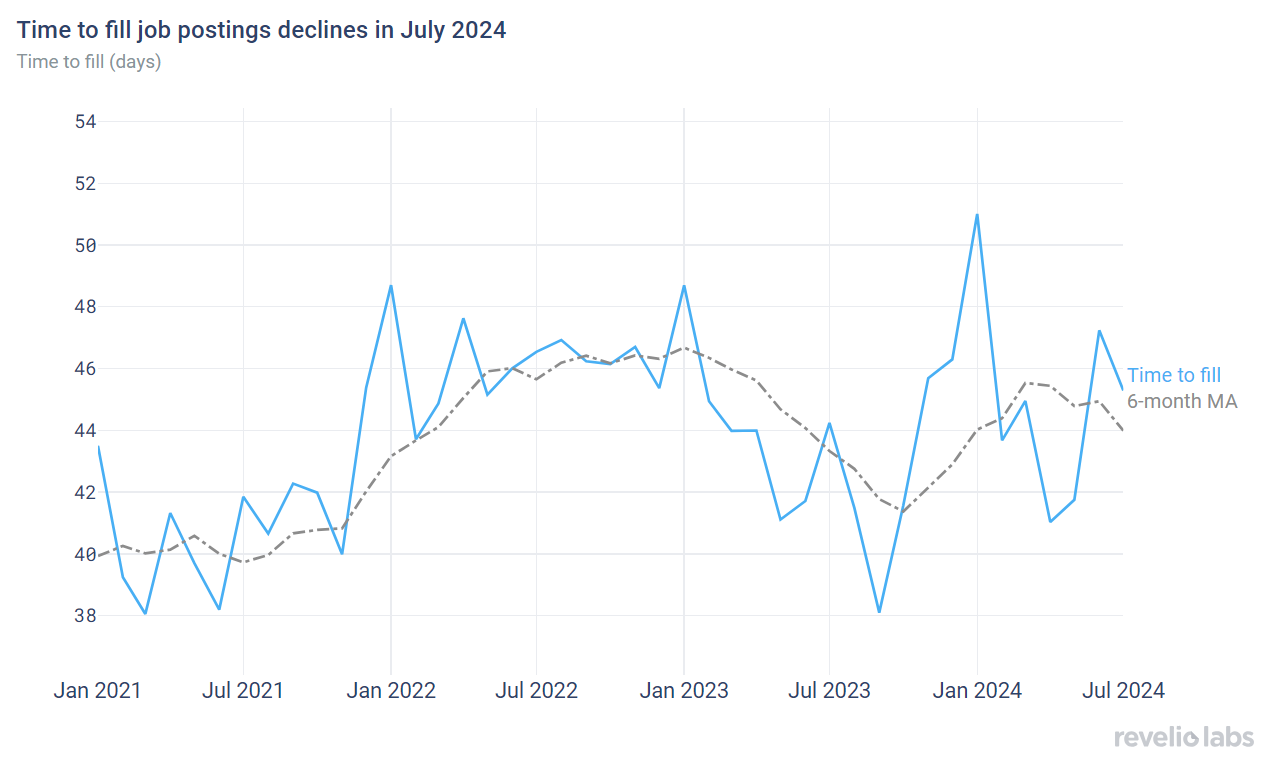

⬇️ 45.3 days to fill job openings in July. This is 1.9 days less than in June and 1.3 days more than in July 2023.

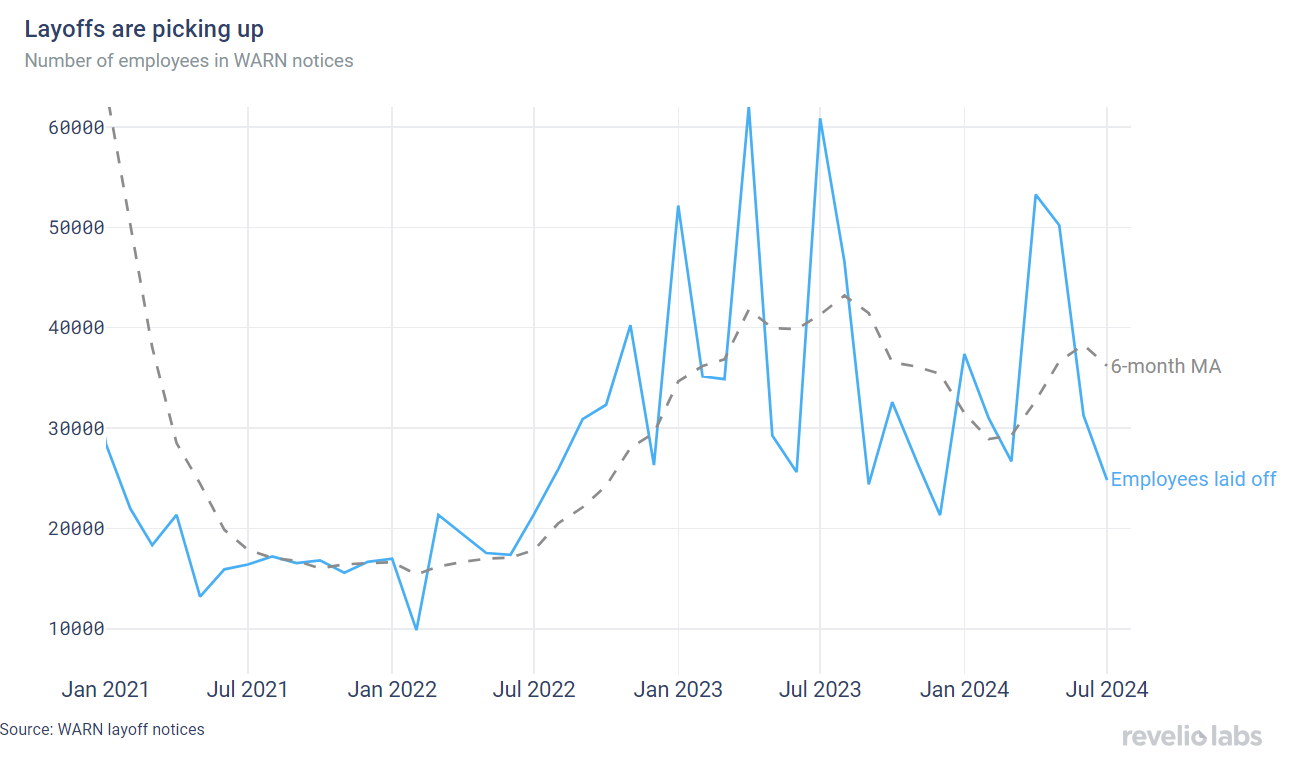

⬇️ 20.6% decrease in the number of employees notified of layoffs under the WARN Act compared to June 2024.

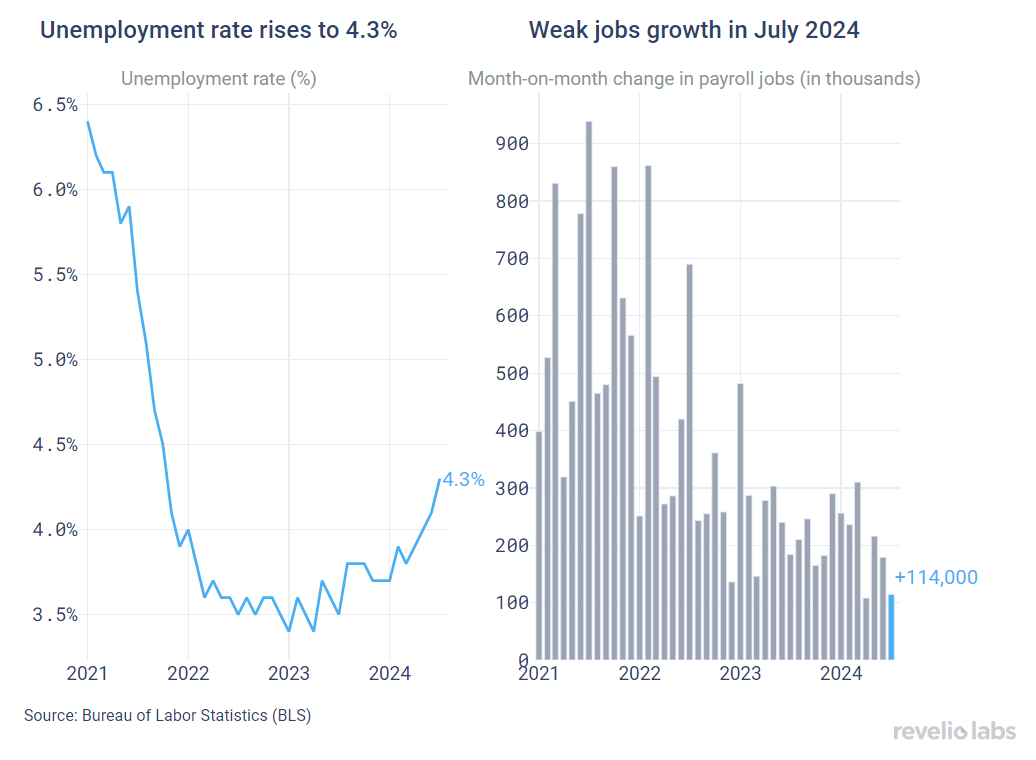

Weak Jobs Report in July

The July 2024 jobs report painted a less optimistic picture of the US labor market than previous months. The unemployment rate rose even further to 4.3%, the highest level since October 2021. It is important to note that the higher unemployment rate comes amid an increase in labor force participation. Meanwhile, the economy added 114,000 new jobs in July, a fewer-than-expected growth in jobs. Employment gains occurred mainly in healthcare, construction, and transportation and warehousing sectors. Employment gains in May and June were revised downwards by 2,000 and 27,000 jobs respectively, suggesting a notable slowdown in the labor market since the beginning of the second quarter of 2024. Overall, the July report suggests a cooling of the labor market.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future? Read the rest of our job report to find out.

Hiring and attrition continue their declining trend

Revelio Labs’ workforce intelligence data show that hiring and attrition rates have continued their declining trend, both reaching a record low. The hiring rate stood at 13.2% (decreasing from the 13.5% hiring rate recorded in June). Meanwhile, the attrition rate stood at 11.4% (lower than the rate of 11.6% recorded in June). As attrition has been declining at a slower rate, the workforce growth rate has been decreasing. The workforce growth rate (difference between hiring and attrition rates) stood at 1.8% (lower than the growth rate in June on a m.o.m basis).

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

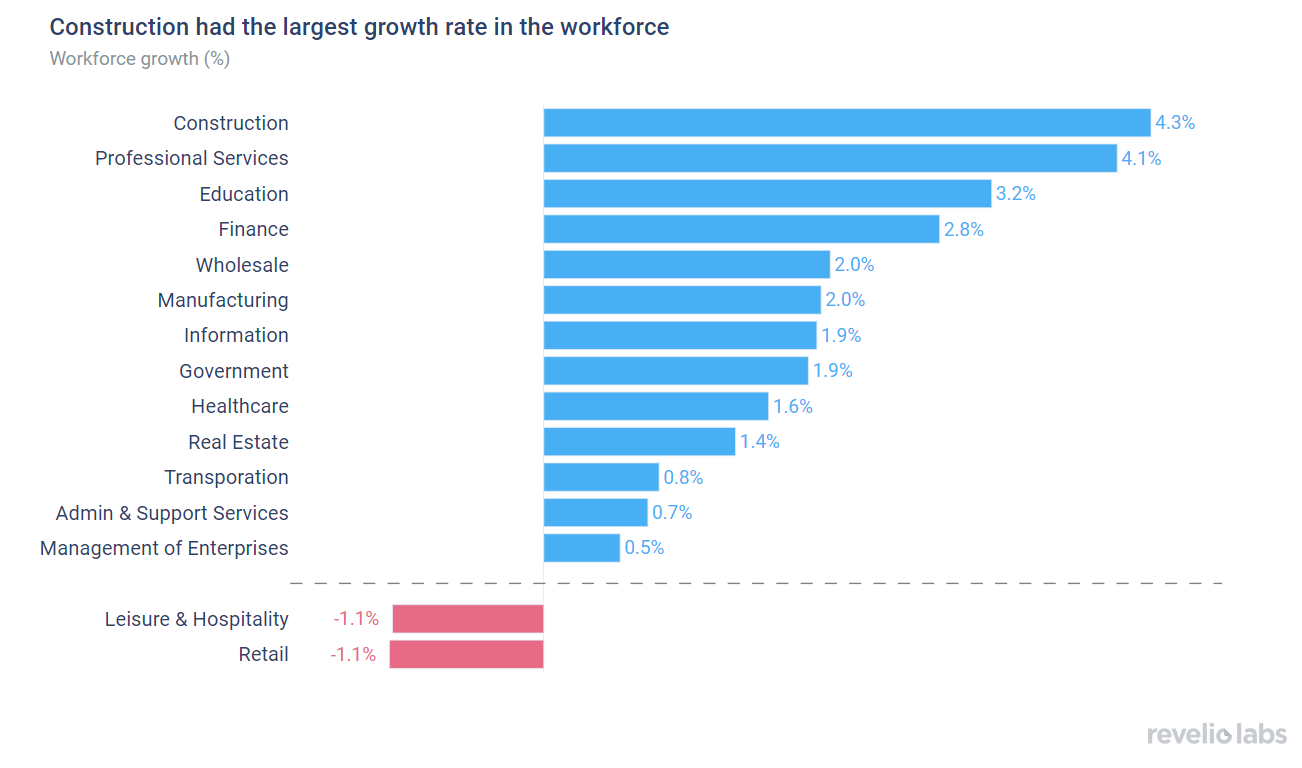

Sectoral hiring and attrition has been largely unchanged from June. Overall, most sectors saw an increase in the growth rate compared to the growth rate in June, with the Construction sector continuing to lead the pack. Construction recorded the highest workforce growth rate (4.3% workforce growth in July compared to 4.3% in June). The Construction sector has also been one of the major contributors to jobs growth in the past few months. The Retail and Leisure and Hospitality sectors saw a decline in the workforce (Retail saw a growth rate of -1% and Leisure & Hospitality saw a growth rate of also -1% in July).

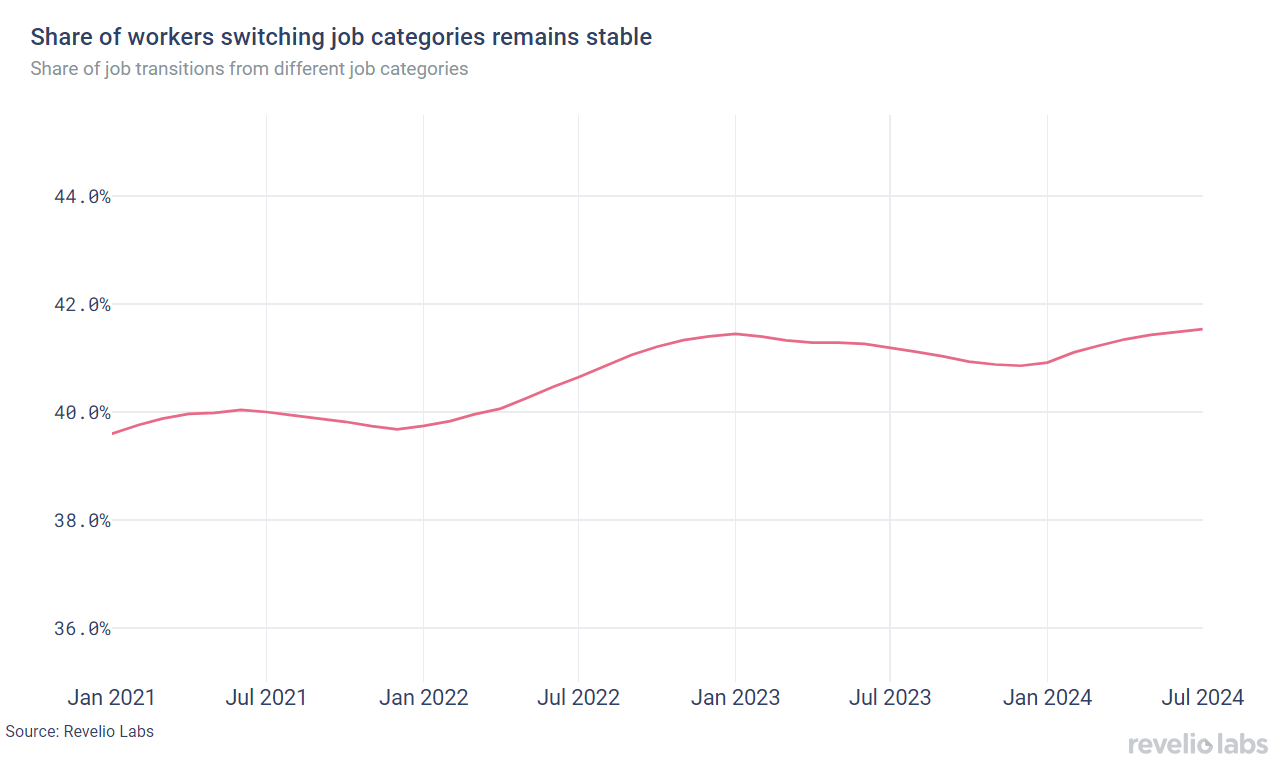

Of those who started a new job in July, 40.4% have transitioned to different roles and 67.8% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 40.4% of workers who started a new job in July did so by switching their broad job categories, lower than the rate of 46% observed in June. Furthermore, 68.7% of workers who started a new job in July started jobs in different industries - down from the rate in June (70.8%).

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to June 2024. The Construction sector saw a notable increase in the influx of workers from other industries. 82.8% of workers who started a job in Construction in July came from other industries (+15.7 percentage points from the share in June). In contrast, the Retail sector experienced the largest decline in the share of workers joining the industry from other industries. 77% of workers who started a job in transportation in July had backgrounds in other industries, relative to 83.5% in June 2024 (a 6.4 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to June 2024. Technical roles, such as IT manager and clinical research exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while legal and worker roles witnessed the largest decline.

Job postings decreased in July

The active job postings index continued to decline in July. Job listings decreased slightly by 2.5% compared to the previous month. New job listings decreased by almost 3.5% month-on-month, while removed job postings also decreased by 2.8% from their level in June.

The decline in job postings reflects a widespread decline in postings in many sectors, with the Management and Administrative Services sector experiencing the largest decrease (8.7% decrease in the number of active job listings in July compared to June). Only the Finance and Information sectors experienced modest increase in job listings relative to June (3.1% and 0.7%, respectively). Operations roles saw the largest increase in active job postings in June, while project management and cashier jobs saw a notable decline.

The days-to-fill for open listings ticked down slightly in July after increasing for 2 months, continuing the downward trend in time to fill that started in the beginning of 2024. Average days-to-fill stood at 45.3 days in July, down from 47.2 days in June (-1.9 days). The general decline in the number of days required to fill open job postings are further signals for the cooling labor market.

Layoffs are picking up

The number of employees receiving layoff notices under the WARN Act slightly decreased in July. However, the underlying trend of the layoff series has been increasing since the second quarter of 2024. The number of layoffs is elevated compared to 2022 and 2023. The trend in layoffs is likely to increase further, with the large layoff announcements from Intel, with 15,000 employees (15% of its total staff) affected and what might follow.

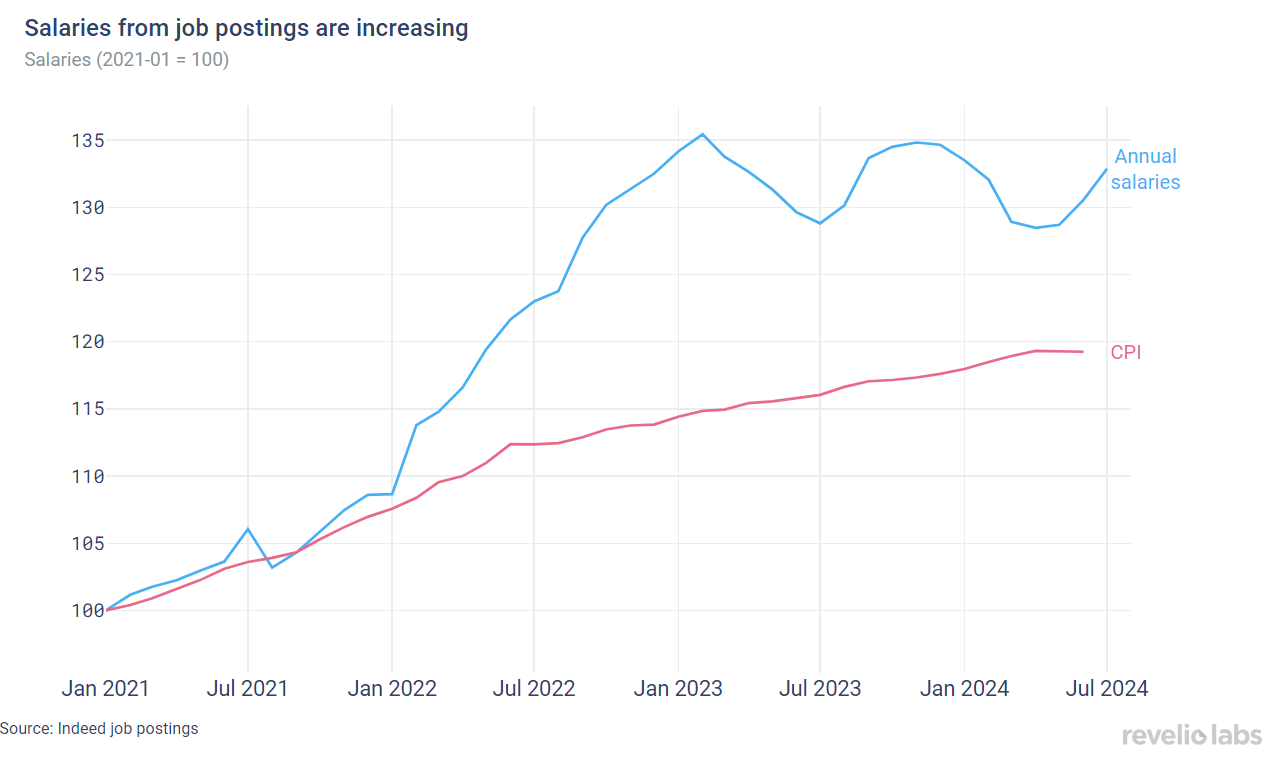

Quarterly highlight: Salaries in job postings

We analyze salaries stated in job postings in the US. Unlike current wages data, the salary information from job postings offer a forward-looking perspective on the economy. It serves as an indication of employers' anticipated compensation for prospective hires, providing insights into labor market conditions and anticipated inflationary pressures. Annual salaries announced in job postings have increased over the past quarter, after they followed a declining trend in the first quarter of 2024. Growth in salaries remains higher than inflation. Overall, the expected gains for employees remain generally stable since 2023.

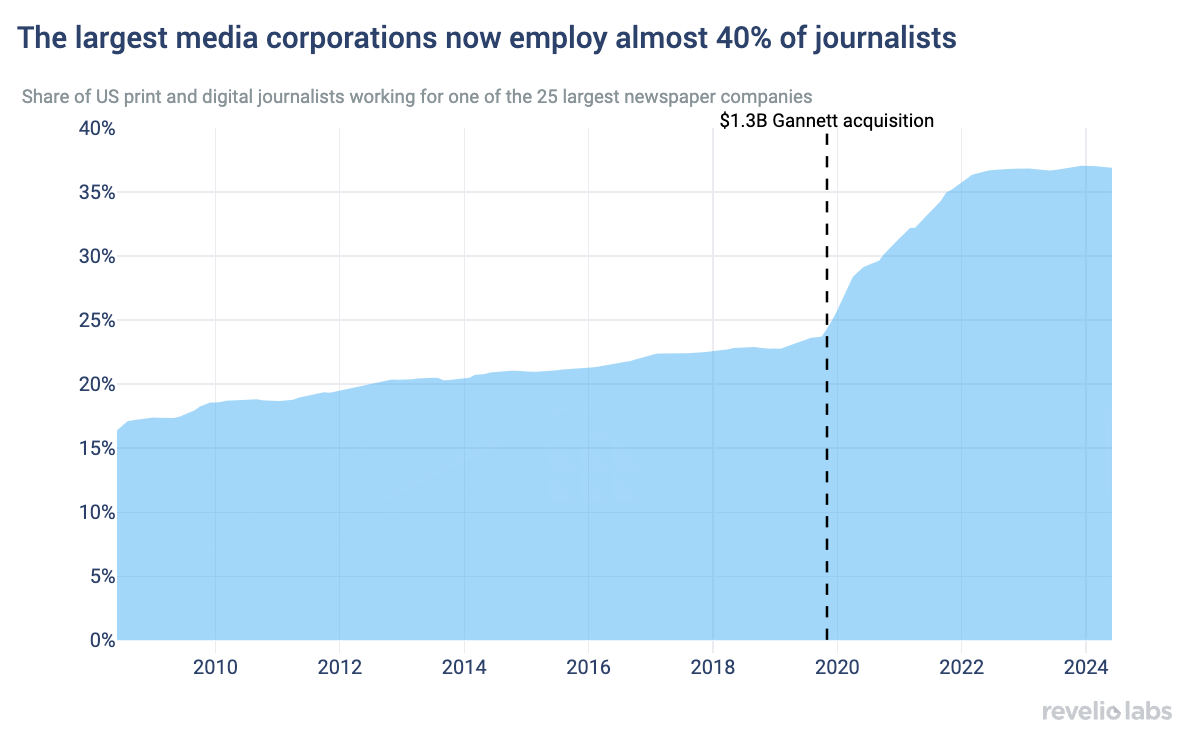

Highlight of the month: Media consolidation results in less news sources variety and also fewer opportunities for journalists

Our recent research highlights the effects of the consolidation of media ownership on the job market for journalists. Larger media conglomerates are increasingly acquiring local media outlets and owning larger shares of the total market; the 25 largest print news companies currently employ 38% of journalists, compared to only 15% in 2008. The Middle states are the most affected by this trend; South Dakota, Nebraska, and Oklahoma have turned into "News Deserts"—places with no or very limited access to reliable local news sources. With the decline in local print and digital news outlets, journalists are increasingly moving to business and financial media publications, which have increased their hiring steadily over the past few years. The absence of reporting on local news, including local and state politics, not only limits the flow of reliable information about local happenings but endangers social cohesion and makes political organization or grassroots movements difficult.

Conclusion

July’s Jobs Report sparked concern in global financial markets. Although the economy continued to create new jobs, the pace of growth has slowed significantly. This deceleration, coupled with a rising unemployment rate (triggering the Sahm rule), suggests the onset of a recession. The combination of July’s jobs report and earnings reports from tech companies caused turmoil in financial markets. Was this panicked reaction warranted? The data suggests otherwise. While the unemployment rate has increased in recent months, it remains relatively low by historical standards. The economy continues to add jobs, and the workforce is still growing. Some sectors are consistently adding jobs and contributing to hiring, particularly construction and healthcare. This comes amid an ongoing strength in other indicators such as salaries in new job postings or large career transitions. While the pace of the slowdown in hiring and job creation warrants caution and will certainly lead the Fed to cut rates at the next meeting – the panic on the markets was not warranted.

Please view our data and methodology for this job report here and our recent research on media consolidation here.