June’s Heatwave Didn’t Reach the Labor Market

A deeper dive into the workforce

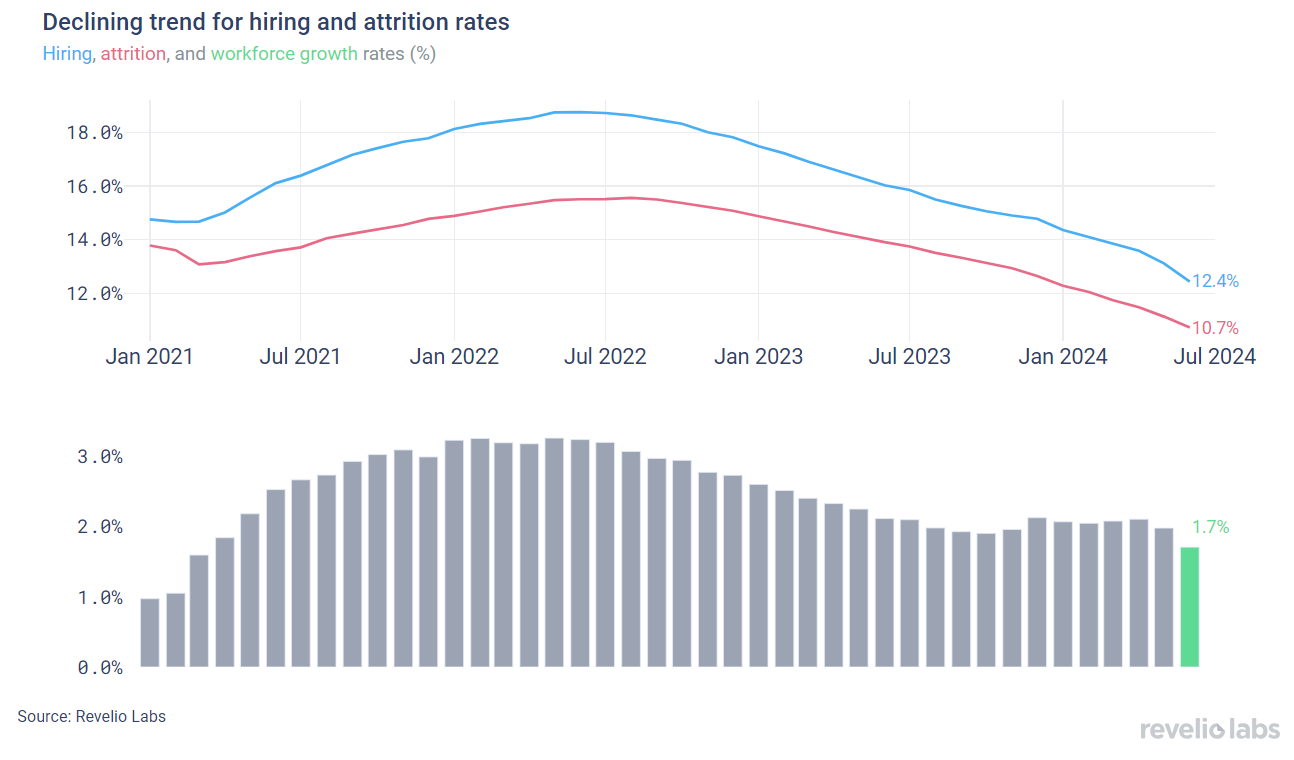

⬇️ 1.7% workforce growth rate in June 2024; lower than the 2% growth rate observed in May. The positive workforce growth rate comes amid a decline in hiring, and the rapidly declining attrition rate.

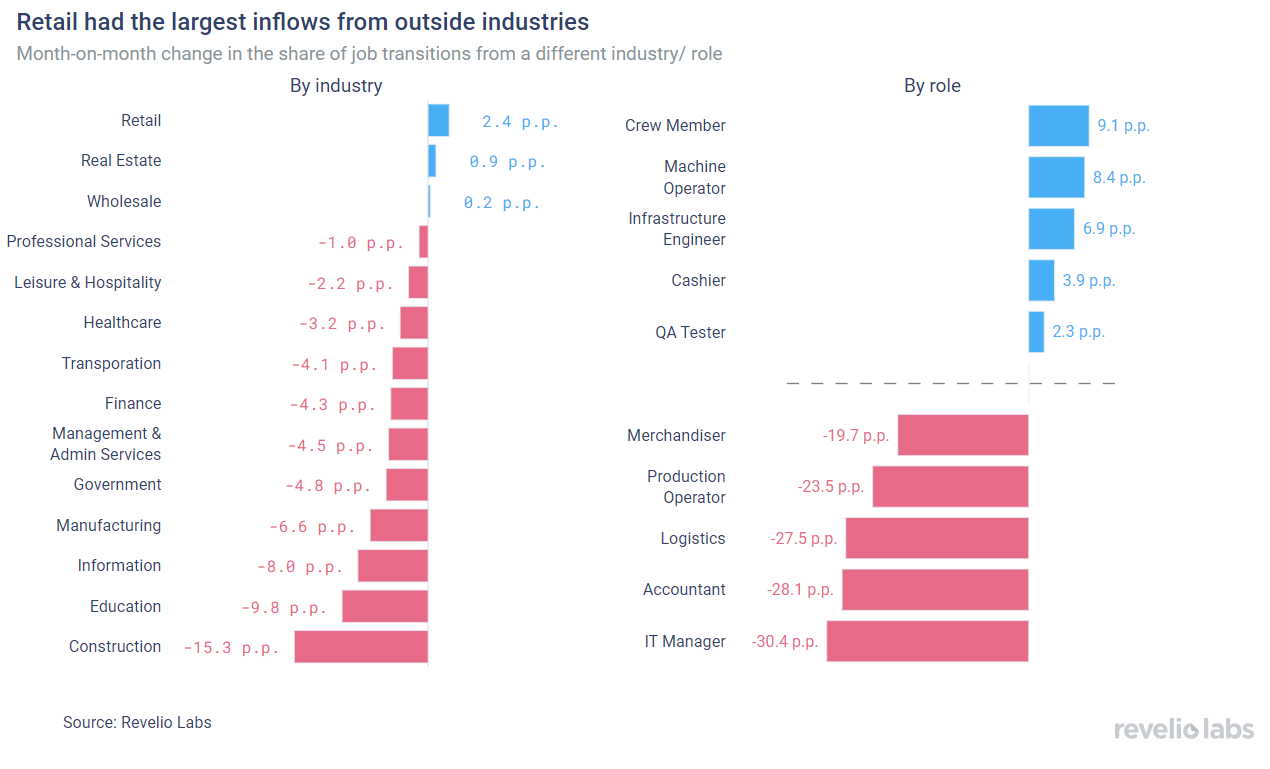

⬇️ 40% of workers who started a new job in June transitioned to a new role and 70.1% transitioned to a new industry. Retail had the largest increase in the share of workers coming from other industries.

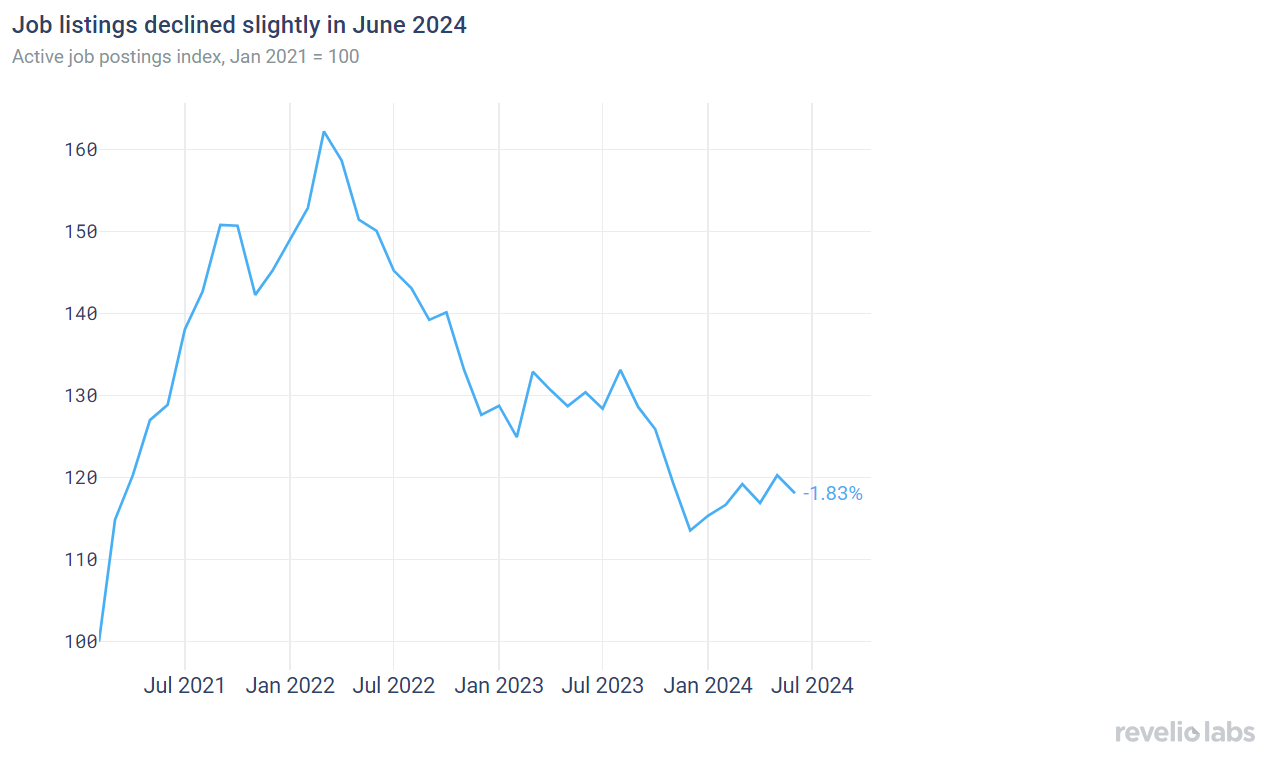

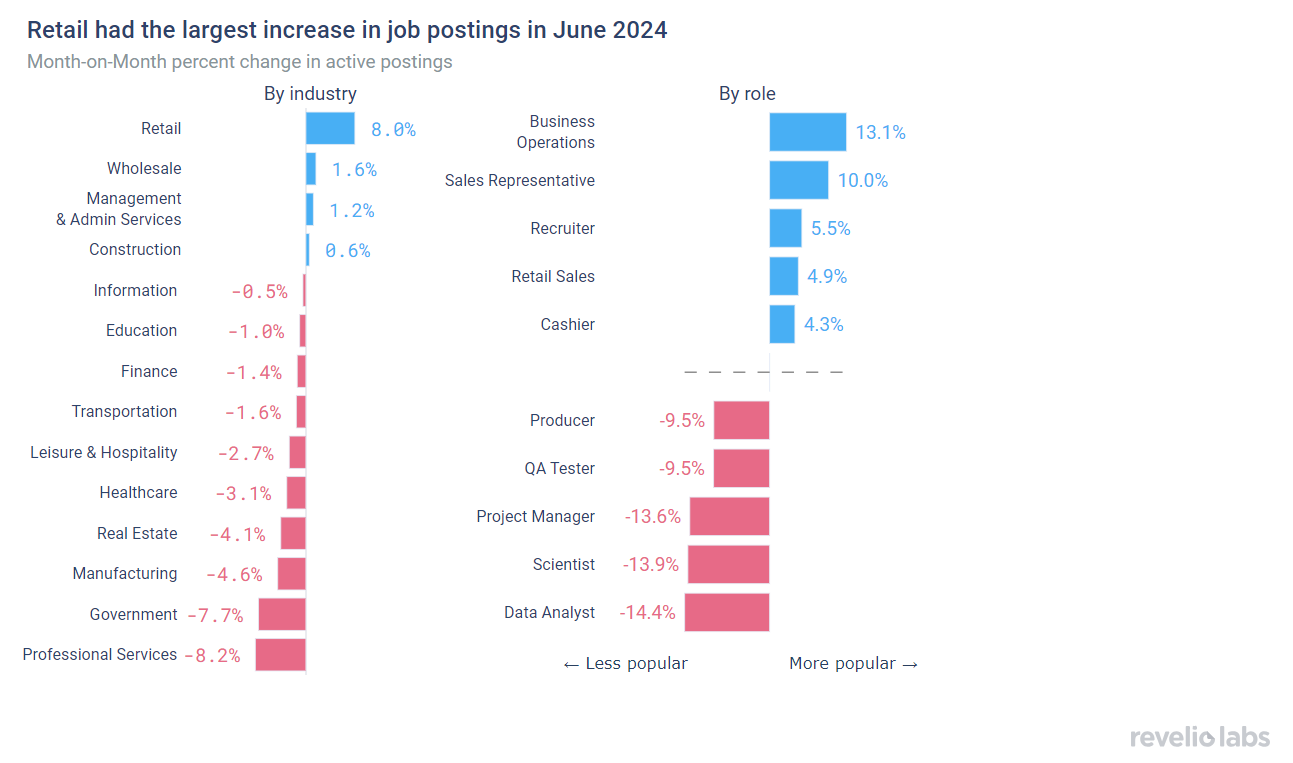

⬇️ 1.8% decrease in active job listings in June from May. The Retail sector had the largest increase in the demand for workers (8% increase in active listings in June), while Professional services had the largest decline in active job postings (-8.2% in May).

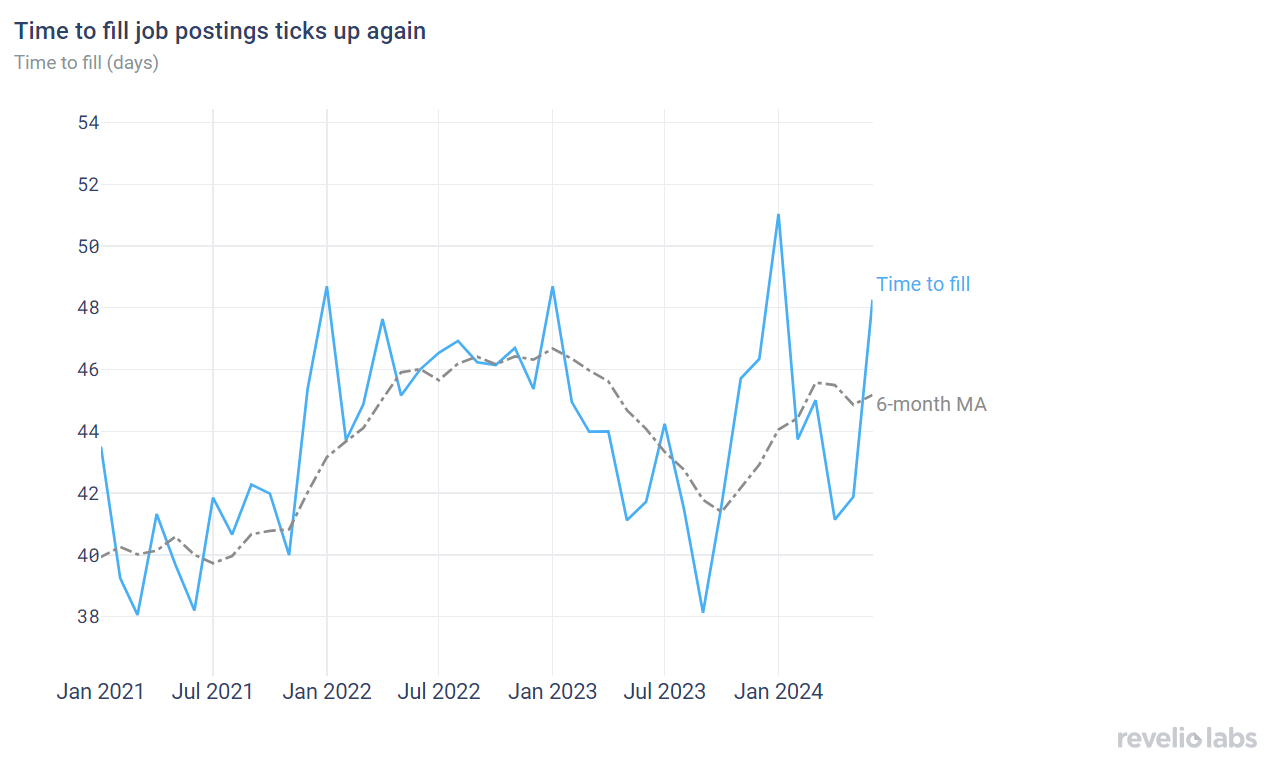

⬆️ 48.3 days to fill job openings in June. This is 6.3 days more than in May and 6.5 days more than in June 2023.

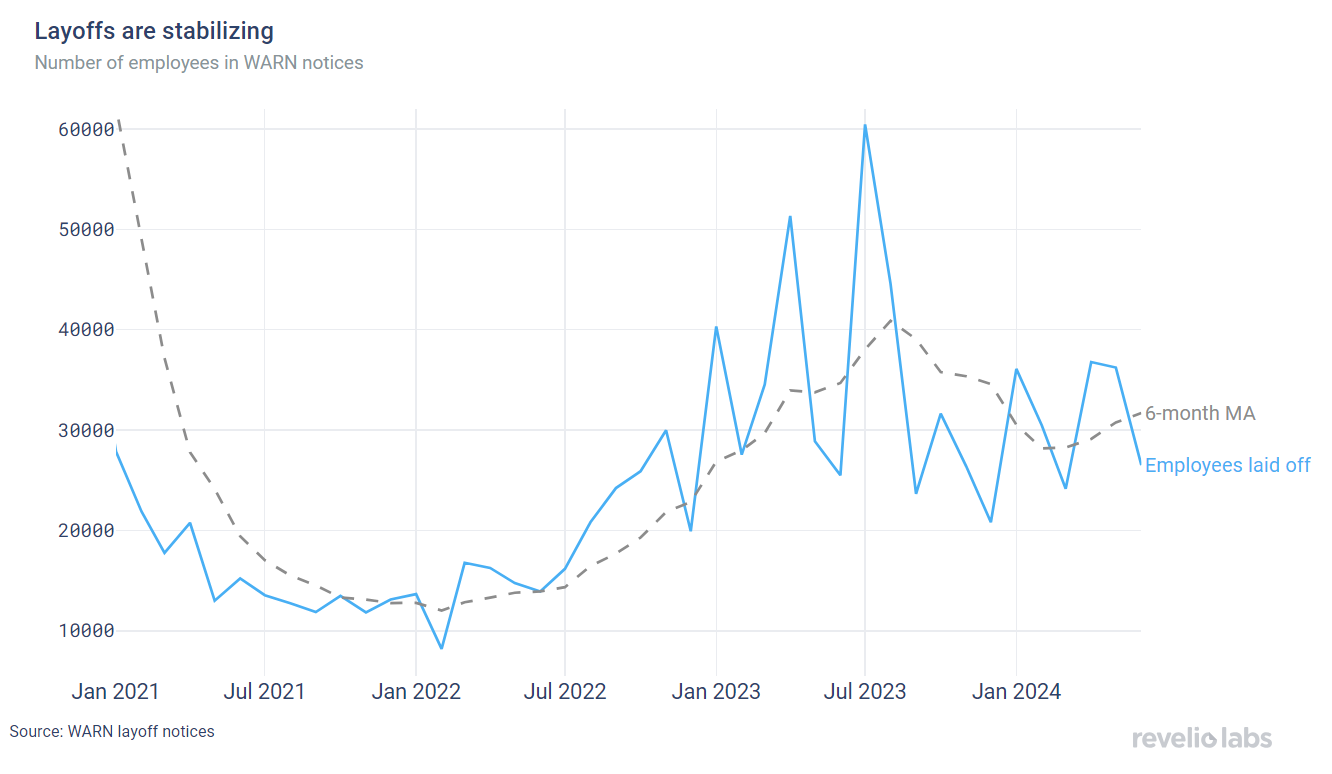

⬇️ 26.8% decrease in the number of employees notified of layoffs under the WARN Act compared to May 2024.

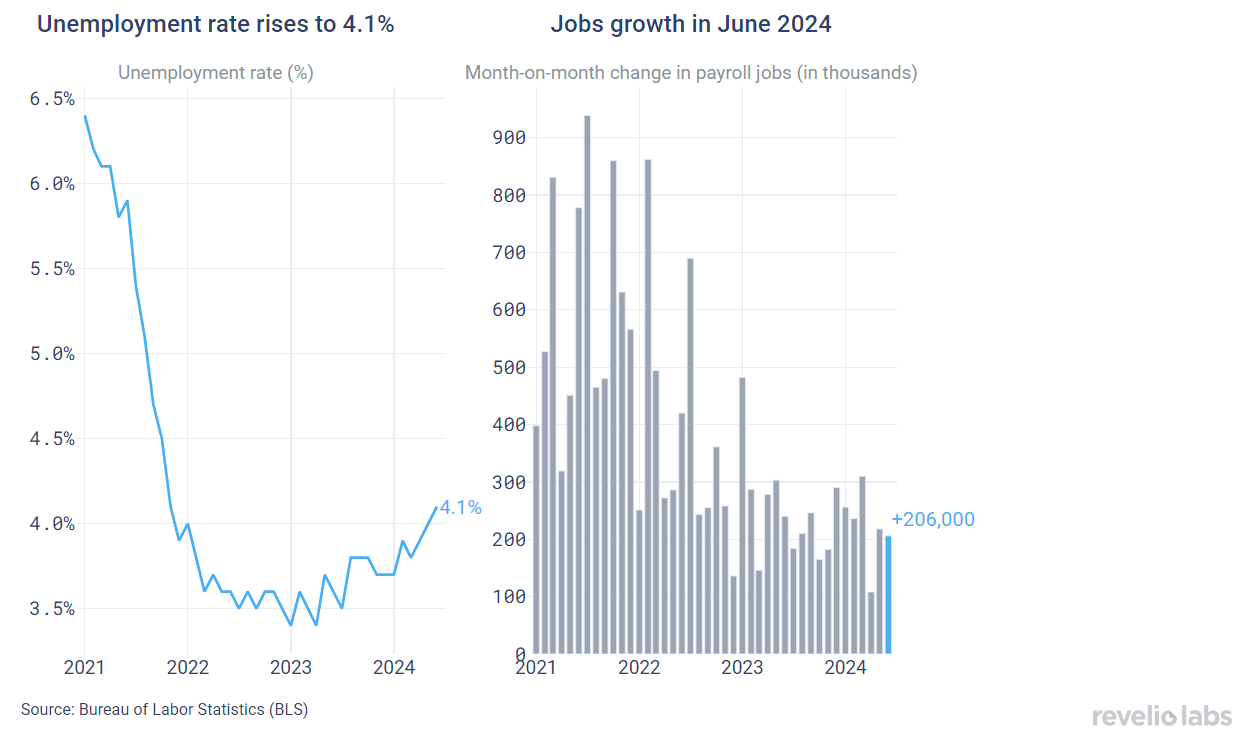

Mixed signals in June’s jobs report

The unemployment rate rose further to 4.1%; a rise that comes amid an increase in labor force participation in the past few months. Meanwhile, the economy added 206,000 new jobs in June, which was in line with economists' forecasts. Job growth has generally slowed down compared to the previous 12 months. Employment gains occurred mainly in government, health care, social assistance, and construction.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future? Read the rest of our job report to find out.

Hiring and attrition continue their declining trend

Revelio Labs’ workforce intelligence data show that hiring and attrition rates have continued their declining trend; both reaching a record low. The hiring rate stood at 12.4% (decreasing from the 13.1% hiring rate recorded in May). Meanwhile, the attrition rate stood at 10.7% (lower than the rate of 11.1% recorded in May). With attrition declining at a much faster rate, the workforce continues to grow. The workforce growth rate (difference between hiring and attrition rates) stood at 1.7% (lower than the 2% growth rate observed in May).

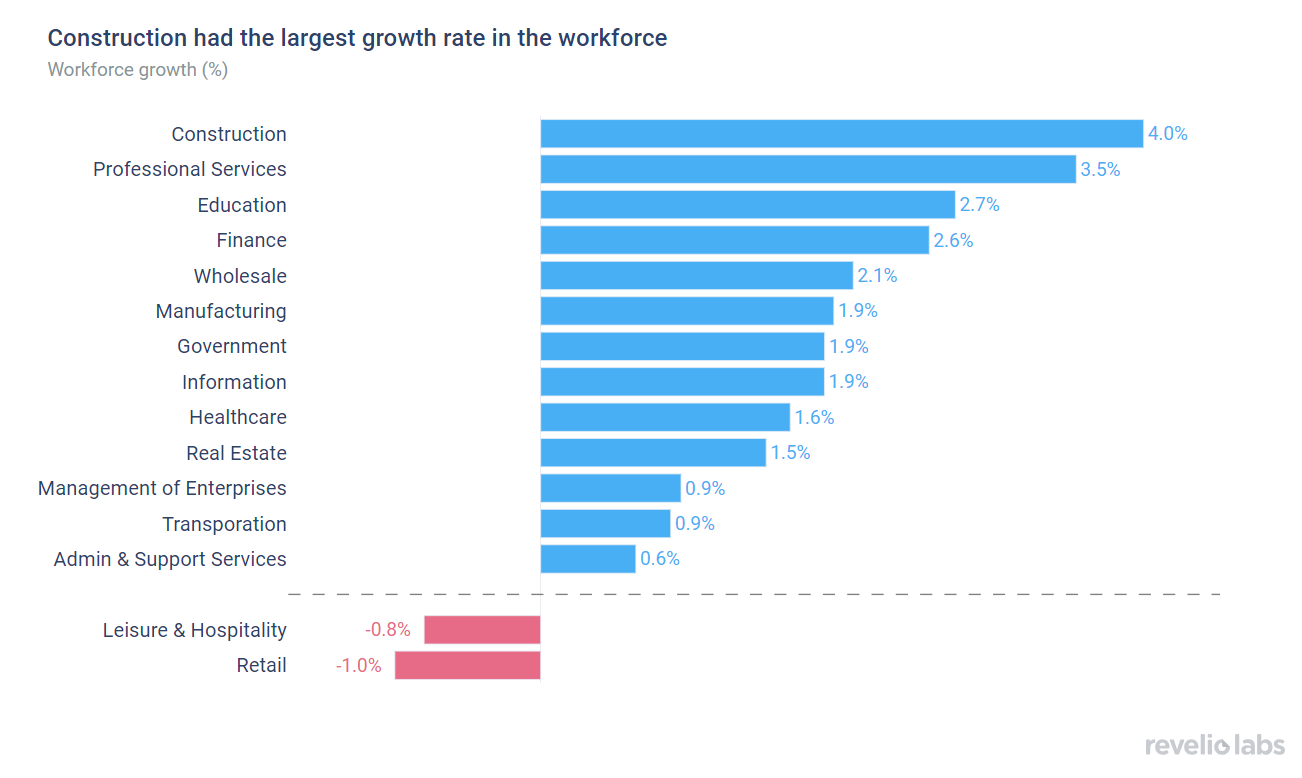

Sectoral hiring and attrition changed slightly from May. Overall, most sectors saw an increase in the growth rate compared to the growth rate in May, with the Construction sector continuing to lead the pack. Construction recorded the highest workforce growth rate (4% workforce growth in June compared to 4.5% in May). The Retail and Leisure and Hospitality sectors saw a decline in the workforce (Retail saw a growth rate of -1% in May and Leisure & Hospitality saw a growth rate of -0.8%).

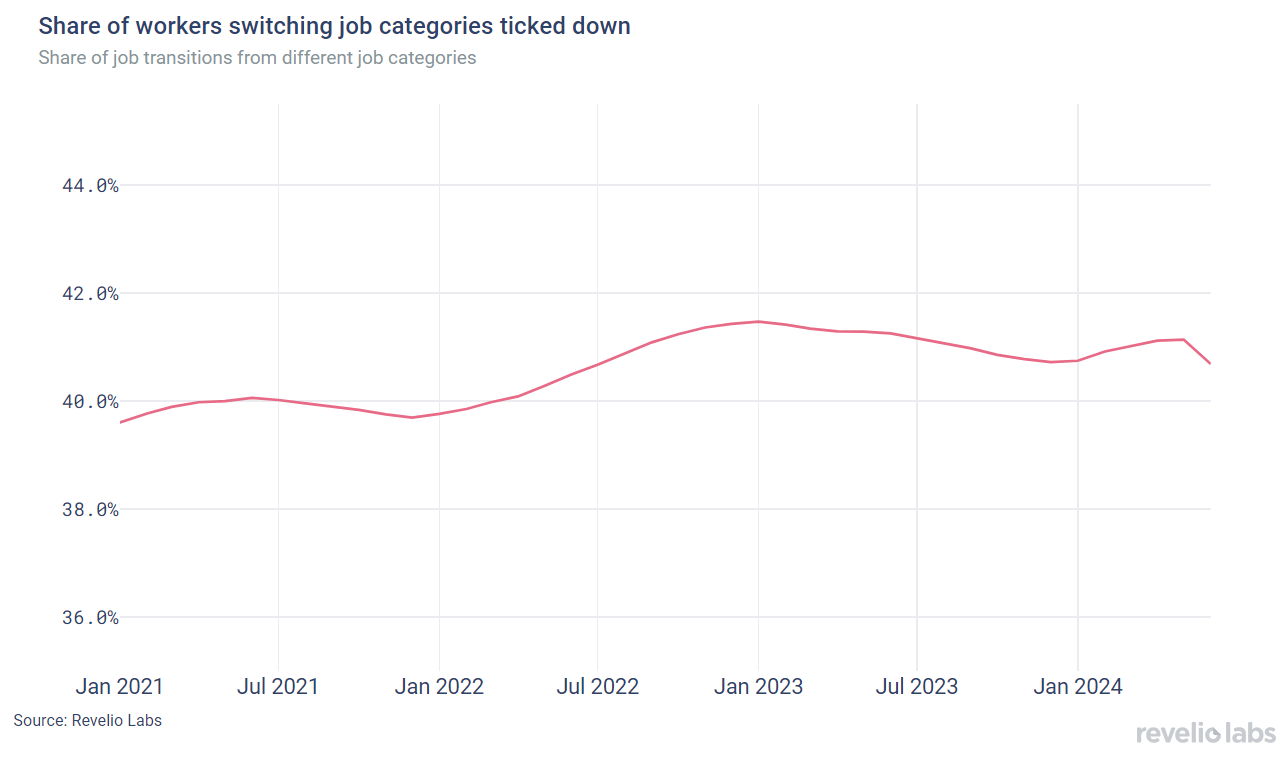

Of those who started a new job in June, 40% have transitioned to different roles and 70.1% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 40% of workers who started a new job in June did so by switching their broad job categories; lower than the rate of 45% observed in May. Furthermore, 70% of workers who started a new job in June started jobs in different industries - down from the rate in June (71.1%).

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to May 2024. The Retail sector saw a notable increase in the influx of workers from other industries. 83.8% of workers who started a job in Retail in June came from other industries (+2.4 percentage points from the share in May). In contrast, the Construction sector experienced the largest decline in the share of workers joining the industry from other industries. 67.5% of workers who started a job in transportation in June had backgrounds in other industries, relative to 82.8% in May 2024 (a 15.3 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to May 2024. Technical roles, such as logistics and operations exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while management and accounting roles witnessed the largest decline.

Job postings decreased in June

The active job postings index ticked down slightly in June, although the upward trend in job postings continue. Job listings decreased slightly by 1.8% compared to the previous month. New job listings decreased by almost 1.76% month-on-month, while removed job postings increased by 1.9% from their level in May.

The increase in job postings reflects a widespread increase in postings in many sectors, with the Retail sector experiencing the largest increase (8% increase in the number of active job listings in June compared to May). Meanwhile, Professional Services experienced the largest decline in active job listings (8.2% decrease in active postings compared to May 2024). Operations roles saw the largest increase in active job postings in June, while science and data analysis jobs saw a notable decline.

The days-to-fill for open listings ticked up further in June. Overall, average days-to-fill open positions have started to increase slightly in the past couple of months. Average days-to-fill stood at 48.26 days in June, up from 41.88 days in May(+6.4 days). The general increase in the number of days required to fill open job postings over the Fall and Winter quarters signals a move back towards a tightening labor market.

Layoffs are picking up

The number of employees receiving layoff notices under the WARN Act slightly decreased slightly in June, although in general they have been following an upward trend since April 2024. The number of layoffs remains elevated compared to 2022.

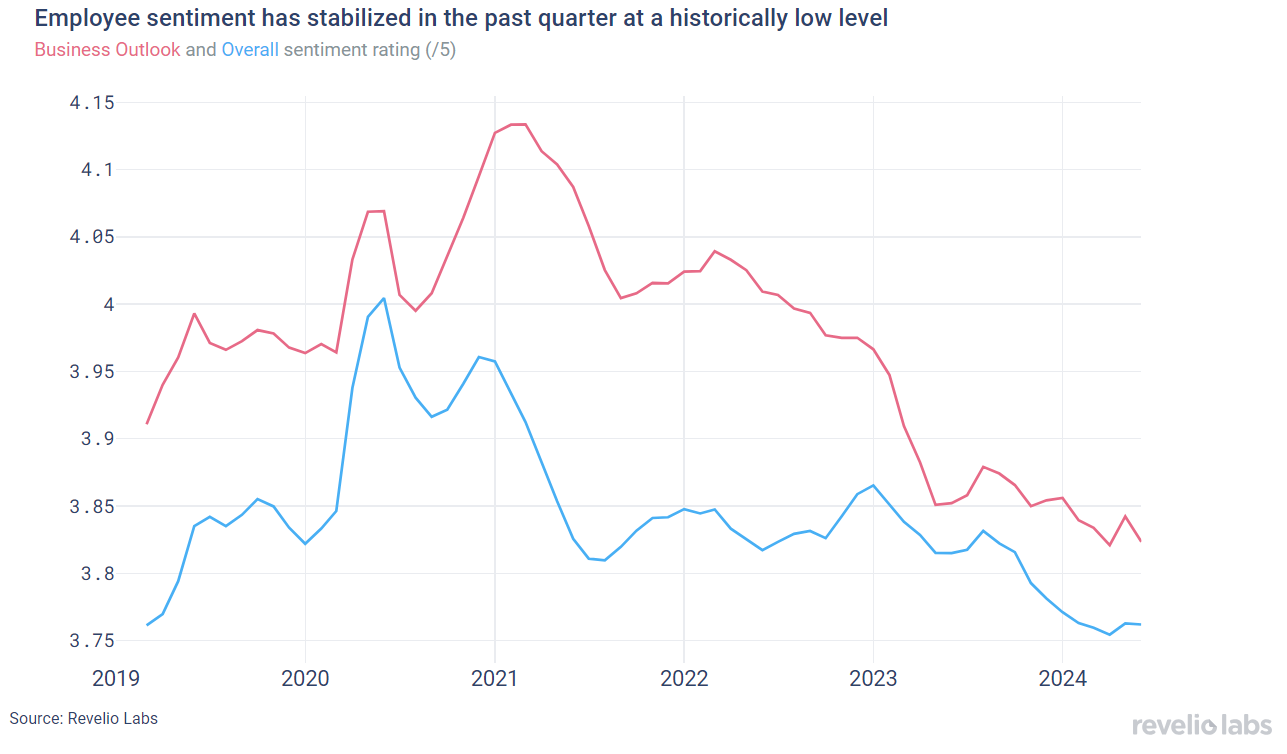

Quarterly highlight: Employee sentiment stabilizes at historically low levels

In our previous research, we have shown that employee sentiment, particularly business outlook sentiment, serves as a leading indicator for negative events in a company, such as mass layoffs or the crypto collapse. We analyze overall average employee sentiment in the US. We find that both overall employee sentiment and business outlook sentiment have followed a declining trend since they peaked in March 2021. In the past 3 months, overall rating stabilized at the pre-pandemic, while Business Outlook sentiment has fluctuated. Low employee morale can be indicative of companies' poor performance and culture, and can be an early sign of low productivity and high turnover.

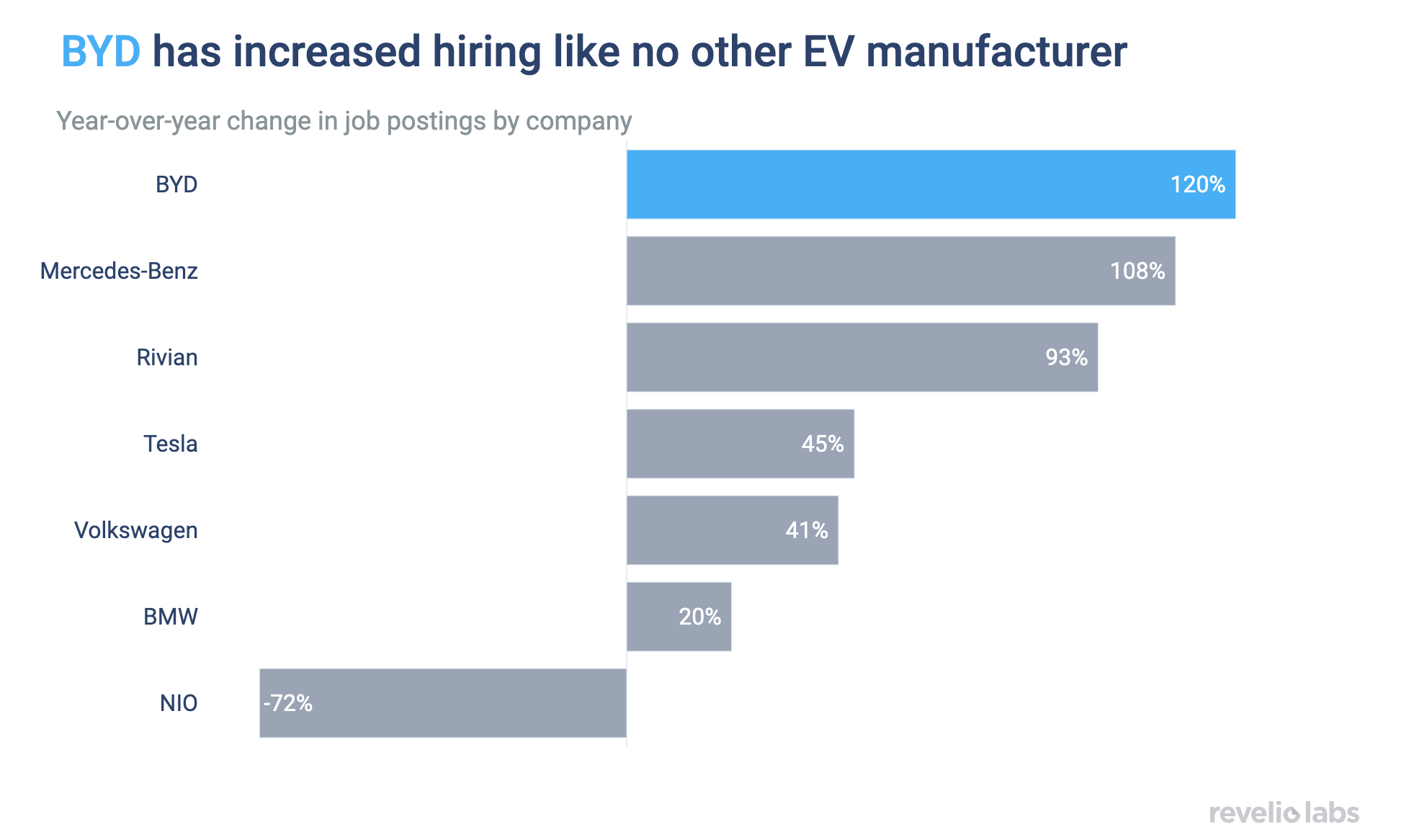

Highlight of the month: China, Led by BYD, dominates the global EV market

Our recent research highlights the rapid expansion of China in the global EV market. Chinese talent demand at major EV manufacturers (BYD, XPeng, and Nio being the largest) increased fivefold between January 2022 and January 2023 and remains highly elevated. BYD stands out for the notable increase in talent demand. BYD increased its talent demand by more than double from Q2 2023, with the fastest growing role being Customer Experience specialists and Sales reps. This rapid expansion of customer success specialists also means that BYD is taking its post-sales and servicing of clients extremely seriously.

Conclusion

June's Jobs Report started the summer off with increased reason for caution. The economy continued to add new jobs, but at a slower pace. Unemployment rate crossed 4%; a rate that has not been observed since November 2021. There are now clearer signs of the labor market cooling down as is evident from the declining hiring rate. There are also many signs of heightened uncertainty ahead of the upcoming elections season in the Fall. The attrition rate continues to decline reaching an all time low, along with less people switching industries and occupations. We believe that the Great Leveling-Off still continues through the summer, and were are to see whether cooling continues or stabilizes.

Please view our data and methodology for this job report here and our recent research on the global EV market here.