The State of the Labor Market Ahead of the Fed’s Meeting

A deeper dive into the workforce

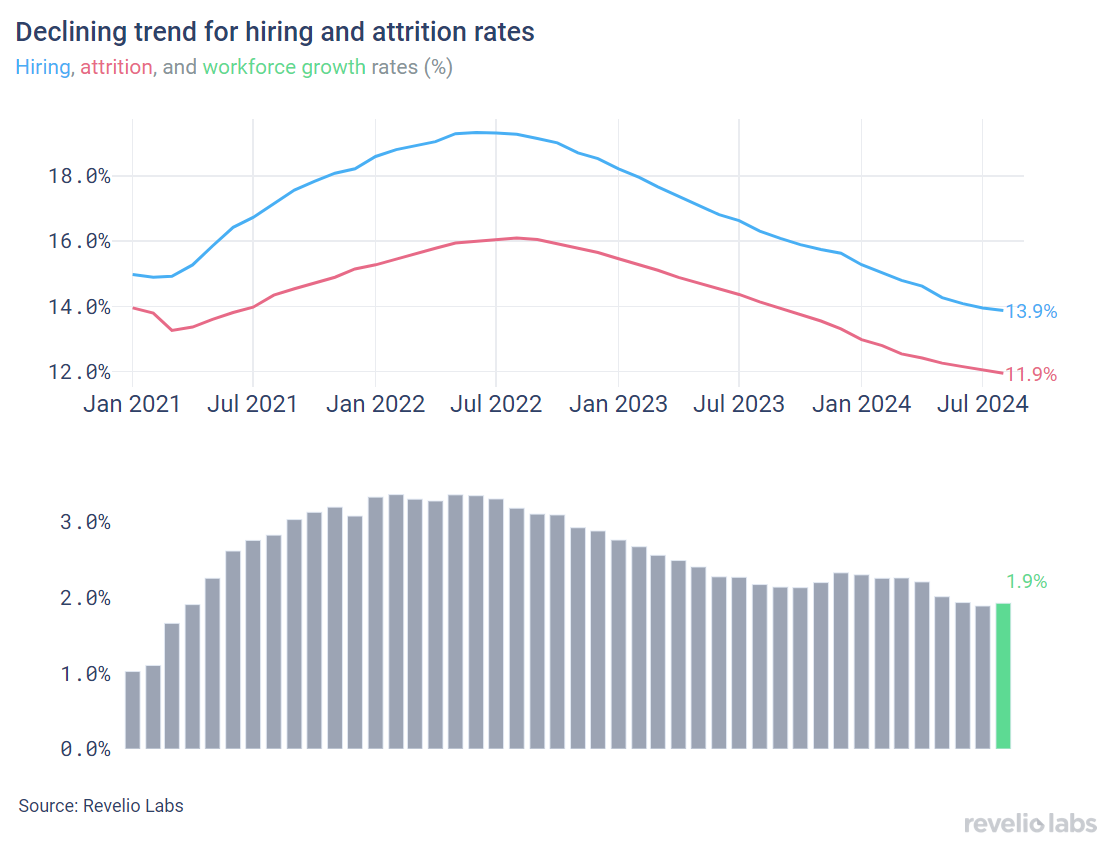

⬇️ 1.9% workforce growth rate in August 2024; unchanged from the growth rate observed in July. Positive growth continues despite the declining hiring.

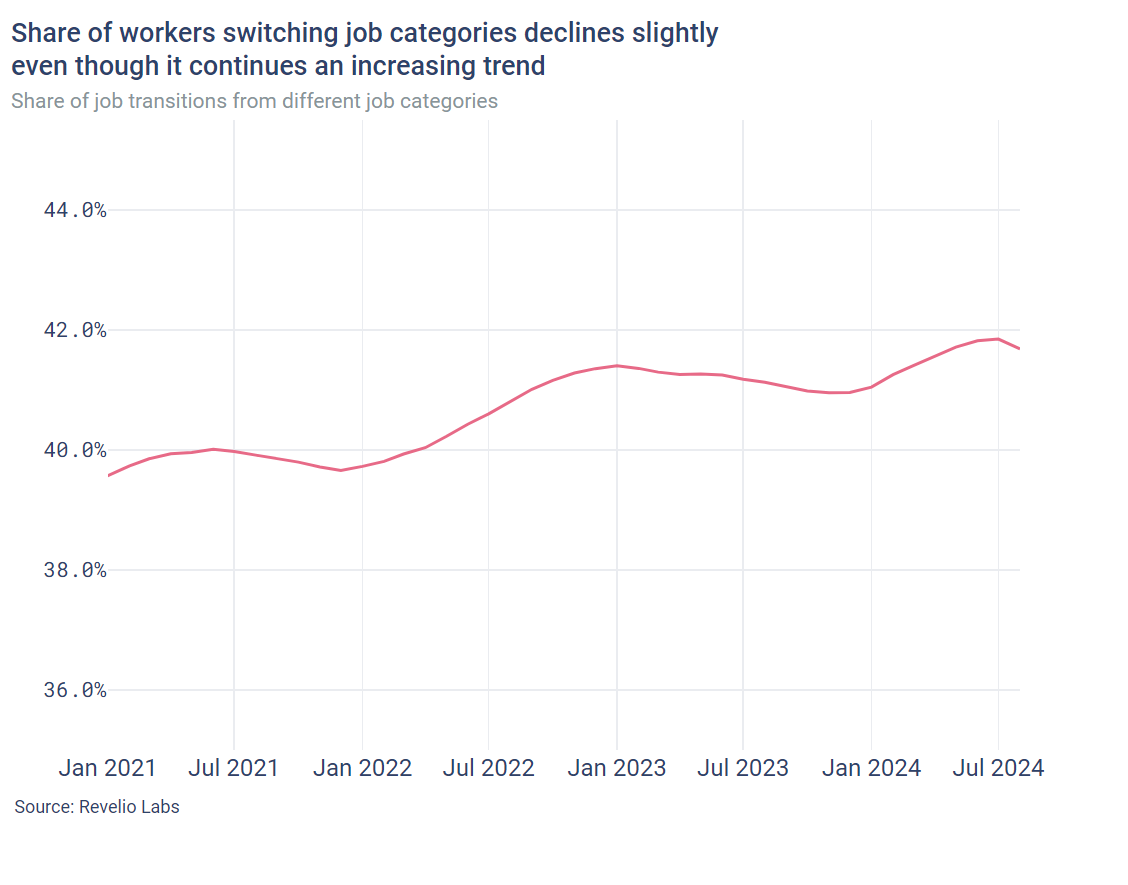

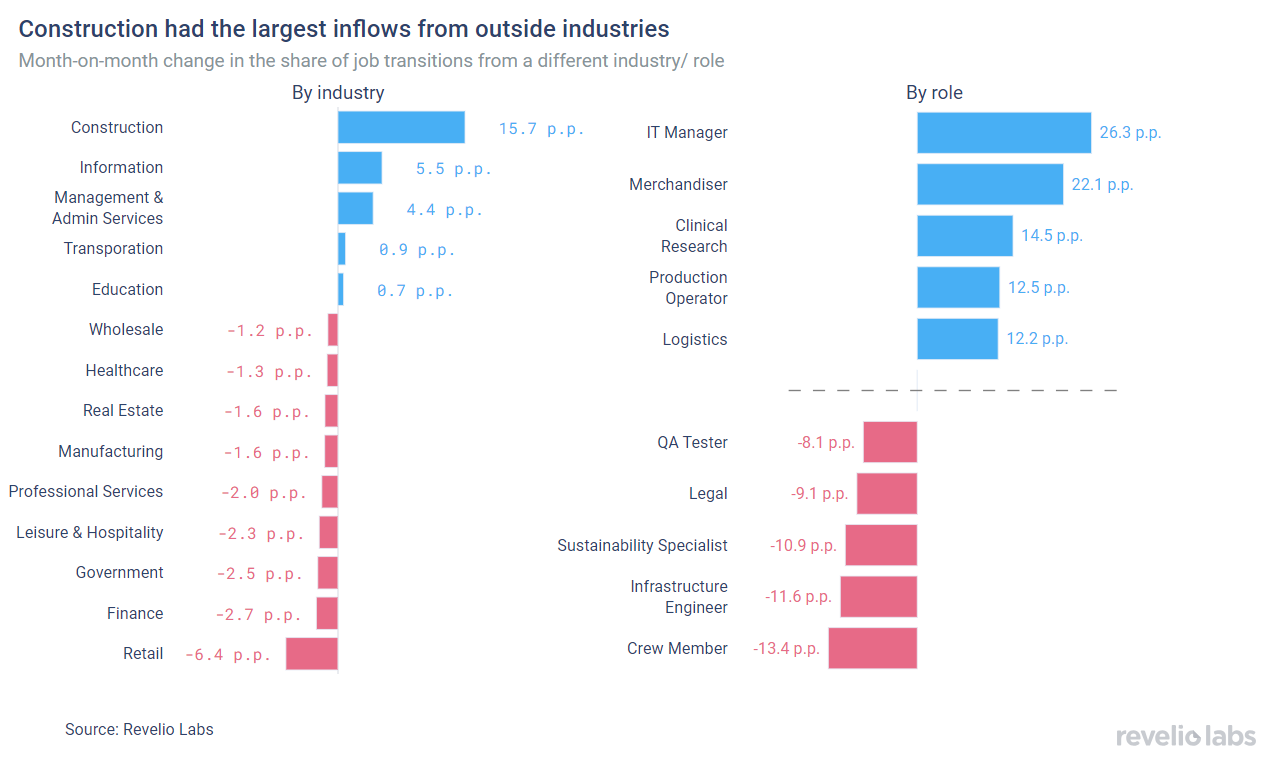

⬇️ Out of workers who started a new job in July, 40.7% have transitioned to different roles and 66.9% have switched industries. All industries witnessed a decline in the share of workers coming from other industries.

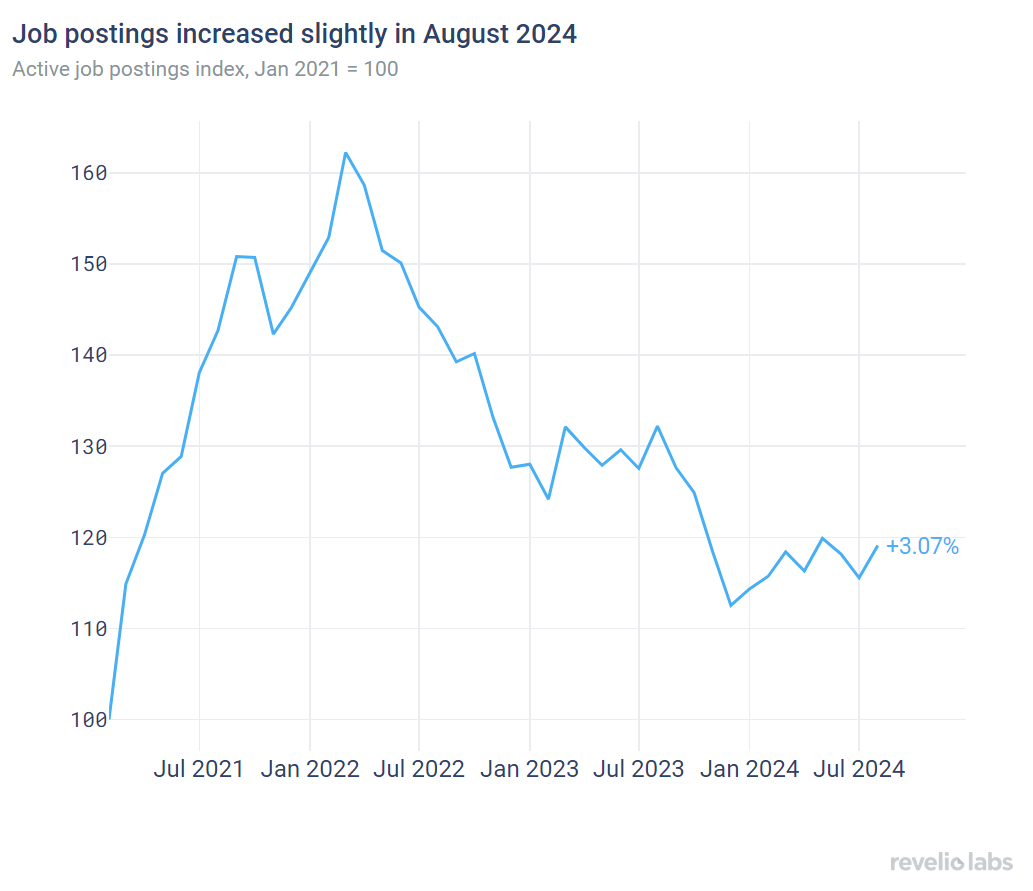

⬆️ 3.1% increase in active job listings in August from July.

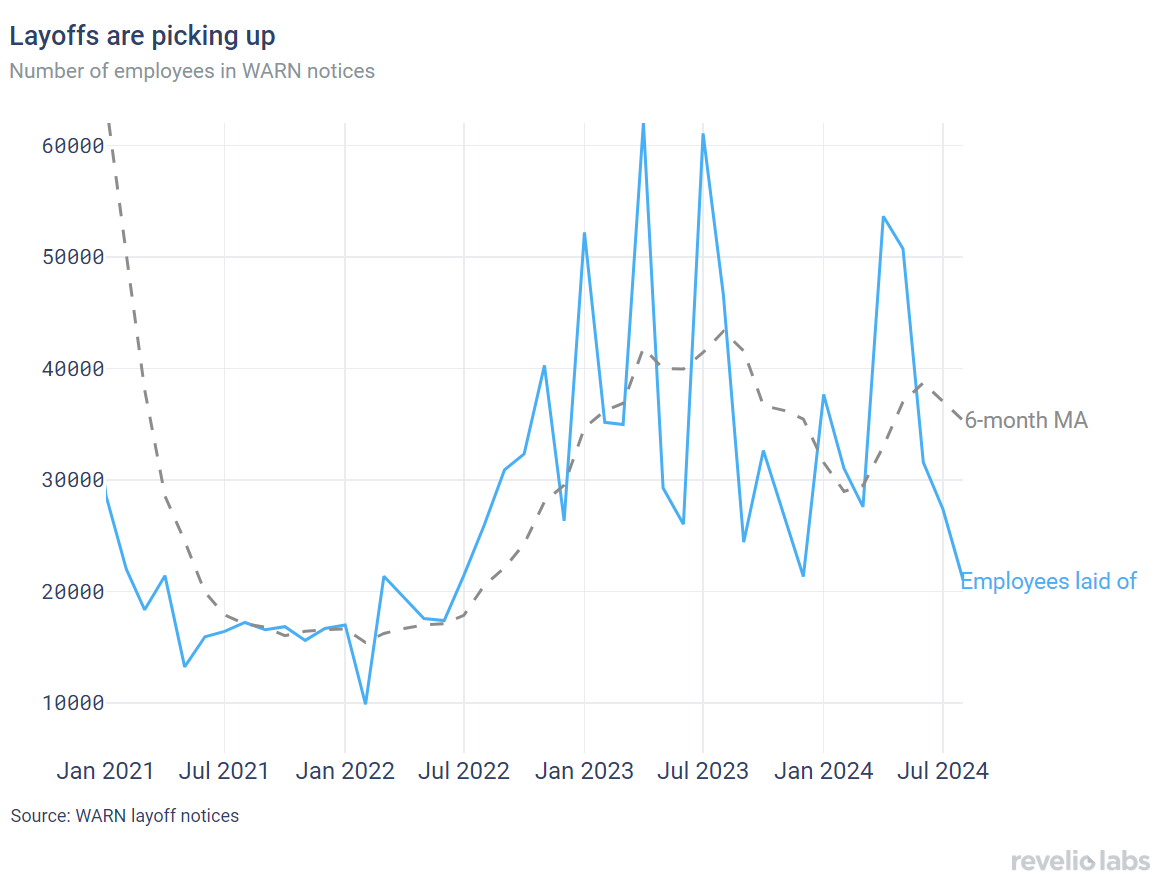

⬇️ 23% decrease in the number of employees notified of layoffs under the WARN Act compared to July 2024.

Revelio Labs’ Hiring and attrition also continue their declining trend through August

The most recent JOLTS report published on September 4th published data on hiring and attrition through July 2024. The newly released JOLTS data showed that both the hiring and separation rates increased slightly in July from their levels in June, although they both continue their declining trend. Revelio Labs’ workforce intelligence data show that annualized hiring and attrition rates have continued their declining trend through August; both reaching a record low. The annualized hiring rate stood at 13.9% (slightly lower from the hiring rate recorded in July). Meanwhile, the attrition rate stood at 11.9% (lower than the rate of 12.1% recorded in July). As attrition has been declining at a slower rate, the workforce growth rate has been decreasing. The workforce growth rate (difference between hiring and attrition rates) stood at 1.9% (unchanged from the growth rate in July on a m.o.m basis).

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

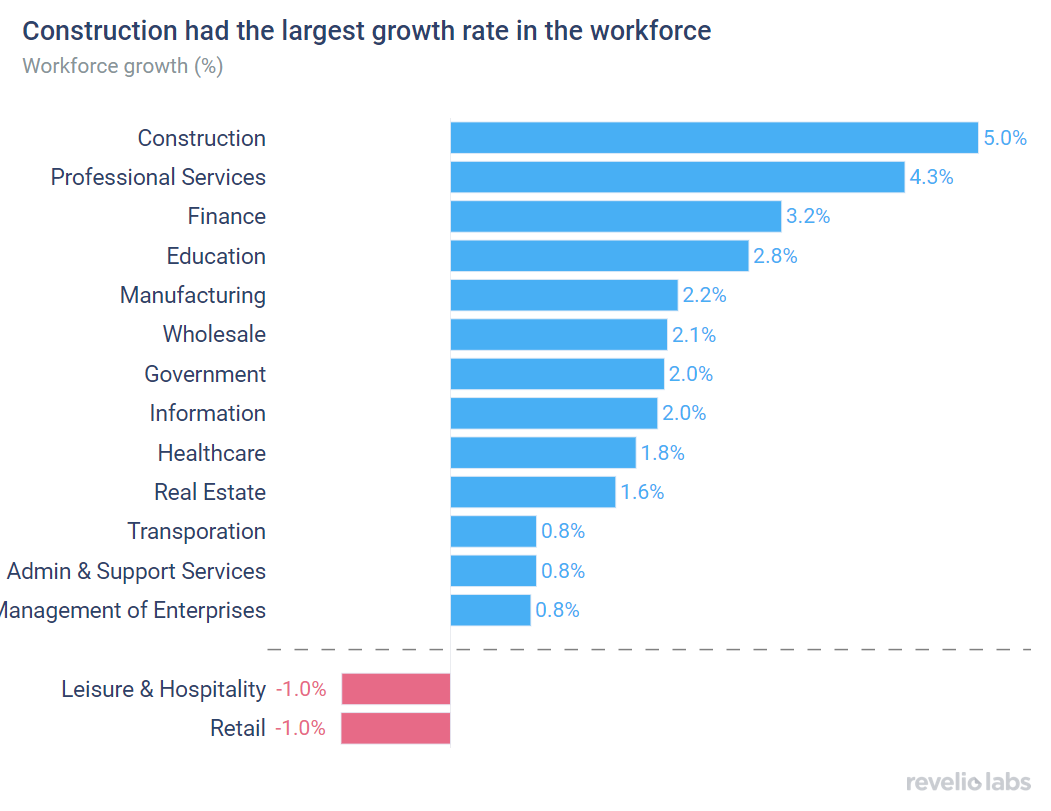

Sectoral hiring and attrition has been largely unchanged from July. Overall, most sectors saw an increase in the growth rate compared to the growth rate in June, with the Construction sector continuing to lead the pack. Construction recorded the highest workforce growth rate (5% workforce growth in August compared to 4.3% in July). The Construction sector has also been one of the major contributors to jobs growth in the past few months. The Retail and Leisure and Hospitality sectors saw a decline in the workforce (Retail saw a growth rate of -1% and Leisure & Hospitality saw a growth rate of also -1% in August).

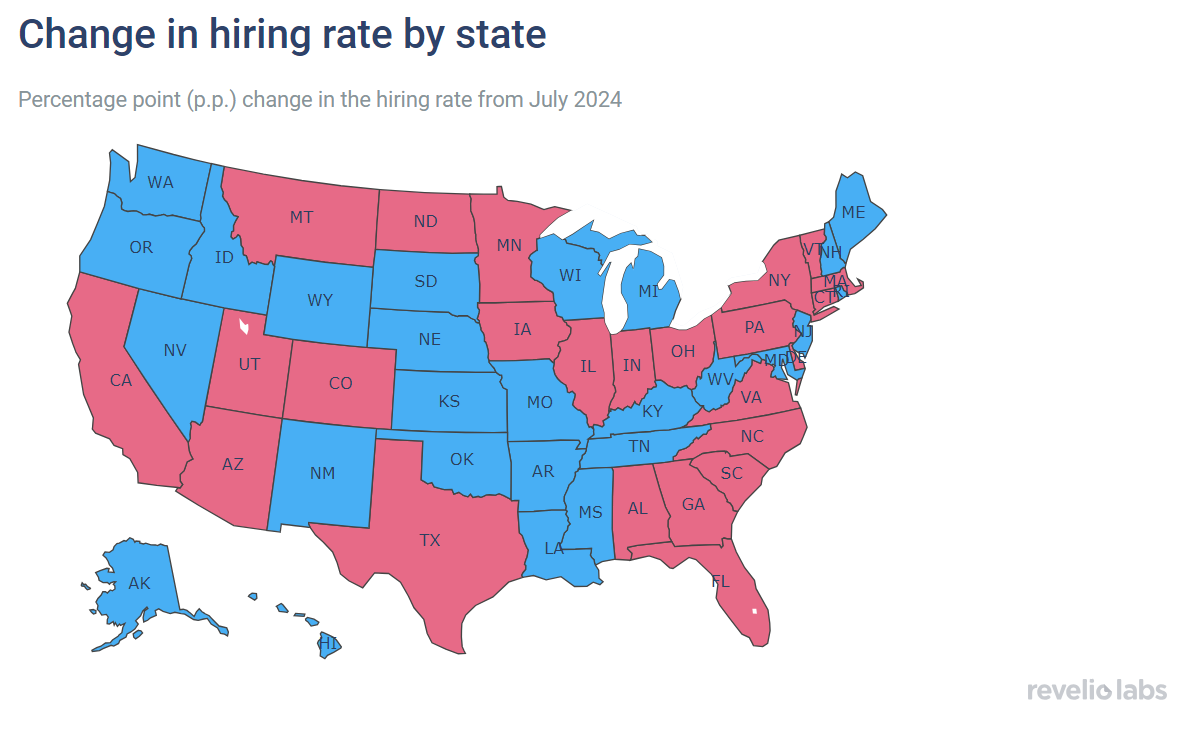

Hiring has increased in many states in August compared to July, although it has declined in the largest, most populous states, such as New York, California, Texas, and Pennsylvania. The decline in hiring in the Southeast states in August is likely to be attributed to Hurricane Debby that affected the Carolina's and Florida early in August. The largest decline in hiring occurred in Vermont (-0.3 p.p.), which was also affected by the hurricane.

Of those who started a new job in July, 40.7% have transitioned to different roles and 66.9% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 40.7% of workers who started a new job in August did so by switching their broad job categories; almost unchanged from the 40.1% observed in July. Furthermore, 66.9% of workers who started a new job in August started jobs in different industries - down from the rate in June (67.5%).

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to July 2024. All sectors saw a decrease in the influx of workers from other industries, with Construction and Real Estate witnessing the largest decline. This is the first month in almost half a year where the construction sector sees a decline in the share of workers transitioning from other industries. 70.7% of workers who started a job in Construction in August came from other industries (-12.8 percentage points from the share in July).

The right panel shows the difference in the share of workers who started a new job in a different role relative to June 2024. Technical roles, such as IT manager and solutions specialists exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while engineering roles (particularly software, infrastructure, and application engineering) witnessed the largest decline.

Job postings increased slightly in August

The active job postings index increased slightly in August after two consecutive months of decline. Job listings increased by 3.1% compared to the previous month. New job listings decreased by almost 8.3% month-on-month, while removed job postings also increased by 11% from their level in July.

Layoffs continue to decline

The number of employees receiving layoff notices under the WARN Act decreased further in August. The decline in the number of employees for 3 consecutive months have shifted the underlying trend of the layoff series to start decreasing. The number of layoffs is currently lower than it was a year ago after they have been elevated on an annualized basis for many months.

Quarterly highlight: What are workers in America talking about?

By examining thousands of employee reviews posted in August, we picked the most common topics that appeared in positive and negative reviews relative to the previous quarter. In this quarter, workers continue to be positive about the benefits, pay and culture. Yet, employees have been negative about their hours and management. Workers also complained about the office; probably the result of return to the office mandates.

Highlight of the month: The most popular unpopular perk

Our recent research highlights the negative sentiment around unlimited paid time off. Despite the increase in popularity of unlimited PTO as a perk, companies are realizing it is not as attractive as they had hoped. Companies with unlimited PTO policies tend to also have lower ratings compared to their competitors, especially in work-life balance. Listen to our Economist Jin Yan discussing more on unlimited PTO.

Conclusion

August's Jobs Report came with fewer surprises than July's report. Although the economy continued to create new jobs, the pace of growth has slowed significantly, with jobs added below expectations. Our data indicate that nothing has fundamentally changed in the labor market. Hiring rates continue to decline, but so do attrition rates, solidifying the Great Stay trend, and leaving the workforce growing at a constant rate for the past year. The Construction sector continues to lead the growth in the workforce. However, we observe an increase in job postings in August, potentially signaling higher demand for workers in anticipation of slightly lower interest rates in the future. As we noted in a previous report, there is a strong demand for recruiters, which may be a sign of companies aiming to hire further in the months to come.

Please view our data and methodology for this job report here and our recent research on unlimited PTO here.