Workforce Digest December 2024

2024 comes to a close on a cautionary note

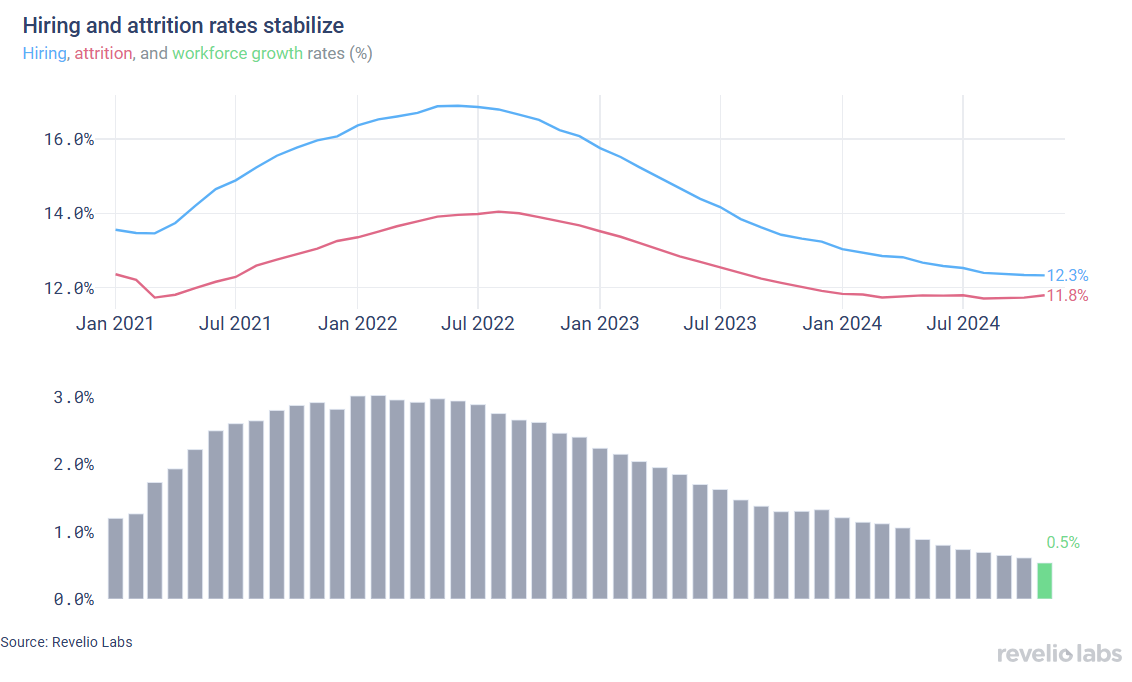

⬇️ 0.5% workforce growth rate in November 2024; lower than the growth rate observed in October. The positive workforce growth rate comes amid stable hiring and attrition rates, after they have been consistently declining since mid-2022.

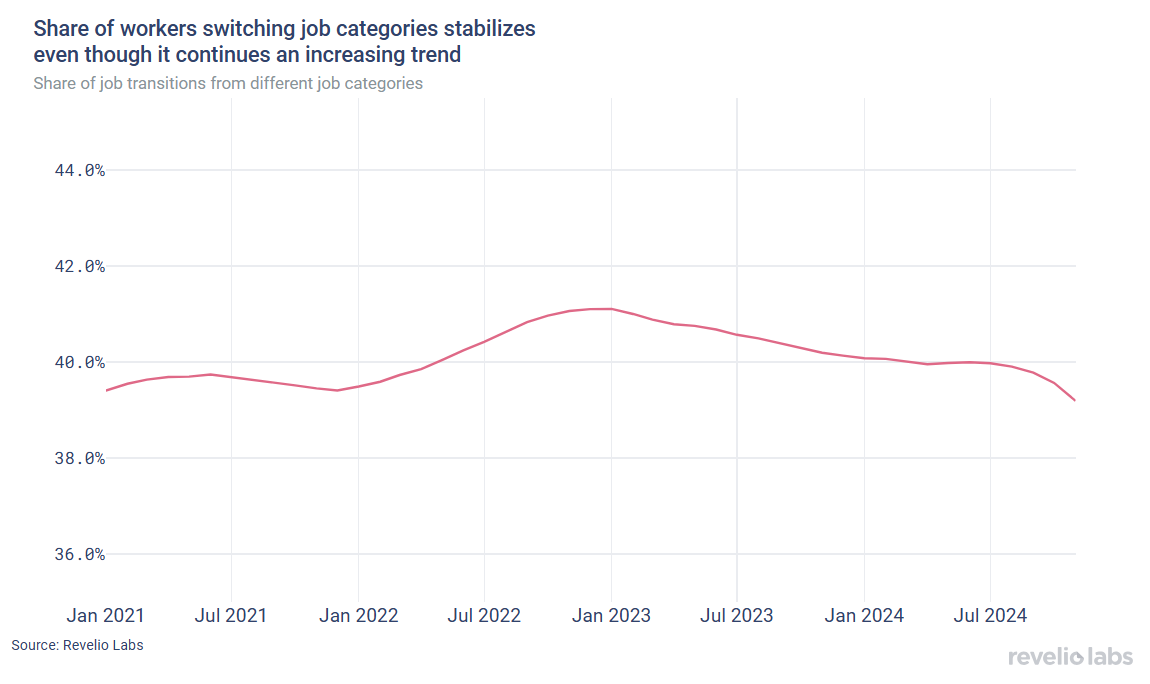

⬇️ Of workers who started a new job in November, 32.8% have transitioned from different roles and 64.3% have switched industries. The decline in the share of workers shifting job categories and industries signals heightened uncertainty among employees.

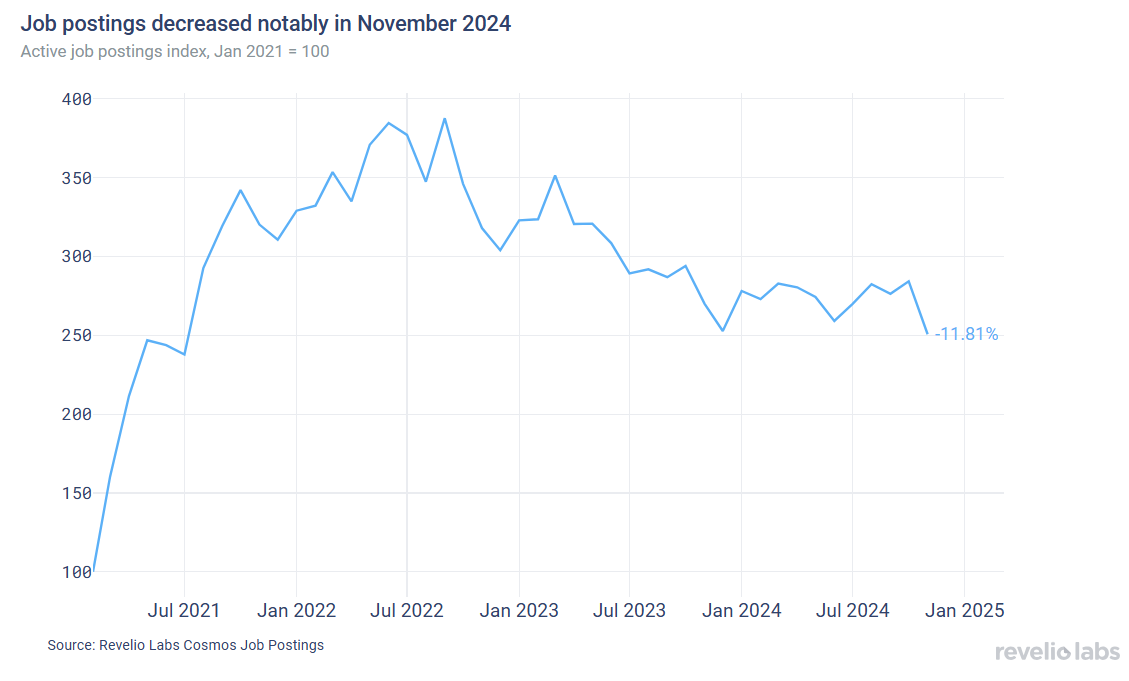

⬇️ 11.8% decrease in active job listings in November from October.

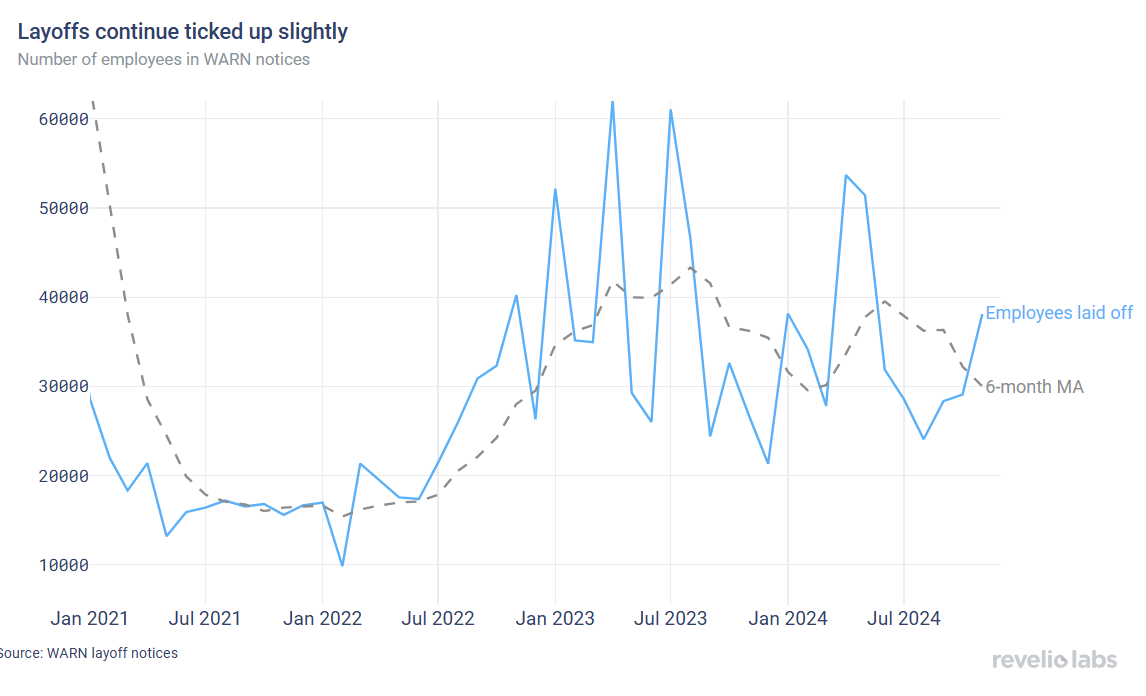

⬇️ 31% increase in the number of employees notified of layoffs under the WARN Act compared to October 2024.

Revelio Labs’ Hiring and attrition have stabilized

The most recent JOLTS report published on December 3rd shows data on hiring and attrition through October 2024. JOLTS data showed that the hiring rate continued to decline, while the separation rate stabilized in October 2024. Revelio Labs’ workforce intelligence data show annualized hiring and attrition through November 2024. According to Revelio Labs data, both hiring and attrition continued to stabilize in the last three months, after a long period of consistent decline since mid-2022. The annualized hiring rate stood at 12.3% (similar to the hiring rate recorded in October). Meanwhile, the attrition rate stood at 11.8% (slightly higher than the 11.7% recorded in October). The workforce growth rate (difference between hiring and attrition rates) stood at 0.5% (slightly lower than the growth rate of 0.6% observed in October on a m.o.m basis).

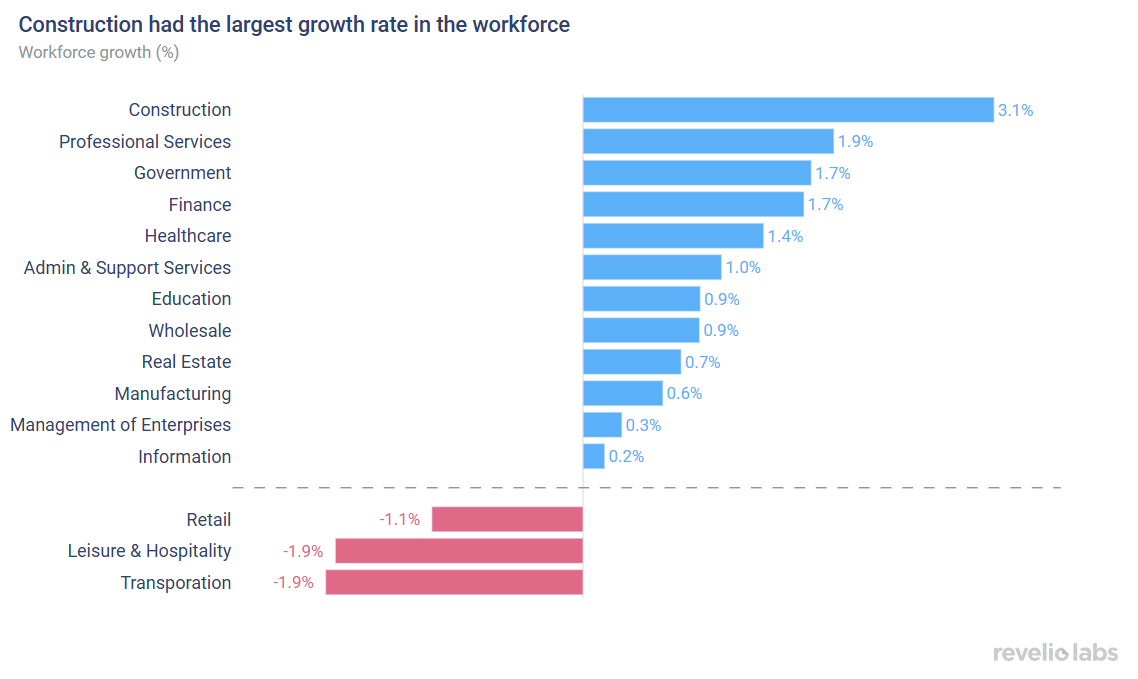

Sectoral hiring and attrition have only changed slightly compared to October. Overall, most sectors saw a slower growth rate in November compared to October. The Construction sector continues to lead the pack in terms of workforce growth rate. Construction recorded the highest workforce growth rate (3.1% workforce growth in November compared to 3.2% in October). Thanks to the Inflation Reduction Act, the elevated job postings over the past year are now translating into hiring, leading the construction sector to be one of the highest contributors to job creation in 2024. The Transportation and Leisure and Hospitality sectors continue to have a decline in the workforce (both Transportation and Leisure & Hospitality saw a growth rate of -1.9% in November).

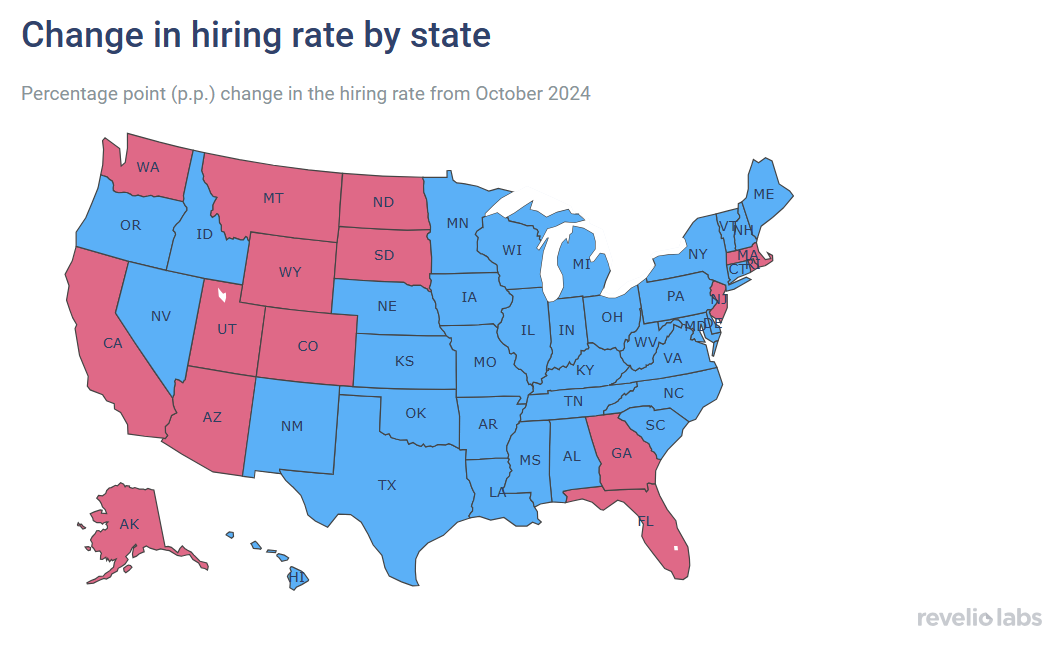

Hiring has increased in many states in November compared to October, although it has declined in the largest, most populous states, such as California and Florida. The largest decline in hiring occurred in Utah (-0.09 p.p.).

Of those who started a new job in November, 32.8% have transitioned to different roles and 64.3% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 32.8% of workers who started a new job in November did so by switching their broad job categories; notably lower than the unchanged from the 53.7% observed in October. Furthermore, 64.3% of workers who started a new job in November started jobs in different industries - down from the share in October (67%).

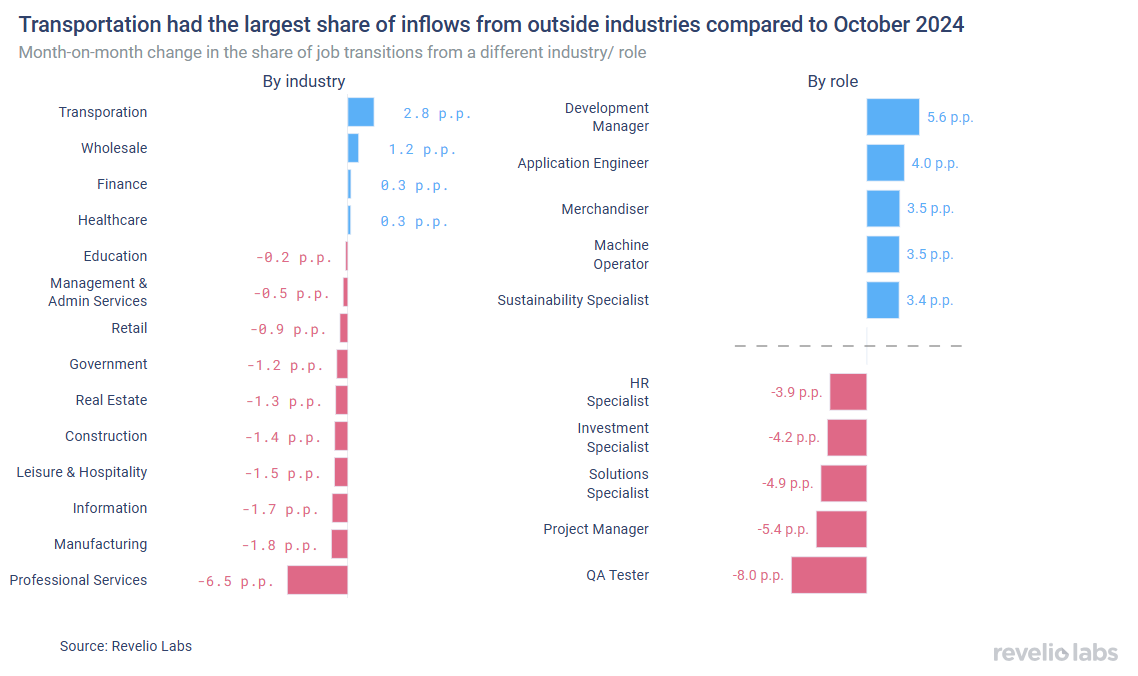

Next, we analyze industry and role switches in positions in November. The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to October 2024. Some sectors saw an increase in the influx of workers from other industries; most notably Transportation. On the other hand, Professional Services saw a large decline in the share of workers transitioning from other industries.

The right panel shows the difference in the share of workers who started a new job in a different role relative to October 2024. Roles, such as Development Manager and Application Engineer exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while business-related roles, such as QA Tester and Project Manager saw the largest decline.

Job postings decreased notably in November

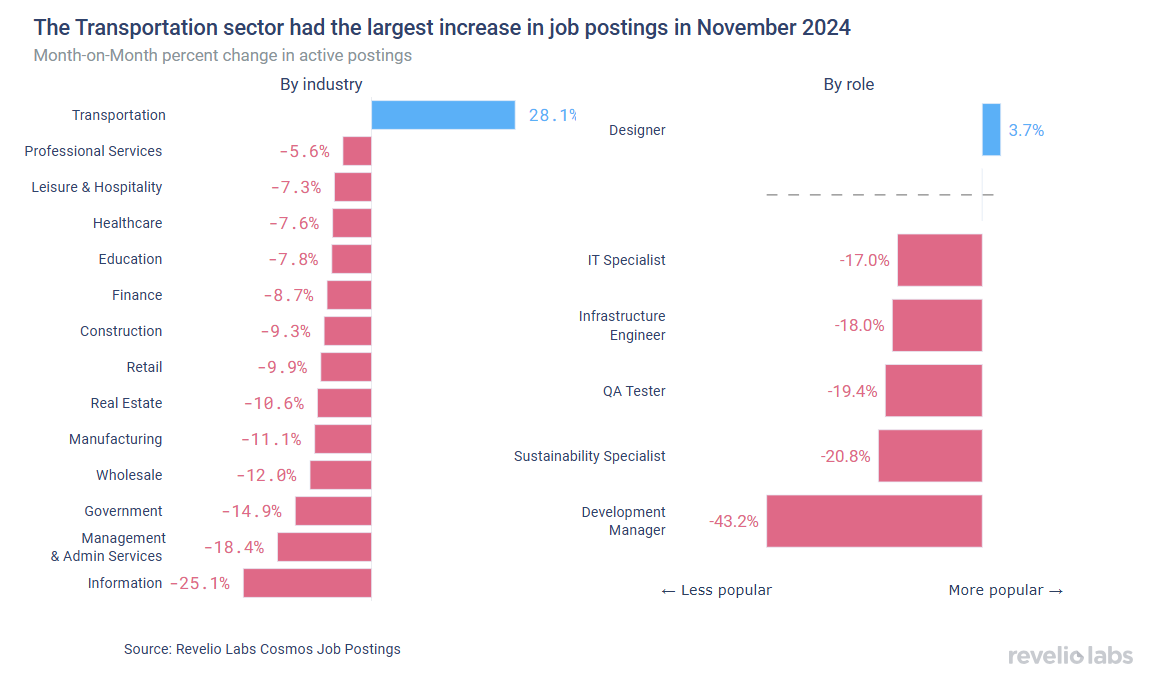

The active job postings index decreased notably in November after two hovering around the same level for most of the year. Job listings decreased by 11% on a month-over-month basis. New job postings decreased by almost 16% month-on-month, while removed job postings also decreased by 13% from their level in October.

The decrease in job postings reflects a decline in postings in most sectors, with the Information sector experiencing the largest decline (25% decline in the number of active job listings in November compared to October). Many roles have also seen a large increase in demand, most notably is Development Manager.

Layoffs tick up slightly, although still following a declining trend

The number of employees receiving layoff notices under the WARN Act increased further in November. This comes amid a declining underlying trend in layoffs that started in the Spring of 2024.The number of layoffs is currently almost equal to its level a year ago after they have been elevated on an annualized basis for many months.

Quarterly highlight: What are workers in America talking about this month?

By examining thousands of employee reviews posted in November, we picked the most common topics that appeared in positive and negative reviews relative to the previous quarter. As we approach the end of the year, workers seem optimistic, as they are positive about the flexible culture and opportunities. On the other hand, employees benefits, growth and leadership. Managers are facing a lot of challenges to satisfy employees.

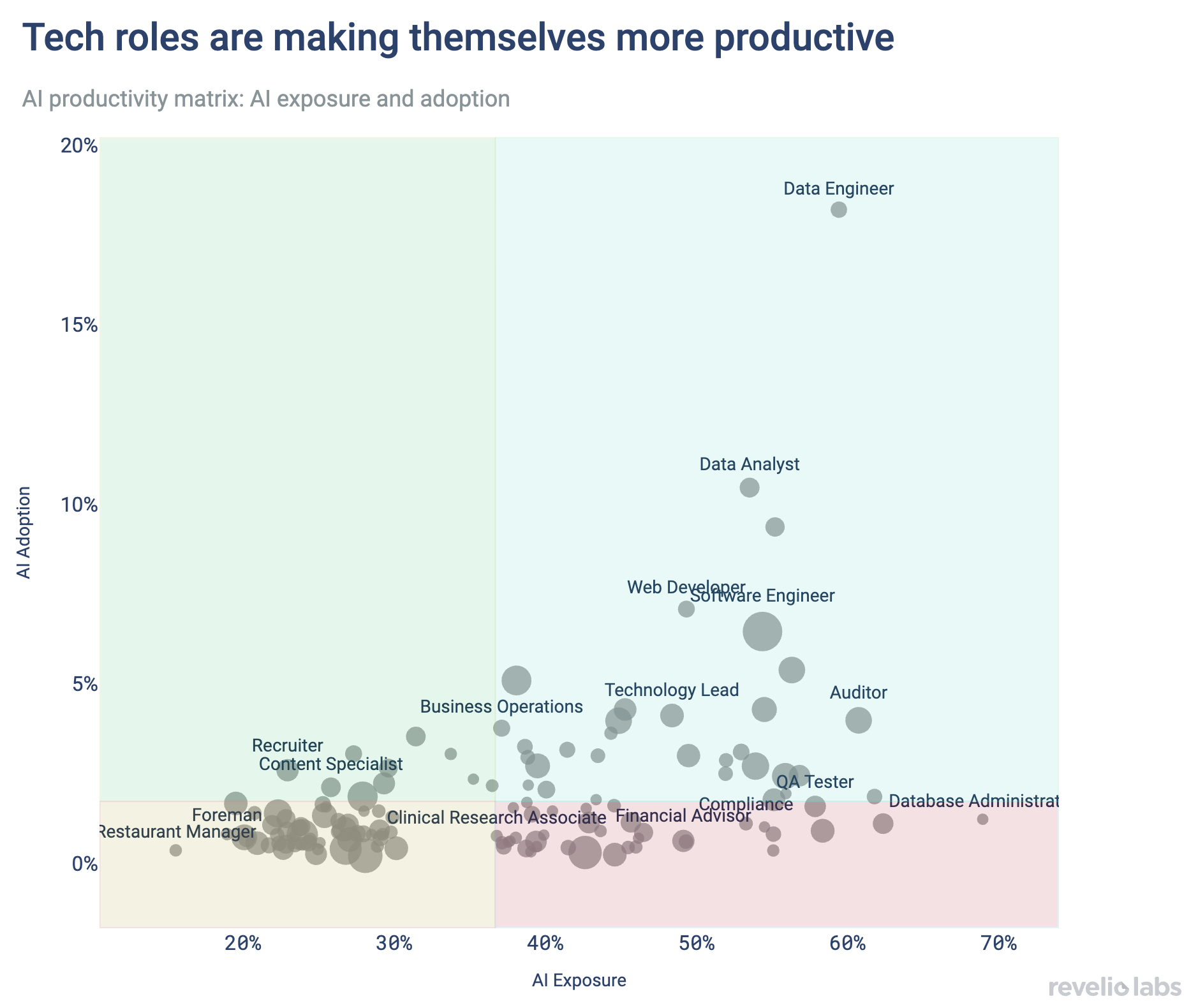

Highlight of the month: The occupations that benefit from AI adoption

In 2024, a key workforce trend is the increasing adoption of AI, driven by significant advancements that boost worker productivity. However, quantifying these productivity gains remains a persistent challenge. Our recent research examined AI exposure in the labor market by categorizing tasks and activities from job descriptions in online professional profiles into those amenable to AI and those that are not. The analysis reveals that technical roles, such as IT and tech roles, along with financial roles, have the highest AI exposure, as many of their tasks can be enhanced by AI. A strong correlation exists between AI exposure and the adoption of AI tools; workers in roles with both high exposure and high adoption demonstrate greater productivity. Conversely, those in high-exposure roles with low adoption face an elevated risk of displacement due to external automation.

Conclusion

As we close out 2024, the U.S. labor market has made it through another year marked by sluggish activity and a notable lack of dynamism. Companies have approached workforce changes with caution, maintaining steady but low hiring levels and avoiding significant layoffs, while employees have stayed in their roles longer, leading to persistently low attrition rates. With the conclusion of the election season, there have been few signs of immediate change. Recent data suggests a gradual uptick in attrition rates, hinting at potential shifts ahead. Looking toward 2025, analysts anticipate that the labor market may regain momentum. With the Federal Reserve projecting further declines in inflation and signaling additional interest rate cuts, conditions are expected to support stronger demand for workers and an eventual increase in hiring rates. Tracking trends across individual sectors will be critical to understanding these shifts, as industries such as construction, technology, and healthcare may respond differently to macroeconomic changes. By monitoring sector-specific dynamics, we can better assess where and how the labor market’s recovery will unfold in the coming year.

Please view our data and methodology for this job report here and our recent newsletter on AI exposure and adoption here.