Workforce Digest February 2025

A deeper dive into the workforce

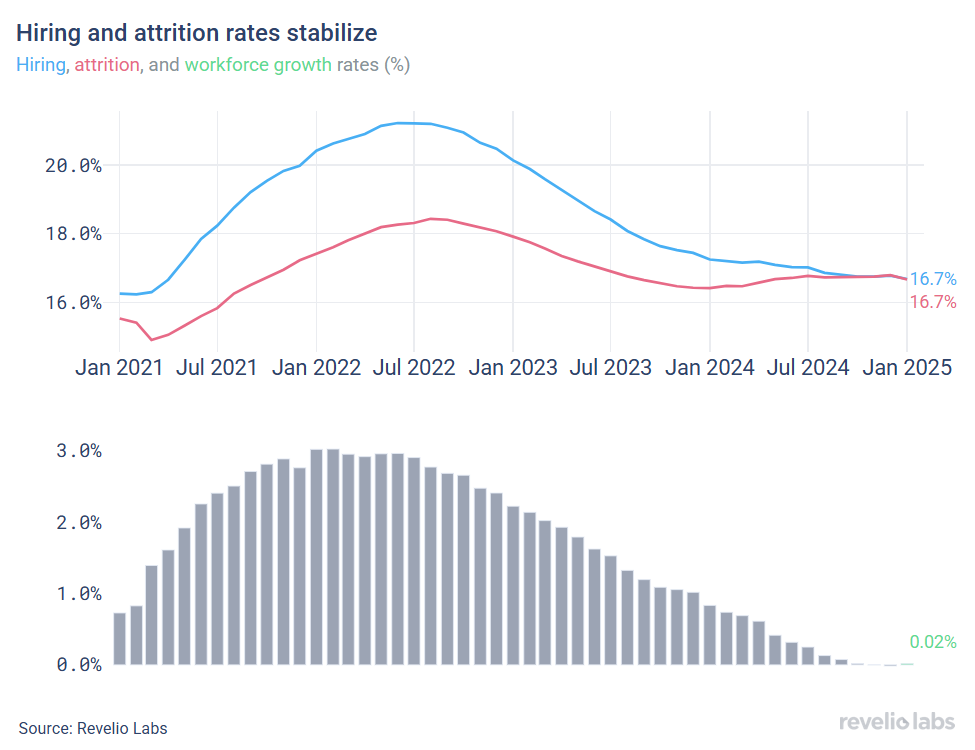

⬇️ 0.02% workforce growth rate in January 2024; unchanged from the growth rate observed in December 2024. The almost zero workforce growth rate comes as both hiring and attrition rates started plateauing after a consistent decline for two years.

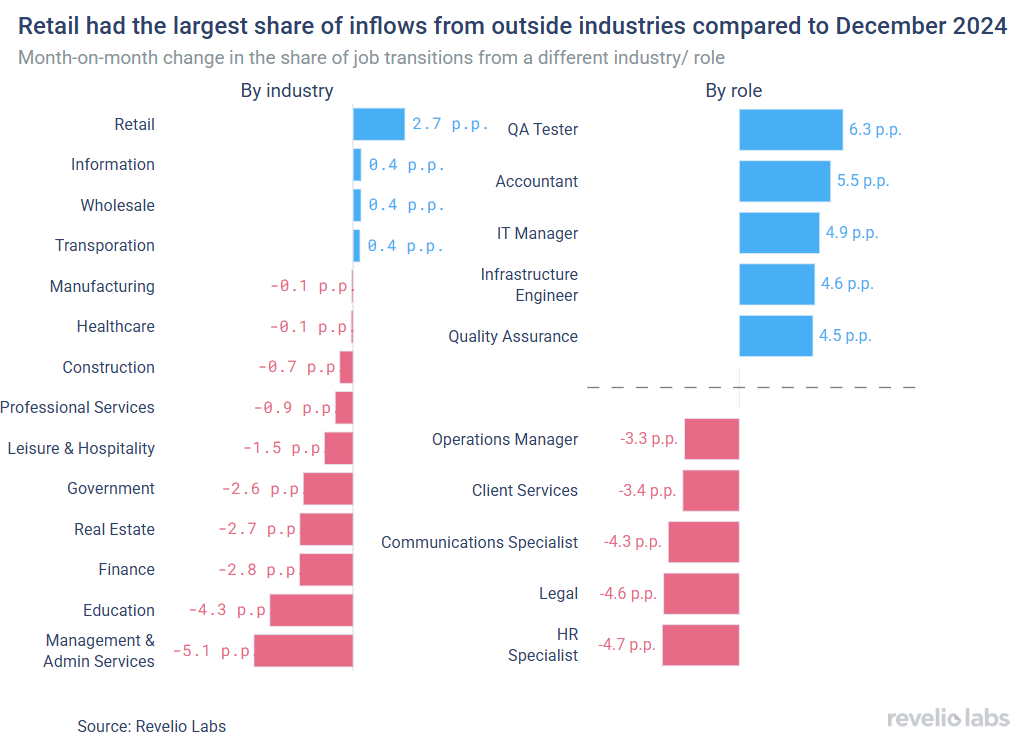

⬇️ Of workers who started a new job in July, 34.4% have transitioned to different roles and 64.5% have switched industries. The decline in the share of workers shifting job categories and industries signals heightened uncertainty among employees. The Retail industry had the largest increase in the share of workers from other industries.

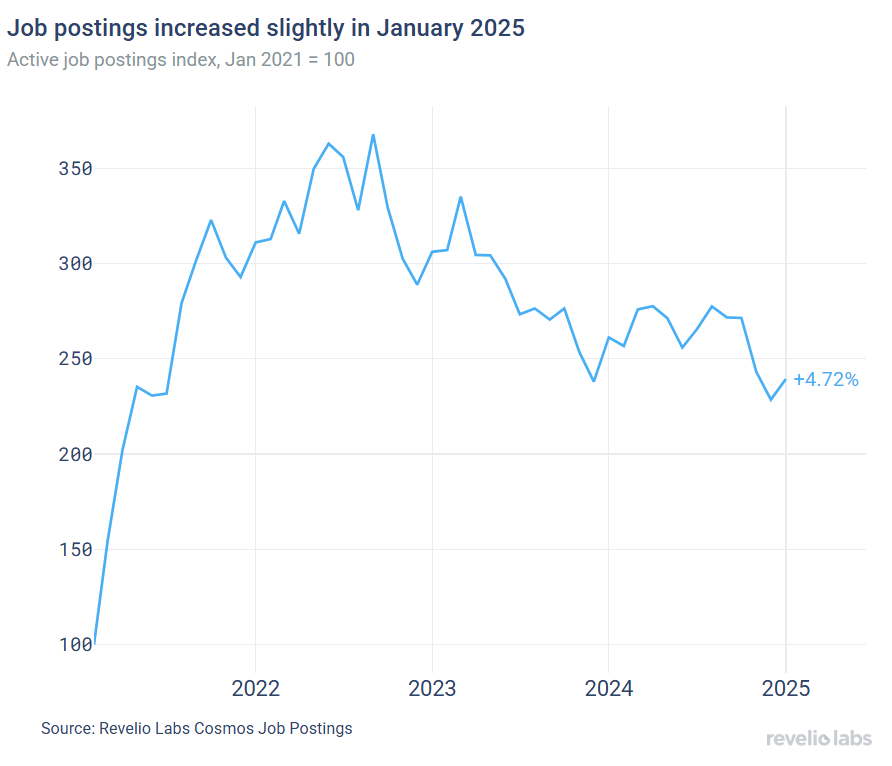

⬆️4.72% increase in active job listings in January 2025 from December 2024.

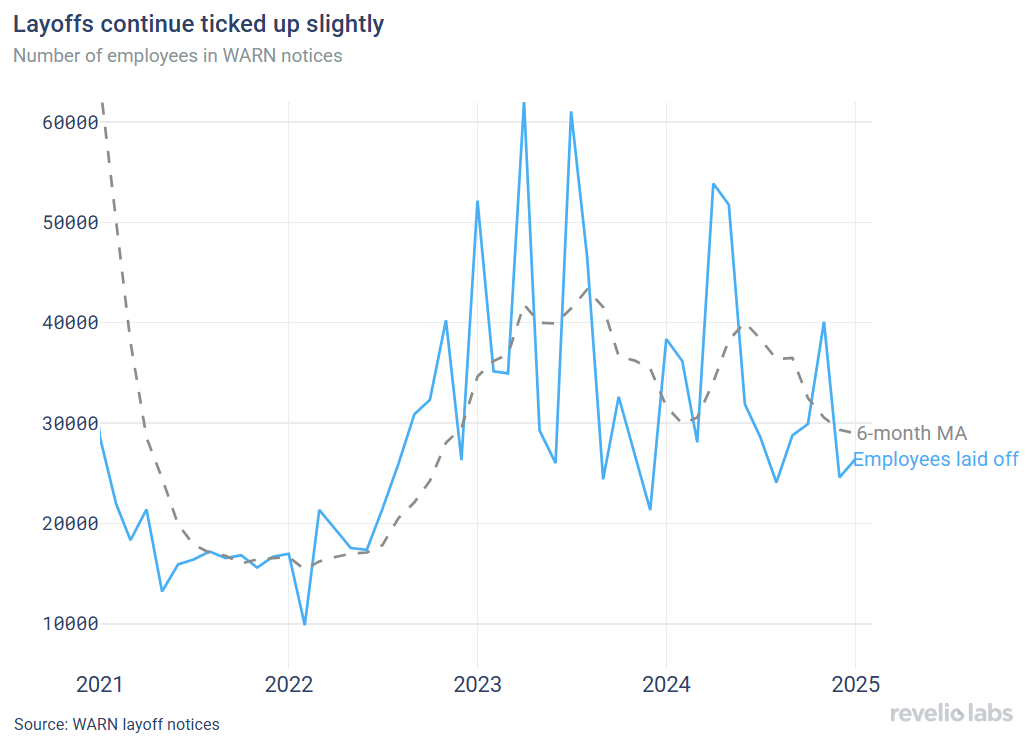

⬆️7.4% increase in the number of employees notified of layoffs under the WARN Act compared to December 2024.

Revelio Labs’ Hiring and attrition have plateaued

The most recent JOLTS report published on February 4th showed data on hiring and attrition through December 2024. The newly released JOLTS data showed that both the hiring and separation rates have been flat since mid 2024, after consistently declining since July 2022. Revelio Labs’ workforce intelligence data show that annualized hiring and attrition rates have plateaued through 2024, with attrition starting to rise slowly in the past two months. The annualized hiring and attrition rates stood at 16.7%. The workforce growth rate (difference between hiring and attrition rates) stood at 0.02% (unchanged from the growth rate in December on a m.o.m basis).

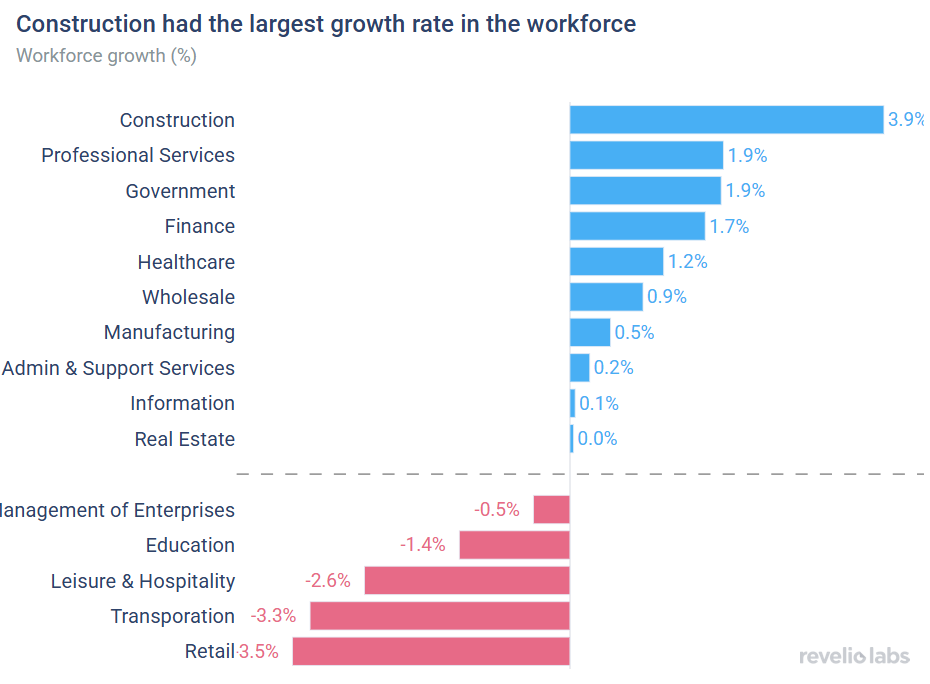

Overall, many sectors saw an increase in the growth rate compared to the growth rate in December, with the Construction sector continuing to lead the pack. Construction recorded the highest workforce growth rate (3.9% workforce growth in January 2025 compared to 3.7% in January). The Construction sector has also been one of the major contributors to jobs growth in the past few months. The Retail sector saw a decline in the workforce (Retail saw a growth rate of -3.5% in January), which is to be expected after the holiday season is over.

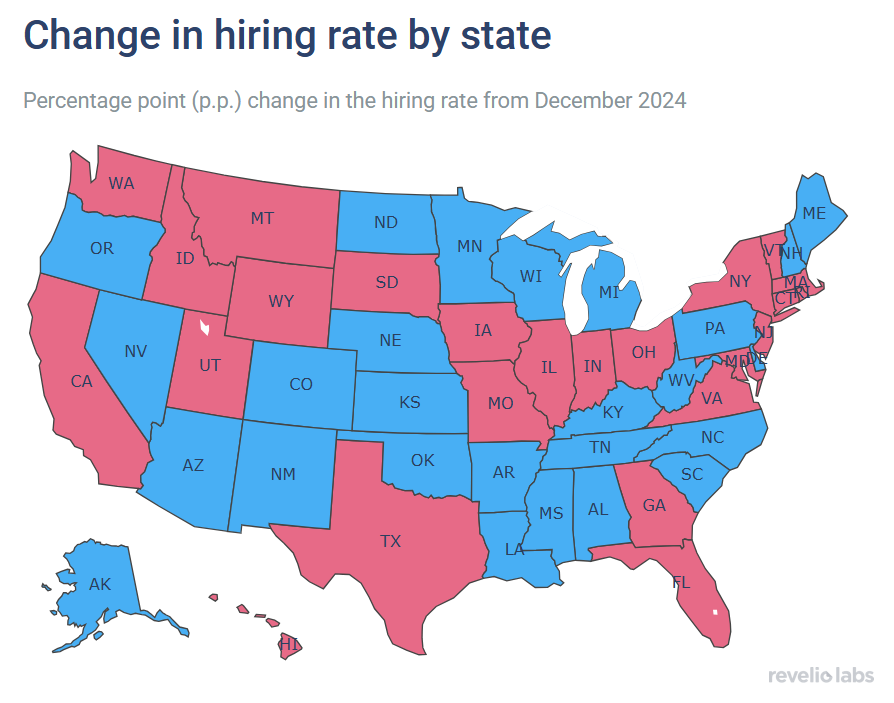

Hiring has increased in many states in January 2025 compared to December 2024, although it has declined in the largest, most populous states, such as New York, California, and Texas. The largest decline in hiring occurred in Wyoming (-0.6 p.p.)

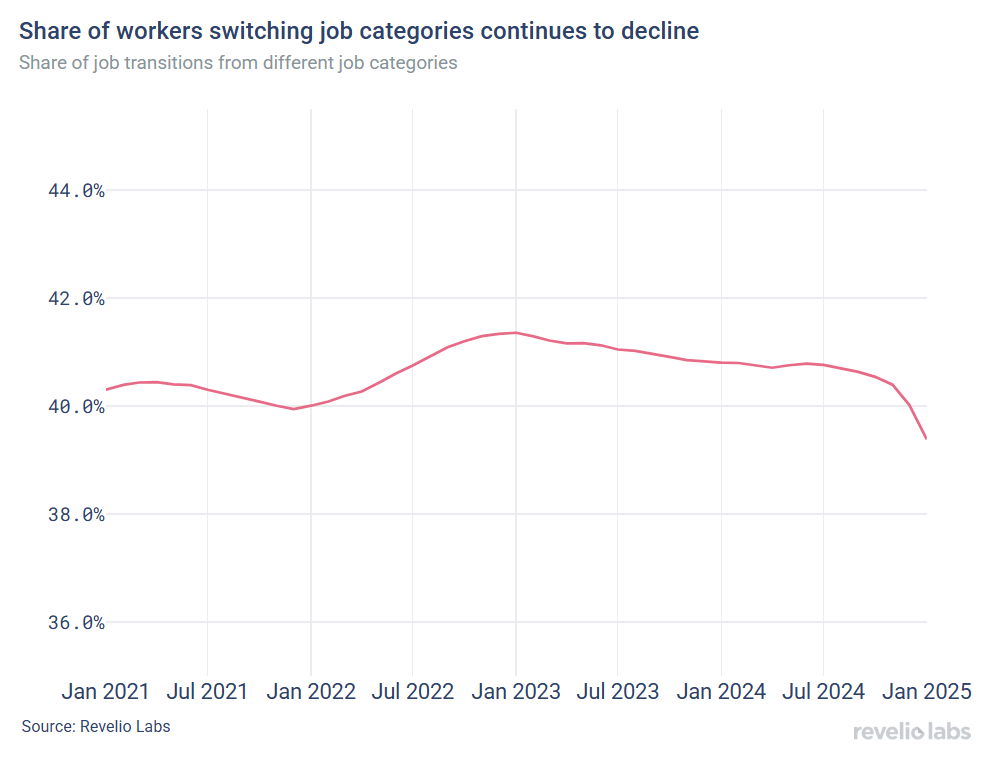

Of those who started a new job in January, 34.4% have transitioned to different roles and 64.5% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 34.4% of workers who started a new job in January did so by switching their broad job categories. This is slightly lower than the 34.7% observed in December 2024. Furthermore, 64.5% of workers who started a new job in January started jobs in different industries - down from the rate in December (65.9%). The continuous decline in the share of workers switching roles and industries is an indication of the declining confidence in the labor market and the available opportunities among workers.

The left panel in the figure below shows the difference in the share of workers who switched to a different industry in January 2025 relative to December 2024. Most sectors saw a decrease in the influx of workers from other industries, with Management and Administrative Services and Education witnessing the largest decline. Meanwhile, Retail saw the largest increase in the influx of workers from other industries.

The right panel shows the difference in the share of workers who started a new job in a different role in January 2025 relative to December 2024. Office roles, such as Accountant and IT manager exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while HR and Legal roles witnessed the largest decline.

Job postings increased in January

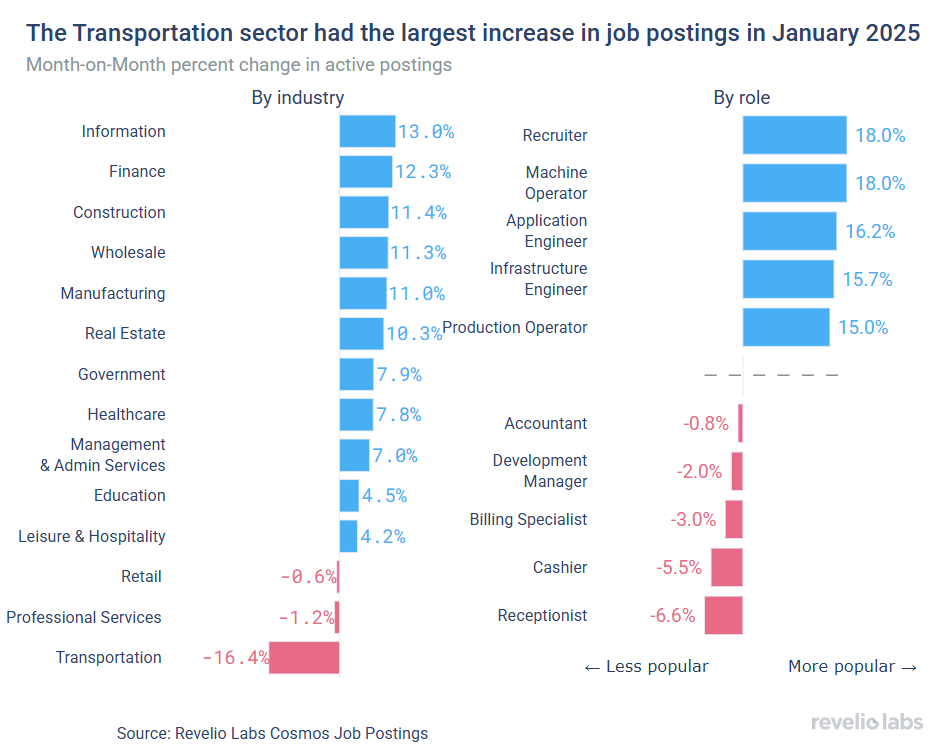

The active job postings index increased slightly in January after consistently declining since October. Job listings increased by 4.7% compared to the previous month. New job listings increased by almost 12.7% month-on-month, while removed job postings declined by 7% from their level in December.

The increase in job postings reflects a increase in postings in most sectors, with the Information sector experiencing the largest increase (13% increase in the number of active job listings in January 2025 compared to December 2024). Many roles have also seen a large increase in demand, most notably is Recruiter.

Layoffs tick up slightly, although still following a declining trend

The number of employees receiving layoff notices under the WARN Act have ticked up slightly in January: An expected increase as companies reassess their priorities and budgets at the start of a new year. In January, several prominent companies across various industries have announced significant layoffs, including Meta, which plans to reduce its workforce by 5%, BlackRock, which is set to cut 1% of its workforce, and Microsoft. Yet, the underlying trend of the mass layoff notices series has been declining since March 2024.

Quarterly highlight: Employee sentiment is rebounding

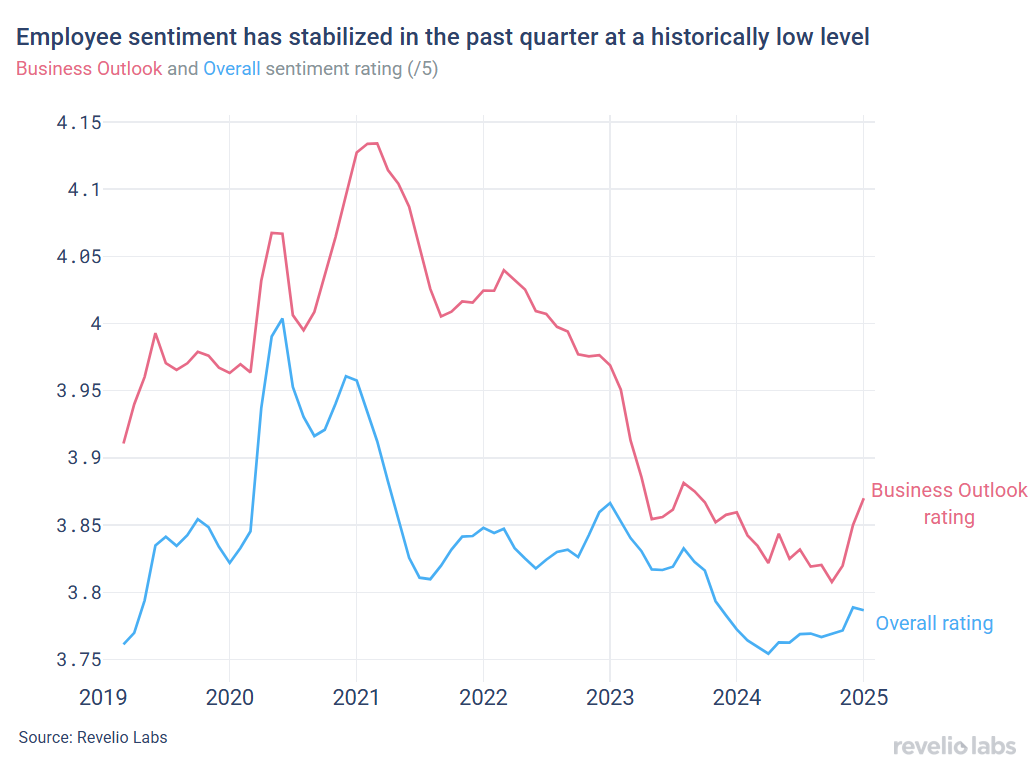

In our previous research, we have shown that employee sentiment, particularly business outlook sentiment, serves as a leading indicator for negative events in a company, such as mass layoffs or the crypto collapse. We analyze overall average employee sentiment in the US. After a consistent decline in employee sentiment since 2021, that is mostly explained by labor market conditions, we observe that employee sentiment has started to rebound in the Fall of 2024. The most notable rebound is the sentiment around business overlook that has increased by about 1.8% since October.

Highlight of the month: Women are lagging behind in adopting AI at work

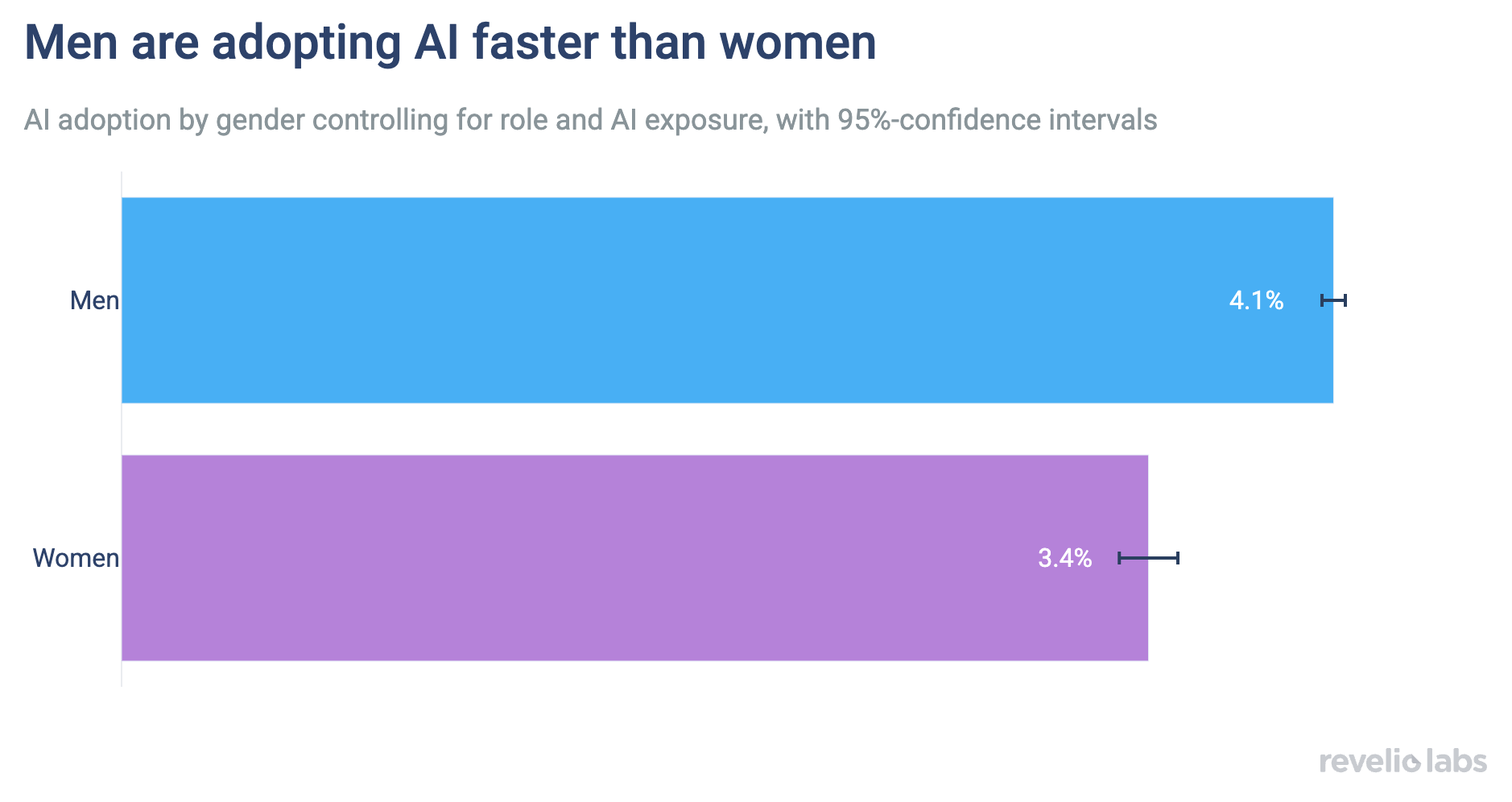

Our recent research explores how adoption rates vary by occupation and gender. As we have previously shown, AI adoption is highest in roles with the greatest AI exposure, such as data engineering and financial consulting. However, a significant gender gap persists: men are twice as likely as women to adopt AI at work, even after accounting for role and the degree of exposure. This gap may be partly due to differences in self-presentation, as men are more likely to mention AI tools in their job profiles. Since AI adoption is linked to higher salaries—both across and within occupations—this gender disparity could contribute to wage gaps, with women potentially facing a 2% salary penalty. It is also interesting to note that women are also underrepresented in high-AI-exposure roles, limiting their opportunities to leverage AI for career advancement. While their concentration in roles that are less exposed to AI may shield them from job displacement, embracing and openly discussing AI use could help close both the adoption and wage gaps.

Conclusion

Revelio Labs data shows that the U.S. labor market has continued to cool down as we head into 2025, even if the declining unemployment rate and solid wage gains reflect ongoing resilience of the market at the same time. Plateauing hiring and attrition rates suggest that the era of the stagnant labor market despite low worker sentiment may be coming to an end. Yet, the pattern of job transitions reveal that workers still lack confidence in the labor market and in the opportunities open to them. The modest rebound in job postings and the ongoing decline in layoffs indicate resilient demand for labor at the beginning of the new year. Additionally, the recent uptick in employee sentiment—particularly in business outlook—suggests that workers' outlook may finally be improving and they are gaining confidence in job stability. As we move further into the year, tracking shifts in hiring and attrition trends, along with workforce sentiment will be key to understanding the broader trajectory of the labor market.

Please view our data and methodology for this job report here and our recent newsletter on the gender gap in AI adoption here.