Workforce Digest: The hottest months are over

Revelio Labs' August deep dive into the state of the workforce

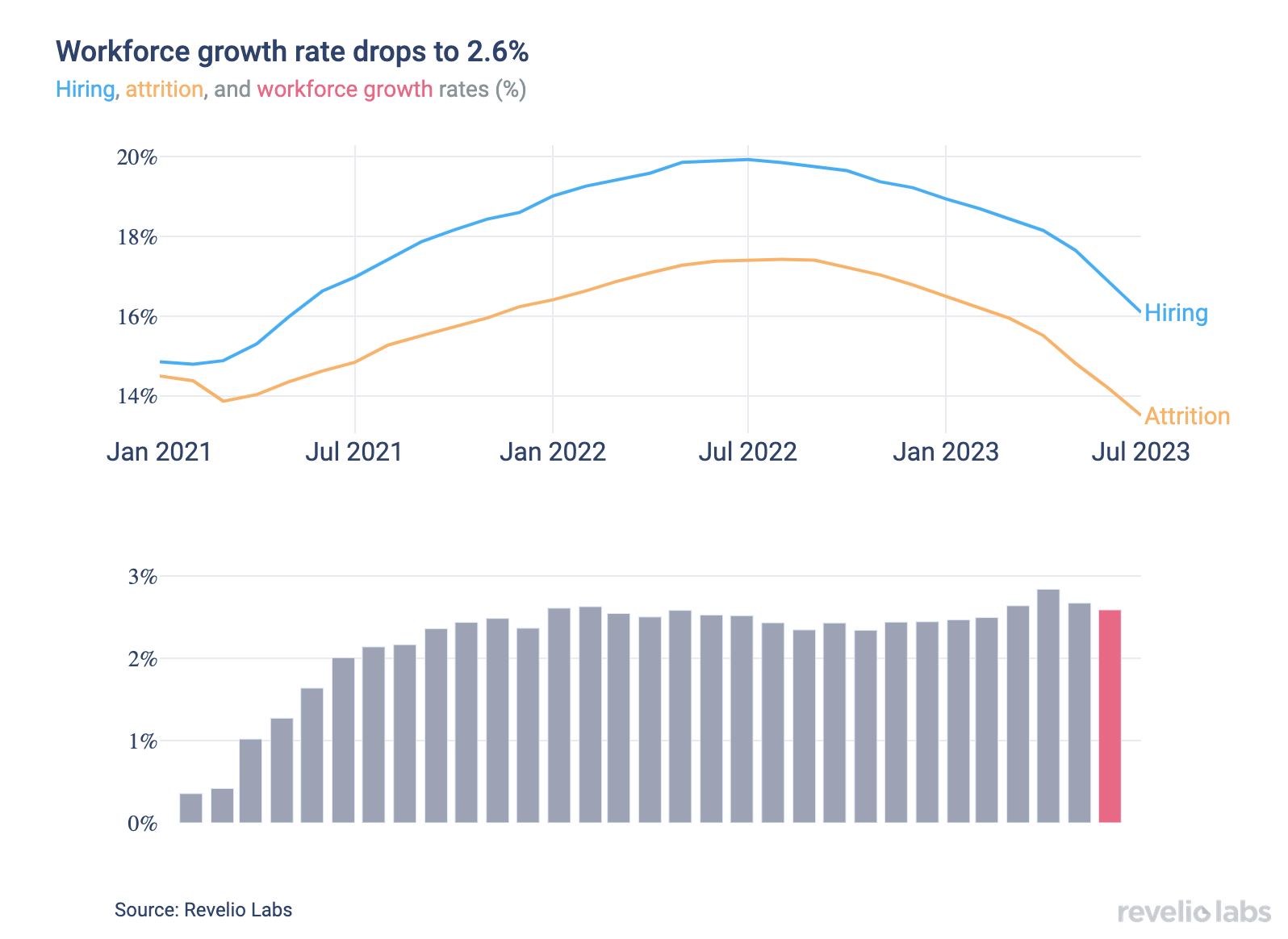

⬆️ 2.6% workforce growth rate in July 2023. This is a slightly lower workforce growth rate than in June, which stood at 2.7%. The decrease in growth rate is a combination of a decline in the workforce attrition rate from 14.2% in June 2023 to 13.5% (0.7 p.p.) as well as a decline in the hiring rate from 16.9% to 16.1% (0.8 p.p.).

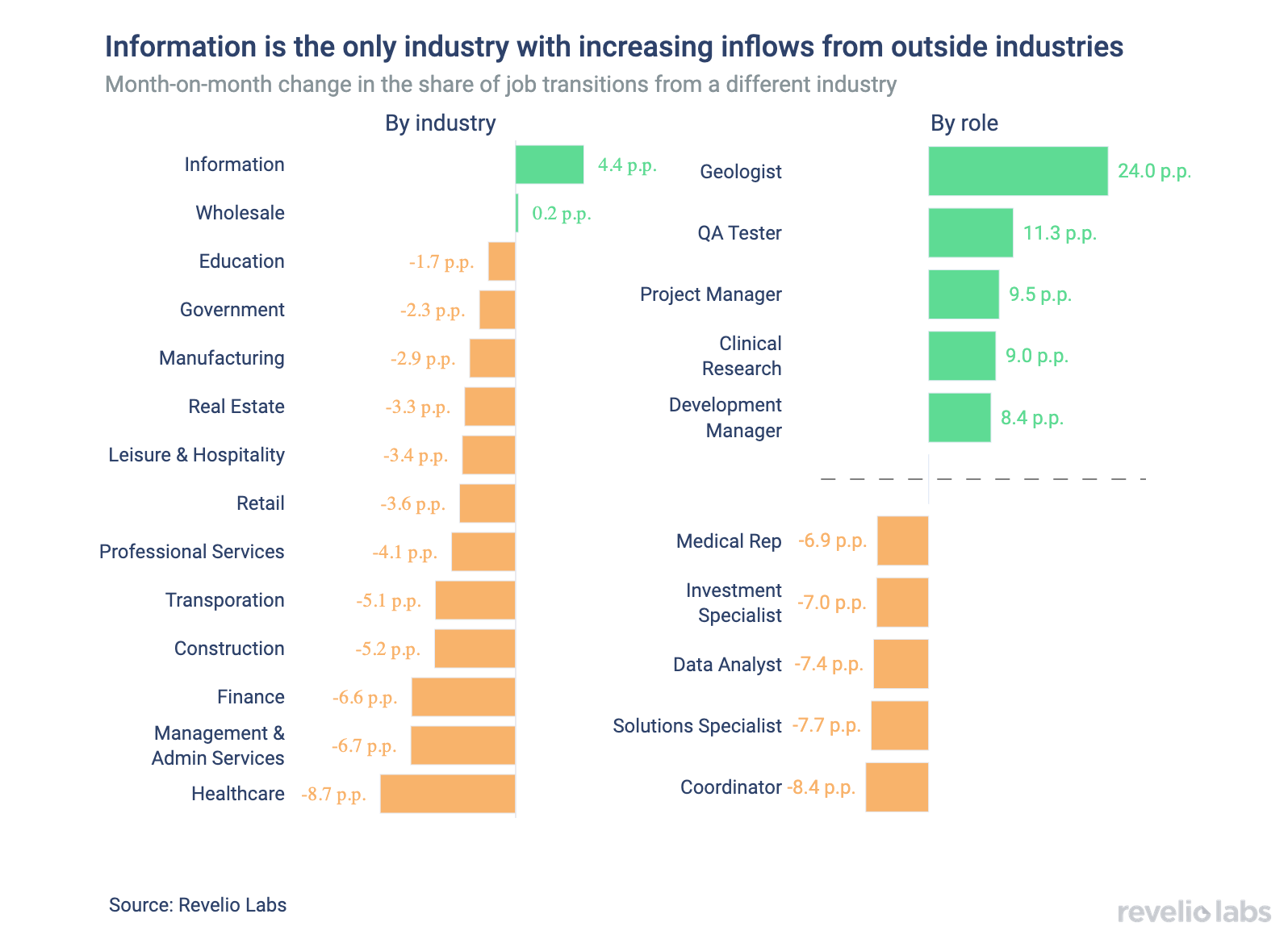

⬇️ 69% of workers who started a new job moved to a new industry. This is 2.6 percentage points lower than June. The Information industry was the only industry with an increase in the share of workers coming from other industries.

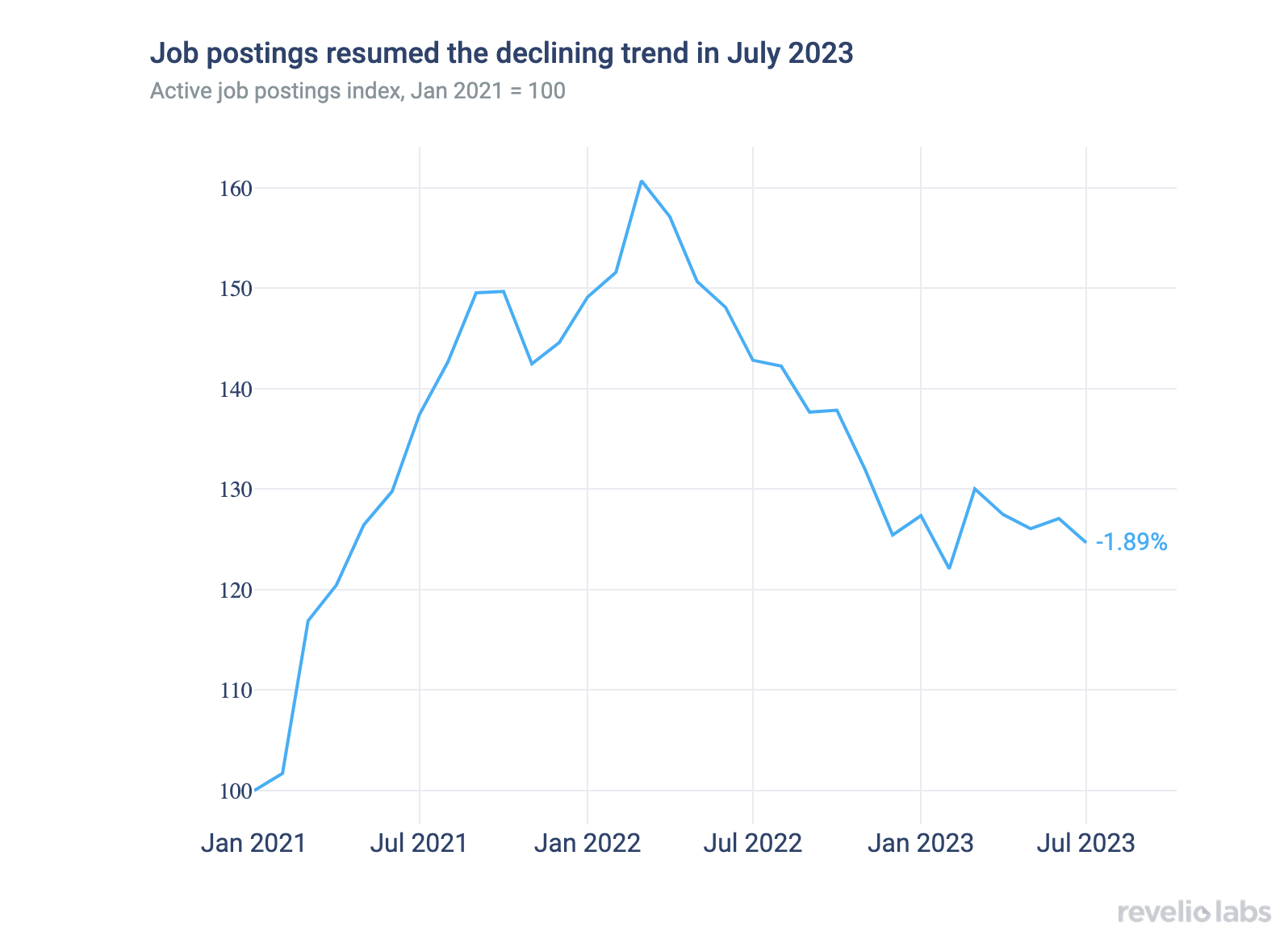

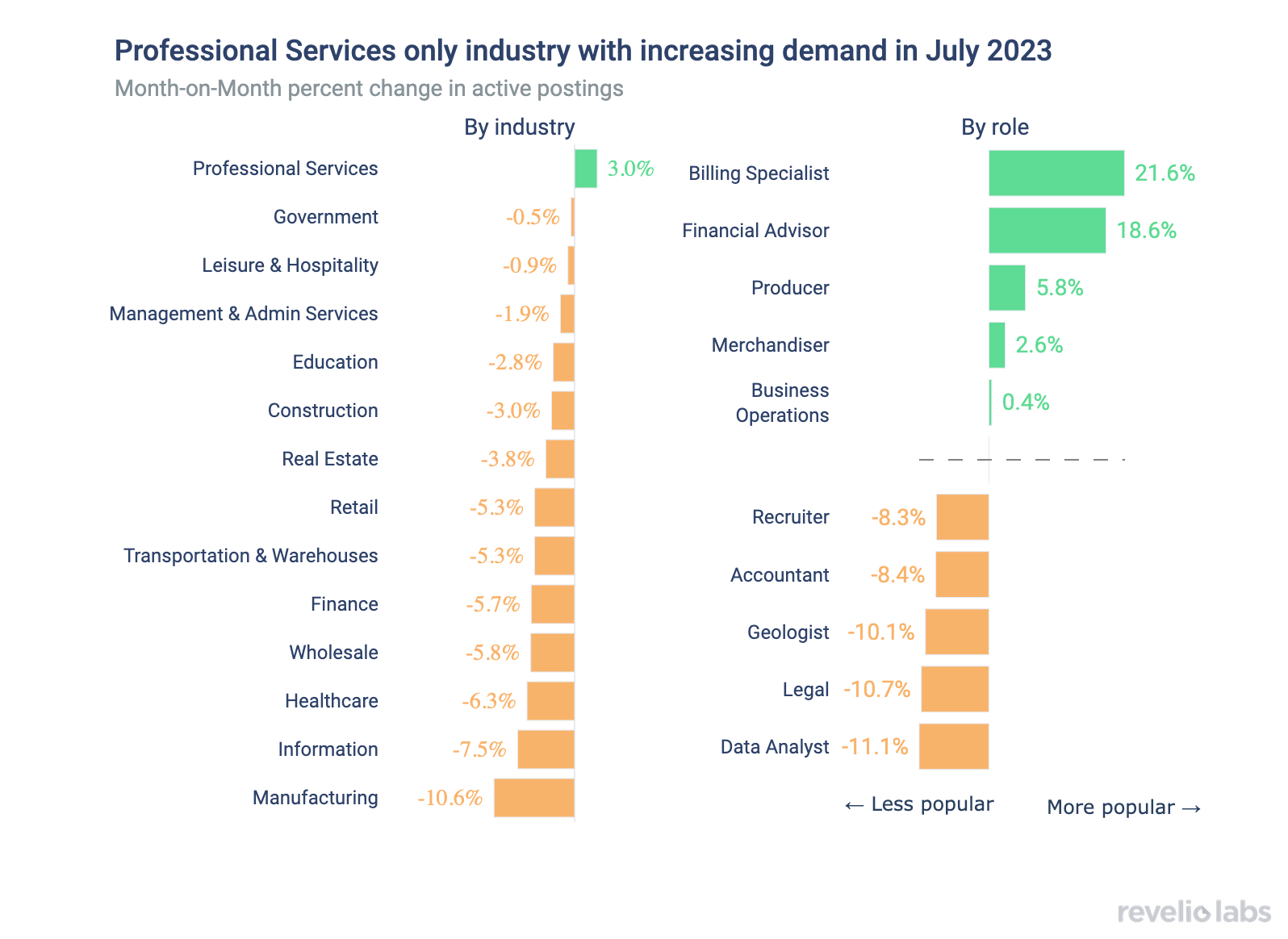

⬇️ 2% decrease in active job listings from June. The Professional Service industry was the only industry with increasing active job postings

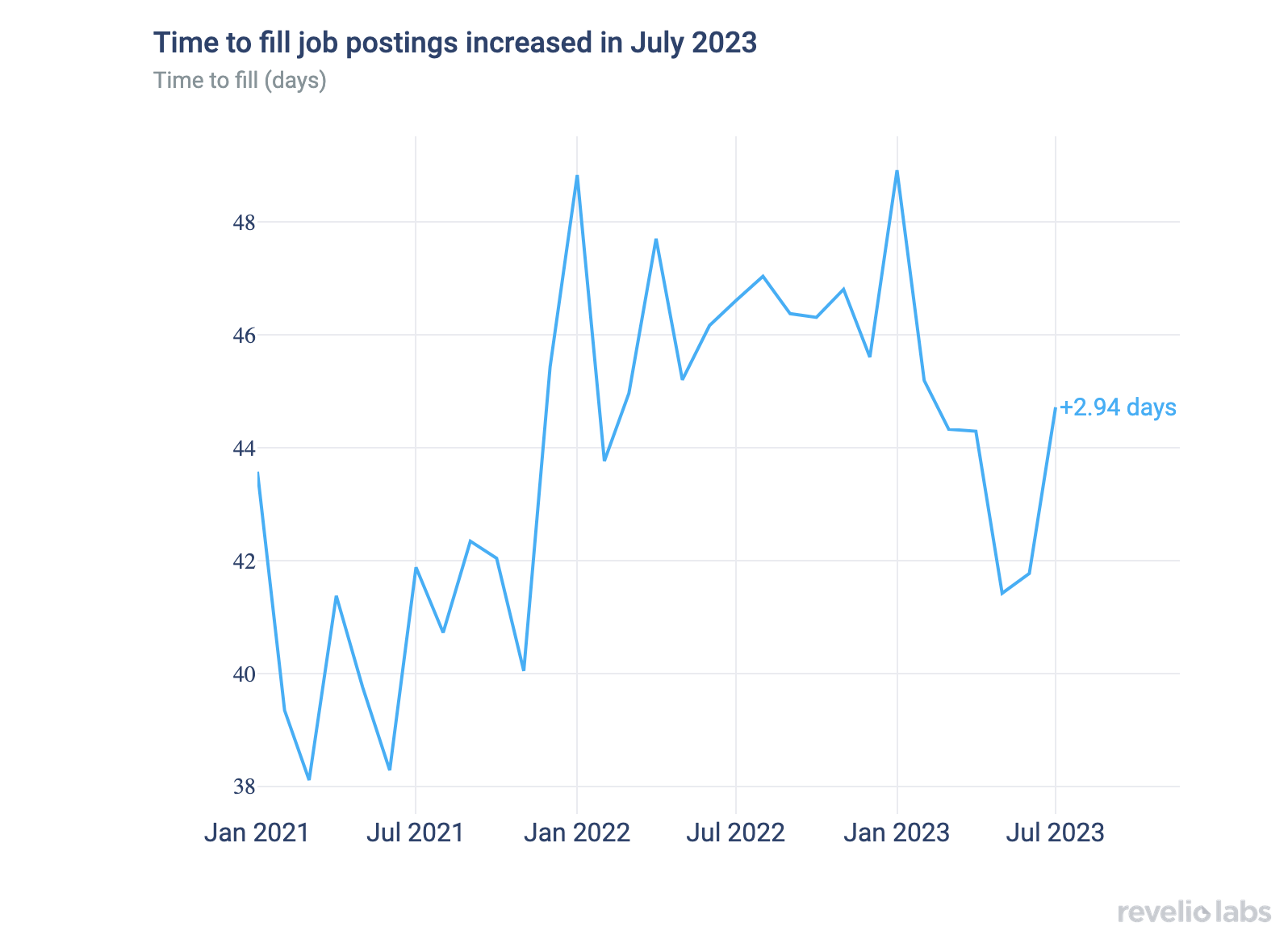

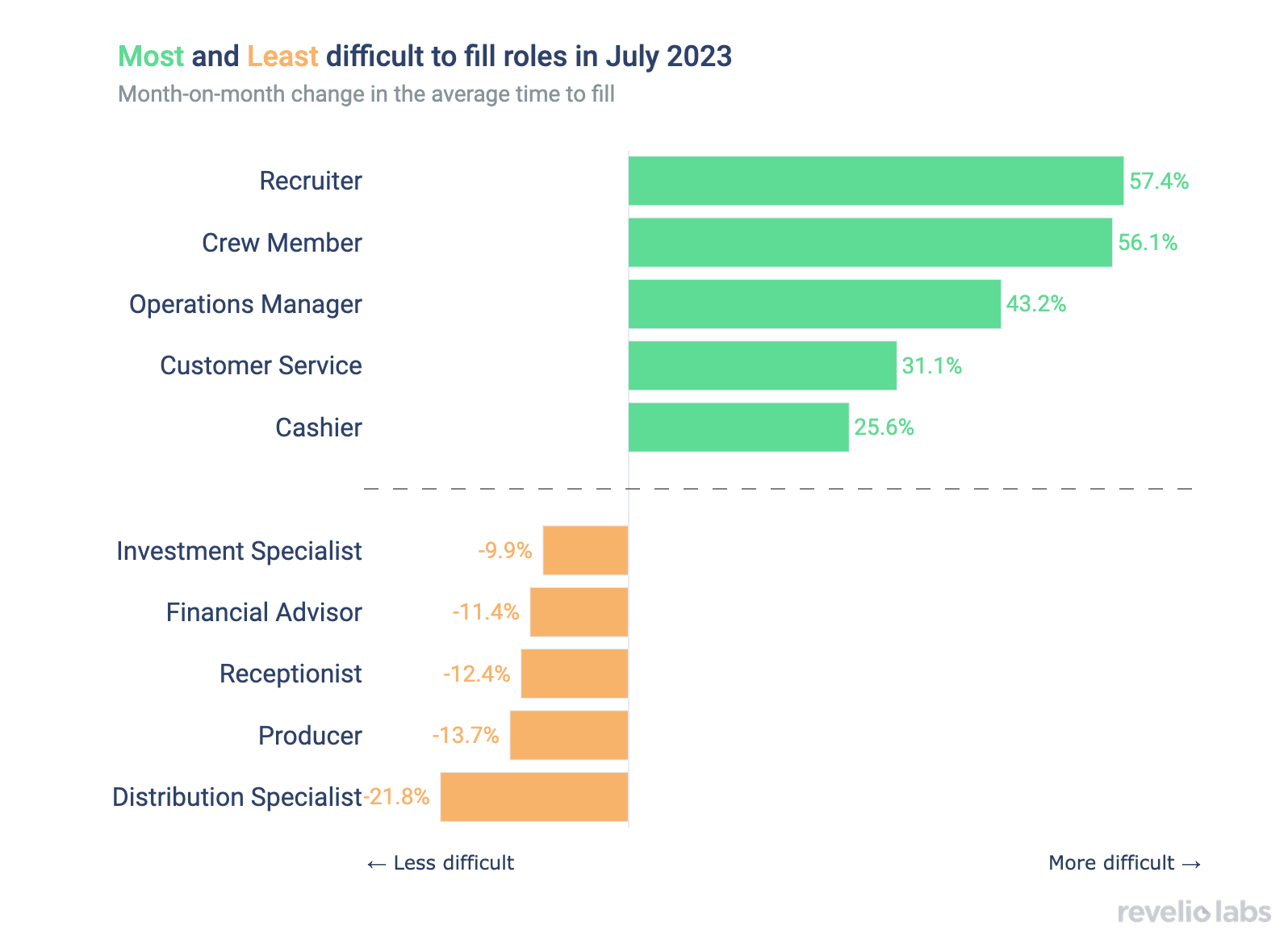

⬆️ 44.7 days to fill job openings. This is 2.9 days more than in June 2023 and 1.9 days less than in July 2022. Recruiter roles were the hardest to fill in July.

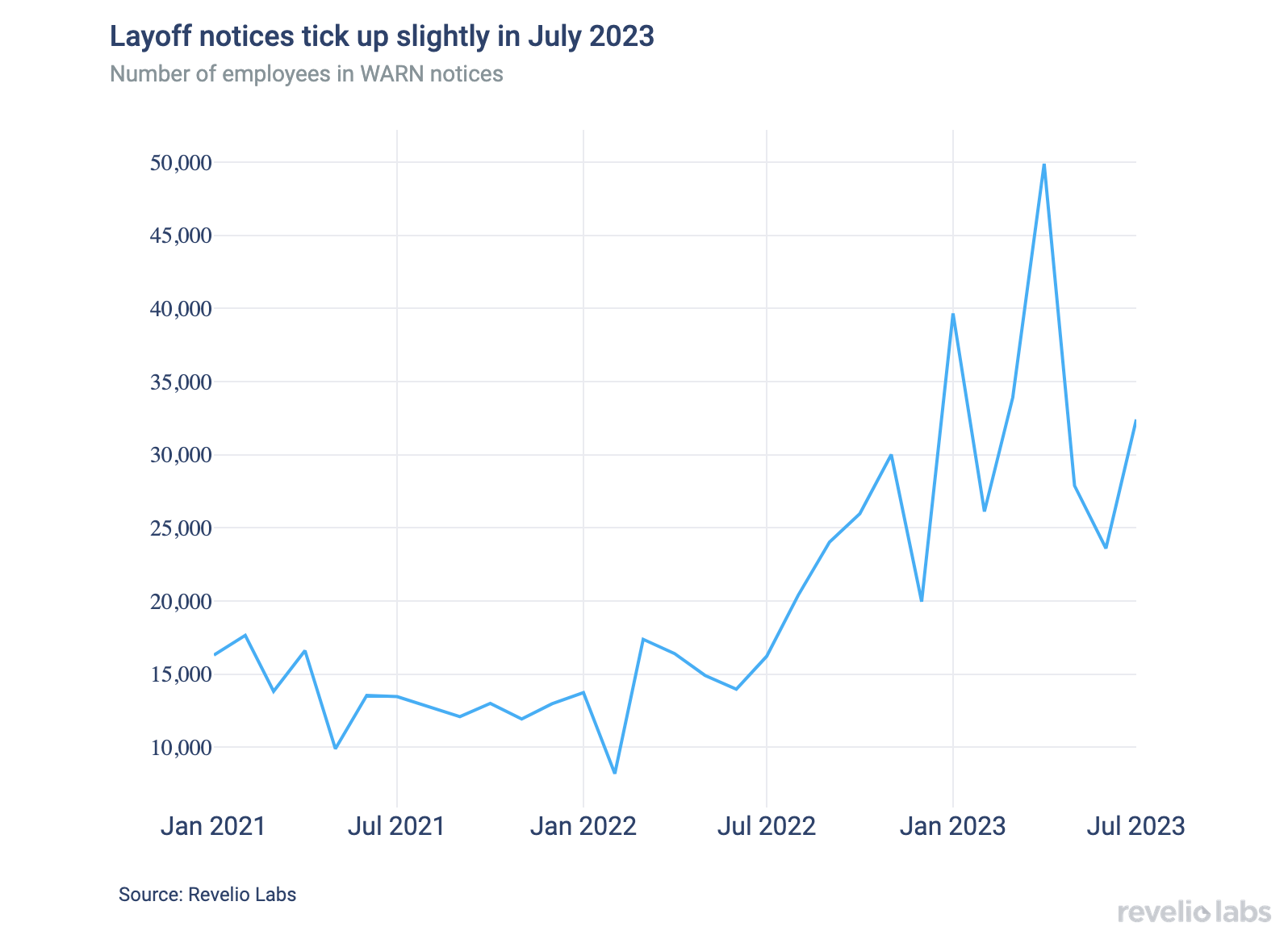

⬇️ 37% increase in the number of employees notified of layoffs compared to June 2023 under the WARN Act.

July's Jobs Report signals some orderly slowdown in the labor market

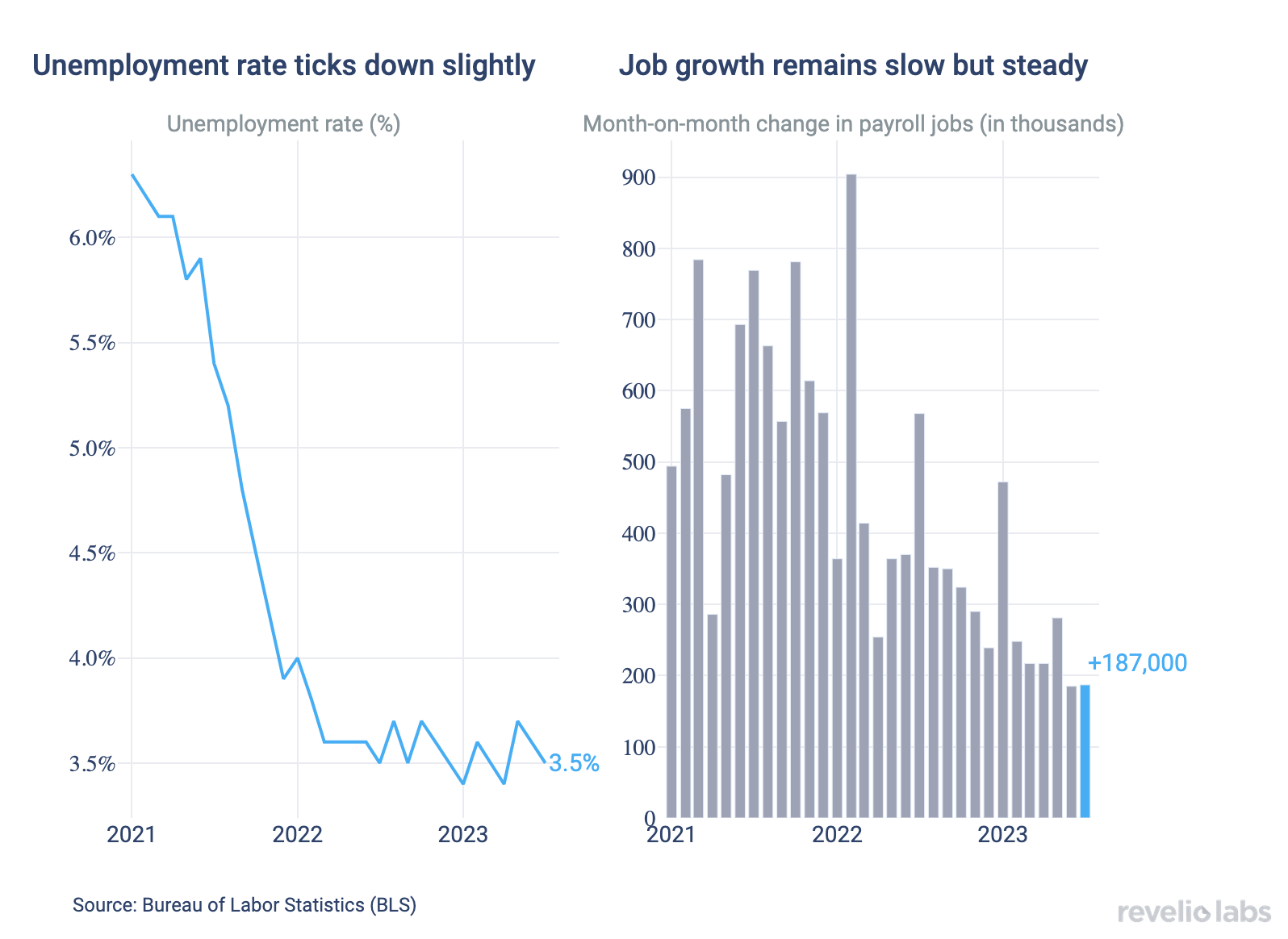

The US labor market is slowing down in a healthy fashion. The unemployment rate remains flat, ticking down by 0.1 percentage points to 3.5%, coupled with an unchanged labor force participation rate. Job growth continued with an even slower momentum: the economy added 187,000 jobs, the same level as the revised 185,000 jobs added in June. The slowdown in the growth in nonfarm payroll employment can be linked to the slowdown in new and active job postings in April, May, and June. Jobs growth was primarily driven by the healthcare sector.

What does the granular workforce data from Revelio Labs have to say about this hot labor market, and what do they signal about the labor market in the near future?

Hiring and attrition rates continue to decline

Despite the increase in nonfarm employment, Revelio Labs’ data show that hiring rates have started to cool down. After persistently increasing through the summer and fall of 2022, the hiring rate started to decrease in October 2022 and continues to decrease through July 2023. Similarly, workforce attrition rates have been decelerating since October 2022, at a similar rate as hiring. The workforce growth rate (difference between hiring and attrition rates) decreased by 0.1 percentage points m.o.m and and increased by 0.1 percentage points y.o.y.

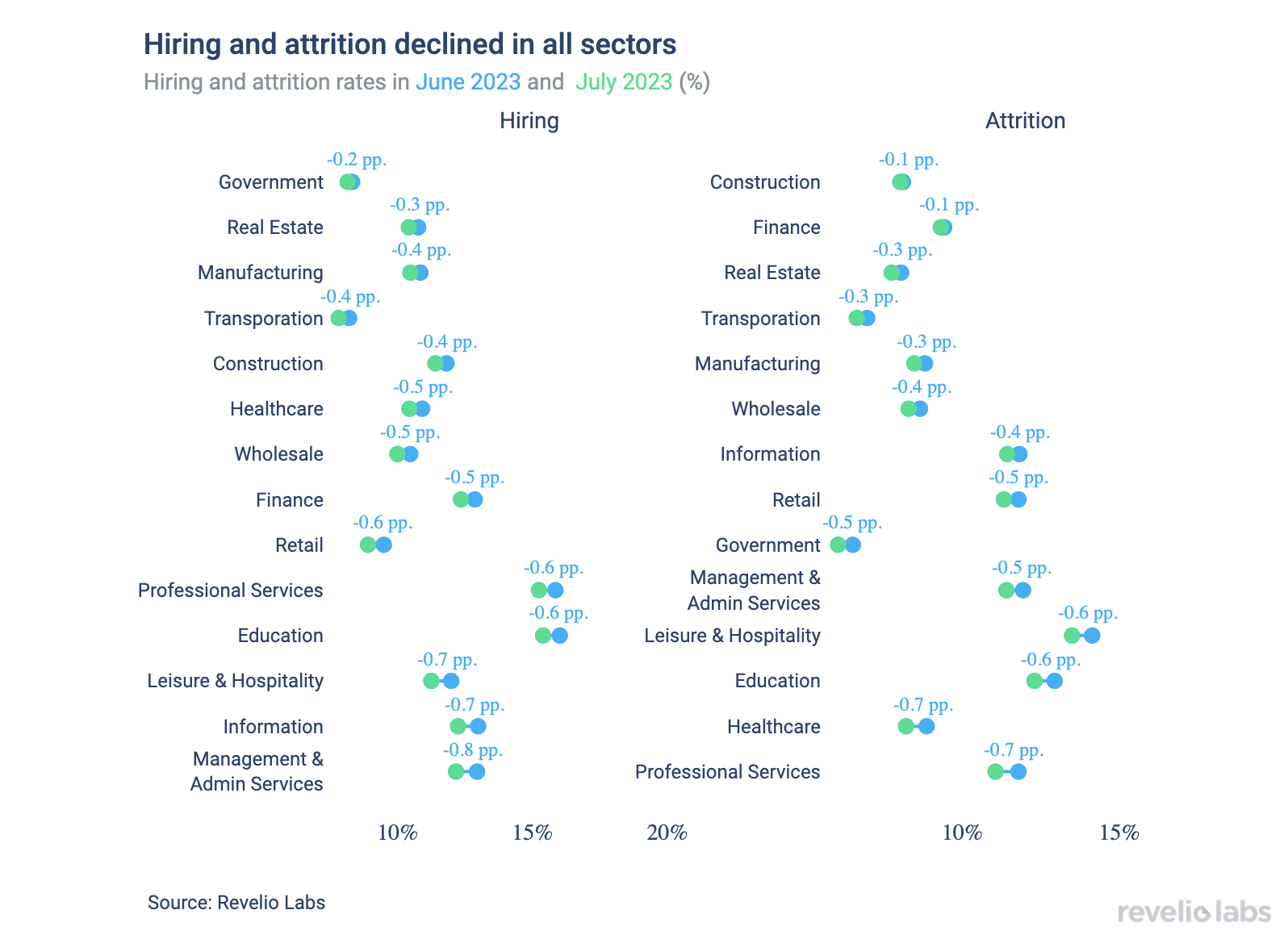

Hiring and attrition have slowed down in all sectors, although we find in this job report that the degree of slowdown varies between industries. Figure 4 shows the change in the hiring and attrition rates in all industries. Compared to June 2023, the Management & Administrative Services industry experienced the largest decline in hiring while Professional Services witnessed the largest decline in workforce attrition.

69% of workers who started a new job in July have switched industries. The Information industry was the only industry with an increase in the share of workers coming from other industries.

Using Revelio Labs’ extensive workforce data on millions of workers’ profiles in the US, we are able to track workers’ transitions between industries and occupations. Our analysis shows that among workers who recorded starting a new job in June, 68.7% of them joined from a different industry. The left panel of the figure below shows the difference in the share of workers who started a new position in a specific industry, having transitioned from another industry, as compared to June 2023. Notably, the Information industry is the only industry to experience a substantial increase in the influx of newcomers from outside industries. In July 2023, 77.3% of workers who started new jobs in the Information sector had backgrounds in other industries, relative to 72.9% in June 2023 (+ 4.4 percentage points). All other industries have experienced a decline in the share of workers joining the industry from other industries through July 2023 (Wholesale remained essentially unchanged).

The right panel of the figure below shows the difference in the share of workers who started a new job in a different role relative to June 2023. Geology exhibited the largest increase in the share of workers transitioning from different roles relative to June 2023.

Job postings decreased in July but they require longer a longer time to fill

The active job postings index continued to decrease after the modest increase observed last month. Job listings decreased by 2% compared to June. The month of July witnessed interesting job postings dynamics with a very sharp decline in the volume of new job postings. New job postings decreased by 8% from their level in June, while removed job postings increased by 2%. The combination of declining active job postings and reduced hiring signal a further slowdown in the labor market in the future.

Almost all industries, with the exception of Professional, Scientific and Technical Services witnessed a large drop in labor demand in July. The Manufacturing industry suffered the largest drop in the number of active postings in July 2023 (-10.6%), followed by the Information industry. In contrast, companies in the Professional Services industry have increased their labor demand in July.

Demand for finance and billing-related roles have witnessed an upsurge in July. Conversely, the demand for data analysts and legal workers has experienced a significant slowdown, with the decrease being particularly notable on a year-over-year basis. This decline can be attributed to reduced job postings and hiring activities in the information and finance sectors.

The decline in active job postings was accompanied by an uptick in the average time to fill open jobs relative to June 2023. Average days-to-fill stood at 44.7 days in June compared to 41.8 days in June 2023 (+2.9 days). Yet, the labor market slack has generally continued, with average days-to-fill stabilizing in the range of 41 to 45 days in the past three months compared to a peak of 49 days in January 2023.

In July 2023, recruiter roles had the biggest increase of 57% in time to fill compared to June. Other roles with large increases are customer facing: time to fill roles such as restaurant workers increased by 56% relative to June. In contrast, filling finance and distribution positions was relatively less difficult, with a 23% decrease in the time to fill compared to June.

Layoffs tick up again

The number of employees receiving layoff notices under the WARN act ticked back up from June 2023. The layoff index increased by 37% relative to its level in June. The layoff index is currently standing at similar levels to earlier this year, and is now twice as high as it was last summer. The increase in layoff notices is driven by an increase in permanent layoffs.

What are worker in America talking about this month?

By examining thousands of employee reviews during the month of July, we picked the most common words that appeared in positive and negative reviews relative to June. In July, employees were more positive about the work culture, experience, and benefits relative to June. But they were more negative about growth, salaries, and balance.

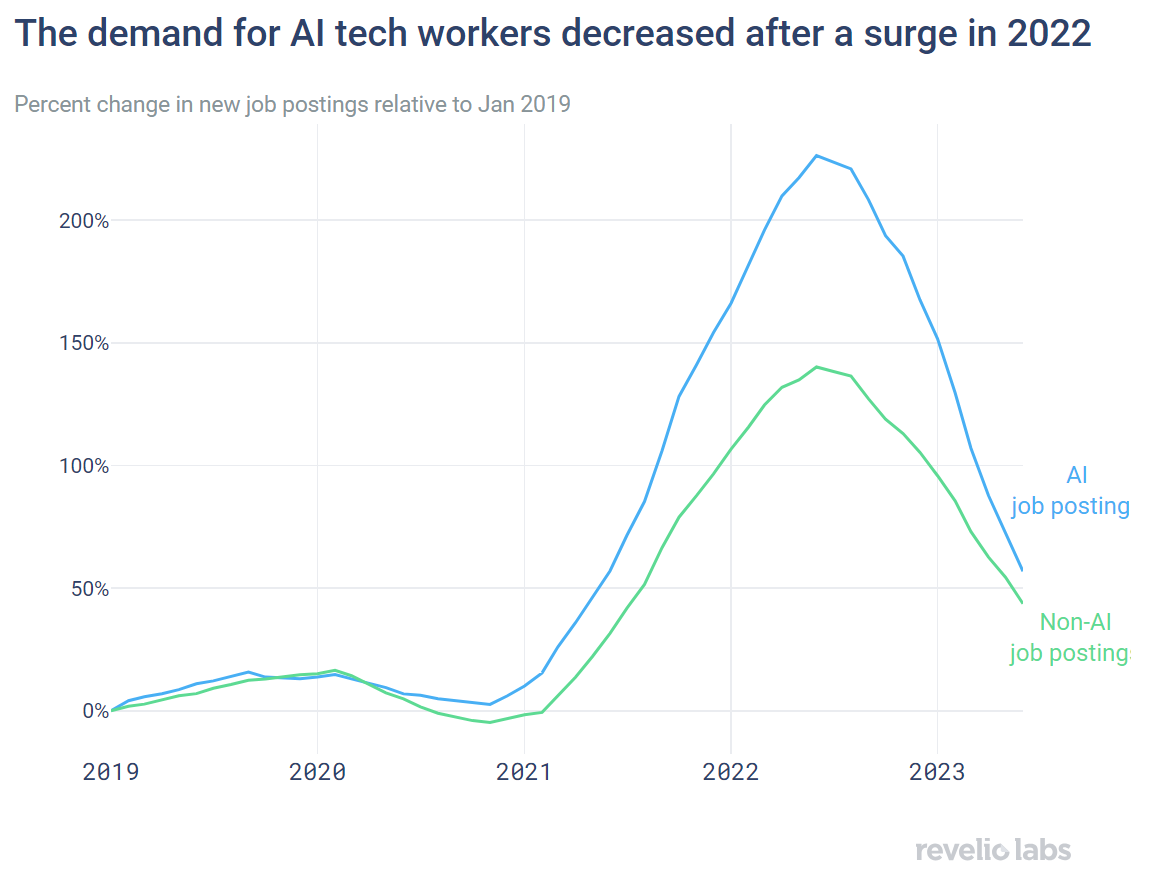

Highlight of the month: the boom and bust in the market for AI talent

In our recent collaboration with LinkUp and Bloomberg, we analyzed the demand for AI talent using Revelio Labs and LinkUp joint Job Listings with predicted salaries. The data shows a surge in demand for AI tech workers from 2021 to 2022, followed by a steep decline in 2023. Still, AI-related job postings remain 60% higher than in 2019, akin to non-AI tech jobs. AI tech jobs offer a 5.8% salary premium compared to similar positions without AI-related skills. Tech workers and new entrants to the tech job market should hone their AI skills to remain competitive.

Conclusion

July's Jobs Report points to a soft landing in the economy. With stable unemployment and labor force participation rates and job growth that aligns with expectations, the labor market seems to be highly resilient. The workforce growth rate is 2.6%, and Revelio Labs' data on declining job postings and an uptick in layoff notices show signs of an orderly slowdown.

Please view our data and methodology for this job report here and check out our collaboration with LinkUp here